This article was co-authored by Samantha Gorelick, CFP®. Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner™ designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.

There are 13 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 95% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 108,208 times.

Managing your money can seem like an impossible task, but that is only because you haven't taken the time to start managing it. Today, keeping your finances in order is easier than ever. With careful budgeting, smart saving, and some basic attention to your income and expense, you can manage your money wisely without getting an MBA.

Steps

Budgeting Your Money

-

1Make a list of your guaranteed monthly income. Calculate all of your income on a monthly basis. Do not include any income you hope to get from overtime, tips, bonuses or anything else that is not guaranteed. Only use income that you know, without a doubt, will be earned that month. This gives you a clear picture of how much money you have to spend each month, allowing you to draft an accurate budget.

- Any additional money (tips, bonuses, etc.) should be considered "extra." By planning for only your guaranteed income you ensure that you will have enough money to cover living expenses should anything happen. It also leads to the happy "surprise" of extra money when it comes.

-

2Track all of your expenses each month. Keep all of your receipts to get an accurate picture of your spending habits. Luckily, modern technology has made this easier than ever, as you can log-in online to see you bank and credit card activity. Most banks even break this up by type of spending as well, such as "Food/Groceries," "Gas," or "Rent."

- If you spend cash, keep the receipt and make a note of what you bought.

- Apps like Mint, Mvelopes, HomeBudget, and more allow you to sync your credit cards, bank accounts, and investments to one place, providing graphs of your spending based on categories.[1] This is a great way to get a view of your finances with very little work needed.

Advertisement -

3Break your expenses down into fixed, essential, and non-essential. This is the best way to see where you can save money and start spending wisely.

- Fixed Expenses: These are things that do not change month to month but must be paid, including rent, car/loan payments, etc.

- Essential Expenses: These include food, transportation, and utilities -- anything that you need to live but whose cost changes from month to month.

- Non-Essential Expenses: This is everything else, such as movie tickets, drinks with friends, and toys/hobbies. This is the biggest place most people realize they can save money.

-

4Keep these records every single month. You cannot just do this once and expect to get a perfect budget. The best way to see how you spend money is to keep tabs on it all the time, checking at least once a month to see how you are doing. In general, your income will stay the same, so you will need to adjust your expenses if you feel like you are losing money.

- Place your month income and expenses side-by-side in a spreadsheet. You can also write them down in a journal or notebook. Having these numbers next to each other lets you see how much money you have left over to spend.

-

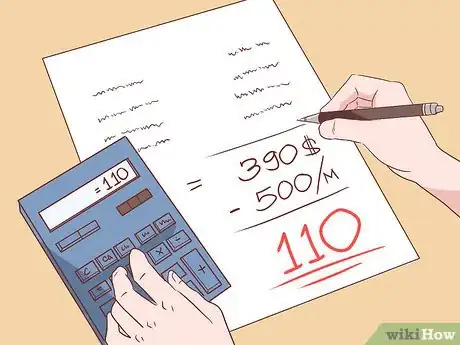

5Calculate how much money you have left over after fixed and essential expenses. If you only spent the money you needed to live, how much of your income would be left over? Take your guaranteed income and subtract the fixed and essential expenses to find out how much money you have to spend each month. You need to have this number in order to manage your money wisely, as it is your "allowance" for savings and fun.

- This includes the money you spend on your rent or mortgage, utilities, phone bill, and other essential needs.[2]

-

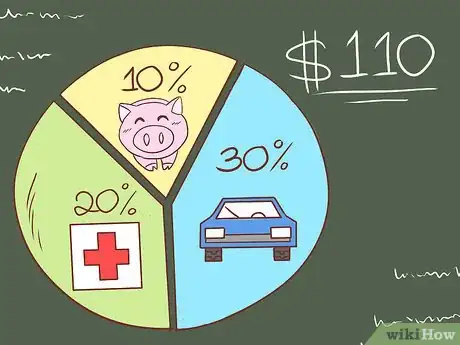

6Split your remaining "allowance" into savings/investments and lifestyle activities. The money that's left over after you subtract your essential bills every month is your discretionary income. You can use that for things like shopping, buying groceries, going out, and adding to your savings.[3] There are many, many schools of thought on how much money you should be saving each month, and they all have their pros and cons.

- 10% is the bare minimum you should be putting aside into savings. This will quickly grow, and often will not hurt you much in the short-term. That said, this money should also be used to pay off any debt if it is large and interest payments are big.

- 20% is considered a good, safe amount of savings. This ensures that, ever 5-6 months, you end up with enough saved income to protect you for a full month if something happens to you. It allows you to save a lot of money without drastically affecting quality of life.

- 30% is the goal everyone should shoot for. This allows you to save money for retirement, big activities like vacations, and large purchases (cars, college, etc.). It may, however, limit what you can afford in the short term.[4]

Spending Smartly

-

1Set a personal budget and stick to it. Once you know how much spare cash you have, you need to commit to spending no more than what you have. If your problem is shopping for clothes -you have a passion for fashion- you need to learn to ask yourself "Do I really need this?" in the store. Don't waste money on designer brands and shop at used clothes stores. Shop during sales, but only if you actually need things from the store.

- What are you priorities in life -- good food, vacations, or just time with the family? Knowing what you personally care about buying can help avoid costly impulse buys.

- What things in your life can you cut and hardly notice -- such as a scone to go with your morning coffee, the 200 cable channels you hardly watch, bottled water, etc?

- You'll have an easier time sticking to your budget if you build it around how you actually spend money. Then, you can adjust your spending in certain areas if you find places where you can cut back.[5]

-

2Only use credit cards for bills you know you can pay that month. Credit cards are not free money. Interest rates on credit cards are huge, even if they don't make you pay them immediately. Managing your money wisely means using your credit cards wisely-- as extensions of your budget, not separate budgets. That said, responsible card use helps to build credit, which is required for home and car loans. Some crucial things to remember include:

- Read all of the agreement form before signing up for your card. What is the monthly interest rate? How is minimum payment calculated? Are there annual or overdraw fees?

- Always try and pay more than the monthly minimum. If you pay the entire balance each month, for example, you won't pay any interest down the road.

- One credit card is enough -- juggling multiple bills and statements is a surefire way into credit card debt.

- Curb spending on credit so that you stay within 30-40% of your limit. You should never get close to your limit, as this is often difficult to repay without exorbitant interest rates.[6]

-

3Know your purpose when shopping. Impulse buys are the bane of smart shoppers and money managers. You need to ask yourself, before buying anything, do you need this to live? Will you enjoy it for a long time, or is it a fleeting pleasure? Avoid shopping as a recreational activity, instead saving it for the essentials.

- Making grocery lists will keep you on track in the store, helping save money and plan meals effectively so no food is thrown out.

- Never buy something just because it is on sale -- you are still spending money, no matter how much the advertisement talks about "savings."[7]

-

4Do your research before making any big-ticket purchases. Car shopping, for example, is not the time to turn into an impulse buyer. It is also not the time to get swept up in a sales pitch, no matter what the car dealer is trying to tell you. You can save tons of money by taking 2-3 hours to research cars, house, home theater systems, etc. in advance before you go shopping, avoiding rip-offs and getting what you came for and nothing more.

- Browse online and set an appropriate spending cap -- the absolute maximum you will spend on a car/house/etc. Be very strict about this cap, no matter what a salesman says.

- Look up how much the object should cost and memorize the number.

- Check the prices at 2-3 different vendors to compare them. If you feel comfortable negotiating, you can mention to a vendor that you've found a similar or better price and ask them to lower theirs.

- If you have time to spare, wait and look for sales. Typically, for example, car dealerships offer sales in the summertime.[8]

-

5Buy in bulk whenever possible. It is difficult to lower your essential expenses, such as food, but it is not impossible. Buying in bulk is more expensive up-front but you save money in the long run. You can buy toiletries, food, and cleaning supplies online or at bulk stores like Costco to slash your expenses.[9]

- When buying food you only save money if you don't throw any out, otherwise you simply paid more money for the same amount you normally eat.

- Learn to read "unit price" which is the small label in stores that says "price per pound" or "price per ounce." Bulk items have a lower unit price, which means you are getting more product for less money.

-

6Take out the money you can spend in advance if you have trouble saving. If finances are tight, one of the best ways to keep from overspending is to take out the total amount you have to spend, in cash, at the beginning of the month. Separate it out into envelopes, one for food, gas, rent, etc. so that you know exactly how much you have. Leave your debit / credit cards at home. It is a lot easier to simply swipe a debit or credit card without thinking about the dollar value of a purchase. If you have to hand over the same amount in cash each time you buy a non-essential item you are much more likely to pause.[10]

Saving for the Future

-

1Aim to have 3-6 months living expenses, at a minimum, saved at all times. Many financial advisers even suggest going further, saving for at least 9-12 months, but 3 is the absolute bare minimum that you should have on hand in case of emergencies. This money is only spent if you absolutely need it, like if you lose your job or need to pay medical bills.[11]

- What are your fixed and essential expenses for one month? Multiply this number by 3-6 months to get your minimum emergency savings.

-

2Make a list of your saving goals. Are you planning for retirement or a vacation to Aruba next year? Depending on what you want to save for, the amount you need to save each month will change drastically. Make a list of events you want to save for, their costs, and then the number of months until the event occurs. For example, you may need to buy a car for a new job next year. You've got your mind on a used car for $5,000, and the job starts in 6 months. This means that you need to save roughly $834 each month to pay for the car.

- Start saving for the holidays 5-6 months in advance. Even $50 a month will give you a cushion of $300 for gifts by December.

- Saving to send your kids to go to college can't start early enough. Make separate savings accounts for them when they're born and make saving a priority.

-

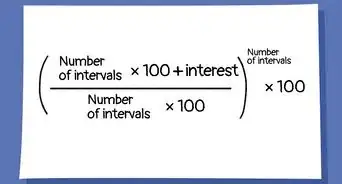

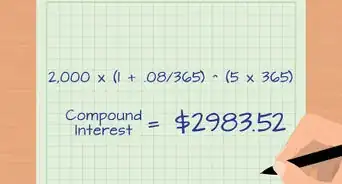

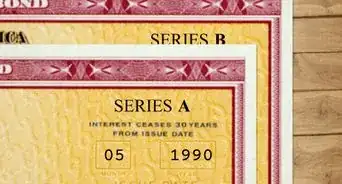

3Invest in your future early and often. Placing $5,000 a year in retirement savings in your 20's earns you twice as much money when you retire as someone who invests $20,000 a year in their 40's.[12] This is because, with time, a small amount of money gains interest. That interest then gains interest as well, quickly multiplying your money. Long story short-- saving now will pay big dividends later on in life.

-

4Save and pay debts simultaneously whenever possible. Do not try and prioritize one at the expense of the other, as you could actually be losing money. For example, you can write-off $2,500 of your student loans on your taxes, and the interest rates will always stay fixed. This means paying the minimum now and pocketing any excess cash in savings will actually make you money, as the write-off can offset interest payments and the savings have more time to grow with interest.[13]

- The exception to this is high-interest credit card debt. If you find yourself sinking into a hole of credit card payments or are only able to pay interest, you may save more money by taking 2-3 months to pay them off.

-

5Put away profits and raises in savings accounts or investments. Whenever possible, take additional cash and throw it into savings and investments. You may be tempted to buy a nice new car or toy, but saving the money now will make a huge difference later in life.

- When you get a raise, add that amount to your monthly savings. You will keep your same quality of life and save much more in the long-term. [14]

-

6Look into employee-matching options. Many companies that offer 401k investments offer matching benefits as well, meaning they will double what you pay for your own future. The benefits of this cannot be overstated -- it is literally free money for your retirement. Talk to your HR department to see what options you have -- some companies also have matching college saving programs and stock or investment options as well.[15]

- Never remove money from a 401k or long-term investment before it matures -- you may have to pay a fee or relinquish all the gains you've made.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow can I manage my money more wisely?

Samantha Gorelick, CFP®Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner™ designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.

Samantha Gorelick, CFP®Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner™ designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.

Financial Planner

Warnings

- Investments are inherently risky -- you never know 100% if it will pan out. Talk to a financial adviser if you want to invest a significant amount of money in anything.⧼thumbs_response⧽

References

- ↑ https://www.dailyworth.com/posts/2815-7-of-the-best-money-management-apps/7

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ http://www.forbes.com/sites/robertberger/2015/03/03/how-much-of-your-income-should-you-save/

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ https://www.mappingyourfuture.org/money/creditcards.cfm

- ↑ http://mywifequitherjob.com/how-to-build-wealth-by-spending-money-wisely/

- ↑ http://www.goodhousekeeping.com/life/money/advice/a19098/125-tips-to-save-money/

- ↑ http://www.sheknows.com/living/articles/808185/tips-on-how-to-save-money-and-spend-wisely

- ↑ http://www.investopedia.com/articles/pf/08/pay-in-cash.asp

- ↑ http://www.bankrate.com/finance/savings/how-big-should-emergency-fund-be.aspx

- ↑ http://beginnersinvest.about.com/od/retirementcenter/a/060104a.htm

- ↑ http://www.kiplinger.com/article/retirement/T047-C000-S002-how-to-retire-rich-4-smart-steps-at-ages-21-35.html

- ↑ http://www.investopedia.com/articles/retirement/07/plan_retirement.asp

- ↑ http://www.kiplinger.com/article/retirement/T047-C000-S002-how-to-retire-rich-4-smart-steps-at-ages-21-35.html

About This Article

The key to managing your money wisely is only spending what you can afford and saving for a rainy day. Keep track of your income and expenses so you know how much money you have leftover to spend. Try to save around 20 percent of your income for future investments and purchases. It's also a good idea to keep 3 to 6 months’ worth of living expenses in a savings account in case of an emergency, like losing your job or having to pay for extra medical bills. Only use credit for bills and purchases you know you can afford at the end of the month. That way, you won’t end up paying extra interest. When you’re making big purchases, like a new car or computer, do plenty of research so you can find the best deal and save money. For more tips, including how to invest your money for the future, read on!