This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 444,128 times.

Did you know that PayPal offers a debit card for instant access to your online PayPal income? Using a PayPal Debit MasterCard is a convenience afforded only to PayPal account holders who have business or premier accounts. The PayPal debit card may be used anywhere that MasterCard is accepted around the world, including at ATMs, stores, and online. It is useful to have such a card at your disposal, and it’s not hard to sign up for one.

Steps

Setting Up Your Paypal Business Account

-

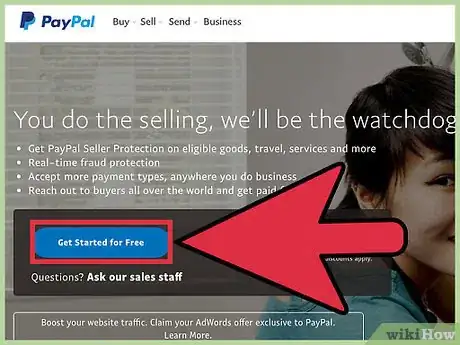

1Switch to a business account. If you have a personal PayPal account, you can’t apply for this debit card as it is only available for Premier and Business PayPal accounts. You can upgrade to one of these accounts. A business account is held by business owners.[1]

- Switch to business from your personal account by selecting the link “Upgrade to Business account” in the lower left hand corner of your home screen after logging into your personal account, and then follow the prompts.

- You can either “upgrade” your current account to keep the same profile name and email address, or you can “create new account” to have a separate account with a different email address.

- You can also find the “upgrade to business account” link by clicking the cog in the upper right hand corner after logging into PayPal, next to the “log out” button, and scrolling down. You will find the link under “Account options.”

- Switch to business from your personal account by selecting the link “Upgrade to Business account” in the lower left hand corner of your home screen after logging into your personal account, and then follow the prompts.

-

2Switch to a Premier account. Although you can switch to a Premier account to use the debit card, this is not widely advertised. A Premier PayPal account is for users who want to have a high transaction volume or accept personal credit card payments. It is basically a business account, but is useful if you don't officially own a business; it has all the features of a business account.[2]

- The only way to get a Premier account is to upgrade to it from within your personal PayPal account. You cannot open a Premier account from the PayPal homepage.

- Follow the same steps to upgrade to Premier as for upgrading to Business.

Advertisement -

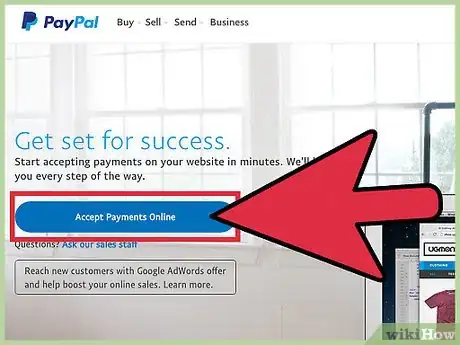

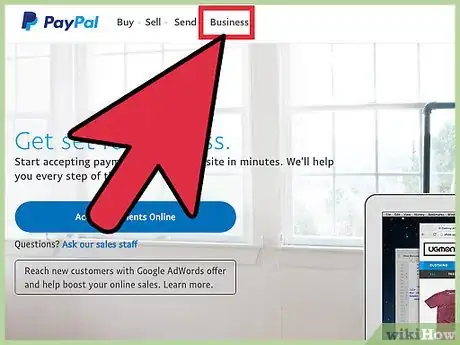

3Visit the PayPal website or app. If you don’t have a PayPal account yet, or if you know that you want to use a different email address than your personal PayPal account has right now, go straight to the PayPal homepage. Once on the PayPal website, select the “Sign Up” button in the upper right hand corner.

-

4Select the button next to “Business Account.” After you elect to sign up, a screen will pop up giving you two options. You can select the bubble next to “Personal Account” or next to “Business Account.” Click the radio button next to "Business Account."

- A business account should be opened by a business owner. There is no verification process for this, so technically you can open this type of account even if you don't own a business, but that is what this type of account is for. There are many extra features within the Business account that are useful for businesses, such as invoicing services and the ability to accept credit card payments.

- It is useful to use your EIN number instead of social security number for the Business PayPal account so that you can keep this income separate from your personal income for tax purposes.

-

5Choose either Standard or Pro. Once you’ve selected “Business Account” and tapped or clicked the “Next” button, another screen with two options will show up. Choose between “Standard” or “Pro” accounts. The Standard is free, and the Pro is $30 a month.

- The Pro offers customization for the checkout page on your business website. Click on the link that says “Learn more” to see what the checkout screen would look like on your business website with Pro.

-

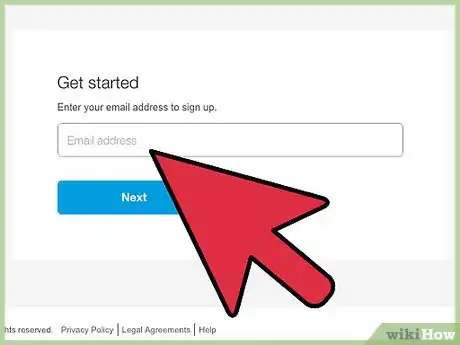

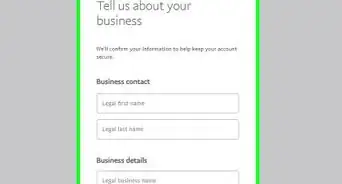

6Enter your personal details. Once you’ve chosen a type of business PayPal account, you’ll need to supply PayPal with your email address. Make sure this is the email address you want to use for a business account because it becomes your profile name and PayPal identity.

-

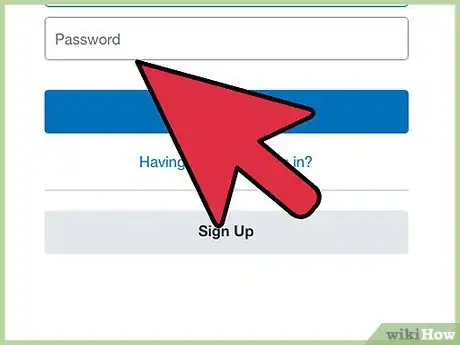

7Create a password. After entering your email address, you’ll create a password. To keep your account especially secure, it is wise to use a combination of all functions (lower case, upper case, numbers, and special characters) and then copy and paste the password into a document saved to your hard drive or phone so that you never lose it or need to memorize it.

- After you create a password, you will be prompted to enter personal information so that PayPal can keep track of your identity in future transactions.

-

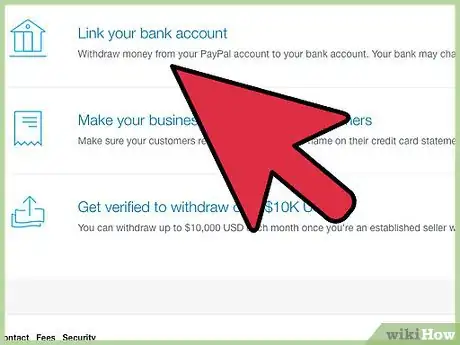

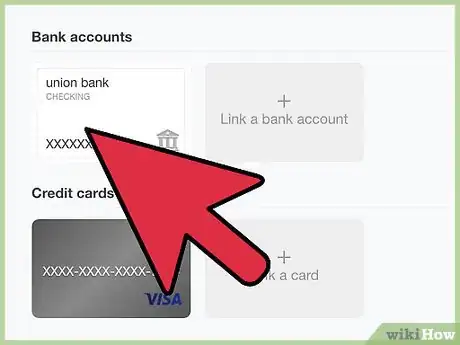

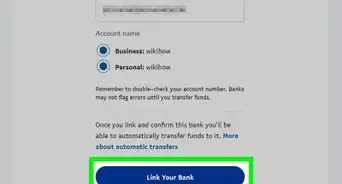

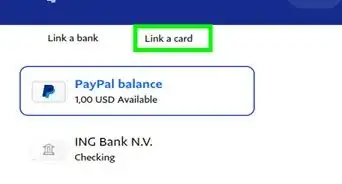

8Link a credit card, debit card, or bank account. Once your account is open, you can immediately accept money or receive payments. However, you can’t pay for anything until you link a card or bank account, so it is smart to go ahead and choose either your debit card or bank account, or credit card, to attach to this PayPal account. This is in case your PayPal balance is ever too low.[3]

-

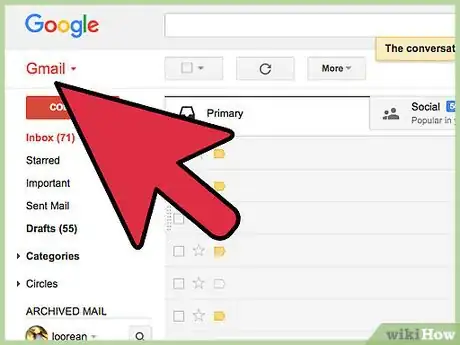

9Verify your PayPal account. Your account is not activated until you check your personal email and open the verification email sent from PayPal. Inside this email, you will find a verification link. Clicking this link activates your account and takes you back into your PayPal account.

- This is so that PayPal can verify your identity before allowing you to conduct business.

-

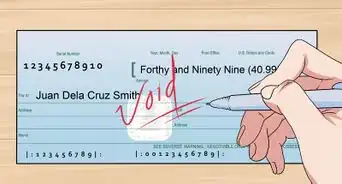

10Confirm your bank account or debit/credit card. Once your account is verified through email, you’ll need to confirm your alternate method of payment. If you’ve linked your bank account to PayPal, PayPal will give you three options for confirming the account. Your card may or may not need to be verified.

- Sometimes a card can be confirmed instantly.

- If you choose only one method of confirmation for your bank account, you will have a monthly cap on how much you can move to your checking account. If you use two forms of verification, the cap will be removed and you can transfer as much money as you want per month to your checking account from PayPal.

Signing Up for a Debit Card

-

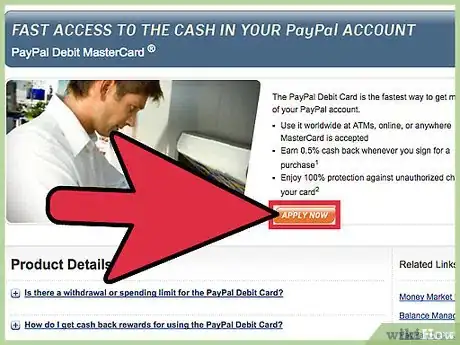

1Pull up the debit card application. Once your PayPal account is set up, you can apply for a PayPal Business Debit Master Card. Within your PayPal home screen, select the menu option “Tools” at the top of the screen. Select the option for “All Tools.” You will see a lot of different blocks, so scroll down until you see one for “PayPal debit card” on the left hand side (in row 4).

- Clicking or tapping this box will take you to the debit card application.

-

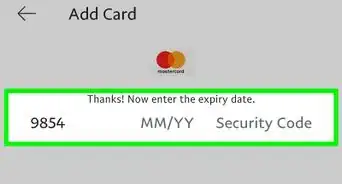

2Fill out your personal info. On the application screen for the PayPal Business Debit MasterCard, your name should already appear. Confirm your birth date, enter your social security number, then confirm your address and phone number. This is all the information you need to apply. Just having a PayPal Business account is sufficient beyond your personal details.

- Keep in mind that PayPal has a reputation for strict internet security. If you still don’t like having to enter your social security number, then read PayPal’s explanation.[4]

- PayPal asks for your personal details in order to abide by federal laws that are in place to protect America from terrorism and money laundering activities.

-

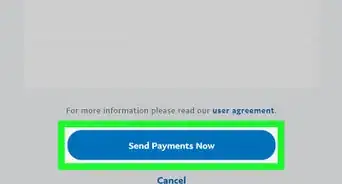

3Wait for your approval. After submitting your application through your PayPal account by clicking or tapping the button that says “Agree and Continue,” you will have to wait to get approved for the debit card. Approval should be fast.

- You can reapply 30 days after being denied.[5]

-

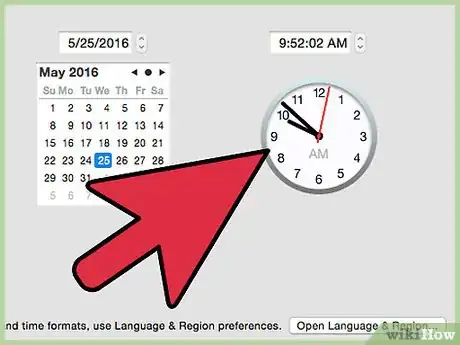

4Wait for your card to come in the mail. After receiving approval for your debit card, you will have to wait for the card to arrive in the mail. It should be on your doorstep or mailbox within seven to ten business days.[6]

-

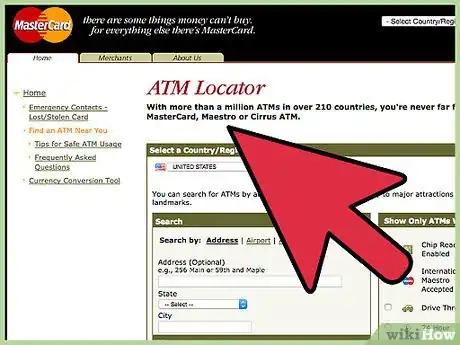

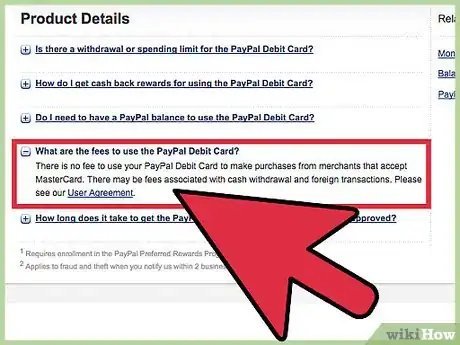

5Keep daily spending limits in mind. Although it isn’t widely advertised, there is a standard daily maximum for PayPal debit card use. You are only allowed to withdraw $400 a day from an ATM, and only allowed to spend $3,000 a daily in purchases.[7]

- Your limits get periodic reviews. As you use the card over time, your limit may increase or decrease based on your account history, activity, and other things.

Considering the Benefits

-

1Use an ATM. You might be wondering why you should get a PayPal debit card when you already have a bank account with a debit card. The PayPal card is useful for people who conduct a lot of business over the internet and want to have instant access to their money without having to wait for it to transfer to their bank accounts. This is especially useful at an ATM, where you can literally get cash from your PayPal account while you’re out and about.

- You can use the PayPal Business Debit MasterCard at any ATM run by MasterCard, Maestro, or Cirrus.[8]

-

2Use the card without an annual fee. Just like with a PayPal account, there is no annual fee for maintaining this debit card (unless you choose Business Pro).[9] This is useful for those whose banks charge a fee for having a checking account, a common occurrence with business bank accounts that transact a lot of money.

-

3Use the card wherever you see a MasterCard logo. This debit card is all about being convenient. You can use it in person at any store, or to pay at any online store, that displays the MasterCard logo. This is useful for business owners who spend much of their days buying and selling and who need their income as soon as it arrives in the PayPal account.

-

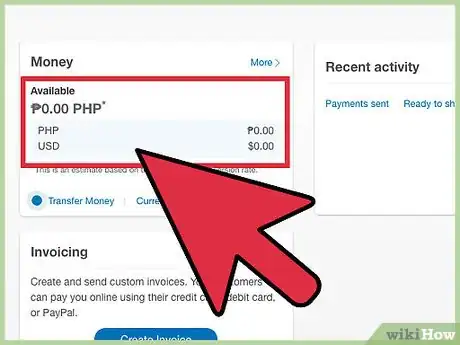

4Use the card even if you don’t have enough in your PayPal account. Since you link your checking account to your PayPal account via bank account or debit card—or use a credit card—you will never have to stop using the PayPal debit card or worry that there’s not enough money in your PayPal account. When your funds are too low, the money is withdrawn from your bank account or credit card.

-

5Get identify theft protection. PayPal offers a zero liability identity protection on their Debit MasterCard. This means that if there is ever an unauthorized payment using your card, PayPal will reimburse the full amount as long as you follow their guidelines for reporting theft.[10]

- PayPal allows you 60 days to report the incident or error.

- You must call PayPal (or write to them) to report the unauthorized use of your debit card.

- You must include the following information: name, debit card number, explanation of the error, approximate date of error.

- A written summary of this information may be required within 10 days of reporting.

- It takes 10 to 45 business days to approve the error and refund the money, if the PayPal investigation confirms your report.

-

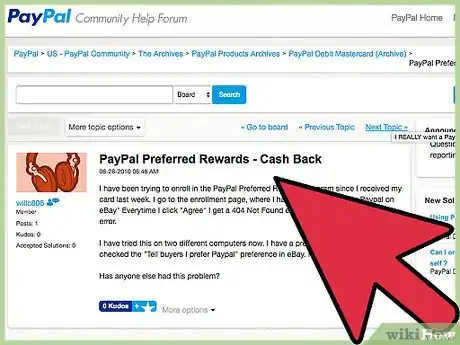

6Get cash back. Once you receive your debit card, you will have the option for signing up for the cash back program. Sign up with PayPal Preferred Rewards and get unlimited 1% cash back when you sign for your payment or use it online—in other words, when you don’t use the PIN number.[11]

- It takes up to 48 hours after signing up to start seeing cash back accrue.[12]

- The cash back is calculated as a net percentage of your monthly purchases, meaning returns do not qualify, and is applied to your account at the end of each month.

- You also get cash back for catalog or phone purchases.

- You will be removed from the cash back program if your card is not used in 12 months.

References

- ↑ https://www.paypal.com/bm/cgi-bin/webscr?cmd=xpt/account/DCIntro-outside

- ↑ https://www.paypal.com/cgi-bin/webscr?cmd=p/gen/personal_vs_business-outside

- ↑ https://www.paypal.com/selfhelp/article/HCA128

- ↑ https://www.paypal.com/us/webapps/mpp/ua/debitcard-full

- ↑ https://www.paypal.com/selfhelp/article/HCA140/1

- ↑ https://www.paypal.com/selfhelp/article/HCA140/2

- ↑ https://www.paypal.com/us/webapps/mpp/ua/debitcard-full

- ↑ https://www.paypal.com/selfhelp/article/HCA140/2

- ↑ https://www.paypal.com/selfhelp/article/HCA140/2