This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 743,716 times.

Switzerland is known for its impressive banking system, including its legendary privacy policies. It is actually a criminal offense in Switzerland for a banker to reveal private information about bank clients, which in the past was a huge perk for anyone wishing to conceal ill-gotten money or valuables. In today's world, however, concerns about terrorism and smuggling have forced the authorities in Switzerland to reject clients whom they believe to be involved in illegal activities.[1] Some Swiss banks are now also refusing American customers, in general, due to sweeping investigations by the United States Department of Justice.[2] While Swiss banks may not be as exciting as they are depicted in spy movies and action thrillers, they are still extremely well run and impressively private. Each bank has its own steps for setting up an account, but knowing what basic information and documents you will need can help you get started in setting up your own Swiss bank account.

Steps

Choosing a Bank and Service

-

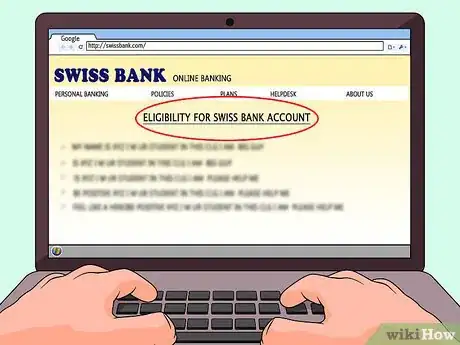

1Learn whether you're eligible for a Swiss bank account. Many banks, even in Switzerland, must now verify the identity of the account holder and all sources of income. This is to prevent money acquired through illegal activities from being stored in Swiss bank accounts. And due to tax-evasion crackdowns by the US Department of Justice, some Swiss banks are refusing to do business with American clients for fear of legal repercussions.[3] Where you live and what you do for a living could influence whether or not you are eligible for a checking or savings account with a Swiss bank.

- Citizens of certain countries are prohibited from opening Swiss bank accounts. This can be for any number of reasons, such as official embargoes (with countries like Russia and Iraq, for example) and other political exclusions.[4]

- Regardless of your nationality and source(s) of income, your application for a Swiss bank account may be rejected if you are deemed to be a “politically exposed” person - someone who has been involved in a scandal or has a publicly dubious reputation. The bank would be concerned that if that sort of person became a client, he or she might pose too great a risk to the bank's reputation.

-

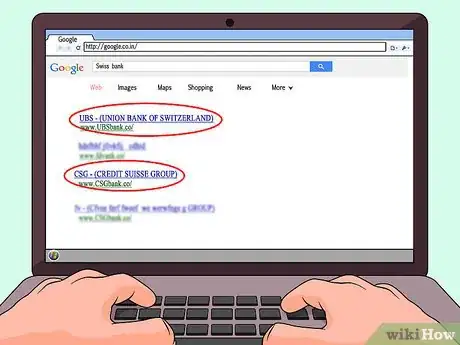

2Find a bank that meets your needs. There are approximately 400 banks in Switzerland, though two banks in particular - UBS (Union Bank of Switzerland) and Credit Suisse Group - account for almost half of all investments in Swiss banks.[5] One of the biggest factors in determining which bank to choose is what you're looking for in a bank. Comparing policies and investment opportunities at a variety of top-rated banks can help you examine the pros and cons of each bank and find one that's right for you.

- If privacy is a factor, consider going with a bank that does not have branches in your home country. Most banks are governed by the laws of the nation in which a given branch is located, not by the laws of the head office's nation.[6]

- Be aware that unless a bank has earned a status of qualified intermediary (QI), that bank may have to report the owner of an account and all money received from the United States to the IRS, if the account holder is a US citizen.[7]

Advertisement -

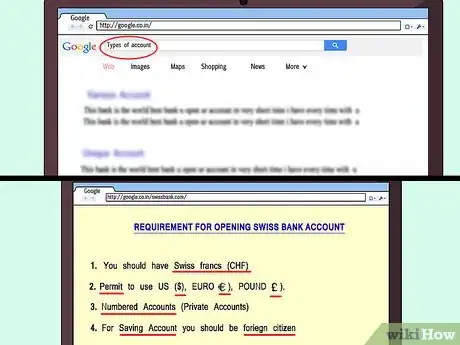

3Choose an account type. There are many different types of bank accounts available through Swiss banks. Certain bank accounts require a minimum amount for the initial deposit, a minimum account balance, and other qualifying factors.[8] Compare the requirements for each type of account you're interested in opening to find one that will work best for your financial needs.

- Some banks require customers to use Swiss francs (CHF). Others permit the use of US dollars, euros, and other forms of currency from around the world. Check with the bank you wish to do business with to see what form(s) of currency they accept if exchanging into other currencies is a concern for you.

- One of the most secretive accounts is what is known as a numbered account. These accounts are not, strictly speaking, "secret" or "anonymous" accounts. Certain high-level bank employees will know the identity of the account holder(s), but these accounts still offer some degree of privacy, as numbered accounts require the bank to use only the account number in any and all correspondence regarding the account.[9] However, these accounts tend to have a number of restrictions, and maintaining a numbered account may come with annual fees of up to 2,000 Swiss Francs.[10]

- It is worth noting that some Swiss banks are reluctant to offer general savings accounts for foreign citizens. Instead, Swiss banks focus on providing foreign citizens with investment opportunities and wealth management specialties.

Opening an Investment Account

-

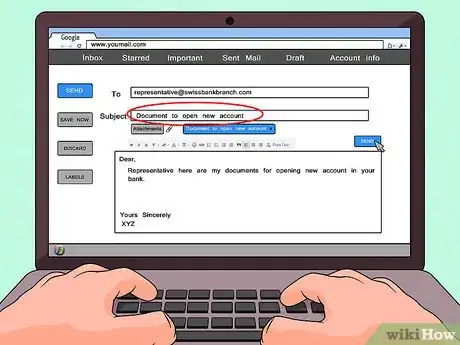

1Visit a bank branch or representative office. Customers interested in opening a Swiss bank account must visit an operational bank branch, either in person or through a representative. If sending a representative, that representative will have to provide documentation for both himself and the person he represents. Due to strict banking guidelines, bank accounts cannot be opened online, as there is currently no way to verify the potential client's identity or source(s) of income online.

- Certain banks may allow you to complete this process by mail. A photocopy of your official, government-issued passport would have to be certified by an approved institution and sent to the bank you wish to do business with.[11]

-

2Provide the necessary documentation. Like most banks around the world, Swiss banks are required to verify the identity and source of income of customers who wish to open a new account. For this reason, most banks require potential clients to meet in person with a bank representative to complete the verification process.

- Customers may be required to provide a valid passport as a means of identification.[12]

- Bank representatives may ask for documentation to verify the origin of income. For example, bank representatives may request a copy of a contract proving that a house was sold to acquire the money in question, or receipts from securities sales, or a verifying statement from a bank you've done business with in the past.

- Banks may verify the listed address of a potential customer by sending some type of correspondence through the mail.

-

3Fill out the necessary paperwork. As with any other bank account, there are forms and application materials that potential customers must fill out. Due to the security of Swiss banks and the international pressure to account for tax evasion efforts, however, the paperwork process can be quite lengthy. One Swiss bank expert reported that there can be upwards of 100 pages of paperwork required for a foreign investor to open a Swiss bank account.[13]

-

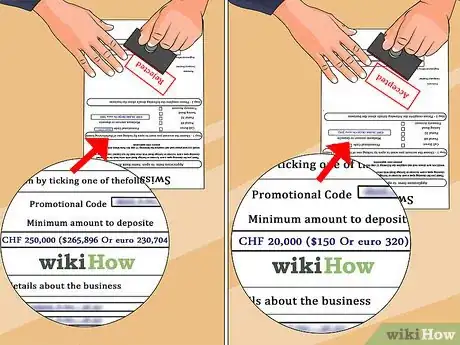

4Meet the minimum investment requirements. Each bank has different requirements on the minimum deposit/investment an individual must make. Sometimes various types of accounts within the same bank may have drastically different requirements. Some banks (and account types) have minimum deposit/investment sums ranging in the millions of dollars.[14]

- Many private banks will not accept new clients unless that client is willing to invest a minimum of CHF 250,000 ($265,896.64 in US dollars, or 230,704.37 Euros). However, some banks, including UBS and Credit Suisse, will accept investments below CHF 50,000 ($53,179.33 US dollars, or 46,140.87 Euros).[15] Check with the bank you're interested in investing with to learn more about their minimum requirements.

Opening a Personal Account

-

1Visit a bank branch or representative office. Anyone new to Switzerland who hopes to open a bank account there will need to meet with a bank representative. It's best to make these arrangements and get a bank account set up as quickly as possible. It may be helpful to visit a Swiss bank branch before you close out your old bank account from the country you're leaving, if at all possible. Some expatriates may have a difficult time securing their housing without a bank account, yet they may also have a difficult time opening a bank account without an address.[16]

- Potential customers living outside of Switzerland who wish to open a Swiss bank account but cannot visit a branch in person may be able to request an application package by mail. Documents provided by the potential customer will need to be authenticated, either by a notary, an employee of the Swiss bank, or an employee of a correspondent bank that the Swiss bank is willing to work with.[17]

-

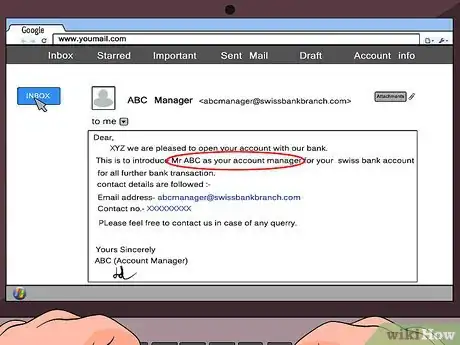

2Get assigned an account manager. Most Swiss banks assign a personal account manager to work with each customer, and it's important to remember who your account manager is for all future bank transactions. Ask for your account manager's contact information, including his email address and direct phone line at the bank.[18]

- Bank branches in major cities tend to have at least one account manager who speaks a foreign language, including English. Otherwise an account manager will most likely be fluent in one of Switzerland's four major languages: German, French, Italian, or Romansh. If you know you will require an account manager who speaks a language other than the major languages of Switzerland, it's best to call ahead and make the necessary arrangements.[19]

-

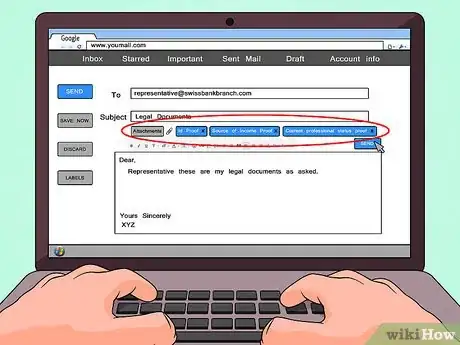

3Provide the necessary documentation. Like most banks and financial institutions around the world, new customers wishing to open a personal account will need to provide documentation that proves the customer's identity and source(s) of income.[20]

- New customers will be asked to verify their identity and address.[21] If your identification card does not reflect your local Swiss address, you may need to provide a signed copy of your lease.

- Some banks will require a new customer to verify his professional status. Banks may also require new customers to show any relevant work contracts and tax returns as part of the employment verification process. Showing proof of employment helps banks know that the money being deposited into an account has not come from illegal activities.[22]

-

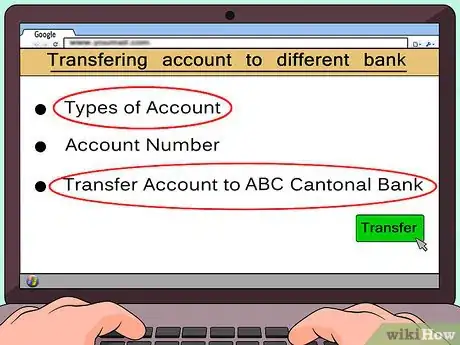

4Learn cantonal requirements. There are over 20 Swiss banks that are cantonal, meaning they only do business with residents of the canton in which each bank is located. If you open a personal account with a cantonal bank and move to a different canton, you may be asked to transfer your account to a corresponding canton. This should not be a problem for customers who open accounts with Swiss national banks.[23]

-

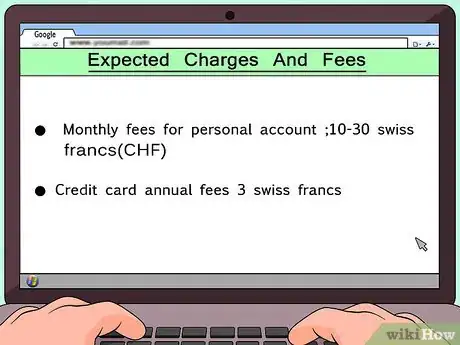

5Expect to pay charges and fees. Most Swiss banks charge a monthly maintenance fee for personal accounts, and may charge additional fees for a credit card or Carte Maestro (debit card).[24]

- Monthly fees for personal accounts tend to range anywhere from 10 to 30 Swiss Francs (CHF), though customers can usually have these fees reduced or waived by switching to electronic banking statements, taking out a mortgage with the bank, or depositing a sizable amount of money into that account.[25]

- Credit cards and Carte Maestros tend to have annual fees that range up to 3 Swiss Francs.[26]

Accessing Money in a Swiss Bank Account

-

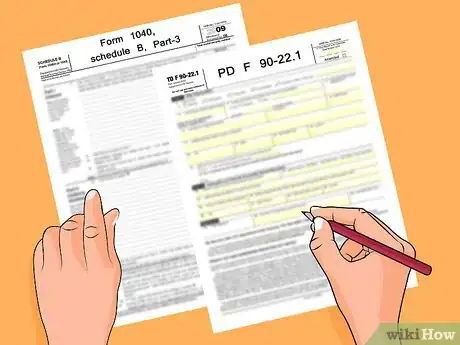

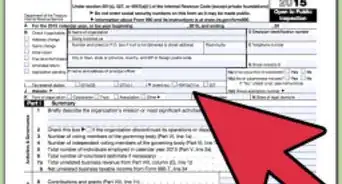

1Learn your tax requirements. This is particularly important for US citizens opening Swiss bank accounts, though it may apply to other countries as well. US citizens, regardless of their choice in bank accounts, are required to:

- file Form 1040, Schedule B, Part III, declaring that you are opening a foreign bank account.

- file Form TD F 90-22.1 by June 30th of each year to inform the IRS of the location of any foreign accounts that were in excess of $10,000 at any point during the previous year.

-

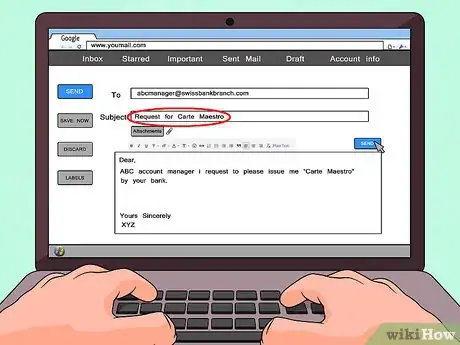

2Request a Carte Maestro. A Carte Maestro is essentially a debit card that is issued by your bank. It can be used to withdraw cash or complete purchases in most shops, though merchants in smaller towns and villages may have cash-only policies.[27]

-

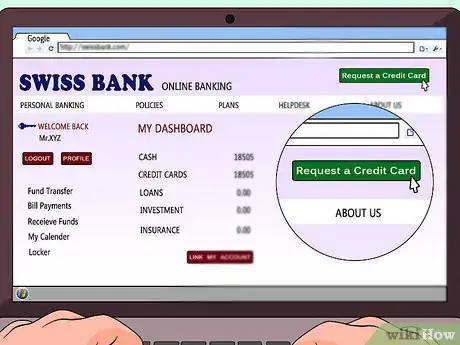

3Request a credit card. Many Swiss banks can issue credit cards to interested customers. However, customers may be required to provide the bank with a security deposit, typically one to two times the maximum monthly credit limit, to deter customers from ringing up delinquent charges. The deposit will be returned to the customer upon the credit card's cancellation, provided that the customer has paid off any charges that were made using that card.[28]

-

4Use traveller's checks. Traveller's checks do not always offer the best exchange rate, but they can be invaluable for overseas customers, as they can be easily replaced if lost or stolen.[29] Additionally, traveller's checks allow customers concerned with security to conduct business and make transactions without compromising the privacy of their bank accounts.[30]

- Investors with private Swiss bank accounts may wish to avoid getting a debit card or checkbook if privacy is an issue. Any time you write a check or use a debit card, it creates a traceable path back to your bank account. If you're trying to maintain a secret account, being issued a debit card or checkbook is an easy way to get caught.[31]

-

5Close your account with confidence. If for any reason you need to close your account or collect on your investment(s), most Swiss banks allow you to do so without any restrictions or fees.[32] This gives many customers confidence, knowing that investments are available in case of an emergency.

References

- ↑ http://www.business-standard.com/article/economy-policy/black-money-6-things-you-should-know-before-opening-a-swiss-bank-account-114102900135_1.html

- ↑ http://blogs.wsj.com/moneybeat/2014/09/10/yes-you-too-can-have-a-swiss-bank-account/

- ↑ http://blogs.wsj.com/moneybeat/2014/09/10/yes-you-too-can-have-a-swiss-bank-account/

- ↑ http://www.premiumswitzerland.com/financial-news/banking/open-a-swiss-account.htm

- ↑ http://www.business-standard.com/article/economy-policy/black-money-6-things-you-should-know-before-opening-a-swiss-bank-account-114102900135_1.html

- ↑ http://www.business-standard.com/article/economy-policy/black-money-6-things-you-should-know-before-opening-a-swiss-bank-account-114102900135_1.html

- ↑ http://www.cnbc.com/id/26182063

- ↑ http://www.business-standard.com/article/economy-policy/black-money-6-things-you-should-know-before-opening-a-swiss-bank-account-114102900135_1.html

- ↑ http://www.cnbc.com/id/26182063

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.premiumswitzerland.com/financial-news/banking/open-a-swiss-account.htm

- ↑ http://www.investopedia.com/ask/answers/08/swiss-bank-account.asp

- ↑ http://www.businessinsider.com/hsbc-and-ubs-swiss-bank-account-and-tax-evasion-scandals-explainer-2015-2?r=UK&IR=T

- ↑ http://www.investopedia.com/ask/answers/08/swiss-bank-account.asp

- ↑ http://www.expatica.com/ch/finance/Banking-in-Switzerland_100032.html

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.expatica.com/ch/finance/Banking-in-Switzerland_100032.html

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.expatica.com/ch/finance/Banking-in-Switzerland_100032.html

- ↑ http://www.expatica.com/ch/finance/Banking-in-Switzerland_100032.html

- ↑ http://www.expatica.com/ch/finance/Banking-in-Switzerland_100032.html

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.expatica.com/ch/finance/banking-investments/How-to-open-a-Swiss-bank-account_102298.html

- ↑ http://www.independenttraveler.com/travel-tips/money-and-insurance/the-best-way-to-carry-money-overseas

- ↑ http://www.business-standard.com/article/economy-policy/black-money-6-things-you-should-know-before-opening-a-swiss-bank-account-114102900135_1.html

- ↑ http://www.business-standard.com/article/economy-policy/black-money-6-things-you-should-know-before-opening-a-swiss-bank-account-114102900135_1.html

- ↑ http://www.business-standard.com/article/economy-policy/black-money-6-things-you-should-know-before-opening-a-swiss-bank-account-114102900135_1.html

About This Article

Before you try to open a Swiss Bank account, keep in mind that citizens from certain countries, like Russia and Iraq, are barred from opening an account, and your application may be denied if you've been involved in a public scandal. Also, know that some Swiss banks won't offer a general savings account if you're a foreign citizen, so you may only have access to investment opportunities or wealth management options. If you are eligible, visit an operational bank branch in person or through a representative, and provide necessary documentation, such as a valid passport and proof of address and income. To learn how to access money in a Swiss bank account, keep reading!