This article was co-authored by Trent Larsen, CFP®. Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 89% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 272,729 times.

It can be difficult to earn and save money, especially if you are not great at money-management and are struggling to pay off your debts. But earning an income is the first step to saving money and paying off any debt that may be limiting your finances. You will also need to adjust your lifestyle habits to be more saving-friendly and increase the savings in your bank account.

Steps

Earning an Income

-

1Look for full time employment. The first step to building your savings is to get full time or part time employment. You can search for potential jobs online through listing websites or in the classifieds section of your newspaper. The key to landing a job is to find a position that you are qualified for and that plays to your strengths as an applicant.

- To increase your chances of employment, you should create a strong resume and a cover letter that is customized for the positions you are applying for. You should then send out applications to several positions you think will be a good fit for you, based on your resume and your qualifications.

-

2Consider getting a part time job. If you already have full time employment but are struggling to save money, you could get a part time job to earn some extra cash. This could be a low skill job like waitressing, bartending, or working as a service employee in retail. You could also take on side opportunities that relate to your full time job. If you are a teacher, for example, you may earn more money on the side by taking open subbing positions or teaching an extra class at a community college nearby.

- If you are planning on earning part time cash by waitressing or bartending, you will likely need to get your ProServe license before you can get hired by an employer at a bar or restaurant. Most ProServe certifications can be done online for $25-$30 through your state's Preserve program.

Advertisement -

3Offer to do odd jobs in your neighborhood. If you are struggling to find full time employment or are looking for extra income on the side, you may look for other ways to earn some extra cash. This could be by offering to shovel driveways or mow lawns for your neighbors or babysitting for a family friend nearby. Look for temporary work that you can do easily and consistently, like a weekly newsletter delivery route or a paid gig as a nanny for children in the area.

-

4Turn a hobby or passion into a source of income. Maybe you have always loved to crochet and have gotten very good at making hats and scarves for family and friends. You can use this hobby as a potential source of income by setting up an online shop where you sell your handmade products or by selling your products at markets and fairs. This will allow you to do something you enjoy and earn some extra income.

- Many small business owners start out small, with limited stock and an online only store, especially if they are the only ones making, marketing, and selling their handmade products. You may run your shop as a side business while you maintain a full time job until it becomes sustainable enough to be your full time source of income.

Creating a Savings Account

-

1Pay off any debt before you start to save money. To save money effectively, you will need to first pay down any existing debt you may have, such as credit card debit or student loan debt. Do this in monthly payments and always try to pay down as much of your debt as possible, as fast as possible, as this will prevent you from being charged high interest rates.[1] [2]

- You can set up automatic payments through your bank where you pay down the same amount on your outstanding debts every month. With consistent payments, you should be able to pay down your debt quickly and efficiently.

EXPERT TIPBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.Financial Advisor

Benjamin Packard

Benjamin Packard

Financial AdvisorOur Expert Agrees: It's impossible to save money when you still have outstanding debts because you will have to pay them at some point and they'll keep gaining interest when you're not paying them off. Prioritize paying off debts before you begin to save.

-

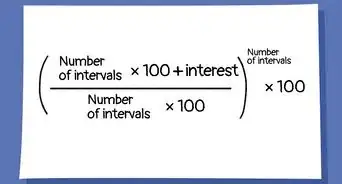

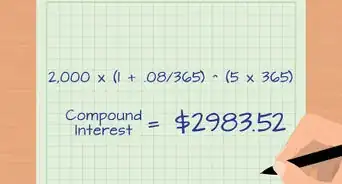

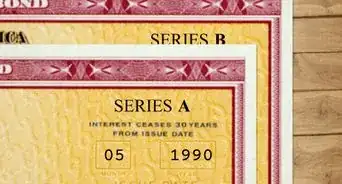

2Set up a savings account at your bank. Once you have paid down all your debts, you should open a savings account at your bank. Talk to a bank representative at your bank about opening an interest free savings account, where you are not charged a fee for depositing money into the savings account every month. Some savings accounts are also set up to reward you for depositing a certain amount into the account every month.[3]

- Depending on your employer, you may also be able to direct a portion of your paycheck into your savings account every month. Talk to your employer about this possibility.

- If you really want to ensure you do not spend any of your savings, you can open up a savings account at another bank that is not your main bank. This way, your checking account and your savings account are completely separate and are not easily accessible from one account or one debit card.

- Another option is to pay yourself first before you pay your bills. This means putting your paycheck into your savings account and then making recurring weekly payments to your checking account to pay for bills and expenses. This will help to ensure you do not neglect your savings account or use your savings to pay for unnecessary expenses.

-

3Commit to saving a certain amount of money every month. Set a minimum amount of money you will be depositing into your savings account every month and stick with it.[4] This could be small, $200-$300 to start, especially if you have a high amount of expenses. Try to increase the amount as your income increases and your expenses become more manageable. Ideally, you should be saving a good amount of your income so your savings account continues to grow and thrive.

- Your employer may also have a retirement plan that you can enroll in, known as a 401(k). This plan allows your employer to match the amount of money you deposit in your 401(k) fund and the maximum annual contributions for these funds get larger the longer you work at the company. This can help you save for retirement and be smart about your savings.[5]

-

4Use your savings as investment in a future purchase or experience. It can be difficult to save money every month, especially when you’re tempted to buy new clothing or go out every night. Focus on saving with purpose, where each dollar you save will act as an investment in future purchases or experiences.[6]

- Think about a big ticket item you are saving for, like a new home or a continuing education course, or a life changing experience, like a two month backpacking trip or a semester studying abroad. Having a purpose for your savings will motivate you to continue to add to your savings account and reward yourself for being conscious of your spending.

Adjusting Your Lifestyle Habits

-

1Create a budget and commit to it. If you do not already have a budget, you should create one and commit to it. This means determining your necessary expenses and ensuring your income covers your expenses. This can also help you save money, as you will be able to stick your savings plan and not overspend on unnecessary items.[7] Your budget should cover:

- Rent and utilities.

- Transportation.

- Food.

- Miscellaneous expenses, like car payments, school supplies, healthcare payments, etc.

- If you have any debt payments, add these to your budget as necessary expenses and pay them off as soon as possible.

EXPERT TIPNicolette Tura is an Authentic Living Expert who operated her own wellness business for more than ten years in the San Francisco Bay Area. Nicolette is a 500-hour Registered Yoga Teacher with a Psychology & Mindfulness Major, a National Academy of Sports Medicine (NASM) certified Corrective Exercise Specialist, and is an expert in authentic living. She holds a BA in Sociology from the University of California, Berkeley and got her master's degree in Sociology from SJSU. She constantly draws from her own wounds and challenges; with her training in the healing arts and sociology, she offers potent content, powerful meditations, and game-changing seminars on inspiring elevation on a personal and corporate level.Authentic Living Expert

Nicolette Tura, MA

Nicolette Tura, MA

Authentic Living ExpertFocus on how your income is going to increase, not on your lack of money. Consider the law of attraction. If you're always thinking about how much you're in debt, you're more likely to stay in debt. If you focus your attention on money coming into your possession, money is going to start coming to you. The law of attraction brings you what you focus on the most.

-

2Avoid eating out. Eating all your meals out is a guaranteed money waster so cut down on your eating out habits and focus on cooking at least one to two meals a day.[8] If you tend to buy a coffee every morning on your way to work, cut down on your expenses by buying coffee beans and making your own coffee at home. If you eat out for lunch every day, try to pack a lunch instead to save $10-$15 a day. Even a small amount saved every day can add up to more money in your savings account.

-

3Make a grocery list before you go grocery shopping. Plan out your meals for the week and make a grocery list so you stay on track when you go grocery shopping. You should have enough for at least two to three meals a day. It can be helpful to designate one day as your grocery shopping day, such as Saturday or Sunday, when you know the farmer’s market will be open or when you have enough time to do a good grocery shop.

-

4Buy low-price items and use coupons. Be on the lookout for deals on food through coupons to your local grocery store or big box store. You should also opt for low-price versions of food or discounted food when you go grocery shopping.

- Did you know wikiHow offers coupons for a variety of services and stores? Keep your savings on track by using our coupon site for tons of money-saving deals and promo codes.

-

5Put your spare change in a change jar. Don’t keep your spare change with you or deep in your coat pockets. Start a spare change jar and add all your change to it. Over time, it can add up to a substantial amount of money you can add to your savings account.[9]

-

6Think about expensive items for at least 24 hours before you buy them. To prevent buying items on impulse, you should wait at least 24 hours before buying an expensive item or product. Take some time to consider if you would like the item and if the item is a worthwhile investment. This will prevent you from regretting your purchase later or paying too much for an item that you could pay less for with a little research and consideration before purchasing.[10]

-

7Use debit or cash rather than credit to pay for items. Avoid debt by using debit or cash to pay for items, especially necessary expenses. Using debit will allow you to keep track of your purchases and using cash will give you a sense of how much you are spending every day.[11]

- You may want to take out your food money for the month, for example, and use this cash wisely on groceries. This way, you will not be able to overspend before the month is out and you can stay on budget.

How Can I Strategize A Reasonable Savings Goal?

Expert Q&A

-

QuestionHow can I force myself to save money?

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Trent Larsen, CFP®Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

Certified Financial Planner Take baby steps! Start by putting a small, manageable amount in your savings account, whether that's $5, $10, or some other amount. That way, you don't feel overwhelmed by saving a huge sum each month.

Take baby steps! Start by putting a small, manageable amount in your savings account, whether that's $5, $10, or some other amount. That way, you don't feel overwhelmed by saving a huge sum each month.

References

- ↑ http://www.bankrate.com/finance/savings/save-money-on-a-tight-budget-4.aspx

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.bankrate.com/finance/savings/save-money-on-a-tight-budget-4.aspx

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ http://www.bankrate.com/finance/financial-literacy/retirement-planning-for-people-in-their-30s-1.aspx#ixzz3doUwF5aF

- ↑ http://www.bankrate.com/finance/savings/save-money-on-a-tight-budget-5.aspx

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ http://www.bankrate.com/finance/savings/save-money-on-a-tight-budget-3.aspx

About This Article

It can be hard to earn and save money, but if you work at it, you can create a savings plan that will work for you. If you don’t have a job, look through online listings and newspaper classifieds, and apply to any jobs that you’re qualified for. Once you’re earning a paycheck, pay off any debts you have, then set up a savings account at your bank. Put a set amount from each paycheck into the savings account, and try to stick to a budget so you don’t have to use your savings to pay your bills or daily expenses. For tips on spending less money on groceries, keep reading!