This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 36,031 times.

Identity theft occurs when someone steals your identity and poses as you to make purchases with your money, receive medical treatment, claim your tax refunds, or to avoid giving their own personal information to the police. If you have been the victim of identity theft, you will need to prove to banks, creditors, and law enforcement that you are not responsible for whatever the thief did while posing as you.

Steps

Proving Theft to a Bank or Creditor

-

1Call the company where the fraud occurred. If someone stole your personal information and used it to purchase something, contact the company where the fraud occurred and/or the bank or credit card company to which the charge was made. Ask to speak to someone in the fraud department and detail what happened. The representative should able to assist you in freezing or closing your account; changing your login information, passwords, and PINs.[1]

-

2File a fraud alert with a credit reporting agency. There are three nationwide credit reporting agencies: Equifax, TransUnion, and Experian. Contact one and ask how to file a fraud alert. Filing an alert makes it more difficult for the identity thief to open new accounts using your identity. Once you have filed an alert with one of the three reporting agencies, that agency is required to notify the other two. You can reach the agencies at the following:

- Equifax: 1-888-766-0008, or http://www.equifax.com/CreditReportAssistance/

- TransUnion: 1-800-680-7289, or http://www.transunion.com/fraud

- Experian: 1-888-397-3742, or https://www.experian.com/fraud/center.html[2]

Advertisement -

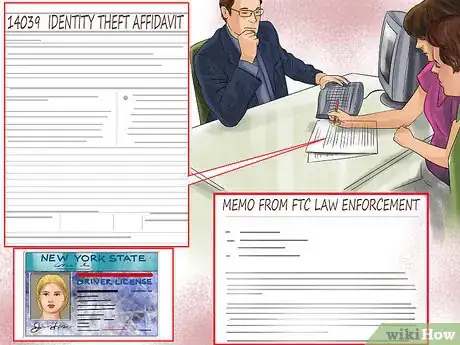

3File a complaint with the FTC. The Federal Trade Commission accepts complaints online or by phone. Once you file a complaint, you will receive an Identity Theft Affidavit. You will need the affidavit to file a police report. The affidavit is the most widely-accepted way for victims to dispute fraud, though some creditors might ask you to complete a separate affidavit specific to their business.[3]

- File an FTC complaint by calling 1-877-438-4338, or visiting https://www.ftccomplaintassistant.gov/#crnt&panel1-1

- To update your affidavit with new information, call the same number.[4]

-

4File a police report. Some creditors may require that you file a police report.[5] You can still file a report even though you do not know who the perpetrator is.[6] Go to the local police department and ask for assistance in filing a police report regarding identity theft. Be sure to bring the following documents with you:

- The Identity Theft Affidavit you filed with the FTC;

- Government-issued photographic ID (such as a state ID card or driver's license);

- Proof of your home address (like a utility bill or rent agreement);

- Proof of the theft (bills from creditors or notices from the IRS); and

- A copy of the FTC's "Memo to Law Enforcement," available at http://www.consumer.ftc.gov/sites/default/files/articles/pdf/pdf-0088-ftc-memo-law-enforcement.pdf.[7]

Proving Identity Theft to the Police or Courts

-

1Contact the police department who made the arrest. If someone was arrested and/or prosecuted, but gave your name and your personal information, then the identity thief may have given you a false criminal record.[8] You might only discover this when you are subsequently arrested, denied employment, or fired from your job as a result.[9] Contact the law enforcement agency that arrested the identity thief to dispute your criminal record.[10]

- If you do not know which agency arrested the thief, you may need to examine the court’s records.[11] Contact the court clerk in your jurisdiction, explain that a criminal record was created in your name, and ask how to access those records.

-

2File a police report. Ask the agency to assist you in filing a police report. Be prepared to provide fingerprints, a photograph, and any identifying documents the police department requests. The department should be able to compare your information with the thief’s and update their records.[12]

-

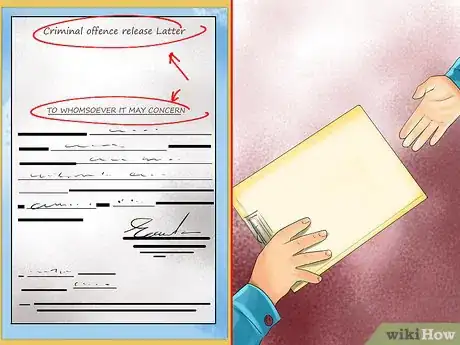

3Request proof of your innocence. Ask the police department to give you a clearance letter or a certificate of release. Keep the proof with you at all times.[13] If you are detained by the police in the future, use this as proof to explain the misunderstanding.

- Remember to use care if stopped by the police. For example, explain to the officer that you would like to show him or her your clearance letter before reaching into the glove box during a traffic stop. Although you know you are innocent, the officer may reasonably believe that you actually have a criminal record.

-

4Contact the court and prosecutor’s office. If the thief was prosecuted in criminal court under your name, contact the court clerk and the prosecutor’s office and ask them to clear your name in their records. You will need to provide proof of your identity and then you can request a certificate of clearance from the court.[14]

-

5Request an Identity Theft Passport. Contact your state's Attorney General’s office and ask if your state has an “identity theft passport” system. If your state uses such a system, you will need to fill out and submit an application. When you receive your identity theft passport, you can use it to clear up financial issues related to identity theft or explain the misunderstanding to police officers who might subsequently detain you.[15]

Proving Identity Theft to the IRS

-

1Respond to the IRS notice. You may first discover that your identity has been stolen when the IRS sends you a notice that you owe money or that more than one tax return was filed in your name. Do not delay. Call the number listed on the IRS notice and fill out an Identity Theft Affidavit Form 14039, available at https://www.irs.gov/pub/irs-pdf/f14039.pdf.

-

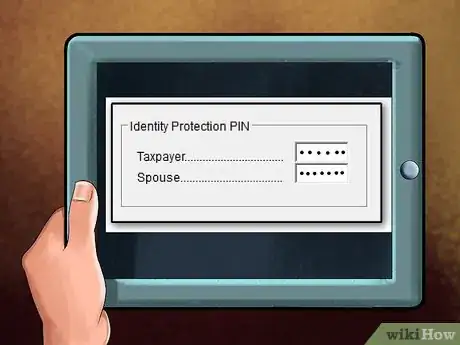

2Request an Identity Protection PIN. The IRS will issue you an Identity Protection PIN, which you will need to enter when you file your tax return. The PIN will prove your identity and prevent thieves from filing returns under your name. The IRS will send you your PIN in a letter. Keep it in a safe place until tax season.

-

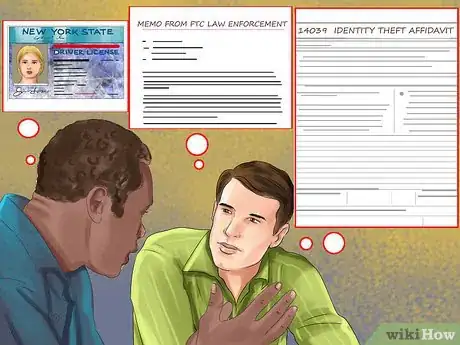

3File a police report. Contact your local law enforcement authorities to file a police report. You can use the report to document the identity theft to the IRS and to creditors, banks, police, and courts. When you go to the police station, bring the following with you:

- Government-issued photographic ID (such as a state ID card or driver's license);

- Proof of your home address (like a utility bill or rent agreement);

- The notice you received from the IRS; and

- A copy of the FTC's "Memo to Law Enforcement," available at http://www.consumer.ftc.gov/sites/default/files/articles/pdf/pdf-0088-ftc-memo-law-enforcement.pdf.[16]

Warnings

- This article is intended as legal information and does not provide legal advice. If you need legal advice, contact a licensed attorney.⧼thumbs_response⧽

References

- ↑ https://www.identitytheft.gov/

- ↑ https://www.identitytheft.gov/

- ↑ http://www.consumer.ftc.gov/articles/pdf-0119-guide-assisting-id-theft-victims.pdf

- ↑ https://www.identitytheft.gov/

- ↑ http://www.consumer.ftc.gov/articles/pdf-0119-guide-assisting-id-theft-victims.pdf

- ↑ http://www.consumer.ftc.gov/articles/pdf-0119-guide-assisting-id-theft-victims.pdf

- ↑ https://www.identitytheft.gov/

- ↑ https://www.identitytheft.gov/#othersteps-criminalcharges

- ↑ http://www.consumer.ftc.gov/articles/pdf-0119-guide-assisting-id-theft-victims.pdf

- ↑ https://www.identitytheft.gov/#othersteps-criminalcharges

- ↑ https://www.identitytheft.gov/#othersteps-criminalcharges

- ↑ https://www.identitytheft.gov/#othersteps-criminalcharges

- ↑ https://www.identitytheft.gov/#othersteps-criminalcharges

- ↑ https://www.identitytheft.gov/#othersteps-criminalcharges

- ↑ https://www.identitytheft.gov/#othersteps-criminalcharges

- ↑ https://www.identitytheft.gov/

- ↑ http://www.nolo.com/legal-encyclopedia/identity-theft-stolen-checklist-29691.html