This article was co-authored by wikiHow staff writer, Danielle Blinka, MA, MPA. Danielle Blinka is a Writer, Editor, Podcaster, Improv Performer, and Artist currently living in Houston, TX. She also has experience teaching English and writing to others. Danielle holds a Bachelor of Arts in English, Bachelor of Arts in Political Science, Master of Arts in English with a concentration in writing, and Master of Public Administration from Lamar University.

This article has been viewed 22,958 times.

Learn more...

A certificate of deposit (CD) is an easy way to invest money with a bank. While they offer lower returns than other types of investments, CDs are low-risk and great for many types of investors. It's relatively easy to buy a CD from a bank, but there are a few things you'll want to consider before you invest your money. If you choose to purchase a CD, you can invest in either a single CD or start a CD ladder, depending on your investment needs.

Steps

Investing in a Single CD

-

1Decide what type of CD you want to buy. Although they may seem confusing, the different types of CDs all work the same way. You will invest your funds for a period of time and get a guaranteed return. There are six types of CDs available:[1]

- A traditional CD lasts for a set period of time and offers a set interest rate.

- A bump-up CD allows the investor one request for an interest rate increase if rates go up.

- A liquid CD lets you withdraw part of your investment without penalty. However, the rates are usually lower than with other CDs.

- A zero-coupon CD reinvests your interest into another CD.

- A callable CD offers a higher rate but can be recalled and paid out by the bank if rates go lower.

- A brokered CD is purchased through a broker for a fee. These usually offer more competitive rates from banks all over the country.

-

2Choose the length of your CD. While your money is invested in the CD, you won't be able to access it. If you may need the money soon, you can choose a shorter term. However, a longer term will offer a better interest rate. For example, a 1-year term may earn 1.75% interest, while a 2-year term may earn 2.25% interest.[2]

- Opt for a longer term when interest rates are going down. Your investment will continue to gain at the current rate even as rates lower.

- Invest for a shorter period of time if rates are increasing. This will allow you to re-invest at a higher rate at the end of your term.[3]

- Remember that withdrawing your funds early will result in penalties.

Advertisement -

3Review rates offered by different banks. You can do this locally, online, or through a brokerage. Interest rates can vary, and choosing the best rate will help you get the most out of your money. When checking rates, remember to look at the term of the investment and not just the interest rate.[4]

- To check rates locally, call or visit banks in your area to find out their current CD rates.

- To check rates online, you can visit bank websites or an aggregator site, such as NerdWallet or BankRate.

- You can also check rates online through a brokerage, though you will likely have to set up an account and pay a fee to use the brokerage.

-

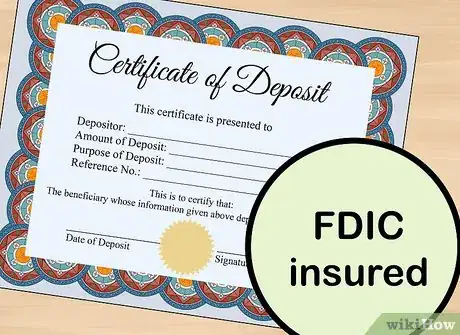

4Make sure your account is backed up by the FDIC. Most CDs are insured by the FDIC for up to $250,000, which is great news for investors. This means that you will not lose your investment even if the bank closes during your investment period.[5]

- It's easy to check your bank's status. Just look for the label “Member, FDIC” on their website or paperwork.

-

5Invest your money with the bank you choose. The bank will place your funds in a CD account, which is similar to a savings account. The main difference is that you cannot access the funds for a specific term. Each month, your money will earn interest according the CD's annual percentage yield (APY), which is the percentage it earns each year.[6]

- The return on your investment can vary from the APY listed, depending on your term. Terms less than a year will earn less than the APY, while terms that are longer than a year will earn the APY each year, compounded.

-

6Pay taxes on the interest you earn. The money you make on your CD will be taxed at the end of the year. The bank that issued your CD will send you a 1099-INT that shows how much interest you earned. You will enter this information in the area of your income tax forms for 1099s. This will count as income toward the amount of tax you owe for the year.[7]

- If you use a tax preparer, provide your 1099-INT to them when you file your taxes.

- If you are owed a refund, the taxes you owe on the interest will be taken out of the refund. Otherwise, you will pay the difference in taxes that you owe.

- If your CD is part of a tax-deferred or tax-free Roth IRA, then you may not have to pay the taxes.[8] In this case, you will not receive a 1099-INT.

Starting a CD Ladder

-

1Choose a CD ladder for a long-term investment with access to the funds. You can create a CD ladder by purchasing more than one CD with different term lengths, such as a 1-year term, 2-year term, and 3-year term. This allows you to invest over a longer period. However, you can still access your money without penalty each year when one of your terms end. Additionally, you'll be able to take advantage of better interest rates on CDs that have a longer term.[9]

- For example, a 3-year term CD usually earns more interest than a 1-year term CD. If you invest part of your money in a longer-term CD, you'll earn more interest.

- A CD ladder works best for investors who have at least a few thousands of dollars to invest.

- You may want to choose a single CD if you have a small amount to invest or plan to use the funds soon. It may also work for you if you don't need to access the funds soon and would like to purchase a single long-term CD.

- Talk to your broker or banker about whether this option is right for you.

-

2Divide your money into smaller investment amounts. Most people choose to invest equal amounts in each of their CDs, but you can change the amount to fit your needs. For example, you may want to invest a larger portion in the shortest-term CD if you may need the funds soon.[10]

- Let's say you want to invest $10,000. You could divide that amount into four portions of $2,500 to invest in four different CDs.

-

3Invest in multiple CDs with staggered terms. Your CD terms should range from a 6-month or 1-year term up to a 3-year term. This allows you to access a portion of your funds without penalty on a regular schedule. You can also take advantage of higher interest rates for part of your funds.[11]

- For example, you could invest your four portions of $2,500 in a 6-month CD, 1-year CD, 2-year CD, and 3-year CD.

-

4Spend or re-invest your money at the end of your term. When your account reaches the end of the term, you will have access to those funds without penalty. This allows you to cover planned or unexpected expenses if you need to. Otherwise, you may want to re-invest the funds in another longer-term CD.[12]

- If you re-invest the funds, choose a term length that will mature at a later date than your remaining CDs. For example, if you originally invested in 6-month, 1-year, 2-year, and 3-year CDs, then choose another 3-year CD for your re-investment.

- Re-investing will maintain the investment ladder.

Deciding if a CD Is Right For You

-

1Opt for a CD if you want to make money on your savings. CDs offer better interest rates than checking or savings accounts, but your money will be easily available than with other options. By placing part of your savings in a CD, you can earn interest on funds that would be sitting in the bank anyway.[13]

- It's a good idea to keep part of your savings in a regular savings account for use in an emergency. Otherwise, you can choose a CD that allows you to withdraw part of the funds with no penalty.

-

2Choose a CD if you want a low-risk investment. One of the best features of a CD is that they let you earn a guaranteed return. Although it's a small return, you have no risk of losing your money.[14]

-

3Make sure you don't need the money for at least 6 months. When you put money in a CD, you can't access it without a penalty. Paying the fees would defeat the purpose of investing your money, so it's not a good idea to put your money in a CD if you might need it soon.[15]

- A CD might be a great option for money that you're setting aside for a specific purpose, such as closing on a home in 1 year.

- It's a good idea to set aside some of your savings in an emergency fund so that you don't have to access the CD early.

Community Q&A

-

QuestionWhat are the methods of paying for a CD?

DonaganTop AnswererYour bank or brokerage will accept cash or a check, or they can debit your existing account.

DonaganTop AnswererYour bank or brokerage will accept cash or a check, or they can debit your existing account. -

QuestionWhat are the penalties for early withdrawal?

DonaganTop AnswererPenalties vary from one institution to the next. Penalties typically depend on the amount of the CD, the interest rate attached and the number of days' or months' interest the institution subtracts for early withdrawal. Ask your bank or other issuing institution for information on their penalties.

DonaganTop AnswererPenalties vary from one institution to the next. Penalties typically depend on the amount of the CD, the interest rate attached and the number of days' or months' interest the institution subtracts for early withdrawal. Ask your bank or other issuing institution for information on their penalties.

References

- ↑ http://guides.wsj.com/personal-finance/banking/what-is-a-certificate-of-deposit-cd/

- ↑ https://www.nerdwallet.com/rates/cds/best-cd-rates

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-invest-in-a-certificate-of-deposit-cd/

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-invest-in-a-certificate-of-deposit-cd/

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-invest-in-a-certificate-of-deposit-cd/

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-invest-in-a-certificate-of-deposit-cd/

- ↑ https://www.investopedia.com/ask/answers/020515/how-are-yields-taxed-certificate-deposit-cd.asp

- ↑ http://guides.wsj.com/personal-finance/banking/what-is-a-certificate-of-deposit-cd/

- ↑ https://www.nerdwallet.com/blog/banking/cd-certificate-of-deposit/

- ↑ https://www.nerdwallet.com/blog/banking/cd-certificate-of-deposit/

- ↑ https://www.nerdwallet.com/blog/banking/cd-certificate-of-deposit/

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-invest-in-a-certificate-of-deposit-cd/

- ↑ https://www.nerdwallet.com/blog/banking/cd-certificate-of-deposit/

- ↑ https://www.nerdwallet.com/blog/banking/cd-certificate-of-deposit/

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-invest-in-a-certificate-of-deposit-cd/

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-invest-in-a-certificate-of-deposit-cd/