This article was co-authored by wikiHow staff writer, Eric McClure. Eric McClure is an editing fellow at wikiHow where he has been editing, researching, and creating content since 2019. A former educator and poet, his work has appeared in Carcinogenic Poetry, Shot Glass Journal, Prairie Margins, and The Rusty Nail. His digital chapbook, The Internet, was also published in TL;DR Magazine. He was the winner of the Paul Carroll award for outstanding achievement in creative writing in 2014, and he was a featured reader at the Poetry Foundation’s Open Door Reading Series in 2015. Eric holds a BA in English from the University of Illinois at Chicago, and an MEd in secondary education from DePaul University.

There are 22 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 32,633 times.

Learn more...

Moving out of student housing and finding a place of your own can be an exhilarating process. It’s easy to get swept away spending hours scrolling through listings looking for that perfect pad! But if you’ve never rented an apartment as a student or this is your first time renting a place, you may have questions about how this process works. The first step is to contact the landlord to take a look at the place, and this is where it helps to mention that you’re a student. If you like the apartment and it’s within your budget, your status as a student shouldn’t keep you from the getting the place—especially if you have a co-signer to cover your obligation to pay the rent.

Steps

How does a student qualify for an apartment?

-

1This depends on where you live, but listings typically explain what you need. When you’re looking at potential apartments, read the listing thoroughly to see what the landlord requires. Typically, you have to have a security deposit, income, and credit. If you don’t have any of these things, you will likely need a co-signer to sign the lease with you so that the landlord knows you’ll pay your rent.[2]

- A co-signer, or guarantor, is a third party who is on the hook for the rent if you can’t pay. This can be a parent or relative, but you can typically use anyone with a good income and solid credit.[3] Basically, if you can’t pay your rent, the landlord can require the co-signer to pay for you.

- If a listing mentions that a unit is “perfect for students” or something like that, it’s a good bet that the landlord will be open to renting to you.

-

2You can always reach out to a landlord and ask them if you’re qualified. If you’re interested in a place but you aren’t sure if you qualify, just ask. Send the landlord a well-written email or call them and explain that you’re a student. Mention whether you’re going to have any help in terms of paying for the apartment, or if you don’t have any credit. Let them know if you’re open to a co-signer, or if you have student loans you’re going to use to pay for a place. They may be willing to meet you halfway if they know you’re a student.[4]

- For example, you may say, “Hello, my name is Edward Schultz and I’m interested in your unit on Grover Street. I’m a student, majoring in business, and I’m looking for a quiet place near campus. I’d like to set up a time to see the apartment and fill out an application if you’re open to it. I have a part-time job, but my parents would be helping me out with some of the rent as well. I can always have them cosign if necessary. Please let me know!”

- Some landlords don’t want to rent to students because they assume they’re not going to take care of the place, or throw parties every week. Some landlords prefer students because they’re not as demanding or difficult to work with. It’s all about finding the right fit for you!

How can I get an apartment at 18 with no credit?

-

1Apply for rental units owned by individuals, not companies. Apartment complexes and property management companies rarely bend on their requirements, but a private landlord has total control over who they rent to. This way, you can rely on your charm and negotiating skills to land yourself a sweet place.[5]

- You can typically tell if a property management company owns a building or not by reading the listing. These companies usually put their company name all over the description.

- Giant apartment complexes are more likely to be owned by a company than smaller buildings.

- If you’re emailing “lakefrontproperties@gmail.com,” or, “Sean@HousingPeopleNY.org,” it’s a company. If their email is “TastyCakes812” or something, it’s a private owner.

-

2Offer to get a co-signer and just explain you’re a student. A co-signer should quell a lot of anxiety a landlord may have about renting to a student. Beyond that, you should just explain that you have no credit because you’re a student. Not having credit is a red flag if you’re 45 years old and you’ve been working full-time for several decades, but it doesn’t matter nearly as much when you’re an 18- to 25-year-old student.[6]

- Remember, you can always offer to pay a bigger security deposit as well. This can make a lot of landlords more inclined to accept your application.

What is a reasonable price for an apartment?

-

1The cost of rent depends on where you live, the neighborhood, and the size of the unit. The average 1-bedroom apartment in Newark, New Jersey will run you $850 a month, but that same unit in San Francisco will cost $3,600.[7] To figure out if a unit is reasonably priced, go on Craigslist, Zillow, or another rental listing site and search for similar apartments in the area. If the listing you’re looking at is similarly-priced to the others, it’s probably a fair price.[8]

- For a basic studio or 1-bedroom apartment, expect to spend $500-1,000 a month depending on where you live. If you’re in a major city, this may be a lot higher. If you live in a small city or rural area, it may cost less than this.

- Remember, nicer units usually cost more, while run-down apartments will cost less. Having a dishwasher, balcony, and in-unit laundry may bump the rent up a couple hundred bucks.

-

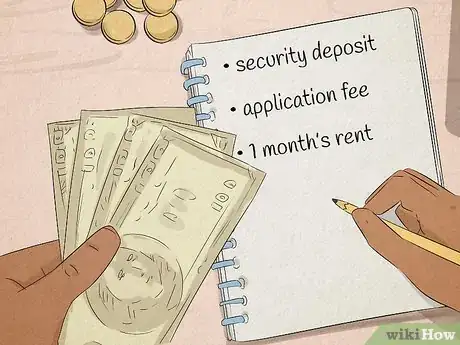

2You’ll need a security deposit, application fee, and at least 1 month’s rent to pay for an apartment. The application fee typically costs $25-100, and this fee pays for your credit check. If you are approved for an apartment, you’ll need to pay the security deposit as well. This is a refundable payment you make to cover potential damage if you don’t take care of the apartment. You typically get this back at the end of the lease, although there may be deductions if you damage the place. You’ll also usually need to pay the first month’s rent, although some states and cities will allow landlords to collect the last month’s rent as well.[9]

- So, if a unit costs $600 a month, the security deposit is $1,200, and you need to pay the first and last month’s rent up front, you’ll need to pay the landlord $2,400 up front to get your keys.

- Security deposit prices depend on where you live. Some cities allow landlords to collect 3-months’ rent for the deposit, while other regions only require 1 month.

- Some landlords don’t require a deposit. However, you may need to pay a non-refundable fee to move into a place with no security deposit.[10]

- This can be a lot of upfront costs, but remember, you should get the deposit back if you take care of the place. If you pay the last month’s rent ahead of time, you won’t need to pay rent the month before you move out.

How do I actually apply for an apartment?

-

1Contact the landlord to take a tour and check the place out. For each place you find that looks promising, send the landlord an email or give them a phone call to set up a showing. A showing is where the landlord walks you through the unit, talks to you about the lease, and explains what they’re looking for in a tenant. If you like the apartment and you meet the landlord’s criteria, tell them you’d like to apply![11]

- Treat this kind of like a job interview. Dress nicely, show up on time, and be friendly. Feel free to ask questions about the unit, too!

- If you don’t like the place, just tell the landlord it isn’t quite what you’re looking for and move on. You may need to view multiple units to find something you like!

- If you plan on using a cosigner, bring them with you for this part of the process.

-

2Fill out an application, pay for the credit check, and wait to hear back. The landlord will give you an application. You just enter your personal information to fill it out. This includes your name, previous addresses, occupation, and income. Give them a check or cash for the credit check and application fee. The landlord will contact you in a few days to let you know if you got the place![12]

- The landlord will require a proof of income for either you or your cosigner. A bank statement or paystub will typically work for this.

- You will also need a passport or driver’s license, and letters of reference if your landlord requests them.

- If you don’t have a job, just write “student” under “occupation.” If you have a part-time job, write something like, “Student/cashier”

How do college students pay for apartments?

-

1Many students use a combination of work and help from their parents. It’s extremely common for family members to help students pay their rent, so don’t hesitate to ask if you’re thinking about moving out of student housing.[15] Still, a lot of students rely on part- or full-time work to help pay the rent, so it’s a good idea to start filling out some job applications if you aren’t already employed.[16]

- The general rule of thumb is that your rent shouldn’t be more than 30% of your monthly income, so sit down with your parents and do the math on what you can afford.

- If your parents aren’t going to help you pay rent and you can’t cover a decent apartment with your part-time job, you may just have to wait and save up to get your own place.

-

2Don’t count exclusively on student loans if they haven’t been paid out. Student loans are typically paid directly to the school you’re attending. If there is any money left over after tuition is paid, it will be refunded to you. You can definitely use this remaining money to pay for rent, but it may not be enough to pay for more than a few months, so it’s not a great plan to solely rely on loans for housing.[17]

How can I save money on an apartment?

-

1Getting roommates is a great way to cut back on costs. If budget is a concern, get a few roommates! It’s often cheaper (and more fun) to rent a 3-bedroom unit with 2 roommates than it is to rent a 1-bedroom apartment on your own. You can ask a few friends if they’re interested in splitting a place, or reach out online to find other students looking for roommates.[18]

- It’s probably not a good idea to move in with some random adults you meet online. Students and adults with full-time jobs often have different schedules and you may not be on the same page regarding guests, how to set up the apartment, and what the quiet hours in the unit will be.

- When you have roommates, you can also split the costs of utilities. Even if you spend a little more on electricity with 3 people living in the apartment, the total cost for you will only be 1/3 depending on how you split it up.

-

2Look for apartments that are slightly further from campus. In a lot of cases, apartments right next to campus are going to be in higher demand. Research safe neighborhoods that aren’t right next to campus and go apartment hunting there. If you aren’t sure where to look, follow the bus routes or train lines that lead to campus on a map and then pull up crime data for those areas to find a comfortable neighborhood with direct routes to campus.[19]

- Visit an area if you can before you start setting up appointments for showings.

- If you’re going to drive to school or bike, you don’t really need to pay attention to the public transit options. Just find a safe neighborhood that looks fun to live in!

Can you get an apartment with student loan debt?

-

1In most cases, yes—especially if you aren’t behind on the payments. Landlords run a credit check to see if you’re in the habit of paying your bills, but student loan debt won’t impact your credit score if you’re on time with payments or they aren’t due yet.[20] For many landlords, a student having student loan debt isn’t going to be a big deal. If the debt has impacted your credit score, it may be a problem, though.[21]

- Keep your student loan payments in mind when you’re trying to figure your budget out. If you can afford an $800 apartment but you have to pay $200 a month for student loans, you may need to look for a place in the $600 range to account for the difference.[22]

-

2Offer to get a co-signer or pay more up front if your debt is a problem. Many landlords will work with you if your student loans are the only problem with the application. You can offer to get a co-signer, or offer to put an extra month’s rent down on an apartment. You may be able to mitigate your debt by getting a few roommates that don’t have a ton of student debt as well.[23]

Warnings

- If your parents aren’t offering to help you out and you just don’t have the income to cover rent, a security deposit, and off-campus living, you may have to wait a year or so to save up for your own place. It isn’t a good idea to take on the financial burden of an apartment if you may not be able to pay for it.⧼thumbs_response⧽

- Read your lease before signing it! Landlords can sneak all kind of nefarious details into the lease, so make sure you aren’t going to be on the hook for repairs or anything like that.[25]⧼thumbs_response⧽

- If it sounds too good to be true, or something seems off, it’s probably a scam. If the photos don’t look like they match the building, the rent seems ridiculously low, or the landlord refuses to show you the place before asking for money, just stay away.[26]⧼thumbs_response⧽

References

- ↑ https://www.nerdwallet.com/blog/loans/student-loans/my-first-apartment/

- ↑ https://www.nerdwallet.com/blog/loans/student-loans/my-first-apartment/

- ↑ https://money.usnews.com/money/blogs/my-money/2013/06/07/why-some-use-a-co-signer-on-their-apartment-lease

- ↑ https://communityrentals.ucsc.edu/renters/before-you-rent/email-inquiry.html

- ↑ https://www.moneyunder30.com/how-to-get-an-apartment-when-you-dont-have-a-credit-history

- ↑ https://www.moneyunder30.com/how-to-get-an-apartment-when-you-dont-have-a-credit-history

- ↑ https://www.businessinsider.com/heres-what-the-typical-1-bedroom-apartment-costs-in-50-us-cities-2016-6#-38

- ↑ https://www.fool.com/millionacres/real-estate-investing/rental-properties/how-determine-fair-market-rent-rental-property/#

- ↑ https://www.mass.gov/info-details/security-deposits-and-last-months-rent

- ↑ https://www.chicagomag.com/real-estate/February-2014/Heres-Why-Apartment-Security-Deposits-Are-Going-Away/

- ↑ https://www.apartmentguide.com/blog/plan-your-in-person-apartment-visits/

- ↑ https://www.apartments.com/blog/things-i-wish-i-d-known-before-signing-my-first-lease

- ↑ https://www.apartments.com/blog/things-i-wish-i-d-known-before-signing-my-first-lease

- ↑ https://www.avail.co/education/articles/the-pros-and-cons-of-month-to-month-rental-leases

- ↑ https://www.nytimes.com/2017/02/09/upshot/a-secret-of-many-urban-20-somethings-their-parents-help-with-the-rent.html

- ↑ https://money.usnews.com/money/blogs/my-money/2014/09/02/7-tips-for-managing-rent-as-a-college-student

- ↑ https://www.savingforcollege.com/article/can-you-use-student-loans-to-pay-for-an-apartment

- ↑ https://www.myfirstapartment.com/2016/01/3-steps-to-finding-your-first-apartment/

- ↑ https://www.studyinternational.com/news/save-money-on-student-housing-with-these-hacks/

- ↑ https://www.experian.com/blogs/ask-experian/student-loans-may-appear-in-credit-report-while-in-deferment/

- ↑ https://www.self.inc/blog/renting-apartment-with-500-credit-score

- ↑ https://www.nytimes.com/2014/06/08/realestate/student-loans-make-it-hard-to-rent-or-buy-a-home.html

- ↑ https://www.self.inc/blog/renting-apartment-with-500-credit-score

- ↑ https://www.forbes.com/sites/rent/2014/11/15/9-tips-for-an-efficient-apartment-search/#b22b621610d5

- ↑ https://twu.edu/legal-services/warnings/ten-worst-lease-terms-found-in-many-denton-apartment-leases/

- ↑ https://realestate.usnews.com/real-estate/articles/8-red-flags-to-help-you-spot-a-rental-scam