This article was co-authored by Trent Larsen, CFP®. Trent Larsen is a Certified Financial Planner™ (CFP®) for Insight Wealth Strategies in the Bay Area, California. With over five years of experience, Trent specializes in financial planning and wealth management as well as personalized retirement, tax, and investment planning. Trent holds a BS in Economics from California State University, Chico. He has successfully passed his Series 7 and 66 registrations and holds his CA Life and Health Insurance license and CFP® certification.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 35,656 times.

If you're looking to save money on day-to-day expenses, there are a variety of simple ways to cut down on costs. Everyday expenses, like food and transportation, can add up over time. If you trim from your budget, you can end up saving hundreds a year. From saving on food and shopping to reducing monthly bills, making small changes can add up to a big difference in savings.

Steps

Saving on Food and Groceries

-

1Sign up to receive coupons. Grocery stores and retail outlets often ask for your e-mail at the register or ask you to enter your e-mail when you sign up for a loyalty card. Do not use your regular e-mail, but instead create a separate address specifically to track sales.[1]

- Stores often e-mail coupons and reminders about in-store specials, but such e-mails may inadvertently get filed to a spam or promotions folder in your inbox. You may also overlooked or delete these e-mails if they're mixed in with your regular messages.[2]

- Create a separate e-mail address to give out to retailers and check that e-mail before a big shopping trip. This is an easy way to make sure you see any emails related to store specials. If your new email has a promotions filter, always check that. Check the spam filter as well, as sometimes coupons are accidentally filtered as spam by certain email providers.[3]

-

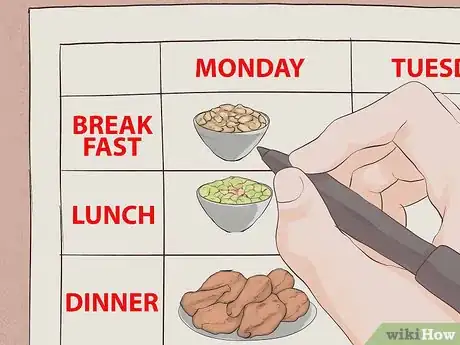

2Plan weekly meals. Meal planning is a great way to save money as you end up only shopping once a week and avoid eating out.[4] You can even plan your meals around upcoming or weekly sales. Many people don't realize planning their meals around weekly sales items can translate into big savings.

- Before making any shopping list, check what you already have. See what staples, like rice and flour, you have in your pantry. Check for fruits, vegetables, and any meats that are still good. Jot down what's available that could be used in a meal.[5]

- Once you've figured out what you have, look at the ads from local grocery stores. See what's on sale and what you may be able to add to existing supplies to make a meal. You can also make meals like casseroles, pastas, and soups that can be used for dinner a few days in a row.[6]

- If you're not sure how to make a meal using what you have and sales items, many websites allow you to plug in your ingredients and offer a variety of meals you can make using them.[7]

Advertisement -

3Shop at discount stores. There are many discount stores available, that sell everything from groceries to cheap clothing. Look into discount options in your area.

- While items sold at dollar stores are not always of the best quality, basics like toilet paper, paper towels, flour, sugar, and spices may be just as good at the dollar store than a regular grocery store.[8]

- Every grocery store has a clearance section, usually towards the back of the store. It's a good idea to browse the clearance section each time you go shopping to see if anything you need is on sale.[9]

- Some towns have a variety of discount grocery stores available where you can shop for marked down goods. See what's available in your area and try to use a discount store for groceries one week out of every month.[10]

-

4Try a farmer's market or co-op. While some items may be more expensive at a farmer's market, things like milk, cheese, and eggs may be both cheaper and fresher if bought from local farmers.[11] These fresh, local items may also be available at a co-op.

- In-season produce at farmer's markets are generally cheaper than what you would find at a grocery store.

- Also, if you're consistently buying a particular item like bread, cheese, eggs, etc., talk to one of the farmers and see if you can strike a deal. The seller may be willing to sell to you at discount rates if you're able to buy on a regular basis.

-

5Buy in bulk whenever possible. Many items are cheaper when purchased in bulk. Non-food items, like paper towels and toilet paper, are generally cheaper if you buy them in bulk. As for food, many non-perishable foods like cereals can be cheaper in bulk. You can also buy perishables like breads, fruits, veggies, and meats and then freeze a certain portion to increase the shelf life of these items.[12]

Cutting Down on Bills

-

1Save electricity by unplugging appliances when not in use. If your electricity costs seem too high, unplugging items you're not using can be a great way to cut down on costs.

- Kitchen appliances like coffee machines and toasters should always be unplugged after use. Even if they're not turned on, simply being plugged in means they drain energy from the wall.[13]

- Electronics are also a major contributor to your overall electric bill. Things like your TV, computer, and phone chargers do not need to be plugged in if they're not in use. Unplugging electronics can save costs on your monthly bills.[14]

- If you have air conditioning, be careful about when you use it. Try to only turn it on between mid-afternoon and early evening, as those are the times of day when it gets most warm. If possible, leave the AC off overnight and rely on a ceiling fan or floor fan.[15]

- If your energy costs still seem high, you may want to shop around for a different provider.

-

2Save on water. If you pay for your own water, there are a variety of ways you can cut back on costs.

- If your shower head was made before 1994, you should replace it. Federal regulation requires models made after that year to be more energy efficient and they will not use as much water during showering.[16] You can also save water by replacing your toilet with a low-flush, or high-efficiency toilet.

- If you do not like drinking tap water, invest in a cheap filtration. You can buy a filter that fits over your faucet or a pitcher with a filter in it. Filtering tap water is cheaper (and lest wasteful) over time than buying bottled water each week.[17]

- If you have a washing machine, wash your clothes in cold water. This cuts down on water heating costs. It might also be better for nicer clothing as it reduces the risk of your clothes shrinking or the colors fading.[18]

- Minimize the amount of water you use to water your lawn by making a few simple changes. Don't mow your lawn too frequently, as this can cause the grass to dry out. Check for leaky sprinklers and consider recycling water. Learn more by reading this helpful wikiHow article.

-

3Cancel your cable subscription.[19] If you subscribe to cable, you might want to cancel your subscription, especially if you pay for premium channels. While many people enjoy television as entertainment, there are cheaper alternative to cable available. You may even be able to receive free TV with an antenna.

- A subscription to a service like Hulu Plus or Netflix allows you to view many programs online for only $7 – $10 each month. Also, many networks will post recent episodes of popular shows online for free after they air.

- If there's a show you really like that you cannot see without cable, consider scheduling weekly viewing parties with friends who also like the show and have cable.[20]

- Talk to your cable provider about bundling your TV, internet, and phone together for lower cost.

-

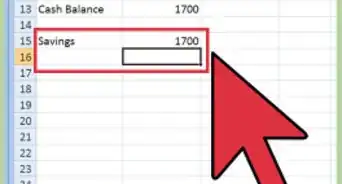

4Keep up on all bank-related payments. Payments related to your bank can add up over time, but there are simple ways to reduce banking costs.

- Avoid bouncing checks in order to save on overdraft fees. Keep a close watch on how much money is in your checking account. If you have a savings account, periodically transfer money from savings if you're running low to assure your checks don't bounce or you don't overdraw from your account when using a debit card. However, check your bank's policy on transferring money. Some banks charge a fee if you transfer too much money from savings to checking or if you transfer money too often.[21]

- Try to reduce credit card debt as much as possible. If you can reduce your overall credit card debt by $1,000, you will end up saving $150 – $200 a year in interest. Always pay your credit card on time to avoid late fees.[22]

- If you need an ATM, take extra time to find one associated with your bank. The $2 to $3 overdraft fee might not seem like much, but it does add up over time.[23]

-

5Save on your rent or mortgage. Cost of housing is a major factor in day-to-day costs, but there are ways to cut down on rent and mortgage payments.

- Do not pay for space you do not need. Instead, try and make living in a smaller house or apartment work. Search online to find tons of ideas to maximize space a small apartment or home. You can also sort through your personal belongings and identify any old clothes, books, or papers you do not need anymore. Tossing some of these items could allow you to use less space, resulting in less cost.[24]

- Talk to your bank about refinancing your mortgage. If the payments are high, you may be able to negotiate a new deal that will cut down on costs over time.[25]

Lessening Transportation Cost

-

1Walk, bike, or use public transportation to get to work. If it's possible to avoid driving, do so. Gas costs are high and finding ways to get around driving is a great way to cut down on day-to-day costs. Try to find a home close to your work space so your commute to work is shorter and cheaper.[26]

- If you live a reasonable distance, you should always opt to walk to work unless the weather conditions are severe. Keep in mind that 20 or 30 minutes of walking a day is also great exercise and good for your overall health.[27]

- If you live in an area with busses, subways, or trains it might be a good idea to look into getting a pass. Taking public transportation can save hundreds a year on gas costs and it's good for the environment.[28]

- Buy a bike. If you live in a city that's bike friendly, consider purchasing a bike and using that as your primary mode of transportation. Biking rather than driving to work, even just a few days a week, can be a great way to save on gas costs.[29]

-

2Carpool. Setting up a company car pool for your office can be an excellent way to save on transportation costs. See if you know any co-workers who live around the same neighborhood as you and ask them if they'd be interested in carpooling to work a couple days a week. You can take turns being the driver and everyone can chip in for gas.[30]

-

3Use regular gasoline only. Don't bother with premium or other expensive forms of gasoline. Most car experts agree using anything other than regular gasoline is a waste of money. Unless your car specifically requires a more expensive type of gas, stick to regular to save on costs. Premium grades of gasoline cost anywhere from 20 to 40 cents more than regular gasoline.[31] https://www.wikihow.com/Save-Money-in-Everyday-Life

Finding Cheap Entertainment

-

1Save when going out. If you don't want to miss out on a night on the town now and then, you don't have to. There are a variety of tricks to save money when going out.

- If you enjoy movies, consider seeing a matinee. They are generally cheaper. You could also look for small, local theaters that may offer cheaper tickets. While they might not have the most recent blockbusters, it might be fun to see an old favorite on the big screen.[32]

- If you go out to eat, do not order soda or juice as a beverage.[33] Stick to tap water. While the $3 for a soda may not seem like a lot, it does add up in your overall tab. Also, avoid appetizers. Not only will your dining bill be cheaper, you'll have more room for the main course.[34]

- Look for specials at local bars and restaurants. Many places offer half off drinks or appetizers on certain nights. Rather than getting a full meal out, you could share a round of appetizers with your friends.[35]

-

2Borrow books and movies. Oftentimes, you end up spending a lot on purchasing movies and books. Borrowing might be cheaper.

- Get a library card. On average, Americans spend $200 a year on books alone. If you don't plan on re-reading a particular book, it might be cost effective to simply borrow a copy from your local library.[36]

- If you have friends who are big readers or movie buffs, consider asking them if you can borrow books and movies periodically. This can cut down on the cost of renting movies and save you a trip to the library if you need a book.[37]

-

3Host potlucks. A potluck can be a fun event that allows you to socialize with friends and neighbors while also saving on costs. Simply ask everyone to bring a dish and a drink and everyone can share in the bounty while talking and hanging out. A potluck is a simple, fun way to socialize and entertain without going overboard on spending.[38]

How Can I Strategize A Reasonable Savings Goal?

References

- ↑ https://www.tomorrowmakers.com/articles/financial-planning/10-hacks-that-can-save-money-in-day-to-day-life

- ↑ https://www.tomorrowmakers.com/articles/financial-planning/10-hacks-that-can-save-money-in-day-to-day-life

- ↑ https://www.tomorrowmakers.com/articles/financial-planning/10-hacks-that-can-save-money-in-day-to-day-life

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ http://goodcheapeats.com/2014/03/planning-meals-to-match-the-grocery-sales/

- ↑ http://goodcheapeats.com/2014/03/planning-meals-to-match-the-grocery-sales/

- ↑ http://goodcheapeats.com/2014/03/planning-meals-to-match-the-grocery-sales/

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ https://www.tomorrowmakers.com/articles/financial-planning/10-hacks-that-can-save-money-in-day-to-day-life

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ http://www.21st.com/auto-insurance-information/savvy-spending-tips.htm

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ https://www.tomorrowmakers.com/articles/financial-planning/10-hacks-that-can-save-money-in-day-to-day-life

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.americasaves.org/for-savers/make-a-plan-how-to-save-money/54-ways-to-save-money

- ↑ http://www.aarp.org/money/budgeting-saving/info-10-2012/simple-ways-to-cut-expenses.html#slide2

- ↑ http://onecentatatime.com/101-ways-to-save-money-in-everyday-life/

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ http://onecentatatime.com/101-ways-to-save-money-in-everyday-life/

- ↑ http://onecentatatime.com/101-ways-to-save-money-in-everyday-life/

- ↑ http://www.aarp.org/money/budgeting-saving/info-10-2012/simple-ways-to-cut-expenses.html#slide3

- ↑ http://www.aarp.org/money/budgeting-saving/info-10-2012/simple-ways-to-cut-expenses.html#slide3

- ↑ http://www.cnbc.com/2015/04/23/here-are-20-easy-ways-to-save-some-money-every-day.html