This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 98,248 times.

Learn more...

A sole proprietorship is a business owned and operated by one person. You need to do very little to set one up in Texas. Pick a business name and register it with the appropriate office. If you want to hire employees, then you will need to take additional steps.

Steps

Business Name

-

1Decide if you want a business name. You can operate your business under your legal name.[1] This might be your best choice if you don’t need to advertise. For example, someone who writes freelance articles or does web design might just use their legal name.

- However, consider getting a business name if you’ll be advertising. For example, which is more memorable—“Carmen Lopez, tutor” or “Emergency Tutors”?

-

2Choose a memorable name. Your name should stick out in the marketplace. You want consumers to associate your name with important qualities, which is how you build your brand. For example, “Emergency Tutors” makes people think you offer last-minute tutoring for people in a crunch.Advertisement

-

3Check whether your business name is available. You can’t use a name if another business is already using it or a similar name.[2] Check the database at the Secretary of State’s website. It costs $1 per search.[3]

- Also check whether the name has been trademarked. Search the federal trademark registry at https://www.uspto.gov/trademarks-application-process/search-trademark-database.

- If you want a website, check whether the URL is available. Businesses usually have their name in their URL.

-

4Register your name. Complete an Assumed Name Certificate (Form 503) from the Texas Secretary of State's office. (As of September 1, 2019, you no longer need to file this form at the county clerk’s office for the county where your business will be located, this is true for Corporations (for-profit, nonprofit and professional) or other incorporated entities, Limited liability companies (including professional limited liability companies), Limited partnerships, Professional associations, Limited liability partnerships, Foreign filing entities. Sole proprietorship, General partnership or joint venture, Estates, Real Estate Investment Trusts or any other type of business entity not included above or those listed as filing with the Secretary of State must file at the county clerk's office. [4] ) You’ll have to pay a filing fee of $25.[5]

- Consider trademarking your business name, which will cost a few hundred dollars. However, you’ll get important rights, such as the ability to sue anyone who uses your trademark without permission.

Legal Requirements

-

1Obtain necessary permits and licenses. Before you can open your doors, you might need a license or permit. Check with your city or county government to see what you need. For example, you might need a business license from the city, or you might need a professional license.[6]

- You can also check with your nearest Small Business Development Center (SBDC), which can advise you about what you’ll need. Find your nearest SBDC at https://www.sba.gov/tools/local-assistance/sbdc.

-

2Register to pay state taxes. Depending on your business, you might need to pay sales or use tax. Apply for your sales tax permit at https://comptroller.texas.gov/taxes/permit/. It will take two to three weeks before you receive your permit.

-

3Get an Employer Identification Number (EIN). A sole proprietor can always use their Social Security Number as their tax ID. However, you should get an EIN if you want to hire employees or if you want a business bank account.[7]

-

4Hire employees the legal way. Report all new hires to the state’s Child Support Division within 20 days of the hiring date.[8] You can create an account at the appropriate website and report your hires. You’ll be fined $25 if you don’t.

- You also must pay unemployment tax for employees. Contact the Texas Workforce Commission.

- Check if you need to buy workers’ compensation insurance. Most employers don’t need to, but you might if you work on public projects.[9]

Future Steps

-

1Open a bank account. Shop around to find a bank account that works for you. Many banks offer business owners perks, such as lines of credit or reduced fees. You’ll open an account with your business name certificate and your EIN.[10]

- It’s probably a good idea to keep business and personal banking separate. This way, you can easily track your business expenses.

-

2Find office space. Decide if you want to run your business from home. You can save money that way and might qualify for a home office deduction. However, you’ll need to check with your local zoning office to see if you can.

- If you want to rent, find commercial space available online or in your local newspaper. Commercial rents are usually calculated by the square foot.[11]

-

3Buy business liability insurance. Sole proprietors are personally liable for all business debts and lawsuits. For example, if someone sues your business and wins, they can come after your personal assets, such as your home. Get a general business liability policy to protect you.[12]

- If you work from home, you shouldn’t assume your homeowner’s insurance will cover you. Many policies don’t cover business injuries that occur in your home.

-

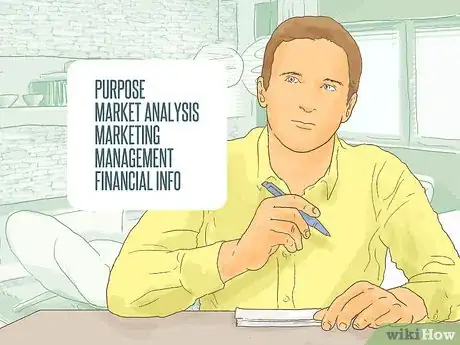

4Draft a business plan. A solid business plan explains where your business is headed and the steps you will take to get there. You’ll need a business plan if you want a business loan. However, writing a plan is a good idea even if you don’t need financing. It can focus your attention on your business’ current weaknesses. Include the following information:[13]

- Business Purpose. This is the problem your business was created to address. For example, you might think there are not enough tutoring services in northwest Texas.

- Market analysis. Identify and assess your competitors. What do you do better than them? What are their strengths? Then identify your target consumer based on age, race, gender, location, education, etc.

- Marketing plan. Describe how you will reach your target audience. For example, you might do paid advertising in newspapers, magazines, or on television or radio. Also discuss how your pricing strategy is designed to reach your potential clients.

- Operations and management. Discuss your business and educational experience. If you are selling products, identify who will manufacture them.

- Financial information. If you need start-up funds, identify the amount and what you will spend the money on. Also create financial projections for at least three years: balance sheet, cash flow analysis, and income statements.

-

5Hire professional help. You might be tempted to do everything yourself at first. As you grow, you might want to bring on the following professionals to help you:

- Bookkeeper. Someone needs to keep track of your daily business transactions: money coming in and money going out. You can use software to start, such as QuickBooks. However, you might want to hire someone once the paperwork becomes overwhelming.

- Accountant. Your accountant can help you file taxes at the end of the year. They can also help you create financial records and presentations to show investors.

- Business lawyer. A good business lawyer can represent you in court and serve as an advocate outside of court. For example, your lawyer can negotiate key contracts to protect your rights. Get a referral to a business lawyer by contacting the Texas Bar Association at 800-252-9690, Monday through Friday, 8:30 am to 4:30 pm.[14]

Community Q&A

-

QuestionShould checks be made out to me or my business name?

Community AnswerAll income has to be taxed, and for that reason you should start a business bank account and make checks payable to the business. This makes it easier to separate your income from your savings and any other personal funds.

Community AnswerAll income has to be taxed, and for that reason you should start a business bank account and make checks payable to the business. This makes it easier to separate your income from your savings and any other personal funds. -

QuestionHow do I register my online business?

Community AnswerYou don't have to register a sole proprietorship in Texas. If you want to register to pay state taxes, visit the Tax Center.

Community AnswerYou don't have to register a sole proprietorship in Texas. If you want to register to pay state taxes, visit the Tax Center. -

QuestionDo I have to be located in Texas?

Community AnswerYou can set up a sole proprietorship elsewhere and most steps would apply, but you'll need to check your state/region's regulations and practices.

Community AnswerYou can set up a sole proprietorship elsewhere and most steps would apply, but you'll need to check your state/region's regulations and practices.

References

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-texas.html

- ↑ http://info.legalzoom.com/setting-up-sole-proprietorship-texas-24499.html

- ↑ http://www.sos.state.tx.us/corp/sosda/index.shtml

- ↑ https://capitol.texas.gov/tlodocs/86R/billtext/pdf/HB03609F.pdf

- ↑ https://direct.sos.state.tx.us/help/help-corp.asp?pg=fee#9900

- ↑ http://info.legalzoom.com/setting-up-sole-proprietorship-texas-24499.html

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-texas.html

- ↑ http://www.twc.state.tx.us/businesses/new-hire-reporting

- ↑ http://www.tdi.texas.gov/pubs/consumer/cb030.html

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-texas.html

- ↑ http://smallbusiness.findlaw.com/business-operations/negotiating-a-lease-for-commercial-real-estate.html

- ↑ http://www.nolo.com/legal-encyclopedia/how-establish-sole-proprietorship-texas.html

- ↑ https://www.extension.purdue.edu/extmedia/ec/ec-735.pdf

- ↑ https://www.texasbar.com/AM/Template.cfm?Section=Lawyer_Referral_Service_LRIS_