This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 10 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 59,497 times.

Whether you want to help build and strengthen your own community, are inspired by the giving of others, or feel called to provide aid in a national or international crisis, you may have a desire to start a nonprofit organization. The initial process of setting up your organization is relatively simple, although if you want to incorporate and enjoy tax-exempt status, you must comply with more complex record-keeping and reporting requirements.

Steps

Researching What your Community Needs

-

1Choose a general category for the services or assistance you want to provide. While you already may have a general idea of the type of nonprofit organization you want to start, categorizing can help you focus your efforts.

- For example, suppose you want to help the homeless in your city. There are many different ways you can help the homeless, such as by providing food or shelter or helping with a job search.

- Categorization also will help you identify the types of assistance you'll need. For example, if you want to help homeless people navigate the legal system, you will need lawyers who are willing to volunteer their time and professional expertise. On the other hand, if you want to provide food and shelter, you'll have to find a location and secure applicable permits to operate.

-

2Find out what services are already available. If you want to make sure your organization truly makes a difference, you need to be sure your efforts aren't duplicating those of someone else.

- Evaluating pre-existing nonprofits also can help you find nearby organizations that have missions that relate to yours. These organizations may be willing to work with you or stage joint events to bring awareness to the larger issue and help more people.

Advertisement -

3Conduct surveys to locate demand. If you're able to talk to the people you think would benefit from your organization, you can get a better sense of things for which there is a true need.

- The strongest path to a sustainable organization is finding a niche where there is a demonstrable need. People will be more inclined to donate if you can show that your organization will make a significant impact on people's lives and on the community at large.[1]

-

4Find your state association of nonprofits. Each state has an association of nonprofits, which can provide you with invaluable resources and guidance on starting your organization.[2]

-

5Work with existing nonprofits in your area. If an established nonprofit already is working in the area where you wish to contribute, you may be able to make more of a difference if you join forces.

- This can be especially helpful if there's another organization in your community that already does something similar to what you want to do.

- In some instances, you may be able to approach that organization about working as a sponsor for yours, which would make your startup process far smoother and provide additional support and expertise as you build your organization.[3]

Creating Your Team

-

1Evaluate the needs of your organization. Particularly when you're just starting out, you want to avoid building a team with members who all have similar skill sets.

- You also want to avoid simply making space for friends and family members who want to help if they don't have any relevant expertise that they can bring to the table.

- Keep in mind that you can build your team slowly – there's no need to rush into anything or have every position filled as soon as possible. Instead, take time to find people who fit your needs and also are passionate and dedicated to the organization's goals.

- Draft a job description for each of the roles you anticipate needing to fill that you can present when you're talking to candidates about the position. That way they'll know what will be expected of them and can make a decision accordingly.

-

2Recruit founding board members who will support and advance your goals. The initial members of your organization should have the experience and expertise to meet your operational needs.

- The types of expertise you need will depend on the focus of your organization. For example, if you plan to provide legal assistance to low-income people, you obviously will need lawyers. If you plan on offering free tax planning and advice to low-income people, on the other hand, you might want to bring some accountants on board.

- Not only must you look for people with expertise, you also must find dedicated staffers who are passionate about your organization's purpose and its goals.[4]

- The people you need also will depend on what your organization will be doing and where it will be located. For example, if you plan on primarily having a web presence and soliciting donations online, you need talented web designers and social media experts.[5]

- You often can find good candidates by talking to religious leaders or executives at large nonprofit institutions.

-

3Establish a social media presence. Not only are social media accounts free, but if used regularly and effectively they can help you gain a substantial following and stimulate interest in your cause.

- Start accounts for your organization and connect to other organizations in other areas that fall into the same category or have similar goals.

- You also might connect with organizations connected in a tangential way to your mission, so you can assist and refer clients to each other. For example, if your organization will help homeless people find jobs, you might want to connect with an organization that supplies homeless people with suits to go on interviews.

- In addition to connecting to other organizations, you also can use accounts to connect to potential supporters and volunteers. Track hashtags relevant to your mission to find people who share the same passion.

-

4Seek out passionate volunteers. A large staff of volunteers demonstrates support for and involvement in your project, which may in turn increase donations.[6]

- Even if you exist primarily online, you can build teams of volunteers who are willing to share information about your organization or write blog posts to encourage others to visit your site.

- If you're developing an organization that will have a local focus and physical location, you might consider having a meet-and-greet event to raise awareness for your cause and attract supporters in your neighborhood.

- When you sponsor events or canvass for donations out in the neighborhood, you also can use those opportunities to recruit interested volunteers to your cause. Sometimes people who don't have the money to donate will be interested in donating a few hours of their time instead.

Funding Your Organization

-

1Develop a comprehensive budget. To know how much money you'll need to raise, you need to have a good understanding of how much it will cost to operate your organization on a daily basis.[7]

- Depending on your budgetary and financial needs, you might want to consider hiring or retaining an accountant – especially if you anticipate filing for tax-exempt status in the future.

- Keep in mind that even if you plan on having a primarily online organization, you still will have operating expenses such as domain registration and website hosting that should be included in your budget.

- Figure out not only the fixed costs to start your nonprofit, but also costs of licensing or registration fees, and other costs for infrastructure and development. For example, if you need to rent a physical space, the cost of finding and securing that location should be included in your budget.

- Depending on the type of organization you're starting, you also will need supplies. For example, if you're opening a soup kitchen you will need cookware as well as plates, bowls, cups, and utensils.

- A solid understanding of your daily operating expenses will help you calculate how much money you need to raise to make ends meet and provide benefits to the people you want to help.[8]

-

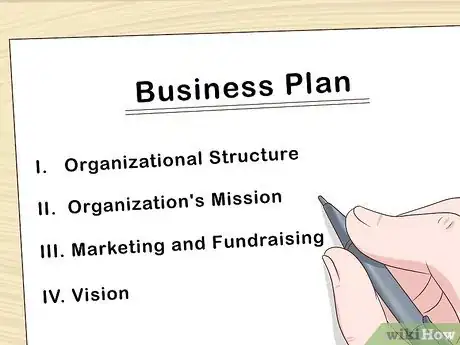

2Draft a business plan. Outlining the structure, operation, and projected growth of your nonprofit organization helps you focus and understand your budgetary needs.[9]

- Outline all aspects of your plan, including the organizational structure, your organization's mission, marketing and fundraising efforts, and projections for future operations and growth.[10]

- You can use parts of your business plan later on, such as when filing for tax-exempt status or creating fundraising brochures.[11]

- Develop a solid understanding of the economic climate in your area, as well as general economic projections, so you can realistically estimate how much money you'll be able to raise and accurately assess your organization's financial viability.[12]

-

3Acquire any necessary licenses or permits. You'll need to register with your state's nonprofit association, and depending on the type of services you plan to offer, you may need other state and local licenses or permits to operate.

- At a minimum, you typically must register with your state's nonprofit agency before you can start fundraising or engage in political lobbying at the state or local level.[13]

- You also may need state charitable solicitation registrations. These forms are required in most states if you plan to solicit donations there, so if you intend to collect donations online you may have to register in every state.[14]

- Other licenses or permits may be required depending on the types of clients you intend to serve or the types of employees you want to hire.[15]

- If you plan on operating in a physical location open to the public, you must first make sure the location is zoned for that use.[16]

-

4Start fundraising. Based on your budget and your daily operating expenses, you can figure out how much money you must average to work toward accomplishing your goals.

- Individual donors may make up the bulk of your contributions, especially at first. However, you also should consider soliciting donations from businesses and other associations in the area – especially those who potentially would be impacted by your mission. For example, if you're starting a nonprofit organization to help homeless people find jobs, you might seek donations from your local Chamber of Commerce.

-

5Consider applying for grants. Government entities as well as larger nonprofit institutions and universities may offer grants that can help cover some or all of your operating costs.

- You can research at your local nonprofit association or online to find out if grants are available for nonprofits that supply services such as yours, and how you can apply.

- If you aren't familiar with the grant application process, you may want to hire someone on a temporary contract basis who is experienced in drafting grant applications.

Gaining Tax-Exempt Status

-

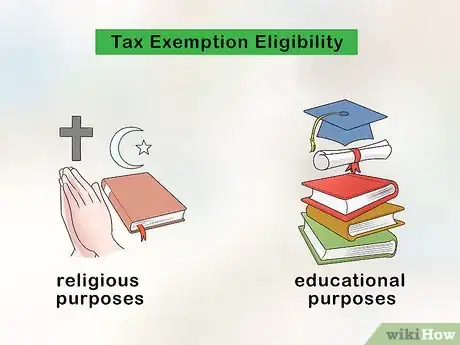

1Determine your eligibility. To qualify for tax-exempt status, your organization must exist to further one of the purposes listed by the IRS, such as religious or educational purposes.[17]

- Keep in mind that if you've listed a broader purpose in your organizing or planning documents than that recognized by the IRS under 501(c)(3) of the tax code, you may have to amend those documents so they match the purpose recognized by federal tax law.[18]

-

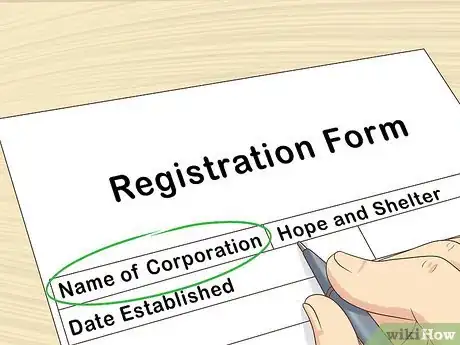

2Incorporate your organization. You cannot get federal tax-exempt status unless your organization is formed either as a corporation or a state-registered unincorporated association.[19]

- You must find a name for your organization that is unique among all registered corporations in your state, whether nonprofit or for-profit.[20]

- Although you don't necessarily have to be incorporated to get federal tax exempt status, some states do require it.[21]

- Check with your state's secretary of state office to find out what documents and paperwork you must file to register your corporation. Many states have different or additional documents required for nonprofit, as opposed to for-profit, corporations.[22]

- Your local association for nonprofits will have state-specific forms, instructions, and resources to help you incorporate your organization and gain tax-exempt status.[23]

- You also should expect to pay filing fees to register your nonprofit corporation, which vary from $30 to several hundred depending on the state of registration.[24]

-

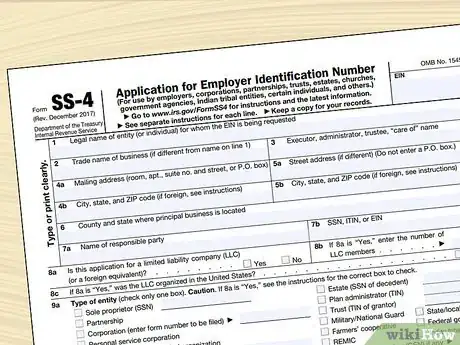

3Get a federal employer identification number (EIN). Even if you don't have any employees, your organization must have its own EIN to apply for tax-exempt status.[25]

- You can get an EIN online by using the IRS's EIN Online Assistant. There is no charge either to have an EIN issued or to use the system, which is available Monday through Friday from 7:00 a.m. to 10:00 p.m. Eastern Time.[26]

-

4Complete your 501(c)(3) application. Typically you must either fill out Form 1023 or Form 1023-EZ to apply for tax-exempt status.

- If you're affiliated with a church or school, your organization usually is considered tax-exempt automatically, and you don't have to file any forms with the IRS.[27]

- The 1023-EZ is a simplified version of Form 1023, which you typically fill out a 1023-EZ if you're a small organization receiving less than $50,000 a year and with assets of $250,000 or less.[28] [29]

- When you file your application with the IRS, it must be accompanied by a $400 processing fee. This fee may be deducted directly from the organization's bank account, or you can pay using a credit or debit card.[30]

-

5Apply for state and local tax exemptions. After the IRS has recognized your organization's tax-exempt status, you can apply to be recognized by state and local authorities as well.[31]

Expert Q&A

-

QuestionWhy do I want to work for a non profit?

Carmela Resuma, MPPCarmela is the Executive Director of FLYTE, a non-profit organization headquartered in Georgetown, Texas that empowers students living in underserved communities through transformative travel experiences. Carmela has a Masters in Public Policy Analysis from New York University and is passionate about youth empowerment, social impact, and traveling.

Carmela Resuma, MPPCarmela is the Executive Director of FLYTE, a non-profit organization headquartered in Georgetown, Texas that empowers students living in underserved communities through transformative travel experiences. Carmela has a Masters in Public Policy Analysis from New York University and is passionate about youth empowerment, social impact, and traveling.

Traveling Specialist Running a nonprofit is one of the hardest things I've ever done, but seeing the impact of our program keeps me going.

Running a nonprofit is one of the hardest things I've ever done, but seeing the impact of our program keeps me going.

References

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-1-research

- ↑ https://www.councilofnonprofits.org/find-your-state-association

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-1-research

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-1-research

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-2-build-solid-foundation

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-2-build-solid-foundation

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-1-research

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-1-research

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-1-research

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-2-build-solid-foundation

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-1-research

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-2-build-solid-foundation

- ↑ https://www.councilofnonprofits.org/tools-resources/step-5-heavy-lifting-ongoing-reporting-and-compliance

- ↑ https://www.councilofnonprofits.org/tools-resources/charitable-solicitation-registration

- ↑ https://www.councilofnonprofits.org/tools-resources/step-5-heavy-lifting-ongoing-reporting-and-compliance

- ↑ https://www.councilofnonprofits.org/tools-resources/step-5-heavy-lifting-ongoing-reporting-and-compliance

- ↑ http://www.irs.gov/pub/irs-pdf/i1023ez.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/i1023ez.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/i1023ez.pdf

- ↑ https://www.harborcompliance.com/information/how-to-start-a-non-profit-organization

- ↑ http://www.irs.gov/pub/irs-pdf/i1023ez.pdf

- ↑ https://www.harborcompliance.com/information/how-to-start-a-non-profit-organization

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-3-incorporation-and-state-forms

- ↑ https://www.harborcompliance.com/information/how-to-start-a-non-profit-organization

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-4-filing-federal-tax-exempt-status

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

- ↑ http://www.irs.gov/pub/irs-pdf/i1023ez.pdf

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-4-filing-federal-tax-exempt-status

- ↑ http://www.irs.gov/pub/irs-pdf/i1023ez.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/i1023ez.pdf

- ↑ https://www.councilofnonprofits.org/tools-resources/how-start-nonprofit-step-2-build-solid-foundation

- ↑ http://www.irs.gov/pub/irs-pdf/i1023ez.pdf

- ↑ https://www.councilofnonprofits.org/tools-resources/step-5-heavy-lifting-ongoing-reporting-and-compliance

About This Article

To start a non-profit organization, first figure out what cause you want to help or what problem you’re trying to solve. For example, you may want to help provide food for the homeless or help homeless people find jobs. Then, do some research to find out what services are already available in your area, so you don’t do something that’s already being done. You might also want to talk directly to the people you want to help, since they can tell you what’s really needed. If it turns out that other organizations are already at work on your issue, consider joining forces to make a bigger impact. For tips from our Attorney reviewer on how to build a team and fund your organization once you’ve figured out what you want to do, read on!

(3)-Status-of-a-Nonprofit-Step-13-Version-2.webp)

(3)-Nonprofit-Organization-Step-19-Version-2.webp)

(3)-Status-of-a-Nonprofit-Step-13-Version-2.webp)