This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 9 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 89% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 95,241 times.

Living paycheck to paycheck is no fun. Even worse is spending more money than you make. When the end of the month has you in the red, it can be very stressful and cause significant financial problems. If overspending is a problem, it's time to learn how to stop spending more money than you make.

Steps

Making a Budget

-

1Understand why making a budget is important. Creating and sticking to a budget will help you to not only cut expenses and reduce debt, but it will also help you to save and build your wealth. The process of building a budget forces you to categorize your expenses into needs and wants, so you learn where you can cut expenses. Also, it helps you to evaluate what you can actually afford giving your current income and expenses. If you know exactly how much you have to spend each month and prioritize your expenses, you will be far less likely to overdraw your account. Also, you can avoid having to pay bills with credit cards, which only increases your debt.[1]

-

2Calculate your monthly income. This can be more challenging for some people than for others. If you are paid a salary on a weekly, bi-weekly, semi-monthly or monthly basis, it is easy to figure out how much you earn in a month. However, if you are paid hourly or your salary varies seasonally, it can be more challenging to determine your average monthly income.[2]

- Those on a fixed salary can determine how many times they get paid per month and multiply that number by their net paycheck amount to determine their total monthly income. For example, if you get a bi-weekly paycheck, then you receive two paychecks per month. If your net paycheck after taxes is $1,250, then your total monthly income would be $2,500 ($1,250 x 2 = $2,500).

- If you are paid bi-weekly, this means you receive 26 paychecks per year, or two extra, because two months of the year have will have three paydays. Be aware which months include this additional payday.

- If you are paid semi-monthly, you will receive two paychecks per month, regardless of the length of the month, resulting in 24 paychecks per year.

- If you get paid hourly or your income is irregular for any reason, then look at the last six to 12 months of paychecks.

- Figure out the average you earn per month. For example, suppose over the past six months you earned $2,500, $3,000, $2,000. $1,800, $3,200, and $2,700. Add these amounts together to get the total ($15,200). Divide the total by 6 to get the average monthly salary ($15,200 / 6 = $2,533 per month).

Advertisement -

3Find out your total debt. Determine your monthly recurring debt payments. Include car loans, student loans, credit card payments and mortgages. For credit card payments, find out your minimum monthly payment. If you have stopped incurring new debt, then these monthly payment amounts are not likely to change in the short-term and you can use them as expense line items in your budget. However, if you haven’t broken your dependence on credit cards, then creating this budget will help you plan to get out of long-term debt.[3]

-

4Determine your recurring monthly expenses. Figure out how much you pay each month for other expenses besides debt. These expenses include household expenses, such as utilities and groceries. Transportation, clothing, cell phone and cable bills may be other expenses you have. Categorize your expenses in as much detail as needed so your budget makes sense for you. For example, some people may be comfortable with one line item for utilities, while others might prefer to break this down into electric, gas and water.[4]

- If you are not sure how much you spend each month on some of these items, then track your expenses for a few weeks.

-

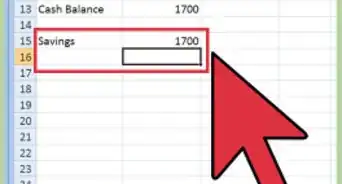

5Evaluate the bottom line. Subtract your total debt payments and other monthly expenses from your total monthly income. If you have a positive balance at the end of the month, then that means you are spending within your means. You have an opportunity to invest some of your extra income and build your wealth. If you have a negative balance, then that means you are overspending. You need to evaluate your expenses and find ways to stop spending more than you earn.[5]

-

6Plan necessary adjustments to spending. If you are overspending, then you need to look at your expenses and see what you can cut. This is where having gone through the exercise of categorizing your expenses will help you. It will help you to not only separate needs from wants, but also to see where most of your money is going.[6]

- You may not be able to make adjustments on some of your line items. Some expenses, such as your rent or mortgage, may be fixed and cannot change in the short-term.

- However, chances are that you will be able to find many other areas where you can reduce your spending. For example, many people begin by looking at how much they’re spending on food and plan to eat out fewer times per month.

- Plan to pay down debt. If you can reduce your expenses for groceries, cable, cell phones and clothing enough, you can divert some of those funds towards paying down your credit card debts.

- Plan to save as much as possible. Also, you should definitely plan to save up a rainy day fund of at least a few thousand dollars. Having this money put aside will allow you to pay for unexpected expenses as they come up without having to use your credit cards and incur more debt.

-

7Track your spending. Put aside at least one hour per week to review your budget. Now that you have made the effort to create a budget, invest time each week to look at your spending and make sure you are staying on track. If you become disciplined about monitoring and sticking to your budget, it will help you to avoid overspending each month. Not only will it help you stop living from paycheck to paycheck, but it will also help you to save some money and do some long-term financial planning.[7]

Reducing Your Monthly Expenses

-

1Plan and cook your own meals. According to the United States Healthful Food Council (USHFC), Americans spend about half of their food budgets on take out. For some families, this means spending hundreds of dollars per month, not only on restaurant food, but also on prepared foods such as chicken fingers. If the average restaurant or take-out meal costs $13 per person,[8] and the average cost to cook a meal at home is $4 per person,[9] , then a family of four can save quite a bit of money by cooking at home just two times more per week.

- Using these assumptions, the average cost of take-out or restaurant meal for a family of four is $52 ($13 x 4 = $52), and the average cost of meal cooked at home for a family of four is $16 ($4 x 4 = $16).

- So, the weekly savings from cooking two meals at home would $72 ($52 - $16 = $36; $36 x 2 = $72).

- By cooking at home two times more per week, a family of four could save as much as $288 per month on food ($72 x 4 weeks = $288).

-

2Make a grocery list. If you are going to make the effort to cook your meals, write out a grocery list and take it with you when you go shopping. Prepare your grocery list based on food category, such as breads and grains, produce, meat and seafood, etc. Purchase only what you need to make the meals on your menu plan. Purchase fresh foods wherever possible. Processed or canned foods are not only less healthy, but they cost more per unit.

-

3Control impulse buying. It’s easy to justify splurging on a cool new gadget, a stylish pair of shoes or even a tasty dessert, especially if it isn’t that expensive to begin with. However, impulse purchases add up over the course of a month. Learning to control impulse spending can help you stop spending more than you earn. You can control your impulse spending with a few practical tips.

- Use cash instead of credit. While it may be more convenient to use plastic for all your purchases, using a credit card can also encourage overspending.[12] People tend to buy and spend more than they want to when they are using a card, because it's convenient and it can make it difficult to keep track of how much you've really spent.[13]

- Carry just as much cash as you're willing to spend on a purchase. This will stop you from impulse buying, since you'll be very conscious of the fact that you have to go to the ATM to get more of your hard-earned dough to buy that item or upgrade you probably don't need.[14]

- Impose waiting periods on purchases over a certain dollar limit or within certain categories. Tell yourself that you have to wait five days, two weeks or one month before making purchases that are more than $50 and are not for necessities like food.[15]

- When you see something that you think you just have to have but it is not a necessity, take a picture of it and hang it on the refrigerator with today’s date on it. If you still want it after your waiting period has expired, then make a plan to purchase the item.

- Think in terms of hours instead of dollars. As yourself how many hours you would have to work to pay for that $50 item.[16]

- Avoid shopping trips to the mall and visits to your favorite online retailers. Don’t put yourself in the path of temptation.

-

4Reduce your cable bill. Get rid of premium cable channels, and opt for internet streaming services such as Hulu Plus, Netflix and Amazon Prime. The average cost of these services is $7.99 per month.[17] Even if you purchase all three streaming services and get basic cable with internet access, you can save almost 50 percent on your cable bill.

- The average cost of a premium cable channel that includes ESPN and HBO is approximately $130 per month.[18]

- The average cost of standard cable (20 channels) plus 15 Mbps internet is approximately $45 per month. Subscribing to Netflix, Hulu Plus and Amazon Prime will cost approximately $24 per month ($7.99 x 3 = $23.97). The total cost of this option would be $45 + $25 = $70.[19]

- This translates to a savings of approximately $60 per month ($130 - $70 = $60), or a 46 percent reduction of expense ($60 / $130 = .46).

- Consider that cable service may include internet access. Examine each cost separately and blended for lowest rate — sometimes an internet/cable package will actually be the most inexpensive option.

-

5Shop around for utility providers. Don’t assume that your local power company is the only source of reliable service. The market is constantly changing, and new companies providing reliable electricity service for less may be popping up in your area. Visit the website powertochoose.org. Enter your zip code to find companies who provide electric power in your area. Compare prices and choose the best option for you.[20]

- Some communities have deregulated natural gas service in addition to electricity. Investigate your options for natural gas providers in your area.

- Know the terms of your current contract. Understanding these terms will enable you to compare with other companies. Look over your bill. Know how much you pay per kWh, whether it is a fixed or variable rate, and when your current contract expires.[21]

-

6Stop paying late and overdraft fees. Late fees and overdraft fees can cost you hundreds of dollars per month. If you are routinely spending more than you earn, then chances are you are paying your bills late and are often overdrawn on your account.[22]

- Set up auto transfers to pay your bills on time.

- Request checking account alerts to avoid overdrafts.

- Get rid of overdraft protection. If your bank won’t authorize payments that overdraw your account, then you can completely avoid overdraft fees.

Using Credit Wisely

-

1Understand how credit cards can get you into trouble. The ease of paying with credit cards can quickly lead to overextending yourself and getting into too much debt. If you have a habit of purchasing things with credit when you don’t have the cash to pay for them, your credit card debt will continue to grow. Soon, your monthly minimum payments may be more than you can afford.[23]

- Controlling impulse spending will help you to use credit cards more wisely.

- Learning how to manage credit, how to strategically pay down balances and how to maximize rewards can reduce your monthly expenses.

-

2Manage your debt-to-income ratio. Your total monthly debt payments, including car payments, student loans and credit cards, should equal no more than 20 percent of your monthly income. If you are close to that limit, then hold off on new credit purchases until you can pay down some of those other loans. Failure to manage your level of debt can not only hurt your credit, but it can also hinder your ability to save for things like retirement.[24]

-

3Figure out the total of your monthly debt payments. For example, if you pay $300 per month on your car payments, $200 per month on student loans and $200 per month on credit card balances, then our total debt payments per month equal $700.

- In this example, if you make $3,500 per month, then your debt-to-income ratio equals 20 percent ($3,500 x .2 = $700). If you make less than this per month, then your debt is too high, and you need to reduce your debt before making any more debt purchases.

-

4Check your credit report regularly. You can get your credit report for free once per year from annualcreditreport.com. Your total debt and your payment history appears on your credit report. The way you manage your credit affects your credit score. Also, errors on your credit report can hurt your credit. Review your credit report often and know whether you need to work on improving your credit score and/or if you need to address errors on your credit report.[25]

-

5Read your credit card policy agreements. Familiarize yourself with all of the fees they charge. Credit card fees include annual fees, charges for balance transfers, cash advance fees and late fees. Choose a credit card with a fee structure that matches your needs. For example, if you want to transfer balances from a high-rate card to a card with a lower rate, look for a card that doesn’t charge fees for balance transfers.[26]

-

6Pay off your balances. Your credit card statement tells you how long it will take to pay off your credit card just by paying the minimum monthly balance. If you have a high balance, this can take many years and cost you thousands in interest expense. Make a plan to pay as much as possible towards your credit card debt. Don’t sacrifice other long-term financial goals, such as saving for retirement. But definitely pay more than the minimum balance each month. While you are paying down your balance, don’t make any purchases on your credit card.[27]

Sample Budgets

References

- ↑ http://www.moneycrashers.com/how-to-make-a-budget/

- ↑ http://www.moneycrashers.com/how-to-make-a-budget/

- ↑ http://www.moneycrashers.com/how-to-make-a-budget/

- ↑ http://www.moneycrashers.com/how-to-make-a-budget/

- ↑ http://www.moneycrashers.com/how-to-make-a-budget/

- ↑ http://www.moneycrashers.com/how-to-make-a-budget/

- ↑ http://www.moneycrashers.com/how-to-make-a-budget/

- ↑ http://www.thesimpledollar.com/dont-eat-out-as-often-188365/

- ↑ http://www.nytimes.com/imagepages/2011/09/24/opinion/sunday/20110925_BITTMAN_MARSHgph.html?ref=sunday&gwh=3430490F993799275091797DF88EA43B&gwt=pay&assetType=opinion

- ↑ http://www.businessinsider.com/35-things-you-can-do-right-away-to-start-spending-less-money-2014-2

- ↑ http://www.businessinsider.com/35-things-you-can-do-right-away-to-start-spending-less-money-2014-2

- ↑ http://www.investopedia.com/articles/pf/08/pay-in-cash.asp

- ↑ http://www.investopedia.com/articles/pf/08/pay-in-cash.asp

- ↑ http://www.investopedia.com/articles/pf/08/pay-in-cash.asp

- ↑ http://www.businessinsider.com/35-things-you-can-do-right-away-to-start-spending-less-money-2014-2

- ↑ http://www.businessinsider.com/35-things-you-can-do-right-away-to-start-spending-less-money-2014-2

- ↑ http://www.bankrate.com/finance/smart-spending/cable-tv-vs-internet-streaming-the-costs-2.aspx

- ↑ http://www.bankrate.com/finance/smart-spending/cable-tv-vs-internet-streaming-the-costs-2.aspx

- ↑ http://www.bankrate.com/finance/smart-spending/cable-tv-vs-internet-streaming-the-costs-2.aspx

- ↑ https://watchdognation.com/texas-electric-bill-savings-guide/

- ↑ https://watchdognation.com/texas-electric-bill-savings-guide/

- ↑ http://www.businessinsider.com/35-things-you-can-do-right-away-to-start-spending-less-money-2014-2

- ↑ https://www.fidelity.com/viewpoints/personal-finance/credit-cards

- ↑ https://www.fidelity.com/viewpoints/personal-finance/credit-cards

- ↑ https://www.fidelity.com/viewpoints/personal-finance/credit-cards

- ↑ https://www.fidelity.com/viewpoints/personal-finance/credit-cards

- ↑ https://www.fidelity.com/viewpoints/personal-finance/credit-cards