This article was co-authored by Srabone Monir, JD. Srabone Monir, Esq., is an Attorney based in New York. She received her JD from the St. John's University School of Law in 2013, and has used her legal training in positions for 32BJ SEIU, the New York Legal Assistance Group, and Disability Rights New York. She is currently a Principal Law Clerk with the New York State Supreme Court. She is also a VA Accredited Attorney as of 2015 and is licensed to practice law in New Jersey and in New York.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 302,280 times.

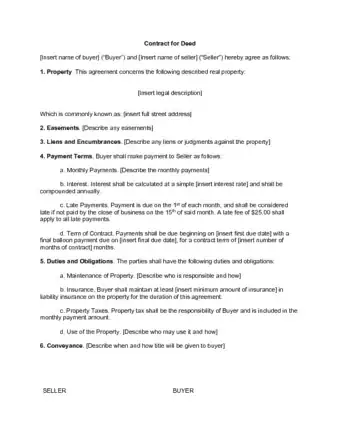

When a property owner wishes to sell his or her property and intends to provide the financing to the buyer, as opposed to the buyer obtaining a traditional mortgage, the parties may use a contract for a deed. This is also called a land contract, and it is used to outline the terms of their agreement. A contract for a deed arrangement can be useful to home buyers who are unable to obtain traditional financing. It is also useful to homeowners, who may wish to make a quick sale or acquire a monthly income.

Steps

Sample Contract

Laying out the Basic Information

-

1Create a title for the contract. You should put the title in bold type and center it across the top of the page.

- Your title should reflect the contents of the agreement. For example, “Contract for a Deed” or “Land Sale Contract”.

- Provide an area for the parties to provide the date on which the agreement was created.

-

2Name the parties to the contract. When naming a party include his or her name and the title by which you will refer to him or her throughout the contract, such as Buyer or Seller.

- For example, “John Doe (“Buyer”) and Jane Doe (“Seller”) hereby agree as follows.”

- Include the full address of each party to the contract.

Advertisement -

3Describe the property. Because street addresses are subject to change, you should include both the street address and the full legal description of the property.[1]

- The legal description of a property can be found in the most recently recorded deed or ownership affidavit.

- If you do not have a copy of the deed or affidavit, contact the Recorder’s Office in the county where the property is located and request one. The Recorder may charge a small fee for locating and copying the deed.

-

4Specify who owns the personal property. A seller may wish to include appliances like washers, dryers, ovens, and refrigerators in the sale—or not. Clarify whether any personal property is included in the sale.

- You may specify this information in an executed written addendum. Execute it in the same manner as you execute the contract for the deed to land: sign it and have it notarized.

Describing the Limitations

-

1List any easements on the property. An easement is a limited right of a third party to use the property, such as a neighbor’s right to use the driveway because it is the only way to reach his or her own property.[2]

- Check with the County Recorder for a description of any easements on the property. The county should have a record of all easements for any property.

-

2Note any liens or encumbrances to the property. Because liens and encumbrances give some third party an interest in the property, or limit a buyer’s interest in it, a buyer is entitled to full disclosure of such interests.

- Liens and encumbrances may include mortgages or other loans where the property was used as collateral. They may also include unpaid judgments to which the property has been attached.[3]

- The full name and address of any creditors should be included.

-

3Describe any covenants affecting use of the property. Covenants are rules affecting what an owner can and cannot do with a property, often resulting from an agreement among residents of a specific neighborhood.

- For example, there may be limits on building any additional structures on the property, or on the colors a building can be painted.[4]

- Covenants are typically managed by a home owners' association in the neighborhood where the property is located. Check with the association to find out if there are any covenants the buyer needs to know about.[5]

Defining the Terms

-

1Define the payment terms. Be sure to describe the terms fully and in plain English. Your payment terms should cover:

- Monthly payments. Include the amount of principle, interest, and the total monthly payment, on what date it is due each month, and where payments should be mailed or otherwise delivered. If there is a final balloon payment due, describe it in this same manner.

- Interest. State the interest rate and describe how interest is calculated. For example, “Interest shall be calculated at a simple seven and one half percent (7.5%) and shall be compounded annually.”[6]

- Late payments. Describe clearly when a monthly payment will be considered late and what late fees shall apply. For example, “Payment is due on the 1st of each month, and shall be considered late if not paid by the close of business on the 15th of said month. A late fee of $25.00 shall apply to all late payments.”[7]

- Term of the contract. State when the payments will start and when they will end, as well as how many payments there will be. For example, “Payments shall be due beginning on the 1st of April, 2009 with a final balloon payment due on the 1st of May, 2019, for a contract term of one hundred twenty-one (121) months.”

- It should be very clear when the contract begins, as the obligations it lays out will not be in effect until that date.

-

2Assign each of the parties’ obligations and responsibilities. During the term of the contract, both the buyer and the seller have an interest in the property. Therefore, each of the party’s obligations toward the property should be described in detail in your agreement. Some common items you may wish to cover include:

- Maintenance. The buyer in a contract for a deed is generally responsible for maintenance and repairs to the property. A seller, however, may wish to include language that will allow him or her to come onto the property to make certain repairs if the buyer fails to make them in a timely manner.

- Property taxes. A seller may bill the buyer each year when taxes come due or she may include property taxes in the monthly payments charged. The contract should describe the method used, e.g., “Property tax shall be the responsibility of Buyer and is included in the monthly payment amount.”[8]

- Use of the property. The buyer in a land contract usually maintains the sole right to possess or be on the property, with limitations on the right to construct new buildings or demolish old ones. Meanwhile, the seller generally retains a limited right to use the property as collateral and allow liens to be placed against the property, to the extent allowed by state law.[9]

-

3Clarify who pays insurance. A buyer is usually responsible for maintaining adequate insurance on property subject to a land contract, and oftentimes is required to name the seller as the insured. Be sure to include in the contract whoever is responsible for carrying insurance on the property.

- If the buyer is responsible, specify the amount of insurance required.[10]

-

4Describe how and when the property will be transferred to the buyer. Ownership of property under a land contract remains with the seller until the final payment has been made.

- Once the final payment is made, the seller gives the buyer an executed deed showing the buyer as the new owner of the land.

- Even though this is the standard procedure for legal ownership and title transfer under a land contract, you should spell it out in order to avoid any later confusion as to when title will be given to the buyer.

-

5Check for additional terms required by your state. The laws governing contracts for deeds or land contracts varies from state to state. Check your state statutes, or meet with a real estate attorney to determine if there are any additional terms or specific language required in a contract for deed. Conditions, or clauses, that may be required under state law include:

- Right of acceleration. The right of acceleration is the right of a seller to call the entire balance of the loan due upon the failure of the buyer to make a monthly payment or comply with some other condition of the contract.

- Warranties. Many states allow a seller to sell property under a land sale contract without making any warranties to the buyer. Some may require an "as is" disclaimer when no warranty is being made.

Finalizing the Contract

-

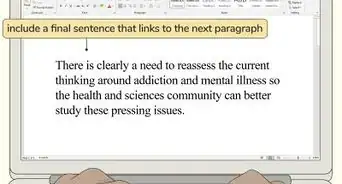

1Include an integration clause. State that the contract “includes the entire contract of purchaser and seller.” Also clarify that any modifications to the contract must be in writing and signed.

- This clause will prevent a party from later claiming that the contract does not contain what the parties agreed to.[11]

-

2Create a signature block. Your signature block should include a line for each party to sign, plenty of room for signatures, the parties’ printed names, and a place for a notary public to notarize the signatures.

- Your signature block should also include a place to enter the date on which the contract was signed by each party. This way it will be clear that the contract was signed after it was finalized, and has not been changed since it was signed.

-

3Have an attorney check the contract. Ideally, you should have a real estate attorney look over your contract before you have the parties sign it. This can ensure that your contract is legal and that you have not overlooked any key information. Though this may present an up-front expense, it would be far cheaper than an in-court dispute due to a faulty contract.

-

4Get the contract signed and notarized. You and the buyer will both need to sign the contract in the presence of a notary public to make it a legally binding agreement.[12]

-

5Make a copy. Both you and the buyer should have a physical copy of the agreement.

- It's also a good idea to create an electronic copy as well, in case something should happen to the physical copy.

- Store your physical copy in a secure location, such as a safety deposit box or in a home safe.

Warnings

- If in doubt, have your contract checked by a professional attorney.⧼thumbs_response⧽

- When providing the legal description of the property, do not use your County Recorder or Assessor’s shorthand version of the description. Be sure the legal description you use is the full and complete description, as provided on the last recorded deed or affidavit of ownership.⧼thumbs_response⧽

- This article does not constitute legal advice. Consult an attorney to verify any legal document before you sign it. You should consult with an attorney before signing anything that may affect your legal rights and/or obligations.⧼thumbs_response⧽

References

- ↑ https://www.rocketlawyer.com/form/contract-for-deed.rl

- ↑ http://realestate.findlaw.com/land-use-laws/easement-basics.html

- ↑ https://www.rocketlawyer.com/form/contract-for-deed.rl

- ↑ http://www.realtor.com/advice/caution-restrictive-covenants-costly/

- ↑ http://www.realtor.com/advice/caution-restrictive-covenants-costly/

- ↑ https://www.rocketlawyer.com/form/contract-for-deed.rl

- ↑ http://freelegalforms.uslegal.com/real-estate/contract-for-deed/

- ↑ https://www.rocketlawyer.com/form/contract-for-deed.rl

- ↑ https://www.rocketlawyer.com/form/contract-for-deed.rl

- ↑ https://www.rocketlawyer.com/form/contract-for-deed.rl

- ↑ http://www.nolo.com/dictionary/integration-clause-term.html

- ↑ http://www.nolo.com/legal-encyclopedia/deeds-faq-29119-3.html

- ↑ http://www.hocmn.org/wp-content/uploads/2013/01/Contract-for-DEED.pdf

- ↑ http://www.hocmn.org/wp-content/uploads/2013/01/Contract-for-DEED.pdf

About This Article

If a property owner decides to sell their property and provide the financing to the buyer, they can use a contract for a deed, or a land contract, to outline the terms of the agreement. Start by creating a title for the contract that reflects the contents, like “Contract for a Deed,” or “Land Sale Contract.” Name the parties to the contract and describe the property. You may also want to specify who owns the personal property, like washers, dryers, ovens, and refrigerators, in the sale contract. You’ll also want to describe any limitations, such as a neighbor’s right to use the driveway to access their house. Make sure to define the payment terms too, like interest rates, when payments will be considered late, and where payments should be mailed. Since the buyer and seller will both have an interest in the property, assign each of them their obligations and responsibilities, like who will take care of maintenance and property taxes. To learn how to finalize your contract, keep reading!

-Step-1-Version-2.webp)

-Step-2-Version-2.webp)

-Step-3-Version-2.webp)

-Step-4-Version-2.webp)

-Step-5-Version-2.webp)

-Step-6-Version-2.webp)

-Step-7-Version-2.webp)

-Step-8-Version-2.webp)

-Step-9-Version-2.webp)

-Step-10-Version-2.webp)

-Step-11.webp)

-Step-12.webp)

-Step-13.webp)

-Step-15.webp)

-Step-16.webp)

-Step-17.webp)