Petroleum industry in Russia

The petroleum industry in Russia is one of the largest in the world. Russia has the largest reserves and is the largest exporter of natural gas.[1] It has the second largest coal reserves, the sixth largest oil reserves, and is one of the largest producers of oil.[2] It is the fourth largest energy user.[3]

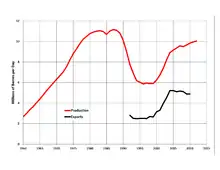

Russia produced an average of 10.83 million barrels (1,722,000 m3) of oil per day in December 2015.[4] In 2009, it produced 12% of the world's oil and had a similar share of global oil exports.[5] In June 2006, Russian crude oil and condensate production reached the post-Soviet maximum of 9.7 million barrels (1,540,000 m3) per day. Exceeding production in 2000 by 3.2 Mbbl/d (510,000 m3/d). Russian exports consist of more than 5 Mbbl/d (790,000 m3/d) of oil and nearly 2 Mbbl/d (320,000 m3/d) of refined products, which go mainly to the European market. The domestic demand in 2005 was 2.6 Mbbl/d (410,000 m3/d) on average.[6] It is also the main transit country for oil from Kazakhstan.

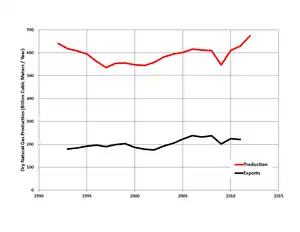

Until 2023 Russia was by far the world's largest natural gas exporter. Most, but not all, authorities believe that Russia has the world's largest proven reserves of natural gas. Sources indicating Russia have the largest proven reserves including the US CIA (47.6 trillion cubic meters),[7] the US Energy Information Administration (47.8 tcm),[8] and OPEC (48.7 tcm).[9] However, BP credits Russia with only 31.3 tcm as of 1st January 2014,[10] which would stand it in second place, slightly behind Iran (33.1 to 33.8 tcm, depending on the source). According to US Geological Survey estimations, Russian has the world's largest proven reserves of natural gas Russia is also likely to have the world's largest volume of still-undiscovered natural gas: a mean probable volume of 6.7 trillion cubic meters. The USGS estimate of Russia's undiscovered oil is 22 billion barrels, second in the world only to those of Iraq.[11]

Investment and sanctions

As of 2008, the Russian oil industry claims to be in need of huge investments.[12] Strong growth in the Russian economy means that local demand for all types of energy sources (oil, gas, nuclear, coal, hydro, electricity) continues to grow.

The 2022 Russian invasion of Ukraine resulted in sanctions imposed by the USA, the EU and other nations, to forbid or reduce the importation of Gas, Oil and associated products from Russia,[13] including the introduction of a novel price cap on crude shipped oil, designed to allow Russia to maintain production but limiting the revenue from oil sales. From 5 December 2022 the price cap is set at USD60 per barrel.[14] This was followed in 2023 with sanctions and a price cap on Russian oil products, and the EU introduced sanctions on natural gas.

A US Treasury report in May 2023 highlighted that Russian oil exports were continuing to rise, providing stability in the world market, as planned, whilst Russia's revenue was being restrained by the price cap to $5-6 billion per month, compared with $8-15 billion a month in 2022. Russia has changed their tax rules to levy more tax on oil producers to help offset falling revenue, to the detriment of investment. Market participants and geopolitical analysts now acknowledge that the price cap is accomplishing both of its goals.[15] Gas exports, which in 2021 were 185bcm have fallen in 2023 by around 70%.

Russia's oil and gas companies

The biggest Russian oil company is Rosneft followed by Lukoil, Surgutneftegaz, Gazprom Neft and Tatneft.[16] All oil trunk pipelines (except Caspian Pipeline Consortium) are owned and operated by the state-owned monopoly Transneft and oil products pipeline are owned and operated by its subsidiary Transnefteproduct.

- Gazprom (Russia's state-run natural gas monopoly; world's biggest gas exploration and production company)

- Lukoil

- Rosneft (State-owned Russian oil and gas exploration company)

- Surgutneftegas

- Tatneft

- Northgas

- Transneft (Russia's pipeline monopoly)

- Bashneft (Russian oil refining company, one of the largest producer of oil in the country)

- Russneft

- Itera

- Novatek

- Rusneftegaz

Academic institutions

- Gubkin Russian State University of Oil and Gas (Moscow)

- Saint Petersburg Mining Institute -Oil and Gas Department (Saint Petersburg)

- Siberian Research Institute of Petroleum Industry (SibNIINP)

- Russia Petroleum Research Exploration Institute (VNIGRI) of Ministry of Natural Resources and Ecology of the Russian Federation and the Russian Academy of Sciences (RAN).

- Tyumen State Oil and Gas University Tyumen)

- Ufa State Petroleum Technological University

- Almetyevsk State Petroleum Institute (Almetyevsk)

- Irkutsk National Research Technical University (Irkutsk)

See also

References

- Overland, Indra. "The Hunter Becomes the Hunted: Gazprom Encounters EU Regulation". In Anderson, Svein; Goldthau, Andreas; Sitter, Nick (eds.). "Energy Union: Europe's New Liberal Mercantilism?". Blasingstoke: Palgrave MacMillan. pp. 115–130.

- "BP Statistical Review of World Energy 2020" (PDF). 2020. Retrieved 7 September 2021.

- "World Power consumption | Electricity consumption | Enerdata". yearbook.enerdata.net. Retrieved 7 September 2021.

- Russia continues to post record oil production Retrieved on 8 January 2016

- Key World Energy Statistics. 2006 Edition Archived 12 October 2009 at the Wayback Machine, International Energy Agency 2006

- Woodruff, Yulia (2006). "Russian oil industry between state and market". Fundamentals of the global oil and gas industry, 2006. Petroleum Economist. ISBN 978-1-86186-266-2.

- Natural gas - proved reserves, retrieved 1 December 2013.

- US Energy Information Administration, International statistics, retrieved 1 December 2013.

- OPEC, Table 3.2 Natural gas proven reserves by country Archived 27 February 2018 at the Wayback Machine, retrieved 1 December 2013.

- BP,BP Statistical Review of World Energy, June 2014.

- Christopher J. Schenk, An Estimate of Undiscovered Conventional Oil and Gas Resources of the World, 2012, US Geological Survey, Fact Sheet 2012-3042

- 'Threat' to future of Russia oil - Lukoil, April 2008.

- "What are the sanctions on Russia and are they hurting its economy?". BBC News. 27 January 2022. Retrieved 25 November 2022.

- "EU agrees to impose price cap on Russian oil". RTÉ.ie. Retrieved 2 December 2022.

- "The Price Cap on Russian Oil: A Progress Report". 18 May 2023.

- LUKoil to lose the lead soon. Rosneft will become Russia's leading oil producer in 2007, Analytical department of RIA RosBusinessConsulting

External links

- All Russian oil companies on Russian Business Map MXKR.ru.

- Country Analysis: Russia's Oil and Natural Gas.

- "Major Russian Companies: Some Details" (1995–1996), Joint Project by Expert Magazine and Menatep Bank, undated.

- "Russia's oil renaissance", BBC, 24 June 2002.

- History of Oil in Russia, Sibneft, 2003.

- "The Oil and Gas Industry": 1999–2000 and 2000–2004, Kommersant, 23 October 2001 and 17 May 2004.

- David Correll, "Russia: the new oil giant. An industry perspective", AMEC, July 2004.