This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

This article has been viewed 278,296 times.

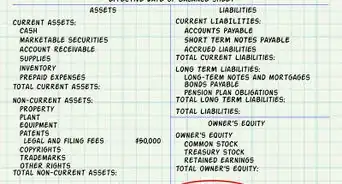

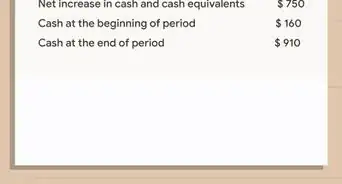

Expenses that a company has incurred (but not yet paid) are commonly referred to as accrued expenses.[1] Accrued expenses are classified as current liabilities on the balance sheet. Learning how to recognize and record accrued expenses requires a solid grasp of the underlying accounting principles, but the process itself is fairly straightforward.

Steps

Knowing What Expenses to Accrue

-

1Understand what an accrued expense is. An accrued expense occurs when an accounting period is coming to a close and there are unpaid expenses and unrecorded liabilities. For example, wages that have been earned but not yet disbursed would represent an accrued expense. Companies handle accrued expenses by making adjusting entries to the general journal.

-

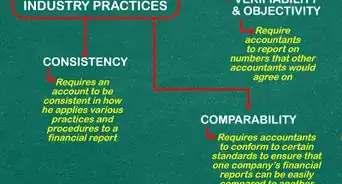

2Understand why you need to accrue expenses. The accrual basis of accounting states that you must record revenues and expenses in the period in which they are incurred, not when cash is received or paid. The principle relating to expenses is called the matching principle.

- The matching principle dictates that accountants record expenses in the period when they are incurred and that they are offset against their corresponding revenues.[2]

- The implication of this principle is that you cannot always wait until cash changes hands to record an expense. Say, for example, a company has a biweekly payroll expense of $10,000, but the current pay period is split evenly in half between two accounting periods. That means half of those wages have already been earned at the end of the current accounting period. You must record half of the full amount—$5,000—during the current accounting period even if the employee paychecks won't be written until the following accounting period.

Advertisement -

3Determine the expenses that require accrual. Following these principles, any incurred expenses that have not yet been paid require accrual on the balance sheet. The following are some of the most common:[3]

- Accrued wages

- Accrued interest

- Accrued taxes

Recording Accrued Expenses

-

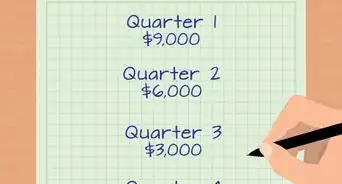

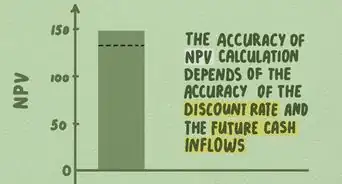

1Calculate the prorated accrual. Once you have identified the accrued expenses, you must calculate the amount of the accrual by prorating the portion of the total expense that falls into the current accounting period. Once the accrual accounts and the total dollar amount of the accrual have been determined, it is time to record them in the general ledger.

- In the example above, 50% of the payroll amount is recorded because half of the payroll falls within the reporting period.

-

2Make the appropriate adjusting entry. You accrue expenses by recording an adjusting entry to the general ledger. Adjusting entries occur at the end of the accounting period and affect one balance sheet account (an accrued liability) and one income statement account (an expense).[4]

- The adjusting entry should be made as follows: debit the appropriate expense account, and credit the appropriate payable account. Remember, debits increase expense accounts, and credits increase liability accounts.[5]

- Using the previous example, you would debit the expense account related to payroll by $5,000, and you would credit the payable account for the accrued wages by ($5,000). Remember that since this is a payable account, you’re “crediting” a liability.

- You understate liabilities and overstate income by neglecting to make the adjusting entries in the appropriate accounting period.

-

3Reverse the entry in the next period. The invoice relating to the accrual will eventually arrive and will be processed in the ordinary course of business. Thus, in order to avoid double counting the expense, the initial accrual entry must be reversed in the following accounting period.[6]

- Most computer accounting software packages allow the user to specify the reversal date for an adjusting entry. You can also reverse the adjustment manually.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhat do I do if those accruals for the previous year are still not paid until the next year?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor

-

QuestionCan we enter accrued expenses in income statement?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor

-

QuestionHow do I know that the amount I have accrued is correct?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor

Things You'll Need

- Accounting software

References

- ↑ http://www.accountingcoach.com/terms/A/accrued-expense

- ↑ http://www.accountingcoach.com/blog/what-is-the-matching-principle

- ↑ http://www.accountingcoach.com/blog/accrued-expenses

- ↑ http://www.accountingcoach.com/adjusting-entries/explanation

- ↑ http://www.accountingcoach.com/adjusting-entries/explanation

- ↑ http://www.accountingcoach.com/adjusting-entries/explanation

About This Article

Accrued expenses are those you’ve incurred but not yet paid for, and you need to record these on your balance sheet. For example, wages that have been earned but not paid should be recorded as accrued expenses. First, you’ll need to prorate the portion of the total expense that falls into the current accounting period. For example, if the current pay period is split in half, you’d record half of the payroll this period and half next time. Then, record the accrued expense by debiting your expense account and crediting the relevant payable account. Don’t forget to reverse the entry in your next accounting period so you don't count the expense twice. Many accounting software packages have options to do this automatically. To learn the matching principle, and other tips from our Financial co-author, read on!