This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 15 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 29,094 times.

Learn more...

An owner operator owns or leases a truck and hauls goods for client companies. If you want to start a trucking business, choose a niche market, such as logging or hazardous materials. Project your costs and revenue to see how many contracts you’ll need to land in order to stay profitable. If you plan on staying in the industry long-term, buy or finance a truck instead of leasing one. Before launching your company, select your business structure, register your business, and file industry-specific tax forms. Buy an insurance policy that meets your jurisdiction's regulations, and obtain operating licenses and any credentials your niche requires.

Steps

Planning Your Operation

-

1Build trucking experience before starting your own business. Being an owner operator requires substantial knowledge of the trucking industry. If you haven’t already, it’s best to work for a trucking company for at least 3 to 5 years before starting your own business. You’ll learn how to manage fuel efficiency, build a professional network, and develop expertise in niche markets, such as logging or refrigerated goods

- If you haven’t already, you’ll need to get a commercial driver’s license (CDL).[1] If you live outside of the United States, you’ll need the operating license required by your jurisdiction.

-

2Choose your niche market. When you launch your business, you’ll compete for contracts with established operations. Additionally, you’ll need to comply with regulations that apply to specific types of transportation. Choosing a niche, or distinct segment of the transportation industry, will decrease the number of competitors and make it easier to comply with regulations.[2]

- Additionally, you’ll need special licensing for some markets. For example, in order to transport goods to a port in the United States, you need to apply for a Transportation Worker Identification Credential (TWIC).[3] If you want to transport hazardous materials, you’ll need a hazardous materials endorsement.[4]

Advertisement -

3Project your costs and revenue. Calculate your fixed costs, including truck mortgage or lease payments, insurance, licensing fees, and permits. Variable costs include fuel, taxes, tires and maintenance, repair, washes, lodging and meals, tolls, and loading and unloading fees. Variable costs depend on your niche, planned hauling distances, and projected annual miles or kilometers.[5]

- If you’re hiring drivers, you’ll need to factor their salaries into variable costs. As a general rule, subcontracted drivers earn 30% of the truck’s gross revenue.

- Total your fixed and estimated variable costs to determine the revenue you’ll need to generate per vehicle in order to break even.

-

4Get help projecting your costs and creating a trucking business plan. Once you start estimating your operating costs and revenue needs, you may feel overwhelmed or uncertain how to proceed. For guidance, visit the Owner Operator Independent Drivers Association's resource center. The U.S. Small Business Administration also has helpful general business plan guidelines: https://www.sba.gov/business-guide/plan/write-your-business-plan-template.

- You can also talk to an accountant or professional financial planner.

-

5Decide whether you’ll buy, finance, or lease your vehicle. Expect to pay $100,000 to $125,000 (USD) for a truck. If you don’t have the capital to buy one outright, you can finance or lease your vehicle.[6]

- If you plan on staying in the industry long-term, it’s better to buy or finance a truck. If not, leasing or renting is your best option.

- Owning or financing a truck is usually more profitable in the long-term. However, keep in mind that you’ll be responsible for all repairs and maintenance.

- As your business grows, you can add more vehicles to your fleet and hire licensed drivers to operate them.

Registering Your Business

-

1Choose a business structure. In the United States, you’ll need to select a business structure before you register your business. Examples include a limited liability company (LLC) and sole proprietorship. The best choice depends on your personal assets and tax liability, so ask your attorney or accountant which structure suits your needs.[7]

- An LLC is the best choice for many small business owners, especially if you want to protect your personal assets. Your personal vehicle, home, and other assets won't be at risk if your business faces bankruptcy or lawsuits.

-

2Register your business with federal and state agencies. To register your business with the IRS (Internal Revenue Service), you’ll need to apply for an employer identification number (EIN), which is free.[8] Registration procedures vary by state; in general, you’ll file your business name, declare its structure, and pay registration fees.[9]

- Apply online for an EIN here: https://sa.www4.irs.gov/modiein/individual/index.jsp.

- Find your state’s business registration procedures here: https://www.irs.gov/businesses/small-businesses-self-employed/state-government-websites.

-

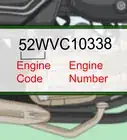

3Apply for operating licenses required by your jurisdiction. In the United States, you’ll need to apply for a Motor Carrier Authority Number and US DOT number with the Department of Transportation.[10] If you only plan on traveling within state lines, you may only need an intrastate DOT number.

- Find your state’s DOT requirements here: https://www.fhwa.dot.gov/about/webstate.cfm.

- For locations outside of the United States, check with your department of transportation or other appropriate agency about licensing requirements. For example, in the United Kingdom, you’ll need to apply for a good vehicle operating license with the Traffic Commissioners of Great Britain.[11]

-

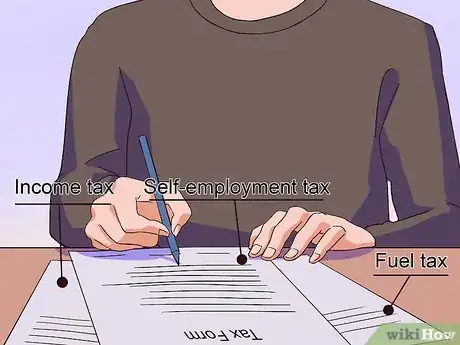

4File industry-specific tax forms. In the United States, you’ll need to file a Heavy Highway Vehicle Use Tax Form (2290) with the IRS.[12] Additionally, you’ll have to pay standard business taxes, including income tax, self-employment tax, employment taxes (if you hire employees), and applicable excise taxes, such as fuel tax.[13]

- Check with your nation’s revenue service if you live outside of the United States.

-

5Buy insurance that complies with your jurisdiction’s regulations. There are strict federal and state regulations on trucking business insurance. Contact your insurance provider or look online to find an independent insurance agent. Ask them to recommend a policy that complies with federal and state standards.

- In the United States, total insurance costs for trucking businesses average around $6,500 (USD) per year.

Sustaining a Profitable Business

-

1Gain referrals and advertise your services. You’ll need to tap into your network in order to land your first contracts. Customer satisfaction is essential, as word of mouth will help you gain credibility and referrals. In addition, you should market your services on social media, haulage and industry-specific publications and, if affordable, radio and television programs.[14]

- You should also promote your services by calling or sending letters to niche-specific businesses, such as logging or manufacturing companies.

-

2Review terms with diligence before signing contracts. You’ll negotiate contracts with the companies for whom you haul goods. Read contracts carefully and, if you have an attorney, have them review terms before you sign. Negotiate mileage rates, determine how you’ll receive payment (such as by check or electronic transfer), and ask whether you’ll receive an advance on loads.

- Find out if you’ll need to purchase additional insurance for goods hauled. If the client doesn’t purchase a policy, you’re not required to purchase insurance or anything else through them. You can take out any additional federal or state mandated policies with a provider of your choice.

- Avoid contracts that include competition clauses. If there is a non-negotiable competition clause, make sure it has a reasonable end date. You won’t want to be restricted from working with other companies in the future.

-

3Manage your fuel costs. Fuel cost is one of the most significant impacts on your bottom line. Learning to drive efficiently takes time, and is a key reason why you should spend at least 5 years driving for another company before starting your own.[15]

- Contrary to popular belief, driving above 60 miles (97 km) per hour can reduce your fuel efficiency. Going faster might help you meet delivery deadlines and land more contracts, but you’ll end up using more fuel.

-

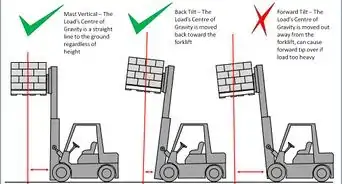

4Maintain your vehicle to control costs and comply with regulations. Regular vehicle maintenance is essential to controlling fuel costs. For instance, if you don’t replace your tires when necessary, your annual fuel costs could increase by thousands of dollars. Additionally, you’ll need to maintain your vehicle to ensure it complies with your niche industry regulations.[16]

References

- ↑ https://www.fmcsa.dot.gov/registration/commercial-drivers-license

- ↑ https://secure.ssa.gov/poms.nsf/lnx/0302101249

- ↑ https://www.tsa.gov/for-industry/twic

- ↑ https://www.bls.gov/ooh/transportation-and-material-moving/heavy-and-tractor-trailer-truck-drivers.htm#tab-4

- ↑ https://www.ooida.com/EducationTools/Tools/costpermile.asp

- ↑ https://www.dmv.org/buy-sell/new-cars/buying-a-commercial-vehicle.php

- ↑ https://www.sba.gov/business-guide/launch/choose-business-structure-types-chart

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/checklist-for-starting-a-business

- ↑ http://itd.idaho.gov/wp-content/uploads/2016/07/StartTruckingBusiness.pdf

- ↑ https://www.fmcsa.dot.gov/registration/get-mc-number-authority-operate

- ↑ https://www.gov.uk/government/publications/apply-for-a-goods-vehicle-operator-licence-by-post

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/trucking-tax-center

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/business-taxes

- ↑ https://www.sba.gov/business-guide/manage/marketing-sales-plan-payment

- ↑ https://www.ooida.com/EducationTools/Tools/costpermile.asp

- ↑ https://www.osha.gov/SLTC/trucking_industry/standards.html