This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 66,020 times.

There are a number of methods for borrowing money if you’ve found yourself in a situation where you don’t have the necessary funds to cover some unexpected costs. Different methods have different advantages and disadvantages, but whatever method you use, you should expect to pay back at least a little bit more than you borrowed. The most important thing you can do when you borrow money is to pay it back on time or early, if possible. Once you’ve done that, try to start saving up a bit of extra money in order to avoid having to borrow more money later.

Steps

Borrowing Money From a Friend or Family Member

-

1Make a list of friends and family members who you think could lend you money. Think of all of the close friends and family members you have who you believe have the means to let you borrow the money you need. Think of your relationship with this person. Are you very close with each other? Have you lent them money in the past?

- They are more likely to lend you money if they have a close, trusting relationship with you and if you have also helped them out financially in the past.

- Choose the person you think is most likely to be willing to help you out, and contact them first.

- In general, it is not usually good to mix money matters with family and friends. If you don’t pay them back you risk ruining your relationship with them forever.

-

2Be straightforward. When you meet to ask for the money, be friendly, but don’t beat around the bush. It’s a good idea to make small talk before bringing up the issue in order to avoid seeming uncaring. For example, don’t just walk in and say, “Hey, I need some money. Can you lend it to me?” Instead, ask them how they’re doing, and see what is going on in their lives before getting into the money.[1]

- When you do bring up the issue be direct, but also polite. For example, you can say, “I’m really sorry to have to ask you this, but I’ve come across some unexpected financial difficulties. I’m a bit short on rent money this month. Would you be able to help me out?” Don’t beat around the bush by telling them that you’re having problems, and hoping for someone to help you out. They may not pick up on the hint, which puts you in an awkward situation.

- Reassure them that you understand if they can’t lend you the money. Though you may really need the money, it isn’t fair to pressure someone you care about into lending you money they may not even have.

Advertisement -

3Be honest about why you need the money. As someone lending you their own money, they have the right to know what you need it for so don’t lie about it, even if you want the money for something that you don’t really need to have.[2]

- For example, if you want the money for concert tickets say, “The thing is, my favorite band is coming to town and I’m not sure if I’ll get another chance to see them. The tickets go on sale in a week, but I don’t get paid for two weeks. I’m worried they will sell out before I get paid. Could I borrow the money from you to pay for them up front and then pay you back in two weeks when I get my pay check?”

- They may have ideas or other suggestions about how you can come up with the money without borrowing it, and you should think about whether these are realistic options for you as it is best to avoid borrowing money when you can.

-

4Offer to pay interest. One great way to make your friend or family member feel more secure in lending you money is to offer to pay interest on the loan. It’s good to suggest a rate between 3% and 5% of the total loan, which will help them out because it means they will be earning more interest on the money than they would if it was sitting in a savings account. It will also help you out because it is a rate lower than what you would be paying if you borrowed money using any other method.

- In general, it is best to insist that you pay some interest on the loan even if your friend or family member says that there is no need to.

-

5Consider offering up something of value as collateral. Another way to help show them that you’re serious about paying them back is to offer up something of value as collateral. This means that, if you don’t pay them back in the agreed upon time span, whatever you have offered up becomes the property of the lender.[3]

- A good example of collateral is your house. If you have a mortgage on your house, the bank has the right to take your home away from you if you fail to make your mortgage payment. In this case, your home is the collateral.

- In a situation where money is being exchanged between friends what you put up as collateral can be something the two of you have agreed upon. For example, maybe you have an antique that your friend really admires and would love to have for themselves. In this case, you can place the antique item up as collateral. If you fail to repay them in full and on time, the item becomes theirs to keep.

-

6Accept their answer. Realize that this person may say, “No.” If they do say no, then accept their answer with grace and remember that they are probably not refusing because of you personally. Many people make it a rule never to lend money to friends or family members in order to avoid ruining the relationship. If they agree to lend you the money, great! However, it is important to follow a few steps before getting the cash from them in order to avoid any potential problems later on.

- Remember that they might refuse simply because they don’t have the money to lend.

- Even if you do think they are refusing because they don’t trust you, avoid being rude. Being friends with someone or being related to someone does not come with an obligation of money lending.

-

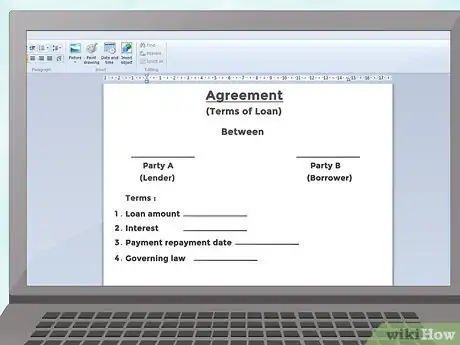

7Create an agreement stating the terms of your loan. It may seem stupid, but it is important to put the details of your loan in writing in order to avoid any potential misunderstandings. If your friend or family member is a bit forgetful, having it all down in writing may also prevent the person lending you the money from saying that they lent you more than they actually did.[4]

- Be sure to include the name of the lender and the borrower, the amount borrowed, when the money should be paid back by, and how much interest should be paid in addition to the original loan. If you put up any collateral be sure to include what it is and under what terms it will be returned. Make sure that both the lender and the borrower sign the document.

- You may even consider having the document notarized. Having a document notarized means that a qualified person has witnessed the signing of the document, and that the people signing the document are who they say they are.

-

8Write them a thank you note. Once you have the money, write them a short note thanking them for helping you with your situation. You don’t have to go into details, but remind them that you will be paying them back as soon as possible, or at least by the agreed upon date.

- You may even consider having them over for dinner to show them that you really appreciate them helping you out.

-

9Pay back the loan on time and according to the schedule. When borrowing money from friends or family it is extremely important to pay the money back on time and in full. If you don’t, you risk losing their trust and perhaps the relationship all together. If, for some reason, you are having trouble paying them back, get in touch with them right away. Don’t let the date that you promised to pay come and go without letting them know what is going on. If you are honest and straightforward about why you’re having trouble, they will be less likely to think that you are just trying to get out of paying them.

- That said, you should still work hard to get the money back to them as soon as possible, even if it is just little by little. Say you borrowed $500 and promised to pay the full amount the following month but couldn’t because your child broke his arm, and you had to use that money to pay the deductible at the hospital. Call your friend or family member and tell them what happened. Then pay them back as much as you can, and tell them when you’ll be able to get the rest.

- If you come into some extra cash, then there is no reason why you can’t pay them back ahead of time.

Applying for a Loan From a Financial Institution

-

1Know your credit score. Before going to a bank for a loan, find out your credit score. The reason you need to do this is because many banks will check your credit score before deciding on the terms under which they will loan money (and if they are willing to loan you money at all). Knowing ahead of time what your score is will give you an idea of what you can expect.[5]

- If you have no credit or bad credit, the bank may be willing to offer you a loan, but the interest rate will likely be very high and they may require you to “secure” the loan by offering up collateral. For example, they may ask you to offer your paid-off car as collateral. If you fail to repay the loan they will take the car from you, and it will be the property of the bank.

- The lender may ask for a co-signer on loan as additional surety. Asking a family member or friend to co-sign your loan bears the same risks as if you borrow directly from them (potential personal rifts and lost relationships). The co-signer is also responsible for any unpaid portions of the loan.

-

2Contact your bank or credit union. If you already have an account at a bank or credit union, you should approach this institution for your loan, especially if you have a long and good history with them, as they are more likely to approve your loan. If you don’t have an account anywhere then it may be very difficult to get a bank loan, but you can do an internet search to find out which financial institutions offer personal loans.[6]

- Searching the internet will also allow you to compare different banks and credit unions which may help you get the best interest rate.

- Credit unions are generally less demanding on small loans, especially when associated with an employer.

-

3Apply for the loan. The best way to do this is to go directly to the bank because you will be able to ask questions and clarify any information that you will provide which will determine the decision that the loan officer makes.[7]

- Make sure that you have brought all of the proper documentation with you. Different banks will require different documentation so it is best to give them a call before heading in to see what you will need. You may need documentation from creditors, employers, and other sources of financial information, and you may need a few days to collect everything you need.

- With many banks, you can also apply online, and this is fine. However, you should remember that doing it face-to-face will give you a better chance to make your case and make a good impression with the person who will decide to give you the loan or not.

- When going in to apply for a loan, dress as though you are going to a job interview. That means wearing clean, neatly-pressed, business casual clothing. Make sure that you hair is done neatly, and that you have a generally well-groomed appearance. You may think that you shouldn’t be judged on your appearance, but the fact is that the loan officer will be affected by your appearance.

-

4Understand the terms of the loan. If you are accepted for the loan, make sure that you carefully read and understand the terms of the loan. Do not accept the loan if you have not done this, or if there are terms and conditions that are unclear to you. If there is anything that you don’t understand, ask a member of the bank staff to help clarify the information contained in the document.[8]

- It may also be worth having a lawyer check the document in order to identify any red flags if you can afford to do so.

Asking for a Pay Day Advance

-

1Look into your company’s policy on pay day advances. Many companies, especially larger ones, will already have policies in place that restrict when and under what conditions an employee can request an advance on their pay check. If you can’t find anything in your contract about it, don’t be afraid to approach your human resources department about the matter.

- Ask them about the conditions under which you could request an advance on your pay check, how long this process takes, and when the money you “borrowed” will be paid back. For example, will all of the money borrowed be taken out of your next pay check or can you split larger amounts up over several pay checks?

- If your company has an employee website look there first. Some companies will post their guidelines online.

-

2Ask the right person. If you work for a very small company, you will probably need to approach your boss. However, if you work for a large company, it is probably best to go directly to human resources without bringing your boss into the mix.

- This is more an issue for human resources since it relates to payment and not to the work you do on a daily basis. Thus, it doesn’t really need to concern your boss unless there is no one else to go to.

-

3State why you need the money. If you work for a large company that has a standardized policy for pay day advances you may not need to explain why you need the money. However, you should be prepared for the reality that many bosses will want to know what is going on, especially if you work in a very tight-knit company.

- You don’t have to go overboard with details. If they tell you they need to know what the money will be used for, just give a simple and straightforward explanation. Reassure them that this is a one-time issue and that you wouldn’t ask if there was any other way around the issue.

-

4Avoid asking at busy times. You want to be able to get your boss or human resource representatives full attention so don’t approach them when they are very busy. For example, you should probably avoid Monday mornings or Friday afternoons as they are likely to be busy catching up or trying to wrap everything up before the weekend. You should also avoid times that are particularly busy for your company. For example, if you work in a restaurant, don’t try talking to them about it during the dinner time rush. Instead, ask them in the mid-afternoon, before the rush comes in.

- Try asking on a Monday afternoon or a Tuesday. This way, you will be avoiding the Monday morning catch up, but there will still be plenty of time left in the week for them to handle your request.

-

5Fill out any necessary paperwork. Many companies will require you to fill out some forms related to your pay day advance. This paperwork will document the amount you took in advance, when you took it, and when the money will be taken out of your normal pay check. Don’t fight your employer on this. Remember that they are helping you out, and having documentation of the transaction protects both of you.

- This documentation will probably also explain what will happen should you leave the company early (e.g. because you quit, are laid off, or fired).

Borrowing Money Using a Credit Card

-

1Use your credit card to buy what you need. If you need to borrow money in order to buy something from a retail store (e.g. you want to buy your child a nice christmas present) then using your credit card is an easy way to cover the costs of an item when you don’t have the cash on hand. Though you should be aware that it will incur interest fees unless you pay the balance in full before the end of the month.[9]

- Try to pay back the money as quickly as possible in order to avoid racking up interest charges.

- Your credit card company will usually send you a bill each month (or this may be online) telling you the minimum you’re expected to pay each month towards the money you borrowed. This amount is usually relative to the amount of money you borrowed. For example, if you borrowed $100, you may only be required to pay $15 each month, but if you borrowed $10,000 you may be required to pay at least $150 each month. Be sure that you pay at least the minimum on-time each month.

- If you can, try to pay a little bit more than the minimum and always pay on time. This will improve your credit score. Failing to pay at least the minimum when it is due will incur high fees and will harm your credit score.

-

2Call your credit card company to learn about the consequences of credit card cash advances. As the terms and conditions of getting a cash advance can vary greatly from card to card, it is recommended that you call your credit card company before going down this road. Ask them how much money you will be allowed, what the interest rate is and when it will begin collecting interest, and also ask about whether or not there is a transaction fee associated with the advance.[10]

- When you received your credit card, you probably received a letter giving you your PIN. This is the PIN that you will need if you want to get your cash advance at an ATM. If you never received this, or have forgotten it, be sure to ask about it when you call.

- Most credit cards will allow you to take money out of ATMs like you would with an ATM or debit card. However, some credit cards may do things differently so be sure to clarify this with the company representative.

-

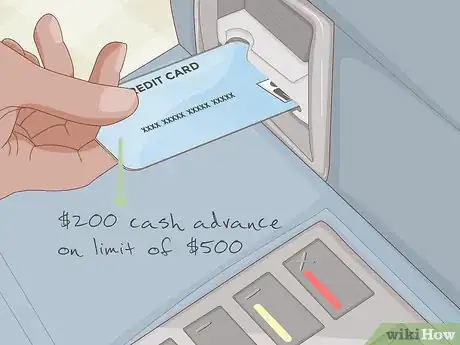

3Get a cash advance using your credit card. In some instances, you may need cash for one reason or another, and won’t be able to pay with the card directly. For example, if you need to pay rent, many landlords are not able to, or are unwilling to, accept a credit card for payment. In this case, you will need cash. Though not every credit card offers this method of borrowing money, many do.[11]

- Be aware that you will not be able to get a cash advance for an amount that is greater than the limit of your credit card, and in many cases the amount you are allowed to take out as cash is significantly lower than your credit limit. For example, if you have a credit limit of $500, you won’t be able to get a cash advance for $501 or more dollars. In many cases, for example, you may only be able to get a cash advance of $200 if your credit limit is $500.

- It is also important to understand that the interest rate on a cash advance is much higher than for normal credit card purchases, and this interest usually begins to incur immediately, whereas with normal purchases you have a grace period where no interest is charged on the purchase.

- Cash advances also usually incur a transaction charge just for taking the money out.

-

4Use your pin to get cash at an ATM with your credit card. In most cases, this will be the easiest method to get your cash. You will need the PIN for your credit card. Then, just use the ATM in the same way that you would when using a normal ATM or debit card. Be sure to get a receipt for your transaction to keep with your records.[12]

- Other methods of getting a credit card cash advance include convenience checks and bank transfers both of which will have to be set up directly through your credit card company.

Getting a Pawnshop Loan

-

1Choose a pawn shop with a good reputation. Do an internet search to see what pawn shops exist in your area. Read reviews to learn about the experiences that others have had with certain shops. If you have time, you can also go and visit the shop to get a feel for the place. Some pawn shops will be more difficult to work with than others so it’s important to pick one that feels right for you.[13]

- If you have a very specific item, try looking for a shop that specializes in the type of item you have. For example, if you have an antique, look for pawn shops that specialize in antique products. If you have a valuable toy in its original packaging look for pawn shops that specialize in action figures.

-

2Choose something of value to use as collateral. Getting cash from a pawn shop can be done by bringing an item that is valuable into the shop. The item will be appraised by the worker and they will give you cash for the value of the item. They then hold onto the item until a specified date. If you haven’t paid back the money you owe by this date, then they are free to sell the item. If you do pay the money back on time, you get your stuff back.

- Realize that you will have to bring in something that is worth at least the amount of money you want to borrow, and the pawn shop must be able to see that the item has value. Remember, they are running on the assumption that you won’t pay the money back so they will have to sell the item in order to benefit from the transaction.

- Pawnshops typically only loan 30% to 40% of collateral market value, expecting 100% markup if they have to sell item. A pawn shop will not usually give you a loan for an amount greater than they would purchase the item.

- There will likely be an interest rate of some sort on your transaction, so if you borrow $500 you may have to pay back the $500 plus an extra 5% in order to get your item back. This interest rate is usually regulated by the state you live in.

-

3Provide evidence of the item's value. If you have something that is really valuable, such as an antique, be sure to bring some evidence of it’s value with you. Though most pawn shop owners are quite knowledgeable about the value of different items, they don’t know everything. Providing them with evidence of the item’s value will make them more likely to give you the amount you want.[14]

- For example, if you own a valuable piece of jewelry consider having it appraised by a jeweler. They will provide you with a certificate that you can take with you to the shop.

-

4Consider selling an item. If you have something of value that you don’t really need or want, then you could consider selling the item straight away. This will mean that you get the cash you need without having to worry about paying it back plus you won’t have any extra interest to worry about.

- Obviously this isn’t really borrowing money, but it does offer a good method of getting some cash if you really need it without the stress of having to pay anything back.

- If you have something that is really valuable and you’re certain of it’s worth, then don’t be afraid to negotiate with the pawn shop. They are trying to buy the item for the lowest price possible in order to increase their profit margins. Don’t be afraid to walk away from the transaction if you feel that you are being taken advantage of.

-

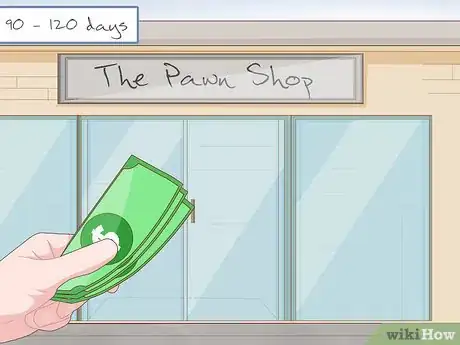

5Pay back the loan on time. If you don’t pay back to loan on time, the item you put up as collateral becomes the legal property of the pawn shop and there is nothing you can do about it. You can try to talk to the owner of the pawn shop, but they are under no legal obligation to help you out.

- There’s no need to wait until the terms of the loan are completed to pay it back. Most pawn shop loans are for 90-120 days, but this doesn’t mean that you have to go in on day 120 with cash in hand to get your stuff back. If you’re able to scrape up the cash after 30 days, you can go in with the money and get your stuff back as soon as possible. However, understand that you will probably have to pay interest for the full term of the loan whether you pay it back early or not. Ask your pawn shop to be sure about this.

Getting a Payday Loan

-

1Research different payday loan companies. There are many companies that offer payday loans. These loans are sometimes also called cash advance loans, check advance loans, post-dated check loans, or deferred deposit loans. If you need a small amount of cash quickly, and have run out of other options, this may be a good way to get the money you need. However, do understand that these loans charge very high interest rates and fees.[15]

- Look for payday loan companies that are associated with a larger financial institution that offers different types of financial services.

- Read reviews online about different payday loan companies to ensure that they are not a scam.

- Look for loan companies that are up-front and straightforward about their loan requirements. If you feel like something is off, then go somewhere else.

- You can apply for a payday loan online, but you are also more likely to get scammed. If possible, apply for your loan in person at a payday loan center.

-

2Understand the terms and conditions of the loan. Before applying for the loan, make sure that you carefully read the terms and conditions of the loans offered by this company. This means you will want to carefully read any fine print. This information is usually available on the companies website or along with the application form. If you cannot find the terms and conditions, then ask an employee at your local center to provide you with them.

- Getting a payday loan should be your last resort. This type of lending usually results in very high interest rates and the loan may incur a lot of fees.

- Be sure to ask for clarification of anything you do not understand completely.

- In some cases, by signing your application, you may be agreeing to the terms and conditions of the loan so be certain that this is the path you want to take.

-

3Prepare your application materials. Once you have chosen the company where you want to apply for a loan, you can find out exactly what documents they require by visiting their website, calling their hotline, or visiting a local payday loan center. Make sure that you will be able to meet all the requirements for a loan before applying in order to avoid wasting your time.[16]

- In most cases, you will need to provide proof of steady income (e.g. pay stubs), evidence that you have a bank account, your and your employer’s contact information, photo identification that shows that you are over the age of 18, as well as a blank check that you will use to pay back the loan.

-

4Apply for the loan. You may be able to do this online, but it is probably best to go into your local branch in order to fill out the application form and provide any required documentation. Going into the center will allow you to ask questions at any point during the process without having to call a phone number and explain your situation to a representative.[17]

- In most cases, there will be an application form to fill out where you will provide basic information about yourself such as your full name, contact details, employer, etc.

- The loan company may look into your credit history, but they typically do not do a full credit check as these companies typically exist to prey on people who have no credit or bad credit.

-

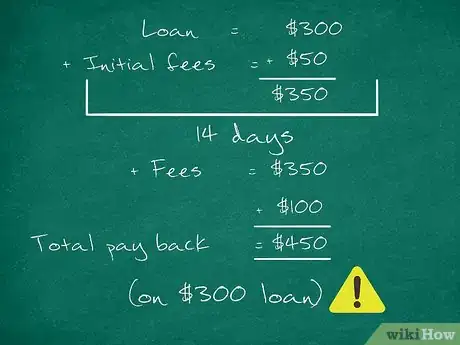

5Avoid renewing the loan. If you have taken out the loan, it will usually be for a short period of time, typically around 14 days. After which time, the company will cash the check you left with them, or they will expect you to come in with the cash you owe them (this depends on the repayment terms you agreed to). Beware that these companies may try to encourage you to renew your loan, which will give you more time to pay them back. However, the down side of this is that they will charge you a fee for doing so. If at all possible, pay the loan back according to the initial terms in order to get caught in a debt trap.[18]

- For example, if you took out a loan of $300, which incurred an initial fee of $50, then you would owe them $350 after 14 days. However, if you renew the loan in order to get an extra 14 days to pay back the loan, then you may incur another fee (which can vary greatly, but lets say the fee is $100). Now you owe them the initial $350 plus an additional $100 meaning you are paying $450 for a $300 loan.

- Remember that these people are not looking out for your best interest. Though you may think these people are really friendly and helpful, the goal of the business is to make money.

References

- ↑ http://www.cbsnews.com/news/loans-from-friends-how-to-ask-to-borrow-money/

- ↑ http://www.cbsnews.com/news/loans-from-friends-how-to-ask-to-borrow-money/

- ↑ http://www.investopedia.com/terms/c/collateral.asp

- ↑ http://www.creditcards.com/credit-card-news/7-best-worst-ways-borrow-500-dollars-1267.php

- ↑ https://www.wellsfargo.com/goals-credit/secured-loan-types/

- ↑ http://www.inc.com/magazine/201605/helaine-olen/how-to-get-a-bank-loan.html

- ↑ http://www.forbes.com/sites/investopedia/2013/07/03/5-tips-for-getting-your-bank-loan-approved/#6e9318b02d80

- ↑ http://www.forbes.com/sites/investopedia/2013/07/03/5-tips-for-getting-your-bank-loan-approved/#6e9318b02d80

- ↑ https://mappingyourfuture.org/money/creditcards.cfm

- ↑ http://www.creditcards.com/credit-card-news/7-best-worst-ways-borrow-500-dollars-1267.php

- ↑ http://www.creditcards.com/glossary/term-cash-advance.php

- ↑ http://www.creditcards.com/glossary/term-cash-advance.php

- ↑ http://www.moneymanagement.org/Community/Blogs/Blogging-for-Change/2011/July/Tips-for-buying-and-selling-at-a-pawn-shop.aspx

- ↑ http://www.moneymanagement.org/Community/Blogs/Blogging-for-Change/2011/July/Tips-for-buying-and-selling-at-a-pawn-shop.aspx

- ↑ https://www.credit.com/loans/loan-articles/the-truth-about-payday-loans/

- ↑ http://www.paydayloaninfo.org/facts

- ↑ http://www.paydayloaninfo.org/facts

- ↑ http://www.paydayloaninfo.org/facts

About This Article

To borrow money, try applying for a loan through your bank or credit union. Or, you can get a loan at a pawn shop by offering something valuable as collateral. You can also try borrowing money from a local payday loan company. If you're not able to take out a loan through your bank or a private institution, consider asking a friend or family member if you can borrow some money from them. For more tips from our Financial co-author, like how to borrow money using a credit card, scroll down!