wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 68,612 times.

Learn more...

Current ratio is a measurement of a company’s ability to pay back its short-term obligations and liabilities. It is crucial for determining a company’s financial health. In general, a current ratio of 2 means that a company’s current assets are two times higher than its current liabilities and is considered healthy. A current ratio of 1, meaning that a company’s assets and liabilities are equal, is considered acceptable. Anything lower indicates that a company would not be able to pay its obligations.

Steps

Part 1: Understanding Current Ratio

-

1Understand current liabilities. The term “current liabilities” is used frequently in accounting to refer to business obligations that must be paid in cash within a year or within the operating cycle of a company. These obligations will be settled either by current assets or by the creation of new current liabilities.

- Examples of current liabilities include short-term loans, accounts payable, debts to suppliers, and accrued liabilities.

-

2Understand current assets. The term “current assets” refers to assets that are used to pay a company’s obligations and liabilities within a year. Current assets can also be converted into cash.

- Examples of current assets include accounts receivable, stock inventory, marketable securities, and other liquid assets.

Advertisement -

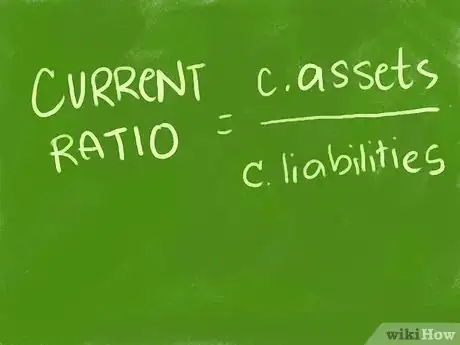

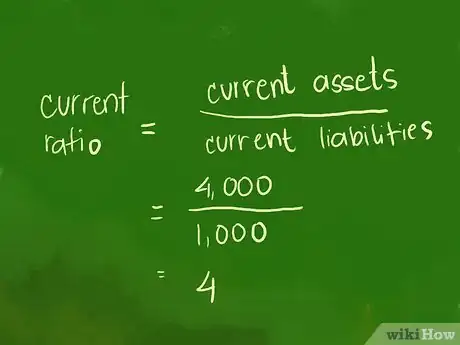

3Know your basic formula. The formula for calculating current ratio is a simple one: current assets divided by current liabilities. All the numbers you’ll need should appear on a company’s balance sheet.

Part 2: Calculating Current Ratio

-

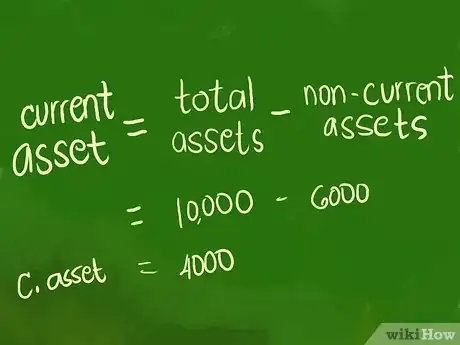

1Calculate current assets. In order to calculate a current ratio, you’ll first need to find the company’s current assets. To do so, subtract non-current assets from the company’s total assets.

- To illustrate, let’s say you are calculating the current ratio of a company with $120,000 in total assets, $55,000 in equity, $28,000 in non-current assets, and $26,000 in non-current liabilities. To calculate current assets, subtract non-current assets from total assets: $120,000 - $28,000 = $92,000.

-

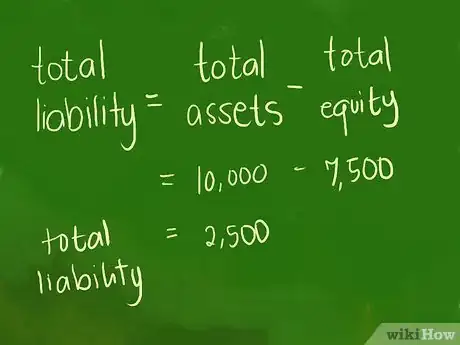

2Calculate total liabilities. After calculating the company’s current assets, you’ll need to find its total liabilities. To do so, subtract total equity from the company’s total assets.

- In the example above, to calculate the company’s total liabilities, subtract equity from total assets: $120,000 - $55,000 = $65,000.

-

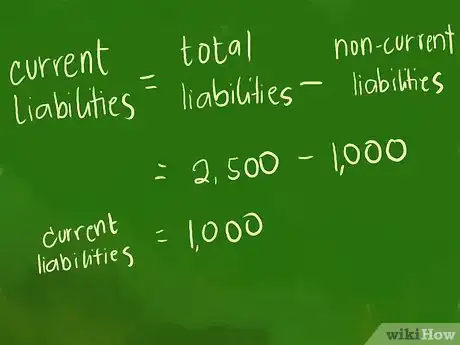

3Determine current liabilities. Once you’ve found the company’s total liabilities, you are ready to calculate its current liabilities. To do so, subtract the non-current liabilities from the company’s total liabilities.

- In the example above, to calculate the company’s current liabilities, subtract non-current liabilities from total liabilities: $65,000 - $26,000 = $39,000.

-

4Find the current ratio. After determining current assets and current liabilities, plug your answers into the basic current ratio formula of current assets divided by current liabilities.

- In the example above, divide the company’s current assets by its current liabilities: $92,000 / $39,000 = 2.358. Your company’s current ratio is 2.358, which is a satisfactory indicator of a financially healthy business.

Community Q&A

-

QuestionShould I put it in the form of a ratio?

DonaganTop AnswererYes, that's a useful form.

DonaganTop AnswererYes, that's a useful form. -

QuestionIs a 1:9 current ratio good?

DonaganTop AnswererYes.

DonaganTop AnswererYes. -

QuestionWhy do we subtract total equity from total assets to get the total liabilities?

DonaganTop AnswererCurrent ratio is about the ability to pay bills. Equity does not help pay bills, so they ignore equity in calculating current ratio.

DonaganTop AnswererCurrent ratio is about the ability to pay bills. Equity does not help pay bills, so they ignore equity in calculating current ratio.

References

About This Article

To calculate the current ratio of your company, simply divide the value of your current assets by the value of your current liabilities. If you don’t know these values off-hand, calculate them by subtracting any non-current assets or liabilities from the company’s total. Once you’ve divided these two values, the resulting number will represent your company’s ability to pay back its short-term obligations. A current ratio of 2 is considered healthy, and anything below 1 is considered unacceptable. To calculate the current ratio of your company, simply divide the value of your current assets by the value of your current liabilities. If you don’t know these values off-hand, calculate them by subtracting any non-current assets or liabilities from the company’s total. Once you’ve divided these two values, the resulting number will represent your company’s ability to pay back its short-term obligations. A current ratio of 2 is considered healthy, and anything below 1 is considered unacceptable. To see current ratio calculations applied to real-life examples, scroll down! To calculate the current ratio of your company, simply divide the value of your current assets by the value of your current liabilities. If you don’t know these values off-hand, calculate them by subtracting any non-current assets or liabilities from the company’s total. Once you’ve divided these two values, the resulting number will represent your company’s ability to pay back its short-term obligations. A current ratio of 2 is considered healthy, and anything below 1 is considered unacceptable. To see current ratio calculations applied to real-life examples, scroll down!