This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 14 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 28,306 times.

When you inherit money, you have to pay taxes on the money. In the United States, you have to pay “estate tax” to the federal and state governments. Six states also charge a separate “inheritance” tax. In the U.S., this is solely a state tax.[1] To calculate your inheritance tax, you need to learn the laws of the state whose laws apply to the estate. You are also encouraged to seek the assistance of a CPA or other tax professional when dealing with tax issues.

Steps

Calculating Inheritance Taxes

-

1Check if your state imposes inheritance taxes. Currently, six states impose an inheritance tax. Taxes are imposed even if you do not live in one of the states. What matters is whether or not the person who left you money lived in that state or owned property there. The six states are:[2]

- Iowa

- Kentucky

- Maryland

- Nebraska

- New Jersey

- Pennsylvania

-

2Calculate if the estate is too small. Some estates will be exempted from state inheritance tax because they are too small. In Iowa, for example, an estate valued at $25,000 or less is not assessed inheritance taxes.[3]

- Each state will have rules for properly valuing an estate. Generally, you must subtract certain allowed liabilities from the “gross estate.” The gross estate is the market value of all of the property in the estate. Usually, it is calculated according to its market value on the date of the deceased’s death.[4]

Once the gross estate is determined, then certain liabilities are subtracted. Depending on state law, these liabilities may include:

- expenses for funerals

- any debts the deceased person owed

- mortgages on the estate property

- taxes which accrued before the death

- certain probate expenses, such as court costs and attorney fees

Advertisement - Each state will have rules for properly valuing an estate. Generally, you must subtract certain allowed liabilities from the “gross estate.” The gross estate is the market value of all of the property in the estate. Usually, it is calculated according to its market value on the date of the deceased’s death.[4]

Once the gross estate is determined, then certain liabilities are subtracted. Depending on state law, these liabilities may include:

-

3See if you qualify for an exemption. Whether you owe a tax will depend on how closely you are related to the deceased who left you property. For example, you will be exempt from inheritance taxes in every state if you inherit from a spouse or domestic partner.[5]

- Children may also be eligible for exemptions. In Iowa and Kentucky, for example, children are exempt.[6] [7]

- In some states, a smaller exemption will apply for more distant relatives. In Kentucky, for example, nieces and nephews, as well as aunts and uncles qualify for a $1,000 exemption.[8] In Nebraska, these same relatives will qualify for a $15,000 exemption.[9] If the estate is larger than the exemption, then you must pay inheritance tax on the amount that exceeds the exemption.

- The tax rate can also vary depending on your relationship. In New Jersey, for example, brothers and sisters are taxed at a 11-16% rate, with $25,000 exempt. However, other beneficiaries, such as a non-relative, will be taxed at a higher rate (15-16%).

-

4Read the applicable state’s law. You should read the state’s law to understand the tax rates and all applicable exemptions. You should be able to find the laws on the state’s Department of Revenue or Comptroller’s website.

-

5Calculate the inheritance tax. Once you have valued the estate properly, you will then need to look at the tax tables for the state to which you must pay inheritance tax. The inheritance tax will vary by state but is generally a function of the state’s tax rate and your relationship to the decedent.

- If you are a sibling in New Jersey, for example, and the estate is $24,000, then no inheritance tax needs to be paid. The estate is smaller than the exemption ($25,000) for siblings. If the estate was worth $450,000, then the first $25,000 is exempt. The siblings who inherit will then pay a 11-16% tax rate.

- In Iowa, siblings will pay a 5% tax on any amount over $0 but not over $12,500. For any amount over $12,500 but not over $25,000, then the tax rate is 6% plus $625.

- By contrast, a nephew in Iowa has a different tax rate. The first $50,000 is taxed at 10%.

-

6File a tax return, if you are the executor (personal representative). It is the executor’s job to file the tax return if a state inheritance tax is applicable.[10] If the personal representative fails to file, then a beneficiary should file.[11]

- If you need assistance with tax forms, then you should contact an accountant or tax professional.

Estimating Estate Taxes

-

1Identify possible exemptions. The U.S. government imposes estate taxes primarily on larger estates. As of 2015, the first $5.43 million is exempted from any federal tax. Because the exemption is so large, only a tiny percentage of estates (roughly 0.3%) have to pay federal estate tax.[12]

- Fifteen states also have an estate tax. A state may exempt a smaller amount from its estate tax. For example, New Jersey exempts only estates up to $675,000.[13]

-

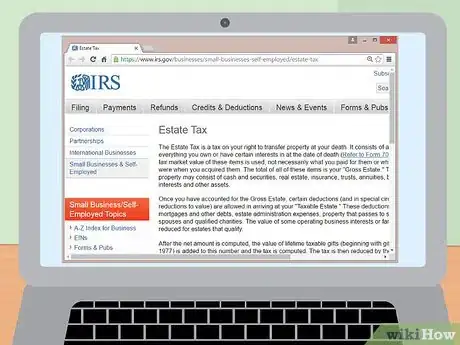

2Read up on the federal law. Although tax law is not easy to understand, the IRS does offer a summary of U.S. estate tax law at https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax. There are also links to many forms that include additional helpful information.

- You should also read your state’s estate tax laws. These laws are often found at your state’s Division of Revenue or Comptroller’s website. Type “estate tax” and then your state into a web browser.

-

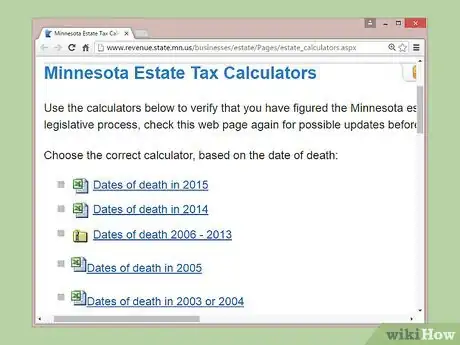

3Use a calculator. You can calculate possible estate tax by using a calculator. There are many on the Internet. The best calculators are those created by government agencies. For example, the Illinois Attorney General has a calculator you can use if the estate or property was located in Illinois.[14] The Minnesota Department of Revenue also has a calculator.[15]

Finding Assistance

-

1Meet with a lawyer. An estate attorney can help you understand the tax consequences of certain estate transfers. If you have a legal question, then you should meet with a qualified estate attorney. You can find one by visiting your state’s bar association, which should run a referral program.

-

2Hire a Certified Public Accountant (CPA). If you are a personal representative and you need to file a tax return for the inheritance taxes, then you should seek professional legal help. As the estate’s personal representative, you may already have an accountant helping you manage the estate. If not, you should seek hiring an accountant.

- A CPA is an accountant who has passed a licensing exam.[20] Although you could certainly hire an accountant who is not a CPA, the CPA designation signals that the accountant has certain education and expertise.

- For more tips, see Hire an Accountant and Get Help Filing Taxes.

-

3Plan your own estate. To make things simpler on your own heirs, you can discuss with your estate attorney or CPA how to arrange your own affairs to minimize the tax consequences. To prepare for your meeting, you should gather the following information:[21]

- the names of all children, including any who are deceased

- the names and the dates of birth of your grandchildren

- an estimate of your assets, including cash or cash-equivalents, stocks, bonds, mutual funds, insurance policies, mineral rights, securities, and retirement plans

- the value of real estate and personal property (art, automobiles, motor homes, jewelry, etc.)

References

- ↑ http://www.nolo.com/legal-encyclopedia/state-inheritance-taxes.html

- ↑ http://www.nolo.com/legal-encyclopedia/state-inheritance-taxes.html

- ↑ http://www.nolo.com/legal-encyclopedia/iowa-inheritance-tax.html

- ↑ https://tax.iowa.gov/inheritance

- ↑ http://www.nolo.com/legal-encyclopedia/state-inheritance-taxes.html

- ↑ http://www.nolo.com/legal-encyclopedia/iowa-inheritance-tax.html

- ↑ http://www.nolo.com/legal-encyclopedia/kentucky-inheritance-tax.html

- ↑ http://www.nolo.com/legal-encyclopedia/kentucky-inheritance-tax.html

- ↑ http://www.nolo.com/legal-encyclopedia/nebraska-inheritance-tax.html

- ↑ http://www.nolo.com/legal-encyclopedia/state-inheritance-taxes.html

- ↑ https://tax.iowa.gov/inheritance

- ↑ http://www.nolo.com/legal-encyclopedia/state-inheritance-taxes.html

- ↑ http://taxfoundation.org/blog/does-your-state-have-estate-or-inheritance-tax

- ↑ http://www.illinoisattorneygeneral.gov/publications/calculator/2013calc/calculator2013.html

- ↑ https://www.revenue.state.mn.us/estate-tax-calculators

- ↑ http://www.pacificlife.com/education_center/calculators/calc_estate_tax_liability.html

- ↑ https://www.revenue.state.mn.us/estate-tax-calculators

- ↑ http://www.actec.org/

- ↑ http://www.aaepa.com/

- ↑ http://www.accountingcoach.com/blog/what-is-a-certified-public-accountant

- ↑ http://estate.findlaw.com/estate-planning-help/prepare-to-meet-with-estate-planning-lawyer.html