This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 37,544 times.

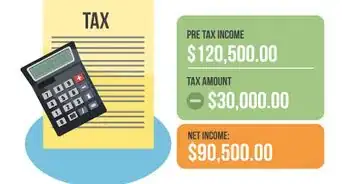

When you need to prepare your financial statements, you may want to hire an accountant, a certified public accountant (CPA) or an accounting firm. Whether you need to prepare financial statements or pay taxes for your small business, your family, or just for yourself, an accountant can help you organize your financial information. As an added benefit, most accountants stay current with the latest tax laws and practices. They can help you identify every possible tax break that you are eligible for, resulting in greater tax deductions and less money owed to Uncle Sam.

Steps

Identifying an Accountant Who Meets Your Needs

-

1Decide whether you need an accountant or a CPA. Different accounting professionals are able to perform different tasks and spend their days doing slightly different work.

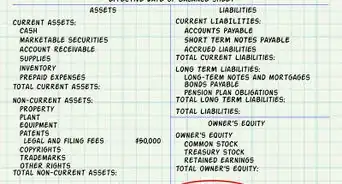

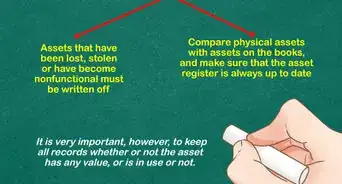

- The duties of an accountant include many bookkeeping tasks, such as making journal entries and posting accounts payable, receivables, and payroll taxes. Accountants handle most of the day-to-day financial tasks of a company, firm, or corporation. [1]

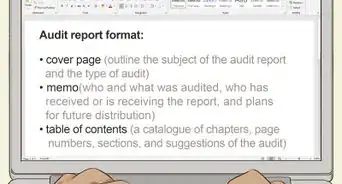

- Responsibilities for a CPA include auditing financial records, determining the method of reporting, and serving as a consultant. They are authorized to take on a few more responsibilities than accountant are, most notably that they are able to represent their clients in IRS audits. Additionally, many CPAs operate their own business.[2]

-

2Ask friends or coworkers for referrals. This can be a great way to begin your search for an accountant and to find local options.

- If you are looking for an accountant for your small business, be sure to ask other business owners in your industry to find an industry-specific accountant.

Advertisement -

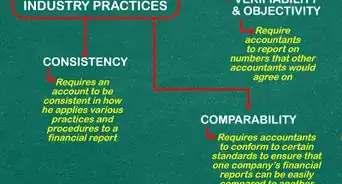

3Check with state and national associations. In the United States, you can contact your state CPA society for assistance in choosing a CPA firm or an accountant. You can also cross-reference an accountant’s references with the National Association of State Boards of Accountancy. [3] Many other countries have similar professional boards.

-

4Use social media with care. Social media sites aren't the most reliable places to look, but it won't hurt to check a potential accountant's credentials there.

Assessing Firms and Individuals

-

1Find the right fit. This is a professional relationship that has very real implications for your financial health. It is important to select an accountant that you respect, that listens to your needs, and can answer your questions.

- How are they at communicating? Can you reach them when it’s necessary? Do you feel comfortable sharing the intimate details of your finances with them?

- Obviously you want an accountant who knows his or her stuff, but the mark of a good professional is that they can translate that esoteric and complicated jargon into information that you can understand. [4]

- Look for someone that you can build a long-term relationship with.

-

2Research the accounting firms that are in your area. Spend time looking over the websites of accountants that you have received referrals for and learn more about them.

- Consider your company needs based on the specialty of the accountant or firm. You may want to choose an accountant who specializes in small business issues, has a good deal of experience, and represents other companies in your industry. Industry experience gives an accountant a leg up on others. An accountant should be able to discuss your business’s needs with you to render their best services. [5]

-

3Evaluate the size of the firm. Do you prefer to work with an accountant who operates their own small firm, or would you rather work with a larger firm?

- Larger firms may be equipped to handle and offer different services than smaller firms. If you need help with a very specialized task, you will need to inquire whether the firm or individual is equipped and licensed to handle this task.

- Larger corporations or individuals with more complex financial situations may need more than one accountant working on their financials so you should look at and interview the larger firm and the team that they are working on.

- For smaller needs, keep in mind that many sole practitioners work from home – it’s fairly common for them to communicate remotely or even keep your books at their home office. They may also ask to meet you at a neutral site like a coffee shop. Don’t be alarmed by this.

- Make sure to check any potential accountant’s credentials. Afterwards, where the work takes place is not all that important. In fact, the lack of an office or suite can mean lower overhead costs and lower fees.

-

4Inquire about accountant rates. It is important to find an accountant that is within your budget, but you may need to adjust your budget if your finances require more attention or are more complicated.

- If you are using an accounting firm, rates for services will vary depending on the size of the firm, the accountant's experience, and the firm's location.

- A junior account can initially handle your tax return preparation and write-up work. In this case, a CPA may review tax returns after the junior accountant prepares them. The firm partners will generally handle the consulting work. The greater the responsibility, the higher the rate per hour a professional charges will be. [6]

Narrowing Your Search

-

1Interview several accountants. Based on your research and any referrals you may have received, you can now begin to contact individuals to set up interviews.

- You should shop around and interview a few different firms and accountants to make sure you’re finding the best accountant for you.

- Prepare before your interviews. You should have an idea of what you are looking for in an accountant, what your budget is, and the services that you need help with.

-

2Request relevant information. This may include references, a list of services, examples of current invoices, and the fee schedule. For example, you are hiring an accountant for tax season, your fee schedule and the services you require will be very different than if you are hiring an accountant for ongoing consultation.

- Follow up on these references and crosscheck them with your state CPA registries and boards.

- Ask about the accountant’s education, companies they’ve worked with before, and what certifications they have. Certifications vary state by state so it is important to ask whether the individual is licensed to practice in your state. [7]

- Ask about completion times, too. Many accounting firms tend to over-promise on timing, so be clear if your business needs information on specific dates.

-

3Ask good questions. While you're interviewing potential accountants, ask questions that give you more information about them as professionals, the firm they work with, and what you can expect.

- Find out how long the individual or firm has been in business.

- How large is the firm?

- How long have they worked independently or for the firm?

- What is the typical response time for tax return preparation or year-end financial statements?

- What other sorts of clients do they have?

- What percentage of clients does the IRS audit annually?

-

4Evaluate what you get for the price. Although accounting services may seem pricey, they may quickly pay for themselves through tax write offs and tax savings.

- When you're interviewing accountants or firms, ask for quotes and use these when you are making your ultimate hiring decision. [8]

- Think of an accountant as an investment in your financial health or the financial health of your small business. Evaluate the opportunity cost of hiring an accountant. What else could you be doing instead of spending hours preparing your financial statements? [9]

- More experienced professionals will often charge more than a more junior accountant, but can work more efficiently and take less time to complete tasks.

-

5Hire an accountant or the accounting firm that meets your requirements and budget. After you have researched and interviewed several accountants, you're ready to select someone to hire.

- Arrange your first meeting with your newly hired accountant to begin to assess your financial and tax needs.

- Get an engagement letter from your new accountant spelling out things like fees, timing, duties, and other expectations. If one isn’t offered, it’s a good idea to ask for one.

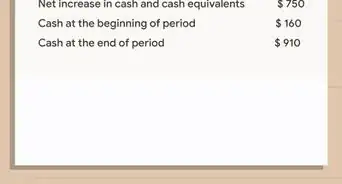

- Begin organizing and preparing your financial statements and information to share with your new accountant.

Expert Q&A

-

QuestionHow much does it cost to hire an accountant?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor Rates among accountants vary considerably based upon the type work being done and the time it takes to do it. Fees may range from $50 to $150 per hour.

Rates among accountants vary considerably based upon the type work being done and the time it takes to do it. Fees may range from $50 to $150 per hour. -

QuestionHow an accountant can help a small business?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor Bookkeeping, tax compliance, financial analysis, payroll compliance, and planning are all ways accountants may help small businesses.

Bookkeeping, tax compliance, financial analysis, payroll compliance, and planning are all ways accountants may help small businesses. -

QuestionWhat qualifications do you need to be an accountant?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor A college degree in accounting from an accredited school is the best evidence of possessing the minimum required skills. However, accounting experience may also be acceptable.

A college degree in accounting from an accredited school is the best evidence of possessing the minimum required skills. However, accounting experience may also be acceptable.

Warnings

- Follow up on references and do your research, not every accountant is as skilled as others that you may find.⧼thumbs_response⧽

- Listen to your gut. If your intuition is telling you that something is wrong with the situation, you may have to walk away.⧼thumbs_response⧽

References

- ↑ http://www.allbusinessschools.com/accounting/job-description/

- ↑ http://oureverydaylife.com/cpa-duties-2375.html

- ↑ https://www.nasba.org/

- ↑ https://www.entrepreneur.com/article/219298/

- ↑ https://www.theguardian.com/small-business-network/2015/jan/05/how-to-choose-accountant-for-small-business

- ↑ http://www.entrepreneur.com/money/moneymanagement/bookkeeping/article45628.html

- ↑ http://www.forbes.com/sites/sageworks/2016/01/31/how-to-choose-a-cpa/#331b056c7ae8

- ↑ https://www.entrepreneur.com/article/217784

- ↑ http://www.investopedia.com/terms/o/opportunitycost.asp