This article was co-authored by wikiHow staff writer, Jack Lloyd. Jack Lloyd is a Technology Writer and Editor for wikiHow. He has over two years of experience writing and editing technology-related articles. He is technology enthusiast and an English teacher.

The wikiHow Tech Team also followed the article's instructions and verified that they work.

This article has been viewed 501,806 times.

Learn more...

This wikiHow teaches you how to create an interest payment calculator in Microsoft Excel. You can do this on both Windows and Mac versions of Excel.

Steps

-

1Open Microsoft Excel. Double-click the Excel app icon, which resembles a white "X" on a dark-green background.

-

2Click Blank Workbook. It's in the upper-left side of the main Excel page. Doing so opens a new spreadsheet for your interest calculator.

- Skip this step on Mac.

Advertisement -

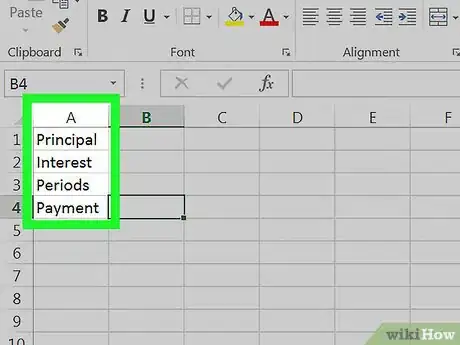

3Set up your rows. Enter your payment headings in each of the following cells:

- Cell A1 - Type in Principal

- Cell A2 - Type in Interest

- Cell A3 - Type in Periods

- Cell A4 - Type in Payment

-

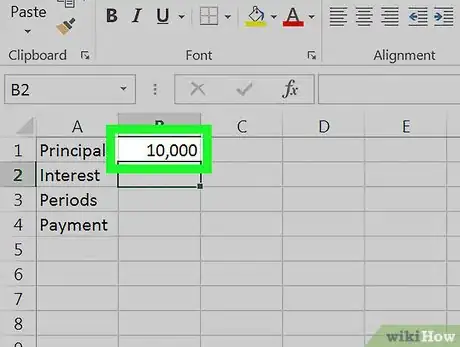

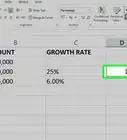

4Enter the payment's total value. In cell B1, type in the total amount you owe.

- For example, if you bought a boat valued at $20,000 for $10,000 down, you would type 10,000 into B1.

-

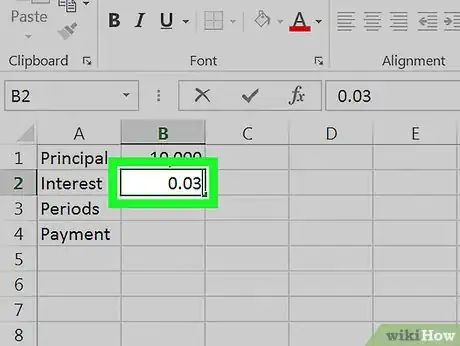

5Enter the current interest rate. In cell B2, type in the percentage of the interest that you have to pay each period.

- For example, if your interest rate is three percent, you would type 0.03 into B2.

-

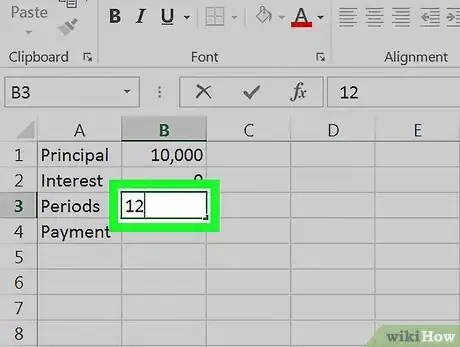

6Enter the number of payments you have left. This goes in cell B3. If you're on a 12-month plan, for example, you would type 12 into cell B3.

-

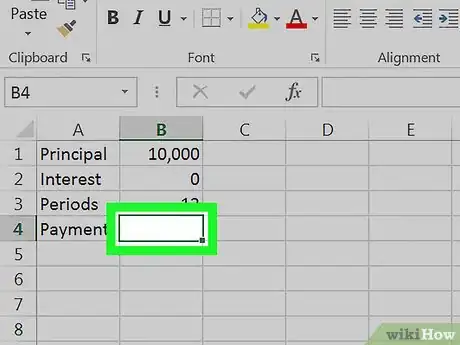

7Select cell B4. Simply click B4 to select it. This is where you'll enter the formula to calculate your interest payment.

-

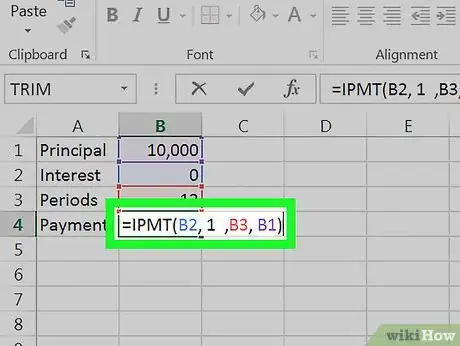

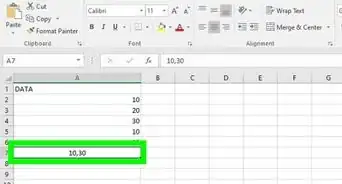

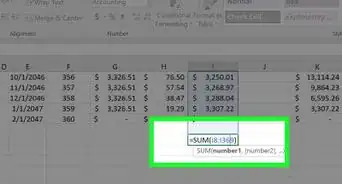

8Enter the interest payment formula. Type

=IPMT(B2, 1, B3, B1)into cell B4 and press ↵ Enter. Doing so will calculate the amount that you'll have to pay in interest for each period.- This doesn't give you the compounded interest, which generally gets lower as the amount you pay decreases. You can see the compounded interest by subtracting a period's worth of payment from the principal and then recalculating cell B4.

Community Q&A

-

QuestionThe interest is 6% per annum, and the amount deposited is 500,000 on January 2016. If a member withdraws his amount on May 2016, what is the interest?

Community Answer6% per annum is .5% monthly (.5 * 12 = 6), so that's $2500.00 in interest per month ($500,000 *.5% = $2,500, or $500,000 * .005 = $2,500). If the member withdrew in May before the interest was calculated and paid out for the month of May, then $10,000.00 ($2,500 * 4) in interest. If after, then $12,500.00 ($2,500 * 5) in interest.

Community Answer6% per annum is .5% monthly (.5 * 12 = 6), so that's $2500.00 in interest per month ($500,000 *.5% = $2,500, or $500,000 * .005 = $2,500). If the member withdrew in May before the interest was calculated and paid out for the month of May, then $10,000.00 ($2,500 * 4) in interest. If after, then $12,500.00 ($2,500 * 5) in interest.

Warnings

- Interest rates are subject to change. Make sure you read the fine print on your interest agreement before you calculate your interest.⧼thumbs_response⧽

About This Article

1. Label rows for Principal, Interest, Periods, and Payment.

2. Enter total value in the Principal row.

3. Enter the interest rate into the Interest row.

4. Enter the amount of remaining payments in the Periods row.

5. Click the first blank cell in the Payments row.

6. Type " =IPMT(B2, 1, B3, B1)" into the cell.

7. Press Enter.