This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 20,669 times.

In the state of Florida, mortgage brokers and loan originators are required by law to have a license. A loan originator is a person who solicits, accepts, or negotiates the terms of any mortgage loans and a mortgage broker is a person who conducts mortgage-related activities through a loan originator employed by the broker. The Florida Office of Financial Regulation (OFR) regulates these licenses. Before working with a mortgage broker and/or loan originator, you should check the status of each person’s license. You want to verify that the person can legitimately handle your mortgage. With just a few pieces of information, such as the broker or originator’s name, you can check online and verify that he or she is licensed.

Steps

Verifying the License of a Mortgage Broker and Loan Originator

-

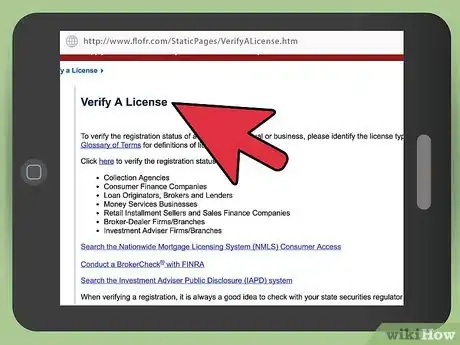

1Visit the Florida OFR website. The Florida OFR allows individuals to verify a mortgage broker’s license on its website. Begin by visiting the OFR’s website. This will connect you directly to the search page.

- If you do not have internet access, call the Florida OFR at 1-800-487-9687 and ask for assistance verifying a mortgage broker's license.

-

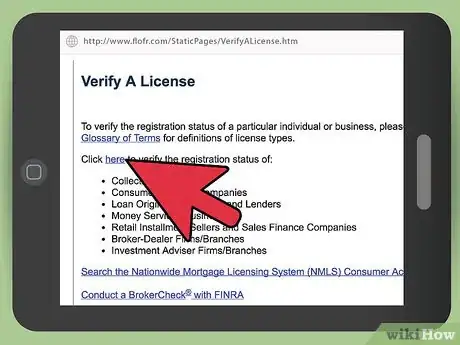

2Access the registration search. Once on the OFR’s license verification homepage, you will see a sentence that states “Click here to verify the registration,” followed by a list of licensee categories. Click on the hyperlink located at the word “here.” You will be redirected to a search page that asks for information about the individual or business for whom you are searching.Advertisement

-

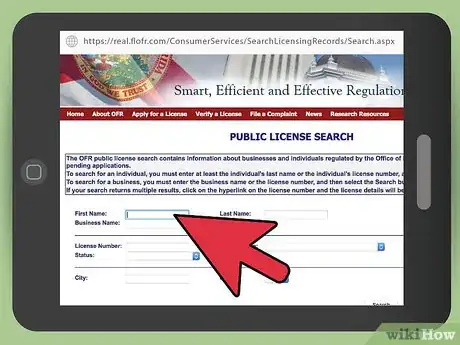

3Provide information about the mortgage broker. In order to check a mortgage broker’s license, you must have at least the individual’s last name or his or her broker number. If you are attempting to verify the license for the mortgage broker’s business, you are must have the business’ name or its license number. Enter the information into the appropriate field, then click on the "Search" button.

- If you want to retrieve a fewer number of search results, you can enter the mortgage broker's first name, or the name of their business.

- You may also perform a search by entering the mortgage broker's license number and indicating "Mortgage Broker" from the drop-down menu next to "License Type."

-

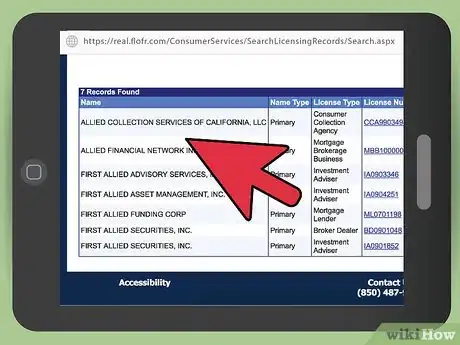

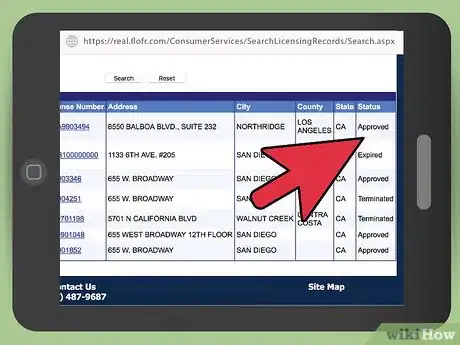

4Locate your mortgage broker from the list of search results. After you have entered your search criteria, the web page will refresh and display a list of search results below the fields for the search criteria. Search through the list and check whether your broker’s information is included in the list.

-

5Check the license status of the mortgage broker. The license status will be shown on the far right and may indicate the status as active, expired, or suspended. You will be also be provided with the mortgage broker's license number, address, city, county, and state of licensure.

- You may see that your mortgage broker’s license is suspended but that he or she has an active license as a loan originator.

- A loan originator is a person who can directly or indirectly solicit a mortgage loan, accept a mortgage loan application, and negotiate the terms of a new mortgage on behalf of a borrower.

- A mortgage broker is a person who conducts loan originator activities through a licensed loan originator that either the broker employs or with whom the broker contracts.

- A mortgage broker business has to be operated by a principal loan originator so if your broker is listed as a loan originator then he or she can act as a mortgage broker for you.[1]

-

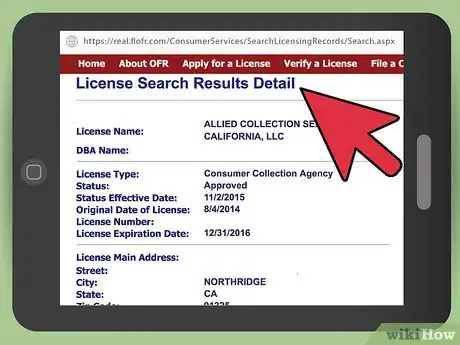

6View the license details of the mortgage broker. If you click on the mortgage broker’s license number, you will be redirected to additional details about the license. You can view information including the date the license was originally obtained, and the license's expiration or suspension date, if applicable.

- If your broker’s license is expired and he or she does not have a license as a loan originator, it is possible that the broker is not currently licensed to facilitate mortgages.

- If your broker is not listed or his or her license is expired, the broker may be exempt from licensing requirements. As discussed below, you should determine whether your broker meets the criteria to be exempt from licensure rules.

Determining Whether a Mortgage Broker or Loan Originator is Exempt From the Licensure Laws

-

1Review Florida’s exemptions from mortgage broker’s license requirements. Florida law establishes a variety of exemptions that relieve a mortgage broker or loan originator from the obligation of getting a license. In addition to the exemptions detailed below, the following are also exempt from license requirements:

- A person who is extending credit solely related to the purchase of a timeshare plan.

- A person who only performs real estate brokerage activities and not mortgage activities.

- A person who makes only nonresidential mortgage loans and sells loans only to institutional investors.

- A person who is making a mortgage with his or her own funds.[2]

-

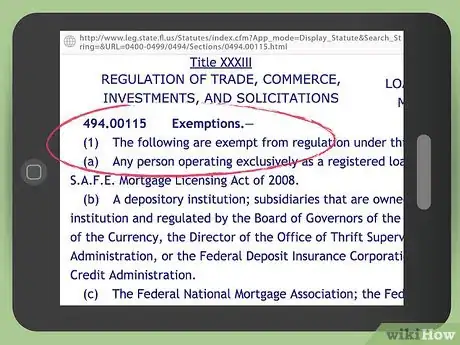

2Determine if your broker is registered under the S.A.F.E. Act. Under Florida law, any person operating exclusively as a registered loan originator in accordance with the S.A.F.E. Mortgage Licensing Act of 2008 is exempt from Florida licensing regulations. The S.A.F.E. Act was meant to provide minimum state licensure regulations for those who write mortgage loans. After completing a number of requirements, a mortgage broker or loan originator can register under the S.A.F.E. Act and would be exempt from Florida’s regulations.[3]

- You can check whether a person is registered with the S.A.F.E Act by searching the Nationwide Mortgage Licensing System and Registry.[4]

-

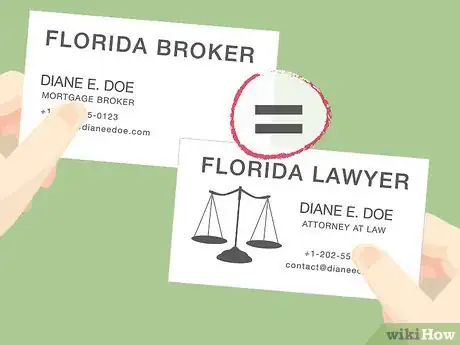

3Verify whether your broker is an attorney. If your broker is also your attorney, he or she may be exempt from mortgage license requirements. Under Florida law, an attorney who is licensed in Florida is not required to get a mortgage broker license if he or she is negotiating the terms of your mortgage as a secondary matter related to representing you.

- For example, if your attorney handles numerous financial matters for you and you also ask your attorney to assist you in securing a mortgage, your attorney is not required to have a mortgage broker’s license.[5]

-

4Determine if your mortgage broker is a governmental entity or mortgage association. Under Florida law, governmental entities, including agencies of the U.S. Federal government are not required to have mortgage broker licenses. In addition, the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, and any state, county, or municipal government or quasi-governmental agency established under the laws of any state or the United States, or any person acting as an agent of these entities are exempt from license requirements.[6]

- If you are unsure whether your mortgage is through one of the above entities, you can ask your broker for whom he or she works.

Filing a Complaint Against an Unlicensed Mortgage Broker or Loan Originator

-

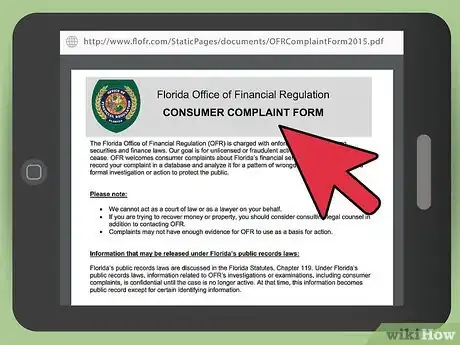

1Consider filing a complaint. If you believe that a person is fraudulently acting as a licensed mortgage broker without actually being licensed, you can file a complaint with the Florida Office of Financial Regulations. OFR handles all complaints related to Florida’s banking, securities and finance laws and are tasked with ending unlicensed activity. If you choose to file a complaint, you will be required to fill out a complaint form. OFR will record your complaint and determine whether there was any wrongdoing. If wrongdoing is found, OFR will commence a formal investigation against the mortgage broker.

- OFR does not act as your attorney and will not assist you in recovering any money or damages from your mortgage broker.

-

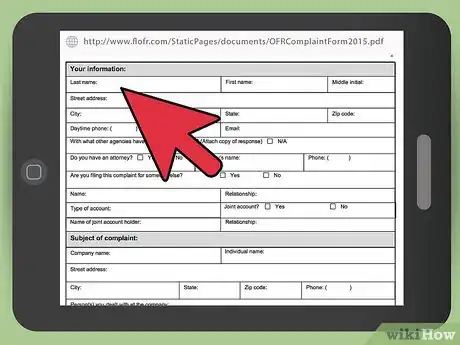

2Complete the complaint form. In order to initiate a complaint, you can either complete a Consumer Complaint Form online on the OFR website or download and complete a hardcopy complaint form. If you choose to file a complaint online, the system will prompt you to register and create a user name and password to use the online system. In the complaint form you will be required to provide the following information:

- Your identifying information including: your name; address; phone number; email address; whether you have an attorney and the attorney’s contact information, if applicable; and whether you are filing the complaint for someone else.

- Information regarding the subject of the complaint including: the company or broker’s name, address and contact information; a description of the activity on which you are basing the complaint; and whether you had previously complained to the company.

- The form also provides you with blank space to write a narrative summarizing your complaint in your own words.

- In your summary, you should describe any steps that you took to verify the broker’s license or potential exemption status.

- You must also include your signature and the date on which you signed the complaint.

- You are also entitled to attach documents that support your complaint but you are not required to do so.

-

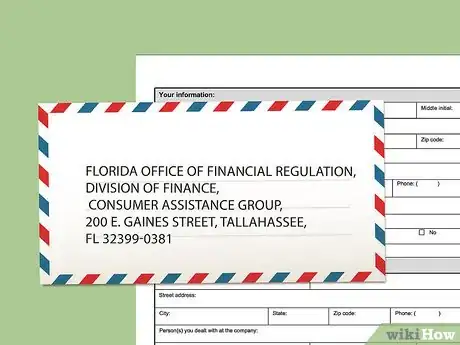

3Submit your complaint. If you are submitting your complaint through the online portal, you will be given an option to submit your complaint electronically. If you completed a hardcopy of the complaint form, you can mail it to: Florida Office of Financial Regulation, Division of Finance, Consumer Assistance Group, 200 E. Gaines Street, Tallahassee, FL 32399-0381. You can also fax your complaint to the OFR at 850-410-9300.

- If you have any questions regarding the complaint process, you can contact OFR’s Consumer Assistance Group at 850-410-9805 or 850-487-9687.

- If you filed your complaint online, you will be able to log back into the system with your username and password and see when a complaint has been assigned to an investigator and the name of the investigator.

References

- ↑ http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0400-0499/0494/Sections/0494.001.html

- ↑ http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0400-0499/0494/Sections/0494.00115.html

- ↑ http://homeguides.sfgate.com/safe-mortgage-licensing-act-7427.html

- ↑ http://files.consumerfinance.gov/f/201203_cfpb_update_SAFE_Act_Exam_Procedures.pdf; http://www.nmlsconsumeraccess.org

- ↑ http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0400-0499/0494/Sections/0494.00115.html

- ↑ http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0400-0499/0494/Sections/0494.00115.html