This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 59,635 times.

Learn more...

A passive income stream is one that, once put in place, earns income for the owner without needing much more additional effort. Passive income streams are a good way to supplement your income because they are inexpensive to create, low risk, easy to duplicate and make money any time of day. You can earn passive income on money you invest or property you rent out, but many people earn it over the Internet.

Steps

Earning Passive Income From Investments

-

1Earn rental income. One of the more common ways that people earn passive income is by buying and then renting out property. These can be homes, apartments, land, or even individual rooms within your home. To do so, you'll have to find a property to rent out, determine a fair rental price by looking at comparable properties in your area, and then act as a landlord for your renters. You can convert this income source into truly passive income by hiring a manager to act as a landlord for you. However, this may not be economically feasible until you have several rental properties.[1]

-

2Invest in a business as a silent partner. A silent partner is an inactive investor in a business. That is, they contribute capital to start the business, but don't actually make any business decisions and leave the management of the business up to the active partners. In turn, they receive a portion of the business's profits. In this way, you have the potential to earn regular, sizable payouts from simply making an initial investment.

- Before investing, make sure that you have the utmost confidence in the active partners and the business.

- Silent partners are liable for losses that the business sustains, but only up to the amount that they originally invested.[2]

Advertisement -

3Purchase the rights to royalties. Royalties are payments made for the use or sale of intellectual property, like a song, book, or trademarked product. These royalties are paid from the seller of the property to its creator. You can earn royalty payments either by creating the intellectual property yourself or by buying royalty rights from someone else. In the latter case, you can buy the rights for a lump sum and then receive regular royalty payments that will eventually return you your initial investment.[3]

- Websites like TheRoyaltyExchange and SongVest hold auctions for these rights.[4]

-

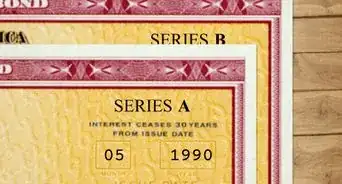

4Invest in dividend securities. Some stocks provide shareholders with regular payouts called dividends. For very large, old companies, these dividend payouts are made for consistent amounts and can amount to a substantial income if you own a large number of shares. Look for companies that are very established and have been paying dividends for a long period of time (more than 10 years). You should be able to find this information with a quick online search.[5]

Creating Passive Income Online

-

1Create a website or blog. With the foundation of a good website, you can build traffic (a flow of visitors to your site) that you can then convert into revenue sources later on. First, you have to get the traffic, so start by writing about what you know on your website or blog. If it is interesting, informative, and well written, you may gain consistent traffic to your site over time.[6]

- You can earn more by charging a small fee for people to browse your site for information. If you have a lot of expert information to offer and the ability to add new information on a regular basis, people interested in what you have to say will pay to be able to access your website.

-

2Become an affiliate marketer. Offer links on your website that lead visitors to products sold by online retailers to earn a small commission every time a visitor clicks on your link and makes a purchase. There are many online retailers that offer affiliate programs; look for those that offer the best commissions.[7]

- For more, see how to start an affiliate marketing business.

-

3Sell information in the form of e-books. E-books are electronic files that can be downloaded and read on the computer much like paper-bound books. If you're an expert at something, you can create an e-book and offer it for sale on your website. You can also have your own affiliate program, allowing others to offer your e-book on their websites, and earning a small commission for each sale.[8]

-

4Offer advertising space. If your website is popular, you can sell space to retailers who want the people who are visiting your site to see advertisements for products, movies, music--just about anything. If you publish an e-zine or send an e-newsletter to subscribers, you can also sell space in the documents.

- Consider using advertising platforms like Google Adsense or LinkShare to gain revenue from ads on your website.[9]

- Some advertisers pay "per click," meaning that you make a small commission every time a visitor clicks on an advertisement and visits the advertiser's web site.

-

5Refer visitors to businesses you trust. You can negotiate an arrangement with business owners to pay a finder's fee for new customers that you refer through your website.[10]

Adding More Passive Income Streams

-

1Focus on your primary passive income stream first. It's difficult to grow your passive income into multiple streams if you don't already have one, solid stream. Focus all of your efforts on that one project first and help it grow as productive as possible. Then, you can take the money you've made and lessons you've learned from this passive income stream and put them into others.

- In addition, once you've built a strong passive income stream, you can make even more money teaching others how you did it.[11]

-

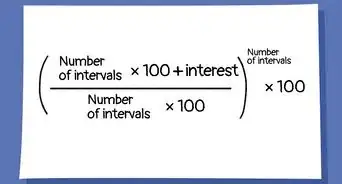

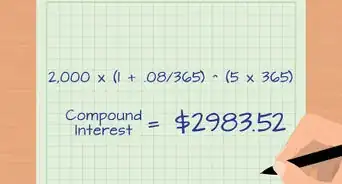

2Reinvest your passive income. Once you've started earning a good amount of passive income, you can reinvest that income to earn ever more. This income will then produce further income that you can also reinvest. This cycle produces ever-increasing income streams without any direct cost to you. For example, you could reinvest revenue from website advertising into more advertising that brings readers to your site. This increase in traffic would then further increase your ad revenue.[12]

- This is also useful for dividends. Some brokers even offer automatic dividend reinvestment that save up dividends and purchase new shares of the stock when possible.

-

3Repackage your products. If you've already created successful content on a blog or website, you can convert that information into another form and sell it. For example, you can compile what you've written into an ebook and sell it on one of the ebook markets like Amazon or Barnes and Nobles. Alternately, you can use it to create an online course to sell on a website like Udemy. Reworking your content can earn you additional income streams without requiring you to actually produce new content.[13]

-

4Hire someone else to manage existing income streams. If you've built up a couple of solid passive income streams and want to move on to others, consider hiring someone to manage them for you. Obviously, this will only work if your income from these streams exceeds the amount you would have to pay someone to manage them. However, this is the way to truly passive income, because with someone else managing it, you're literally earning money by doing nothing.

- Examples of this include having a broker manage your dividend stocks, hiring a landlord to oversee your rental properties, or hiring other bloggers to write content for your website.[14]

Expert Q&A

-

QuestionHow can I make money without being scammed?

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Certified Retirement Planning Counselor Never let anyone take custody of your assets. That's the first thing I think about. What I mean is, is it a VC investment company, and you're putting that money into a VC investment company without your account number, login, and information? These private investment funds often go around investing in things like real estate. In these cases, you're putting the money into a personal investment business, someone is then taking custody of that, and they can use it for whatever they want.

Never let anyone take custody of your assets. That's the first thing I think about. What I mean is, is it a VC investment company, and you're putting that money into a VC investment company without your account number, login, and information? These private investment funds often go around investing in things like real estate. In these cases, you're putting the money into a personal investment business, someone is then taking custody of that, and they can use it for whatever they want.

Warnings

- Be aware that before your passive income stream can start making money, you have to spend many hours creating it, including building the website itself. You must also monitor your sales to see if you must make changes, take steps to ensure that your website appears near the top of the results page of search engines, and periodically add new content to keep visitors coming back.⧼thumbs_response⧽

References

- ↑ http://lifehacker.com/5801188/four-low-risk-ways-to-generate-passive-income-and-make-your-money-work-harder-for-you

- ↑ http://www.investopedia.com/terms/s/silentpartner.asp

- ↑ http://www.huffingtonpost.com/amandah-blackwell/top-8-ways-to-create-passive-income_b_4654371.html

- ↑ http://www.thepennyhoarder.com/how-to-get-royalty-checks-every-month/

- ↑ http://www.thesimpledollar.com/building-passive-income-streams/

- ↑ http://lifehacker.com/5801188/four-low-risk-ways-to-generate-passive-income-and-make-your-money-work-harder-for-you

- ↑ http://www.bankrate.com/finance/investing/creating-passive-income-4.aspx

- ↑ http://lifehacker.com/5801188/four-low-risk-ways-to-generate-passive-income-and-make-your-money-work-harder-for-you

- ↑ http://lifehacker.com/5801188/four-low-risk-ways-to-generate-passive-income-and-make-your-money-work-harder-for-you

- ↑ http://www.howdesign.com/creative-freelancer-blog/design-entrepreneurs/8-ways-earn-passive-income-graphic-designer/

- ↑ http://briankim.net/articles/myth-building-multiple-streams-passive-income/

- ↑ http://wealthartisan.com/passive-income-realizing-the-potential/

- ↑ http://30streams.com/tims-list-of-passive-income-streams/

- ↑ http://theadventurouswriter.com/blogwriting/multiple-streams-income-writers/