This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 27,553 times.

Learn more...

There is no real rule behind purchasing an extended warranty. Whether you choose to do so will ultimately be a subjective decision based upon your own needs. However, by considering the coverages, product reliability, and cost, you can make an informed decision when it comes to purchasing an extended warranty.

Steps

Studying the Warranty

-

1Check for free coverage first. In most cases, the manufacturer's warranty will include a year or more of coverage. In addition, a retailer might add their own warranty on top of that. Check with the retailer and read your included warranty papers to understand the extent of the warranties provided to you with a purchase. With these covering two or even three years, you may realize that an extended warranty is unnecessary.[1]

- You may be covered even further by your credit card provider. Certain Visa, MasterCard, and all American Express cards offer extended warranties for purchase. Check your card agreement for details.[2]

-

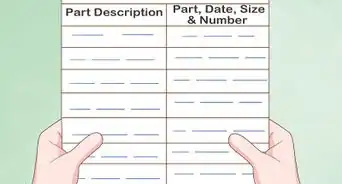

2Read the warranty's coverage rules carefully. Some warranties cover parts only or labor only. Read the fine print and weigh warranty specifics against the product. If everything is covered, then it might be worth purchasing. Only you can determine what may be necessary to cover. Whatever the terms, make sure you get the details in writing should you choose to purchase it.[3]

- For example, if you are buying a television and you plan on having it for as long as possible, you may want to purchase a warranty if it covers parts and labor, because that alone can get expensive.

- However, if the television already comes with some form of warranty and the extended warranty only covers labor, then it may not be worth the additional payment.

Advertisement -

3Watch out for coverage limitations. Some extended warranties come with stipulations about servicing or repairing the product. For example, you may have to have it repaired at a certified location or have it serviced after certain periods of time. In this case, make sure that the required service is reasonable for you, both in cost and distance. If not, the warranty may be impractical.[4]

-

4Look for extra coverage. Check on extra coverage in the extended warranty, such as transferrable coverage. This will allow you to transfer the warranty to another person in the event that you sell the product. Look for this provision if you think you might have to sell the item in question or want to upgrade in the near future.[5]

-

5Find out how claims are processed. Depending on your specific warranty, it may be difficult to actually file a claim, even if your item's damage is covered. First, you'll have to locate the provider of the insurance, which might be a third-party if you purchased your item from a larger retailer. Then, you'll likely have to locate your receipts and warranty papers before contacting the provider. After this effort, it still may take weeks or longer for your claim to be processed, if it ever is.

- Look in the warranty rules for information about providers. Then, look for reviews of the provider online. If the claims process seems convoluted or the provider is poorly-rated, the warranty may not be worth the hassle.[6]

- Read the fine print to see if there are any other costs associated with claims. For example, parts may be covered while labor and shipping are not.[7]

Evaluating Product Risk

-

1Research the product online. Read what others are saying. Find out whether the product is known to break down or if it needs servicing frequency. If so, then consider a warranty. If not, then decide if you think it is worth the risk not to get an extended warranty. Try to find specific information about the reliability of that product or the chance that such a product will be damaged over the warranty period.

- For example, research has shown that a smartphone has a one-in-three chance of being damaged over three years. Depending on your risk tolerance, this might be a high enough risk to make a warranty worth it.

- Other products, like home appliances, are much less likely to break over their warranty periods.[8]

- Try looking at product review websites, like Consumer Reports, to get information on product reliability.[9]

-

2Evaluate the product's reliability. This is a subjective decision based on the product itself and your experience with the product. For example, you may feel that the product is a name brand with a good reputation and so it doesn't need a warranty. Or maybe you are a particular type of person who would be attentive and careful when using the product, as you have been with similar products, and therefore there will be no need to cover it. Only you can make this decision.[10]

- Allow your past experience to be a determining factor. If you have made a similar purchase in the past and paid for a warranty unnecessarily, then decide if you want to do it again. Measure the risk of not getting a warranty and decide whether it will be a costly mistake.

-

3Plan ahead for future purchases. If you know you will likely upgrade the device or product in a few years anyway, there is no reason to purchase a warranty. This may not apply to furniture, vehicles, or appliances, but many electronics will be outdated in several years. Plus, electronic devices are generally more expensive to repair than to replace due to the complex nature of their construction. Make sure to consider whether or not you'd want a replacement copy of the same device in a few years, or if you'll just upgrade instead, before buying a warranty.[11]

-

4Weigh the value of peace of mind. For a very expensive item or one necessary to your work, the extended warranty may be worth purchasing just for peace of mind. However, try to leave your emotions out of your decision. Perform calculations for the potential cost of replacement or repairs and compare that to the warranty cost to make an informed decision. Otherwise, you risk throwing money away to protect yourself from something that will likely never happen.[12]

Assessing Value by Price

-

1Compare the cost of the extended warranty against the cost of the product. A well-priced warranty should cost a small percentage of the product's original cost. If the cost of the warranty is more than 15 to 20 percent of the product cost, then it may not be worth it. At this point, you can always look for extended warranties from other third parties, rather than just buying the retailer's option. These other companies may offer more affordable coverage.[13]

-

2Evaluate the cost of simply replacing the product. Sometimes it just makes more sense to replace the product. For example, an iron or a coffee machine may not deserve a warranty, whereas a fridge or oven probably would. Think about whether you could pay to replace the product if absolutely necessary. If the product is necessary to your life or work, but you couldn't easily pay to replace it, a warranty may be necessary.

- For example, the average person couldn't pay to replace their home, so they buy homeowners insurance. However, a warranty for a $200 television is not necessary for most people.

-

3Research repair costs. Read user reviews and forum posts online about the product to see what the average repair costs are like. Look for common issues and the amount paid to repair them. You can then use this information to construct an idea of what it might cost to repair a product if you need to. Compare this information to the cost of the warranty to determine whether or not the warranty is worthwhile.[14]

-

4Compare the cost of the warranty to the odds that you will need it. The most objective way to measure the value of a warranty is to compare its cost against that of potential repairs or replacement. Combine your research on the odds of product failure, repair costs, and replacement cost to figure out a monetary amount of risk. For example, imagine you have a $1,000 appliance with a 15 percent chance of total failure within three years. This would represent $150 in potential replacement costs.

- If the warranty is less than this cost, it is a good deal. If it is more, you should consider just taking the risk and paying for repairs if needed.[15]

References

- ↑ https://www.moneyadviceservice.org.uk/en/articles/extended-warranties-are-they-worth-it

- ↑ http://lifehacker.com/5871487/are-extended-warranties-worth-it

- ↑ https://www.moneyadviceservice.org.uk/en/articles/extended-warranties-are-they-worth-it

- ↑ http://www.moneycrashers.com/extended-warranty-worth-cost/

- ↑ http://www.moneycrashers.com/extended-warranty-worth-cost/

- ↑ http://www.xconomy.com/national/2013/05/03/do-you-need-an-extended-warranty-do-the-math-says-squaretrade/#

- ↑ http://www.moneycrashers.com/extended-warranty-worth-cost/

- ↑ http://www.xconomy.com/national/2013/05/03/do-you-need-an-extended-warranty-do-the-math-says-squaretrade/2/

- ↑ http://www.nytimes.com/2014/08/29/upshot/should-i-buy-a-warranty.html

- ↑ http://lifehacker.com/5871487/are-extended-warranties-worth-it

- ↑ https://www.moneyadviceservice.org.uk/en/articles/extended-warranties-are-they-worth-it

- ↑ http://www.bankrate.com/finance/personal-finance/are-warranties-worth-the-peace-of-mind-1.aspx

- ↑ http://lifehacker.com/5871487/are-extended-warranties-worth-it

- ↑ http://www.investopedia.com/articles/pf/07/warranties.asp

- ↑ http://www.nytimes.com/2014/08/29/upshot/should-i-buy-a-warranty.html