This article was co-authored by Jonathan DeYoe, CPWA®, AIF® and by wikiHow staff writer, Hannah Madden. Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 7,597 times.

When you hit retirement age, you have all the time in the world to do the things you want to do. If you didn’t quite save as much as you planned, that’s okay! Living a full life doesn’t require a ton of money, especially if you spend yours wisely. In this article, we’ve detailed some of the ways you can cut costs while still having fun during retirement.

Steps

Search for low-cost entertainment options.

-

Check out your local senior center or host your own book club. Gather your friends for a potluck dinner, or join a community center to play sports. There are probably tons of things in your neighborhood that you can do for super cheap (or for free!) that you can take advantage of.[1] X Research source

- You could also host a game night, try bird watching, adopt an animal, take a cheap class at your local community college, or join a community theater group.

- Take a look at bulletins and local newspapers in your area to get more ideas.

Take advantage of senior discounts.

-

Theaters, restaurants, and retail stores sometimes offer senior discounts. If you’re heading out, bring your ID with you so you can prove your age and take advantage of any discounts that come your way. You might just be surprised at all the money you can save once you reach a certain age![2] X Research source

- Different stores have different ages for discount requirements, but many of them start at 55 to 60.

Pick up a cheap (or free) hobby.

-

There are fun ways you can spend your time without breaking the bank. If you’re looking for something to fill your time, try painting, collaging, needle point, writing or reading, dancing, or even volunteering. You don’t need a ton of tools for any of these hobbies, and they’re a fun way to fill up your free time.[3] X Research source

- You could also spend your time learning a new language or furthering your math skills for free on sites like Khan Academy.

Move to a cheaper area.

-

Lower monthly rent means extra money to do fun stuff! If you live in a large city, you might be paying a very expensive mortgage or rent payment each month. If you’d like to tighten up your budget, consider moving to a cheaper area in a new part of the country. Moving can be expensive up-front, but if you go somewhere cheaper, the savings will be worth it in the long-run.[4] X Research source

- You might also want to move to a smaller house or condo. If it’s just you (or you and your spouse), you probably don’t need a huge house to live in.

Get a roommate or two.

-

This can lower your monthly expenses quite a bit. If you’re struggling to pay rent or you can’t make your mortgage, consider putting an ad out for a roommate. Their rent can go toward your bills, and it’s a nice way to have some company while you’re home all day.[5] X Research source

- Becoming a landlord can be a lot of work, and it does involve some paperwork. Take a look at your local property laws to see what having a roommate might entail.

Travel during the off season.

-

Peak season is more expensive so wait until there are fewer tourists. Usually, off season will be during the winter time when most other people are staying home. If there’s a destination you have in mind, your airfare and hotel stays will be much cheaper without a ton of tourists flooding the market.[6] X Research source

- If you really want to tighten down your budget, skip the airfare and only travel to places you can drive to. Road trips are usually cheaper than flying, and they can be a fun way to experience the country you live in.

Take advantage of airline miles.

-

If you have a credit card, use it to your advantage. Make sure you’re getting airline miles every time you make a purchase, then let them rack up until you have enough for a fun vacation. Once you buy your tickets, the only thing you have to budget for is food and hotel stays, which you can greatly reduce if you look for deals.[7] X Research source

- If your current credit card doesn’t give you airline miles, consider applying for a new one with better perks.

Learn to cook at home.

-

Eating out can get pretty expensive. Instead of going out to restaurants and diners all the time, pick up some groceries and practice your cooking skills. Not only will it save you some money, it’s also a great skill to learn, and it can be a fun way to bond with your spouse or your loved ones.[8] X Research source

- There are tons of recipes you can access online for free. You can also search for cooking videos on YouTube if you’d rather have an in-depth tutorial.

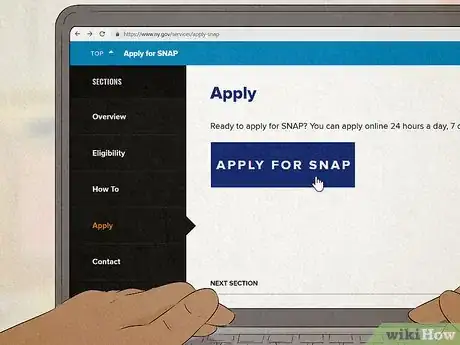

Reduce food costs with SNAP benefits.

-

You can apply for benefits to help you buy groceries and reduce your bills. The Supplemental Nutrition Assistance Program, or SNAP, provides assistance to those in need. You can apply via your local government agency to help you out with food costs and reduce your expenses.[9] X Research source

- If you qualify for SNAP, you will get an Electronic Benefits Transfer (EBT) card to use on select items at the grocery store.

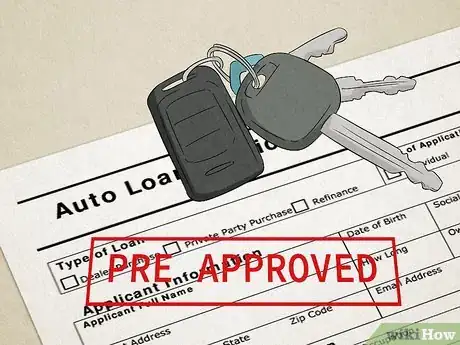

Get a pre-approved car loan.

-

If you plan on buying a new car, this can save you money. Instead of waiting for a loan from the dealership, get pre-approved for one from your bank before you even walk in the door. The interest rate from a bank is usually cheaper, and you’ll be in a better spot to negotiate, too.[10] X Research source

- It’s always better to test drive a car and then leave. Negotiating over the phone is much easier than negotiating in person, and you won’t feel as pressured to make a decision right then and there.

Consider getting a part-time job.

-

It might not sound fun, but it can give you some extra cash. If you’re struggling to fill your days and you wouldn’t mind heading back to work for a little while, a part-time job can be the best of both worlds.[11] X Expert Source

Author, Speaker, & CEO of Mindful Money Expert Interview. 15 October 2020. Look into an easy, part-time job for a little extra money on the side as you enjoy your retirement.[12] X Research source- A lot of people find that they struggle with the switch from a full-time job to retirement. A part-time job is a nice way to bridge the gap—and you don’t have to do it forever!

You Might Also Like

The Top 16 Strategies to Prepare for Retirement in Your 20s

The Top 16 Strategies to Prepare for Retirement in Your 20s

14 Ways to Get in a Routine and Enjoy Life After Retirement

14 Ways to Get in a Routine and Enjoy Life After Retirement

References

- ↑ https://www.greatseniorliving.com/articles/fun-activities-for-seniors

- ↑ https://money.usnews.com/money/retirement/aging/articles/when-do-you-become-a-senior-citizen

- ↑ https://money.usnews.com/money/blogs/my-money/2014/12/11/9-cheap-hobbies-for-restless-winter-months

- ↑ https://www.cnbc.com/2021/01/06/best-budget-friendly-places-to-retire-in-2021-report.html

- ↑ https://www.forbes.com/sites/davidrae/2019/09/17/money-last-in-retirement/?sh=25d11b85645b

- ↑ https://money.usnews.com/money/personal-finance/spending/articles/2017-02-02/15-ways-to-travel-in-retirement-on-a-fixed-budget

- ↑ https://www.forbes.com/sites/davidrae/2019/09/17/money-last-in-retirement/?sh=25d11b85645b

- ↑ https://money.usnews.com/money/personal-finance/spending/articles/2017-02-02/15-ways-to-travel-in-retirement-on-a-fixed-budget

- ↑ https://www.debt.org/advice/financial-assistance-for-senior-citizens/

- ↑ https://www.aarp.org/money/budgeting-saving/info-2021/99-great-ways-to-save/?cmp=RDRCT-67343401-20210629

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ https://www.debt.org/advice/financial-assistance-for-senior-citizens/

About This Article