X

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 74,374 times.

Taxpayers sometimes find they need the assistance of an affordable tax attorney to help them answer questions or concerns from the Internal Revenue Service (IRS).[1] You should confirm the attorney’s credentials and discuss a reasonable rate before you hire the attorney.

Steps

Part 1

Part 1 of 3:

Finding an IRS Tax Attorney

-

1Understand why you need an IRS tax attorney. Some people think they can tackle tax issues on their own, and avoid paying for an attorney. But dealing with tax issues on your own can open you up to missing documentation or bad filing, which could then lead to a big fine by the IRS and possible jail time.

- You should hire a tax attorney if you have an estate that is taxable, are making complex estate planning strategies, or if you are required to file an estate tax return. You should also hire a tax attorney if you are starting your own business and need legal counsel around the tax structure of your company. If you are engaged in international business, a tax attorney can help you with contracts, tax filing and other legal issues. You should also hire a tax attorney if you are under criminal investigation by the IRS, you are planning to bring a suit against the IRS, or you plan to seek an independent review of your case before the US Tax Court or the tax court in your country.

- A good tax attorney can help you file an appeal of a tax court decisions, communicate effectively with IRS officials, and help your business save money by taking advantage of tax credits.

-

2Get a referral from your banker or your accountant. These professionals will likely have contacts in the industry that they have worked with before and trust. A tax attorney with a good reputation is often a good sign.[2]

- You should also do an internet search of a referred attorney. Check if they have a website, or any online reviews of their services.

Advertisement -

3Check professional tax organizations. Look up the attorney in the Tax Law Association database or the public list of the National Association of Tax Professionals to see if he is registered.

- You can also contact your state bar association to see if there are any complaints or disciplinary action on file for the attorney.

Advertisement

Part 2

Part 2 of 3:

Confirming the Attorney’s Qualifications

-

1Check that the tax attorney has his Juris Doctor (J.D.) and a license to practice in your state or area. You can confirm both of these credentials via your state bar association. If the attorney has a website or a listing at a firm, he will likely include these credentials.[3]

- Many tax attorneys also have a Master of Laws in taxation. This is a plus as it shows the attorney has a specialization in tax law.

- Some lawyers are also certified public accountants, which may come in useful for certain types of tax issues.

-

2Note if the attorney specializes in IRS issues. An attorney who has had previous experience with the IRS will have a better understanding of how the IRS processes tax issues and can better represent your case. The attorney may list this experience in his online resume or profile. You can also call the attorney’s office and ask some preliminary questions to confirm his credentials.[4]

- As well, a tax attorney who has worked for the IRS previously may have better insight into IRS management and processing.

-

3Set up an initial consultation with the attorney. Contact the attorney’s office to set up a consultation. Keep in mind some attorneys charge a fee for consultations, so check how much the consultation will cost before you book it.[5]

Advertisement

Part 3

Part 3 of 3:

Getting an Affordable Rate

-

1Be aware of the going rate for tax attorneys. Prepare for your consultation with the attorney by researching the going rates for tax attorneys. There are two ways an attorney will bill you:

- Pay per service: In this type of fee arrangement, you pay your attorney for each service he completes on your behalf. If you need the tax attorney to help you file a complaint against the IRS, for example, he will charge you a set amount to file the complaint. The benefit of this arrangement is you get exactly what you pay for and only on an item by item basis, and there are no hidden fees. But you will need to vigilant to prevent being “provided” unwanted or unnecessary services, and charged the applicable fees. This arrangement can end up being time consuming, as you will need to keep track of every legal expense, and may put strain on your relationship with the attorney.

- Pay per hour: This fee arrangement is used by most tax attorneys. You are charged on an hourly basis for the attorney’s services. The going rate is between $200-$500 an hour. If you hire a lawyer who runs his own practice, you may get lower rates of between $100 to $200 an hour.

-

2Discuss rate options with the attorney. During the consultation, explain your tax situation and what you require from the attorney. Every tax case is different, so you are looking for an attorney who is willing to customize and personalize his services for your case. A good attorney should treat your case as unique and specific. He may also inform you of any previous experience he has with your specific tax issue.[6]

- Always check that the attorney is being transparent and honest with you during the consultation. Don’t be afraid to talk dollars and cents with the attorney, especially the fee arrangement for the attorney’s services. If you are looking for an affordable rate, try to negotiate or discuss a lower rate with the attorney.

- The attorney should also let you know about your tax settlement options and his suggestions for moving forward with your case. This will show he is engaged in your tax case and can provide guidance on your case.

-

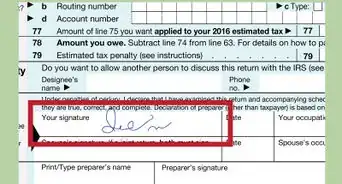

3Sign an agreement for the rates before continuing with your tax case. Prevent any hidden costs or additional representation fees by signing a representation agreement with the attorney before going any further with your tax case. This will show that the attorney is transparent and is willing to be honest about his fees.[7]

-

4Look into free options. To avoid attorney fees entirely, research free services in your area. Most cities offer taxpayer clinics to provide services free of charge.

- Check local law schools, many of which have free tax clinics. For example, Chapman Law School[8] and University of San Diego law school[9] provide free legal services.

- Legal Aid also has taxpayer clinics.

- If you have an interesting legal issue, you may find private law firms that will represent you. Look for local firms that offer pro bono clinics.

Advertisement

References

- ↑ http://www.myirstaxrelief.com/4-tips-for-hiring-a-good-tax-attorney-cpa-enrolled-agent-in-chic.html

- ↑ http://www.bankrate.com/finance/taxes/3-tips-on-finding-tax-attorney.aspx

- ↑ http://www.bankrate.com/finance/taxes/3-tips-on-finding-tax-attorney.aspx

- ↑ http://www.myirstaxrelief.com/4-tips-for-hiring-a-good-tax-attorney-cpa-enrolled-agent-in-chic.html

- ↑ http://www.myirstaxrelief.com/4-tips-for-hiring-a-good-tax-attorney-cpa-enrolled-agent-in-chic.html

- ↑ http://www.myirstaxrelief.com/4-tips-for-hiring-a-good-tax-attorney-cpa-enrolled-agent-in-chic.html

- ↑ http://www.myirstaxrelief.com/4-tips-for-hiring-a-good-tax-attorney-cpa-enrolled-agent-in-chic.html

- ↑ http://www.chapman.edu/law/legal-clinics/tax-law.aspx

- ↑ http://www.sandiego.edu/law/free-legal-assistance/

About This Article

Advertisement