This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 62,418 times.

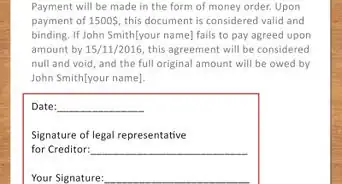

If you have a limited assets or a poor credit history, it can be difficult to get a credit card, a mortgage, or even rent an apartment. Finding someone to act as your guarantor can help. A guarantor is someone willing to pledge their own assets to assume your debt if you do not pay it as promised in the contract. [1] Because of the seriousness of the consequences, finding the right guarantor and having a clear agreement with them is very important.

Steps

Preparing for the Contract

-

1Decide what type of contract you are seeking. The three most common contracts that may need a guarantor are mortgages, residential rentals, and credit cards. Each type of guarantor agreement may have different requirements.

- On a mortgage, the guarantor is part of the mortgage process. Your guarantor will have to disclose his assets, income, and debts, as well as undergo a credit check. The mortgage company wants a guarantor that can pay for his own rent or mortgage and be able to assume yours if you default.

- More and more landlords are asking for guarantors on residential rentals. This is especially true in high cost of living areas like New York City. A landlord is going to want a guarantor who lives close and has a sufficient income to cover the rent payments if you default.[2] [3]

- On a credit card application, the card issuer is going to look at the guarantor's income and credit rating. In short, the credit card will be in your name, but it will be granted on the strength of your guarantor's credentials. Parents often act as guarantors on credit cards issued to applicants that are under 21. [4]

-

2Research your options. There are three ways to have someone act as security for your contract. Besides having a guarantor, you can also have someone act as a co-signer or joint applicant. The lender or landlord will usually have the last say, but it is worth it to you to ask if you have other options than a guarantor.

- A co-signer also agrees to pay the loan if you default. On a mortgage, a co-signer will be listed as a joint owner of the property until the mortgage is paid off. On a credit card or money loan, the co-signer is liable for the debt, but can't make charges.

- The main difference between a guarantor and a co-signer is that the lender must exhaust every possibility of collecting against you before they can sue a guarantor. A co-signer has less protection against liability and can be sued immediately.

- With a joint applicant, you can often pool your assets with another person, usually a spouse, partner, family member, or roommate to meet the requirements for the contract. A joint applicant is someone who will have the same rights as you as far as the property, rental, or charge account. In this type of agreement, the liability is usually equal. Both parties are responsible for the entire debt.

Advertisement -

3Prepare a contingency plan. When someone agrees to be your guarantor, he is trusting you to fulfill the contract. If you default, the consequences to your guarantor can be devastating. Before you ask someone to underwrite your contract, you need to have a contingency plan in case you run into trouble.

- Keep your guarantor up to date on your financial condition. If you are beginning to struggle, it is critical that you be honest. You may need to move or ask for help with mortgage or credit card payments until you can get back on your feet.

- Be prepared to release your guarantor as soon as possible. When a new job starts paying off or old debts are paid, you will usually see your credit score and cash flow increase. On a credit card, it can often be as simple as a joint phone call. [5] On a mortgage or contract, it may require refinancing the agreement or rewriting the lease.

-

4Understand your legal responsibilities. Your guarantor has legal rights against you. He is entitled to copies of all documents regarding the transaction and to check if you are paying your bills as promised. This is only fair. If you default, the lender will be very aggressive in their actions against your guarantor. If this happens, your guarantor has the right to sue you to recover his losses if you default on the agreement.[6]

Finding a Guarantor

-

1Determine your guarantor requirements. If you need someone to guarantee your apartment in Chicago, the landlord may not accept your parents in Florida. On a mortgage, your guarantor may need to be able to attend signings and other meetings. You will also need to consider what kind of assets and credit ratings your guarantor will need to possess. Ask the lender or landlord if they have a guarantor checklist.

-

2Make a list of qualified potential guarantors. Based on the requirements of the loan or lease, make a list of people who would qualify. Common personal guarantors are parents, grandparents, in-laws, and siblings. Be realistic. If your family or close relationships do not have sufficient assets or credit rating, you may have to reconsider your plans.

-

3Arrange an in-person meeting with your potential guarantor. You will need to have as much information as possible, including the contract, the payment terms, the lender's guarantor requirements, your contingency plan, and a clear concise reason why you need his help.

- Anticipate his questions. What would you want to know if a family member was asking you to be his guarantor? Regardless of your personal relationship, this is a business deal. Be prepared for him to answer "no," especially if you have a poor credit and financial history. In the long run, the personal relationship is more valuable than an apartment or credit card.

-

4Research resources with your employer. This is most applicable for residential rentals and mortgages. If you are moving to a new area, especially a high cost of living area, as a condition of your job, your employer may offer guarantor services. This is a legitimate question to ask during job interviews and transfers.

-

5Consider a commercial guarantor. As rental markets tighten, particularly in urban areas, some insurance companies have started offering guarantor services. For a one-time fee (usually around one month's rent,) the company will sign on as your guarantor for a residential lease.[7]

- Commercial lease guarantors are an excellent resource for non-citizens coming to the United States for work or school. You may have considerable assets in your home country, but since suing you and your guarantor would be difficult, the landlord or mortgage company will want a domestic guarantor.

- If you are considering a commercial guarantor, ask for references in the form of landlords they have worked with. Contact the landlords and ask about their experiences with the guarantor. You can also check the Better Business Bureau for complaints.

- Check the default provisions carefully and what penalties you might face if your commercial guarantor has to pay off on your lease.

References

- ↑ http://www.investopedia.com/terms/g/guarantor.asp

- ↑ http://www.rent.com/blog/get-that-apartment-with-a-guarantor/

- ↑ http://www.learnvest.com/2010/08/prove-your-financial-responsibility-what-is-a-guarantor-and-how-do-you-get-one/

- ↑ https://www.bankofamerica.com/credit-cards/education/credit-card-guarantor.go

- ↑ https://www.bankofamerica.com/credit-cards/education/credit-card-guarantor.go

- ↑ http://www.lawyerment.com/library/kb/Banking_and_Finance/Credit_and_Loans/1199.htm

- ↑ http://www.insurent.com/prospectiverenters_faq.shtml#q4