This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 58,935 times.

Occasionally, a charge will show up on your credit card that you did not charge or authorize. Maybe a store accidentally ran your card twice, or maybe someone stole your credit card number. Either way, sometimes you must dispute a charge on your card in writing, and you may need to write both the business that charged and your credit card company to dispute it.

Steps

Writing a Letter to the Business

-

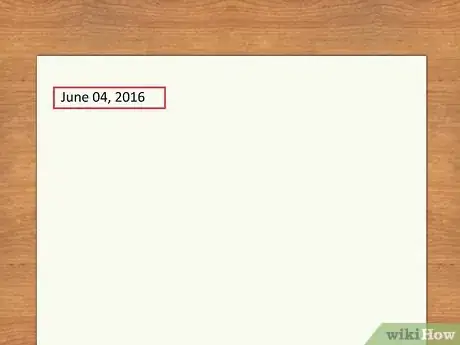

1Begin with the date at the top. Like any business letter, you include the date at the top in the left-hand corner. The form really doesn't matter, but if you want to be more formal, include the full name of the month, the date, and then the year.[1]

-

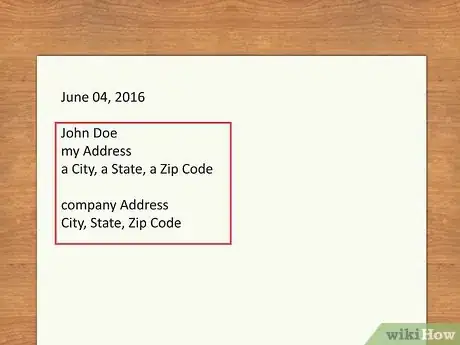

2Add the addresses. Next, add a line break and your name and address. Underneath that, add the address of the company. If it's a large company, send it to their billing center, which you can find on the company's website. If it's a small company, you can send it to the owner or the business manager.[2]Advertisement

-

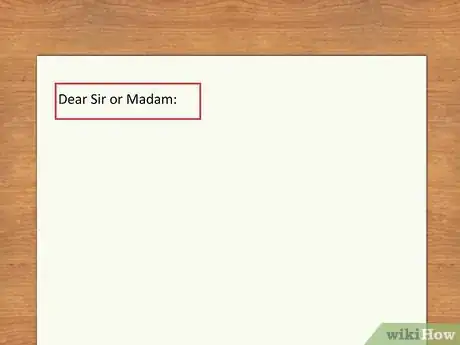

3Address the letter. If you are sending it to a small business, address the manager or owner by name if possible, with "Dear Mrs. Isabel Withers:" Use a colon at the end of the salutation. If you don't have a name, "Dear Sir or Madam:" is fine.[3]

-

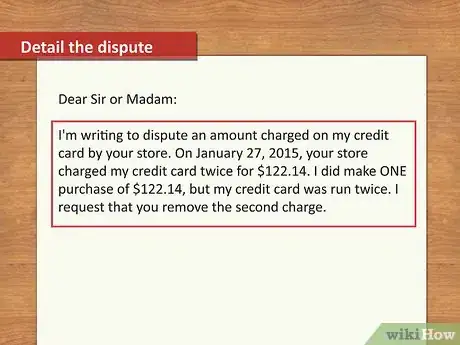

4Detail the dispute. Tell the company exactly why you are writing the letter, including the date and the amount of the dispute. Also explain why you think it is wrong.[4]

- For instance, you could say, "I'm writing to dispute an amount charged on my credit card by your store. On January 27, 2015, your store charged my credit card twice for $122.14. I did make ONE purchase of $122.14, but my credit card was run twice. I request that you remove the second charge."

-

5Include what you've already done. For instance, if you talked to someone over the phone, include that information with the name of the person and the date, if possible. If you've talked to your credit card company already, include that in the letter as well.[5]

-

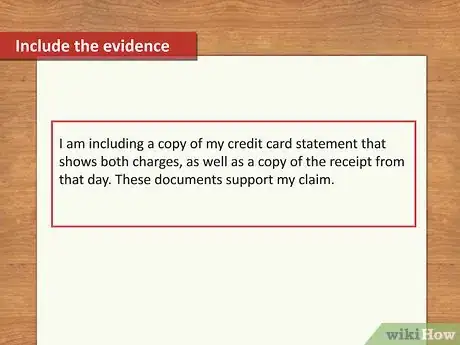

6Note what evidence you are including. To support your cause, you should include evidence. For instance, you could include a copy of your credit card statement (with secure information marked out), as well as a copy of the receipt for the day in question if you have it.[6] Of course, when you say you are including something, make sure you are including it.

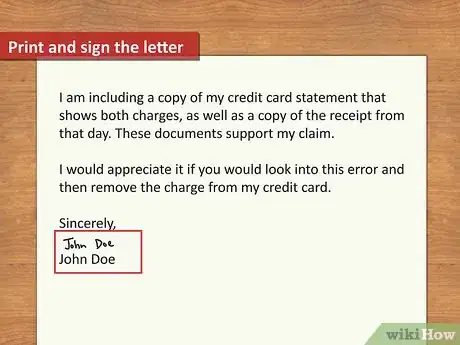

- For instance, in the second paragraph, you could say "I am including a copy of my credit card statement that shows both charges, as well as a copy of the receipt from that day. These documents support my claim."

-

7End by saying exactly what you want the business to do. Do not leave the business confused about what you want. Make sure you are absolutely clear.[7]

- As an example, you could end by saying, "I would appreciate it if you would look into this error and then remove the charge from my credit card."

-

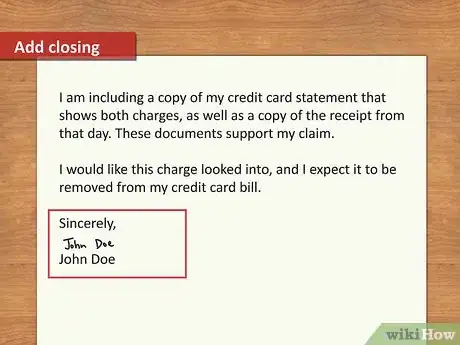

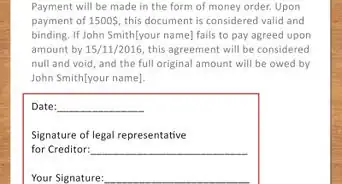

8Close the letter. Under the letter, place the word "Sincerely," with a comma after it. Under that, leave a space (for you to sign your name) and then type your name below it.[8]

-

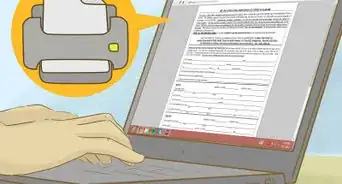

9Print and sign the letter. Print out the letter from your computer. Sign it between "Sincerely," and your printed name.

-

10Keep a copy of the letter. Always keep a copy for yourself, so you have a record. You can keep a copy on your computer, but it's better to keep a copy of the one you sign and send.[9]

-

11Send it by certified mail. Certified mail is best because it guarantees that the company receives it. That way, you have evidence that someone there signed for it.[10]

Writing a Letter to Your Credit Card Company

-

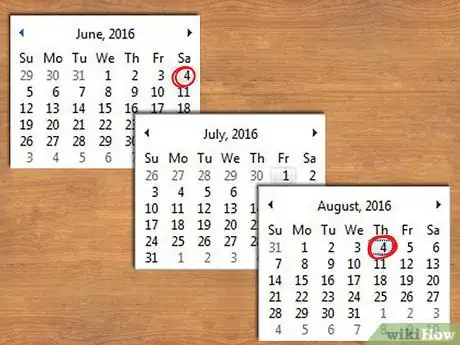

1Write the letter within 2 months. The law backs you up when you are making a dispute, but it does state that you must do it within 2 months of getting your bill. Therefore, make sure you write and send the letter in a timely manner.[11]

-

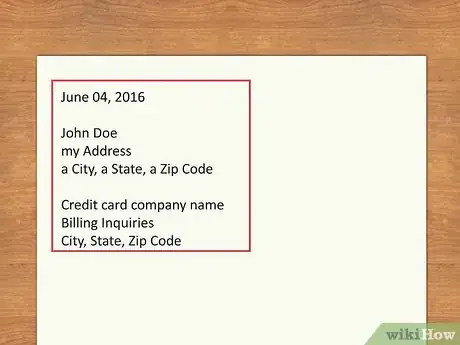

2Begin with the date and addresses at the top. Have the date in the top left-hand corner. Put your name and address underneath the date with a line break between them. You should include your account number with your address. Add another line break, and then put the credit card company's address. You should send it to your credit card company's billing inquiries' address, including "Billing Inquiries" under the name of the company.[12] You can find the address on the company's website.

-

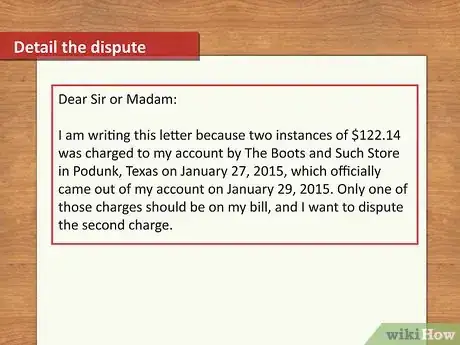

3Include a salutation. You will have a harder time finding someone to address this letter to than your business letter. Therefore, just address it "Dear Sir or Madam:" with a colon after it.[13]

-

4Detail the dispute. Start by saying exactly why you are writing. State the amount of the dispute, the date it was charged, the date it came out (stopped pending), and the company that charged it.[14]

- For instance, you could write, "I am writing this letter because two instances of $122.14 was charged to my account by The Boots and Such Store in Podunk, Texas on January 27, 2015, which officially came out of my account on January 29, 2015. Only one of those charges should be on my bill, and I want to dispute the second charge."

-

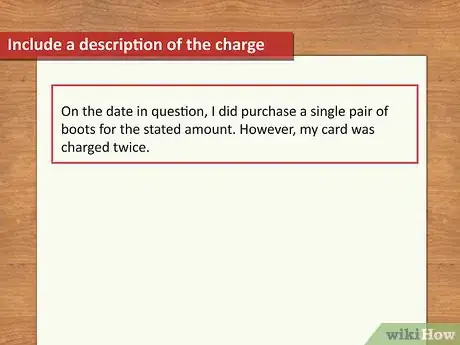

5Include a description of the charge. If you can, provide a detailed description of what was bought. You may not be able to do this step if the charge was completely fraudulent (someone stole your card), but provide as much information as you can.[15]

- As an example, you could write, "On the date in question, I did purchase a single pair of boots for the stated amount. However, my card was charged twice."

-

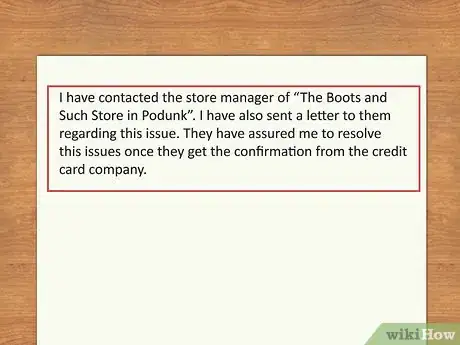

6Discuss what you've already done. Note that you've sent a letter to the business. Also talk about in detail what conversations you've had, both with the business in question and the credit card company.[16]

-

7Add evidence. You should include the same information you did in the first letter, such as a copy of your credit card billing statement and a copy of your receipt. You should also include a copy of the letter you sent to the business. Don't forget to state what you're including in the letter you're writing.[17]

-

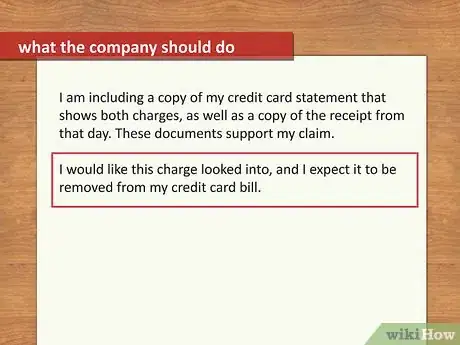

8End with exactly what the company should do. Once again, you need to address what the company should do with the information you are providing. You don't want to leave them confused about what you want.[18]

- As an example, you could say, "I would like this charge looked into, and I expect it to be removed from my credit card bill."

-

9Add a closing. At the bottom, write the word "Sincerely," with a comma. Place a line break (for your signature). Add your name in print.[19] Print the letter out and sign it.

-

10Make a copy of the letter. You want to have evidence of when you sent this letter, as well as what exactly went into it. Keep a copy for your records.[20]

-

11Send it certified mail. It's important to send it this way because it guarantees someone must sign for it on the other hand. That way, they can't say they didn't get your letter.[21]

Warnings

- Make sure you keep paying your bill while you're making the dispute. Your credit card company can report you to the credit score companies if you are late on your charges, even if you are disputing a claim.[22]⧼thumbs_response⧽

References

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp#ixzz3is26Kemz

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp#ixzz3is26Kemz

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp#ixzz3is26Kemz

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp

- ↑ http://www.investopedia.com/articles/pf/07/credit-card-dispute.asp#ixzz3is26Kemz

About This Article

If an unauthorized or duplicate charge has appeared on your credit card bill, you can write a dispute letter to get it investigated. Whether you’re writing to a business or your credit card company, you should provide all the details you have about the charge, such as the date and cost of the transaction and what it was for. Then, tell them what action you’d like them to take, like refunding the purchase. Don’t forget to include evidence of the charge, like a screenshot of your statement or the receipt. If you’re disputing a charge with your credit card company, by law you’ll need to contact them within 2 months of the charge. For more tips from our Financial co-author, including how to address your letter, read on!