This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 14 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 157,745 times.

Cash gifting is when someone gives you a sum of money as a gift rather than in exchange for goods or services. For example, your parents may give you money for a holiday or graduation present. However, it can also be an illegal pyramid scheme that can cost you money and potentially land you in jail. Anytime you are giving or receiving cash as a gift, make sure you are doing it legally. In order to make sure your cash gifting is legal, it’s important to know how to give cash gifts, receive cash gifts, and avoid cash gifting schemes. Making sure your cash gifting is legal is important so you can protect your money when giving it to others or receiving it from others.

Steps

Giving Cash Gifts

-

1Give a cash gift to friends or family. Cash gifting is when you give someone any amount of money without an exchange of goods or services. You can give cash gifts without paying taxes under a certain limit.[1]

- Any cash gifts under $14,000 per person in a calendar year are not taxed. Cash gifts under this amount are not required to be filed as a gift underneath that limit.

- Cash gifts over the $14,000 limit are applicable to be taxed. This is per person, so if you give $28,000 to your son and his spouse then it will not be taxed. It is usually the responsibility of the donor to pay taxes over this amount.

-

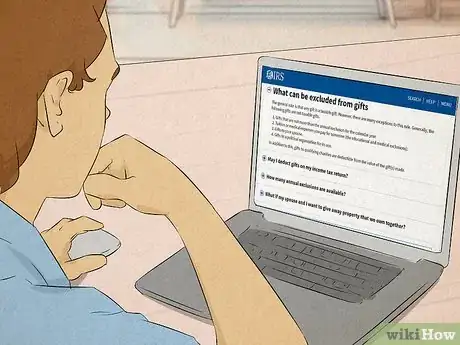

2Pay attention to exclusions to taxable gifts. There are some exclusions to taxable gifts. Even if you are over the $14,000 limit, you may not have to pay taxes on these types of gifts.[2]

- Tuition or medical expenses are excluded from taxable gifts. If you are paying tuition for your son or daughter, you won’t have to pay taxes on those gifts even if they are over the limit.

- Gifts to your spouse are excluded from taxes for the most part. Since you are considered a unit by the IRS, you do not have to pay taxes on gifts to your spouse.

- Any amount given to charities or political organizations are also not taxed as gifts. These usually fall under a separate classification for tax purposes.

Advertisement -

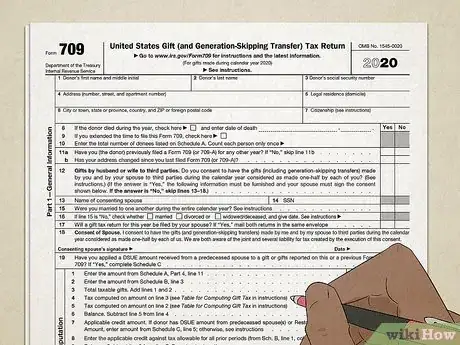

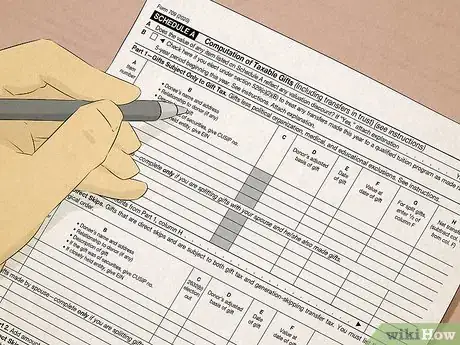

3File a Form 709 if circumstances apply. If the gift is over the $14,000 exclusion amount, you have to file a Form 709, which reports the gift as not meeting exclusions. For the most part, you will have to pay some taxes on your gift.[3]

- Gifts that exceed the minimal exclusion ($14,000) to multiple people require you to file a Form 709. This does not apply to gifts to your spouse though.[4]

- Gifts that are not for immediate use, but rely on future interest, may require a Form 709. Cash gifts require that the gift can be used immediately in order to count as an exclusion.

- Any interest in property that you gave your spouse that’s not for immediately use requires a Form 709. This is especially true if that interest is given for only a limited time.

-

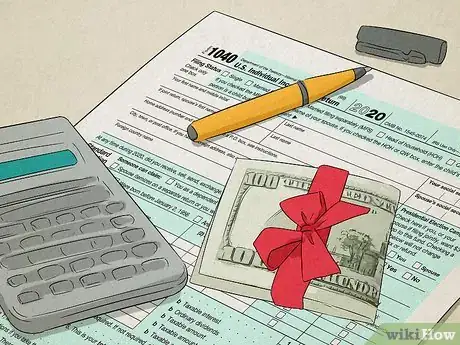

4Realize that gifts are not tax-deductible. Gifts are not usually tax deductible unless they are sent to charities rather than individuals. Unless your son or daughter is literally a charity, legally speaking, you cannot deduct gifts given to them.[5]

- If you are giving to charities, especially when paying from a business account, this is usually deductible under your taxes. The charity must be legally recognized by the IRS.

- When donating to friends or family, they must be a legally recognized charity for you to be able to deduct the gift on your taxes. Otherwise, you must follow regular cash gifting procedures.

Receiving Cash Gifts

-

1Receive a cash gift from family or friends. If you receive a cash gift, your requirements are only to file for taxes it if it is above the $14,000 per person limit. You will still have to report it so it falls under the “annual exclusion” for gifts.[6]

- When you receive cash gifts, you have to file it under an “annual exclusion”. This “annual exclusion” states that the amount of money you received can be used immediately.

- Even if you will not be using the full amount of the cash gift immediately, it can be filed as an immediate use. The IRS just wants to verify that your cash gift is not an investment or payment for goods or services, which are both taxable.

-

2Be prepared to pay taxes if the donor does not. For the most part, donors are required to pay taxes if they do not meet the "annual exclusion" requirements. However, you can arrange to pay the taxes instead.[7]

- In many cases, the donors will pay the taxes of the gift. If they pay you more than $14,000 per person, then taxes will be due.

- You can arrange to pay the taxes instead of them if you desire. If your parents are giving you money for a house down payment, you may want to pay the taxes on it rather than having them pay taxes on their gift to you. Be sure to talk to tax accountants first before making such arrangements.

-

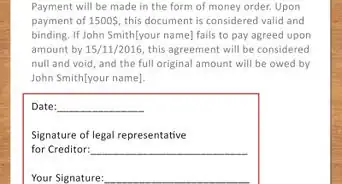

3Be aware that cash gifts are irrevocable. If you receive a cash gift from a relative, there can be no stipulations on that gift. Once it is gifted, it belongs to you permanently.[8]

- In the case of cash gifts for house down payments, your family can set this up as a loan if they wish to have legal recourse in the future. You can usually get banks to set up loan paperwork between individuals for a fee.

- Family members that want their money back or some form of payment after a cash gift have no legal recourse. In order to be considered a gift, the amount can have no requirements on its use.

Avoiding Cash Gifting Schemes

-

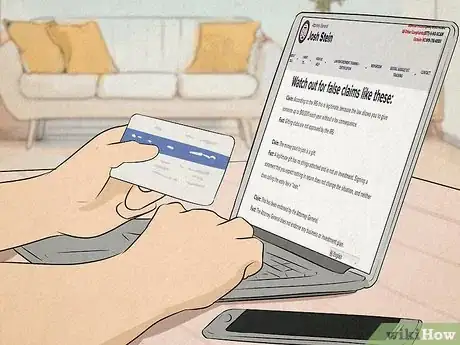

1Recognize cash gifting clubs. You may occasionally be contacted by people or websites promising a windfall of money. These are “cash gifting” schemes that are illegal and can cost you money or even jail time.[9]

- Cash gifting clubs work by new participants paying money out to join the scheme. These initial fees go to those who have been in the cash gifting scheme the longest.[10]

- Though money is promised, those joining cash gifting clubs almost never receive any money. After paying money to those at the top, they only lose all of their money.

-

2Think about what a "gift" truly means. If you were truly getting a gift, then it would not be necessary for you to make an investment or give the person or club something in exchange for the gift — true gifts are given with no expectation of something in return. As with cash gifting between friends and relatives, cash gifting cannot be transactional. If cash gifting schemes argue that you will receive payment, this is illegal per IRS guidelines for cash gifting.[11]

- Even if ads say that members of the club consider their investments a gift, expecting nothing in return, don't fall for it. This is an attempt to cover up the club's illegal activity.

- Any cash gifting schemes cannot require members to do anything based on their cash "gifts". This means that those who you give money to are not required to give anything back in return.

-

3Don't believe success stories. Very few members of cash gifting clubs ever receive any money. If anyone does, it is usually only those at the very top running the scheme.[12]

- You may hear many success stories when first learning about a cash gifting club. Realize that these stories are either made up or extremely rare. And, if they are true, chances are they are exaggerated.

- Only those at the top of the pyramid get any money in the scheme. You are not going to make any money as someone at the bottom of the pyramid.

-

4Take your time when you hear a pitch for cash gifting. If someone is pressuring you to make a decision on the spot, walk away. If the person says you will lose out on this amazing opportunity if you don't join immediately, walk away. Anyone who is making a legal, legitimate offer will allow you time to consider your decision.[13] [14]

- If someone is pressuring you into making a decision today, it may be a bad decision. Take a day before you decide anything about your finances.

- Emotions can play a strong part in your decision making. Never make a financial decision when you're feeling emotional, especially if those emotions are overwhelmingly positive.

-

5Report cash giving. If you are contacting by a cash gifting club, you can report them to the authorities. Either your state’s Department of Justice or the IRS has online forms or phone numbers where you can report cash gifting clubs.[15]

- Find your state’s Department of Justice website. If you search for cash gifting, you should be able to find a form to contact them by e-mail or phone.

- You may also want to contact the IRS; however, it may be more difficult to get an immediate response from them.

References

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

- ↑ https://www.irs.gov/newsroom/tax-tips-to-help-you-determine-what-makes-a-gift-taxable

- ↑ http://www.fool.com/investing/general/2015/10/03/form-709-do-you-need-to-file-a-gift-tax-return.aspx

- ↑ http://www.wsj.com/articles/SB10000872396390443759504577631301143788214

- ↑ http://www.forbes.com/sites/deborahljacobs/2014/04/09/gift-tax-returns-what-you-need-to-know/#4da7ae54a519

- ↑ http://www.moneyunder30.com/gift-tax

- ↑ http://money.usnews.com/money/personal-finance/articles/2013/09/12/what-to-know-before-gifting-a-down-payment

- ↑ http://www.michigan.gov/ag/0,4534,7-164-17337_20942-201450--,00.html

- ↑ https://www.sec.gov/answers/pyramid.htm

- ↑ http://www.income-advantage.com/resources/is-cash-gifting-legal

- ↑ http://www.ftc.gov/bcp/edu/pubs/consumer/alerts/alt056.shtm

- ↑ http://www.ftc.gov/bcp/edu/pubs/consumer/alerts/alt056.shtm

- ↑ http://www.bbb.org/sdoc/industry-tips/read/tip/high-pressure-sales-tactics-2873/

- ↑ http://www.ncdoj.gov/Consumer/Investment-Work-and-Money-Making-Schemes/Gifting-Clubs.aspx

About This Article

If you’re giving or receiving a cash gift, you’ll want to make sure it’s legal so you don't have problems with the IRS. In the U.S., any cash gifts totaling under $14,000 a year are tax-free. Cash gifts over $14,000 for tuition, medical bills, or donations to charities and political organizations are also exempt from tax. However, you’ll need to file a Form 709 if the cash gift is over 14,000, regardless of its purpose, to let the IRS know. Cash gifts to your spouse are also exempt from tax, no matter the amount. Usually, the sender is required to pay the tax on cash gifts, but you can also arrange to pay the tax as the recipient. For more tips from our Legal co-author, including how to spot a cash gifting scam, read on!