This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 60,791 times.

If you owe more on a credit card than you can afford to pay, you may wish to negotiate a settlement with the card company. In a settlement you agree to pay some lesser amount, and the company agrees to accept that amount. You both avoid the trouble and expense of going to court, and you can protect your credit rating at the same time. [1] You may wish to conduct the negotiations in writing to avoid misunderstandings. Both sides are protected by putting the final settlement in writing.

Steps

Writing a Letter to Offer a Settlement

-

1Decide what you can offer to pay. Before trying to settle your credit card debt, you need to decide what you can afford. Review all of your outstanding debts, and compare these to your regular income and any other funds you have available.

- Using your credit report can help you make this decision. Many people focus on their credit score, but your credit report is much more than just a score. It will provide a list of all outstanding debts that you owe, open accounts that you have, and ongoing collection efforts against you. These all factor into your ability to settle a particular account.

- See Check Your Credit Score for more information.

- If necessary, you may wish to get a copy of your credit reports from the three major U.S. reporting bureaus, TransUnion, Equifax and Experian. Their websites contain information about obtaining copies of your reports. [2] [3] [4]

-

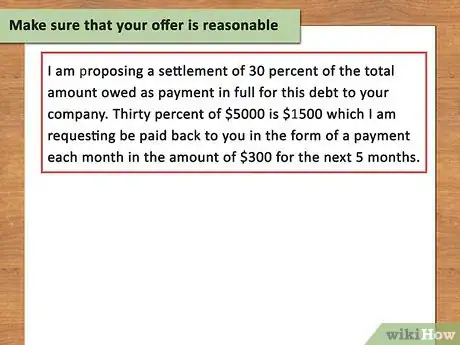

2Make a reasonable offer. If your offer is too small, the company is not likely to accept it, but if you offer too much, you run the risk of not being able to make the payments. Find a number in the middle that you believe you can justify. [5]

- Offer less for older debts. The company is likely to believe that older debts are generally less collectible. Therefore, they are more inclined to accept a lower offer. A reasonable offer might be something around 15-to-25 percent of the debt. [6]

Advertisement -

3Realize that a settlement could well impact your credit score negatively. Anything other than full, on-time payment will hurt your score to some extent. A settlement, however, is better than waiting until the account goes to collection, because it will show that you took some responsibility and addressed the issue directly.

-

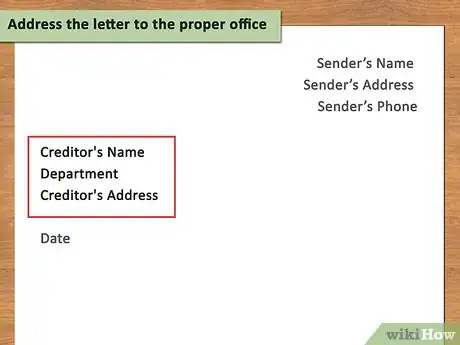

4Address the letter to the proper office. Find out which office of the credit card company handles settlement offers. You can usually discover this by looking up the company online or calling the customer-service number on the back of the card itself. When you reach someone at the company, say that you would like to make an offer to settle your debt, and ask what address you should use for sending a letter.

- Ask if you should address your letter to a particular individual. In most cases you will just write to the collections office (or something similar), but some companies may refer you to a particular individual.

-

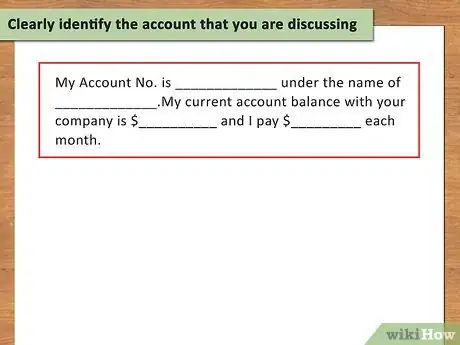

5Clearly identify the account that you are discussing. At the top of your letter, below the address, you should state the account number. Especially if you have more than one account with the institution, it is important to state clearly which account you are trying to settle. [7]

-

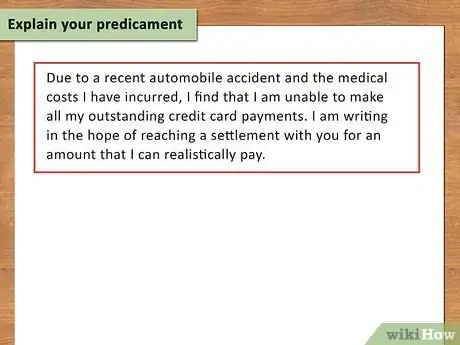

6Explain your predicament. Avoid getting emotional about the problems in your life, but you should explain your reason for needing to settle your debt. It will help your case if you can refer to a particular cause, such as an accident, divorce, or something else that is not likely to repeat. If you've simply overspent, the company will be less inclined to settle, because they have no assurance that your spending habits will change in the future. [8]

- As an example, your letter might begin by saying, “Due to a recent automobile accident and the medical costs I have incurred, I find that I am unable to make all my outstanding credit card payments. I am writing in the hope of reaching a settlement with you for an amount that I can realistically pay.”

- An explanatory letter for a settlement like this may help you with future lenders as well. Keep a copy of the letter, and be prepared to share it. Potential lenders will be concerned when they see a settlement on your credit history, but your explanation will lend context.

-

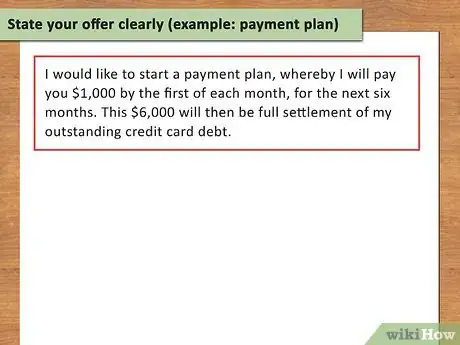

7State your offer clearly. Provide a precise statement of the amount you're offering to pay. You should also make it clear whether you're suggesting a one-time payment or a payment plan for a number of months. Either could be acceptable, but you should clearly outline your offer. [9]

- An offer of this type could say something like, “I am able to make an immediate payment of $4,000 in full settlement of my outstanding credit card debt.” Be sure to use the phrase “in full settlement,” so it is clear that you mean this as a full and final payment and not as part of a payment plan.

- If you intend to begin a payment plan, you could offer something like this: “I would like to start a payment plan, whereby I would pay you $1,000 by the first of each month for the next six months. This $6,000 would constitute full settlement of my outstanding credit card debt.”

-

8Provide a date for a response. At the end of your letter, ask the company to respond to you by a particular date. You should allow at least two weeks for the response. However, even if you do not receive a reply by that date, do not assume that your offer has been rejected. You should call the company, refer to your letter, and try to continue the negotiations. [10]

Continuing an Ongoing Negotiation

-

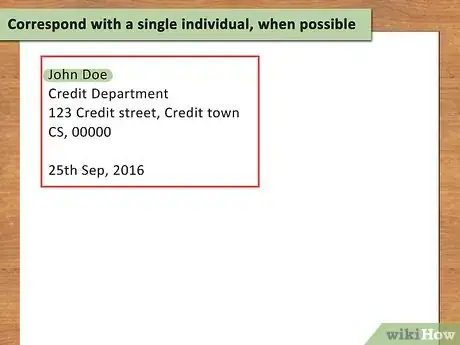

1Correspond with a single individual when possible. Whether you initiated the negotiation by phone or in writing, you should find out the name of the individual handling your account. Address any follow-up correspondence directly to this person by name. [11]

-

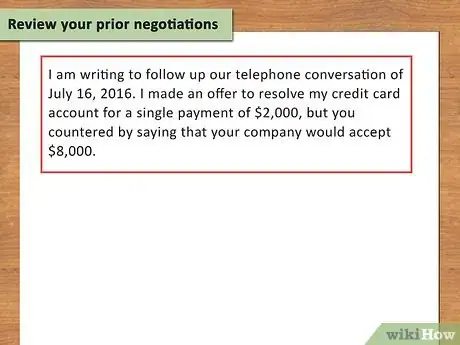

2Review your prior negotiations. In any letters you should make reference to earlier letters or conversations. Provide a brief history of the negotiations so far. This will help maintain context for your current correspondence. [12]

- For example, your opening paragraph may say, “I am writing to follow up on our telephone conversation of July 16, 2016. I made an offer to resolve my credit card account with a single payment of $2,000, but you countered by saying that your company would accept $8,000.”

-

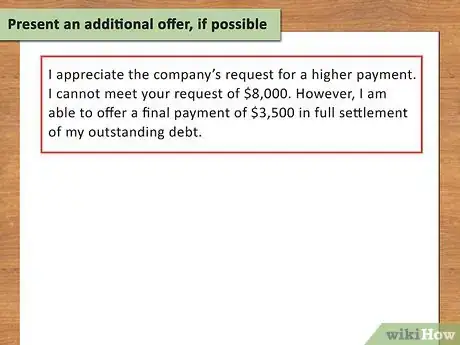

3Present a subsequent offer if possible. Any negotiation involves give-and-take between the two parties. If you can reasonably increase your offer, you should include the newest offer in your letter. If, however, you have reached a point you honestly cannot move beyond, you should say so. The company will then be forced either to accept your offer or proceed with legal action. [13]

- This latest letter could state, “I appreciate your request for a payment of $8,000. However, I cannot meet your request. I am able to offer a final payment of $3,500 in full settlement of my outstanding debt.”

-

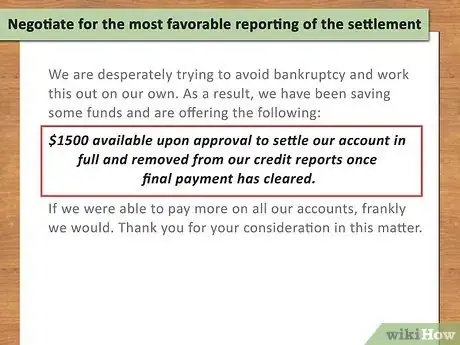

4Negotiate for the most favorable reporting of the settlement. If you pay anything less than the full amount due, your credit score is likely to drop. However, you can try to minimize the damage by modifying the way the company reports the settlement. Ask them to report your account as "paid." This is best for you. If they won't do that, suggest that your account be classified as "settled." The poorest result for you would be a report of "charged off" or "transferred," which indicates you have not paid the full amount. In that case you might expect to be contacted by a collection agency. [14]

- Realize that you really have very little leverage for controlling the way the company reports your account to a credit-reporting agency. Even so, it is worth discussing. Ask for the most favorable treatment you can get.

-

5Keep a copy of all correspondence. Retain a file of all letters you send and receive. You may need to refer to these in the future as you consider further offers. [15]

Confirming a Completed Settlement Negotiation

-

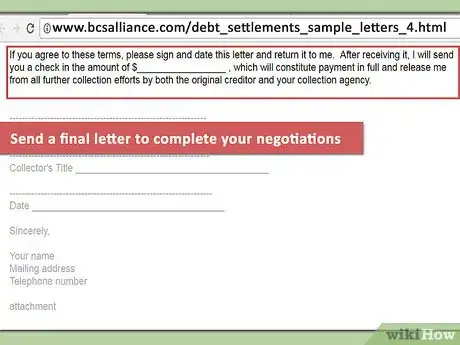

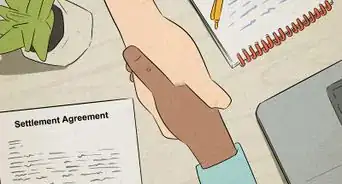

1Send a final letter to complete your negotiations. Eventually you and the credit card company are likely to reach a settlement. When that occurs you must confirm the agreement by putting it in writing. [16]

-

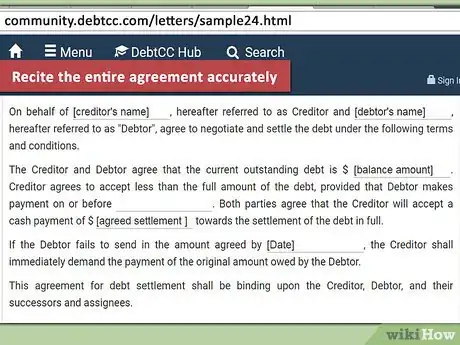

2Recite the entire agreement accurately. In your final settlement letter you must make sure to state the terms of the agreement accurately and completely. Be careful not to leave out any details. Include all of the following:

- the amount of your agreement

- the payment deadline. Even if the agreement is for “immediate” payment and you are including a check with the letter, you must say so.

- periodic payment dates if you are setting up a payment plan

- the phrase “full and final settlement.” This binds the company legally to this amount and prevents future collection efforts for any additional amounts.

- a description of how the company will report this debt to the credit-reporting agencies. It makes a difference whether a debt is reported as “paid,” “settled,” or “paid late.” Try to negotiate for a reporting of "paid."

-

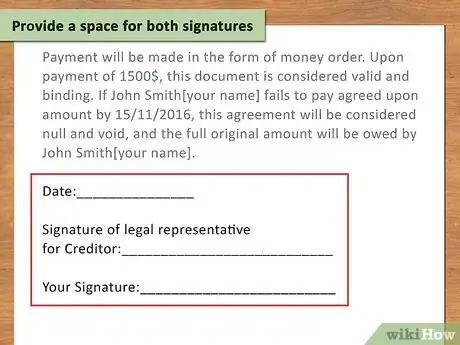

3Provide a space for both signatures. You should sign the letter and provide a space at the bottom for a representative of the company to sign, indicating the company’s agreement.

- Send the company two copies of the letter with your original signature. In the body of your letter, request that the account representative sign one of the letters and return it to you.

- Above the signature space, include the words, “Agreement accepted.” Then provide a line for the company representative to sign and insert the date.

Warnings

- You should have the settlement money on hand before writing the final letter. Be aware that failure to make the agreed-upon payment or payments could cause your default on the settlement agreement, generating even more problems for you.⧼thumbs_response⧽

- Keep a copy of the credit-card settlement letter and all interactions such as payments sent to the company. You may need a record later.⧼thumbs_response⧽

References

- ↑ http://www.nolo.com/legal-encyclopedia/credit-card-debt-settlement.html

- ↑ http://www.transunion.com/

- ↑ http://www.equifax.com/home/en_us

- ↑ http://www.experian.com/

- ↑ http://creditcards.lovetoknow.com/Card_Credit_Debt_Letter_Settlement

- ↑ http://www.creditinfocenter.com/debt/settle-debts.shtml

- ↑ http://www.nolo.com/legal-encyclopedia/credit-card-debt-settlement.html

- ↑ http://www.bankrate.com/finance/debt/settle-your-debts-yourself-4.aspx

- ↑ http://www.bankrate.com/finance/debt/settle-your-debts-yourself-4.aspx

- ↑ http://www.creditinfocenter.com/debt/settle-debts.shtml

- ↑ http://www.creditinfocenter.com/debt/settle-debts.shtml

- ↑ http://www.creditinfocenter.com/debt/settle-debts.shtml

- ↑ http://www.creditinfocenter.com/debt/settle-debts.shtml

- ↑ http://www.experian.com/blogs/ask-experian/defining-charged-off-written-off-and-transferred/

- ↑ http://www.creditinfocenter.com/debt/settle-debts.shtml

- ↑ http://www.creditinfocenter.com/debt/settle-debts.shtml