This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 14 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 36,721 times.

Learn more...

Most car accidents are minor and the resultant damage can be easily fixed. With the help of your insurance provider, you can get your car road-ready again in no time. Occasionally, though, the damage from an accident is so severe that you can’t salvage your car. In a situation like this, you can take a check from your insurance company, sell the junked car for parts or scrap, or donate it to charity for a tax deduction.

Steps

Going through Your Insurance Provider

-

1Verify that your insurance provider has declared your car a total loss. An insurance company defines a totaled car as one which will cost more money to repair than the car is actually worth. If your mechanic says that the car is totaled, have your insurance provider inspect the car and declare the car as totaled or not.[1]

- The question of whether or not a car is totaled isn’t always an obvious one. Sometimes your car will look like a flattened wreck, and you won’t be surprised to hear your insurer’s verdict. Other times, though, it might look merely dinged up, but the necessary repair is so costly and the car as a whole so cheap that it makes sense to declare it totaled.

-

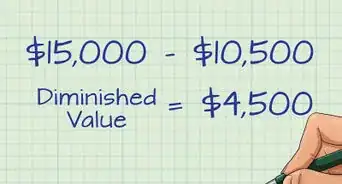

2Figure out the actual cash value of the car. Once your insurer declares your car totaled, they’ll come up with an actual cash value for the vehicle. This is the amount that they’ll pay in order to purchase the car from you as a salvage vehicle and should be based on the fair market value of the vehicle before it was totaled.[2]

- If an accident claim was made against your policy, the insurer will first subtract the deductible from the actual cash value before writing you a check.

- If you still owe money on the car, you’ll have to pay it off with this check from the insurer.

Advertisement -

3Compare your insurer’s settlement figure with your own estimate. Once your insurer declares your car totaled, you should do some research to figure out what you think the actual cash value of your car is. Use the Kelly Blue Book or a car data website to estimate your vehicle’s market value, and then subtract your deductible and any estimated expenses for the insurance company to dispose of your car once they take possession.[3]

- If you disagree with the insurer’s figure, look into your policy and see if you can hire an appraiser for a second opinion. If the appraiser also disagrees, you and your insurer will go through arbitration to reach a settlement.

- Just be sure that the disagreement is significant, as you’ll be responsible for paying for the appraiser no matter what comes out of the arbitration process.[4]

-

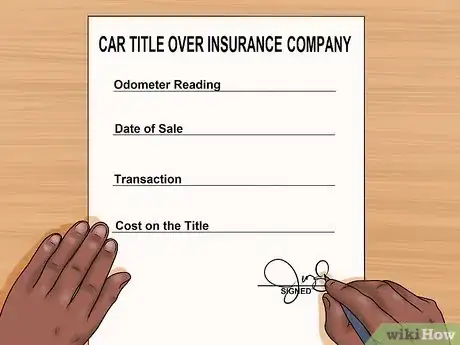

4Sign over the title of your car to the insurance company. Once your insurer has paid you a check for the total loss of your car, they are the legal owners of the vehicle. You finalize this transaction by recording the odometer reading, date of sale, and transaction cost on the title, then signing the title alongside a representative of the insurance carrier.[5] Once this is done, your insurance representative will let you know when they'll have someone pick up or tow away your car.

- If you have a car loan, your lender holds the title to the car and must be involved in the transaction.

Selling Your Totaled Car

-

1Consider selling your car to a dealership or junkyard. The most convenient method of disposing of a totaled car is letting your insurance company handle its sale. If you’re knowledgeable about car parts, though, and think you can make more off the car than your insurance company is offering, or if the car is old and not insured, you might want to sell your totaled vehicle yourself.[6]

- If your car is insured and your company has declared it a total loss, you’ll need to let them know that you intend to keep the vehicle. They’ll still cut you a check for the car, but they’ll deduct the estimated amount of money that they would have received for it from a junkyard or dealership.

-

2Obtain a salvage certificate for the vehicle. Once a vehicle has been determined a total loss, it requires documentation—usually called a salvage certificate—that effectively records its damage and history as a totaled car. You can obtain this salvage certificate by going to your local motor vehicle agency and asking them to issue it in exchange for your old car title.[7]

- Different states and countries have varying salvage auto regulations, so be sure to check your particular state’s or province’s guidelines to make sure you’re filling out all the proper documentation.

- In some places, the Department of Motor Vehicles will charge you a small fee for the salvage certificate. In Illinois, for example, a salvage certificate costs four dollars.[8]

-

3Take your car to a dealership. With your salvage certificate in hand, you can sell your totaled car to a private party or company. A car dealership is the first place to try when doing this, as many dealerships will pay cash for salvaged vehicles in order to make repairs, auction it off, or dismantle and sell it for parts. This practice can be so profitable that some dealerships deal exclusively in salvage cars, so it doesn’t hurt to check with a few dealerships around town and compare their offers.[9]

- Just be sure to explain that your car is a salvage vehicle, as this ‘brand’ or status of the car makes it more difficult to insure and sell in the future.

-

4Contact junkyards in your area for offers. If you don’t get any bites from car dealerships, check with local junkyards to find out how much they’ll pay for your salvage vehicle. Just don’t snap up the very first offer, as different yards will offer different prices depending on their needs, abilities, and expertise.[10]

- Most salvage yards will have their own, set rates for buying vehicles if they intend to crush it down for scrap metal. In this scenario, you can expect around $75 per ton for your car.

- Also consider other factors, such as whether or not the junkyard will pick up your car for free, or if you’ll be expected to dispose of non-metal materials, such as tires, before turning over your vehicle.

-

5Arrange for the junkyard to take possession of your vehicle. Depending on whether or not your car still runs, you can either drive your car to the junkyard, have someone pick it up, or have it towed by the junkyard. Just be sure to find out ahead of time whether or not the junkyard charges a fee for pick-up or towing.[11]

- Also double-check your car before handing it over to make sure you haven’t left any personal belongings in the trunk or main interior.

-

6Sign over the title of your car to the junkyard. Once you’ve received cash or a check from the junkyard, you’ll sign over the title or salvage certificate to its new owner. If you don’t have the vehicle’s title, you can probably still sell the car, but you should let the junkyard know ahead of time that you don’t have it.[12]

-

7Check with your local motor vehicle agency to follow up with the sale. Depending on where you live, you might need to finalize the transaction with further documentation. In some places, for example, you’ll need to relinquish the license plates and cancel your vehicle’s registration.[13]

- If you live in the U.S., you’ll also want to call the DMV after a week or so to verify that the title has been transferred over to the junkyard. If the process is delayed, you could be liable for your vehicle well after you thought you had relinquished ownership.[14]

Donating Your Car to Charity

-

1Identify the charity to which you want to donate. Many people choose to donate their totaled vehicles rather than trying to sell it or claim insurance for it. Not only do you contribute to a worthy cause, but in many places, you also receive a tax deduction for your donation. Just be sure that the charity qualifies for a tax refund: in the U.S., for example, donations to certain non-profits cannot be counted toward any tax benefits.[15]

- Some charities which accept car donations are the Make-A-Wish foundation, Kars4kids, and Vehicles For Veterans.[16]

- If you’re not sure if the charity you’re considering has ‘exempt-status,’ contact your federal tax governing body to ascertain whether or not it qualifies.

-

2Call or sign up online for a pick-up. Once you’ve decided where you want to donate your car, you can follow a simple process to hand it over to the charity. Call and arrange a pick-up time and location, or fill out a form on the charity’s website that designates an appointment.

- If your car still runs, see if you can take the car to a drop-off location for the charity. This will maximize the proceeds your charity earns from your salvage vehicle, as otherwise they’ll have to pay for the towing service.[17]

-

3Determine the fair market value of your car. In order to claim a tax deduction for your donation, you’ll need to figure out what the fair market value of your car is. Use the Kelley Blue Book or Edmunds.com to come up with a figure. Just be sure to accurately reflect the condition, model, and mileage of your vehicle at the time of donation, as fibbing on this question will earn you a penalty if you get audited.[18]

- Just because you’ve arrived at a fair market value for your car, you can’t deduct this figure yet. You can only do so if or when the charity sells your car for its fair market value and notifies you of this sale.

-

4Wait for the charity to send you a written acknowledgement of your donation. Once the charity takes your car away, you’ll need to wait until they send you the proper documentation. This written acknowledgement from the charity states whether or not the charity sold the vehicle, what improvements—if any—were made, and for how much the vehicle was sold.

- If you don’t receive notification prior to the tax deadline, you can file for an extension. Alternatively, you can file your taxes without the car donation and then amend the return once you receive a notification.

-

5Claim a deduction of up to $500 on your 1040EZ. In the U.S., you can claim fair market value or $500 for your donated car, whichever figure is less. This is a good option if you want to use a standard 1040EZ, or if your car’s fair market value is fairly low in any case.

- The charity should send you a tax receipt in the mail to help you when filling out your tax return.[19]

-

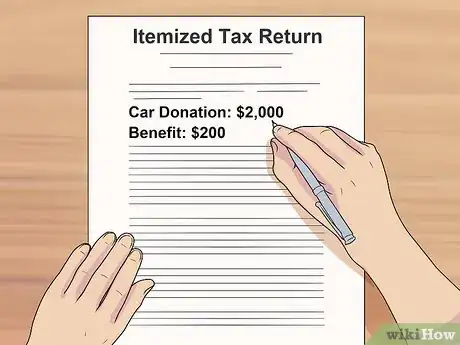

6Itemize your tax return if you want to maximize your deduction. If you want to claim more than $500 for your donated car, you’ll need to file an itemized tax return rather than using a 1040EZ. While you will get a higher tax deduction for the car itself, though, you might ultimately get less than the standard income deduction that you’d receive if you filed the 1040EZ.[20]

- For example, if you’re in the 20% tax bracket and you itemize your car donation for $2,000, you’ll get a benefit of $200. But, if you don’t have a bunch of other itemized donations to add on top of that $200, you’ll end up saving well below the standard income deduction.

- This guideline holds loosely for residents of the U.S., but you should check for local and federal policies no matter where you live.

-

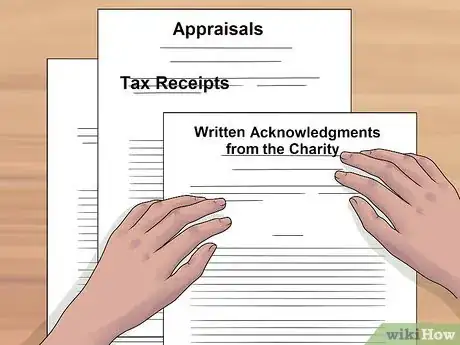

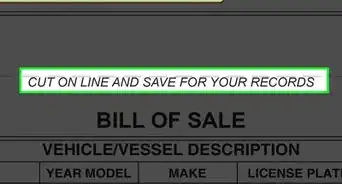

7Attach the appropriate forms to your tax return. Once you receive a tax receipt or bill of sale from the charity, you can fill out your tax return using this documentation. In the U.S., you’ll need to fill out Section A of IRS Form 8283 and attach it to your return, along with the written acknowledgement you received in the mail.[21]

- If your car is worth more than $5,000, you’ll need to fill out Section B of IRS Form 8283, as well as get an independent appraisal of the car to verify its worth. Attach this appraisal to your return, as well as any other pictures or records which attest to its value, such as receipts for new tires or pictures of other upgrades.

-

8Save all your paperwork in case of an audit. Non-cash donations are one of the biggest causes for tax agency investigations, so be prepared for an audit! This is especially important if you itemized your return and claimed more than $500 for the donation. Keep copies of any documents the charity gives you, appraisals, tax receipts, and written acknowledgments from the charity.[22]

- Remember that any discrepancy between what you claimed for the car and what it was actually worth or sold for will result in a penalty for you, the donor, rather than the charity.

-

9Follow up with the motor vehicle agency. Depending on where you live, you might need to send the relevant government agency a report of sale or other documentation. In Alaska and Hawaii, for example, you need to fill out a transfer form attached to the bottom of your vehicle title. You list the new owner as the charity and write ‘donation’ in the purchase price field.[23]

- In many places, you’ll also need to remove the license plates and return them to the motor vehicle agency. In other places, such as Alaska, California, Hawaii, and Minnesota, you can leave the plates on the car.

References

- ↑ http://www.carsdirect.com/sell-cars/how-to-sell-a-car-thats-been-totaled

- ↑ http://www.nasdaq.com/article/5-things-to-do-with-a-totaled-car-cm178060#ixzz4Wj77w3JE

- ↑ http://www.autotrader.com/car-news/crash-course-for-coping-with-a-totaled-car-168401

- ↑ http://www.autotrader.com/car-news/crash-course-for-coping-with-a-totaled-car-168401

- ↑ http://www.carinsurancecomparison.com/sign-over-car-title-car-insurance-company/

- ↑ http://www.nasdaq.com/article/5-things-to-do-with-a-totaled-car-cm178060#ixzz4Wj736NgL

- ↑ https://www.edmunds.com/car-buying/what-is-a-salvage-title-vehicle.html

- ↑ http://www.dmv.org/il-illinois/salvaged-vehicles.php

- ↑ http://www.carsdirect.com/sell-cars/how-to-sell-a-car-thats-been-totaled

- ↑ http://www.dmv.org/articles/follow-these-tips-to-junk-or-salvage-a-vehicle/

- ↑ https://www.yourmechanic.com/article/how-to-make-money-from-your-junk-car

- ↑ https://www.yourmechanic.com/article/how-to-make-money-from-your-junk-car

- ↑ http://www.dmv.org/articles/follow-these-tips-to-junk-or-salvage-a-vehicle/

- ↑ http://www.carsdirect.com/sell-cars/how-to-sell-a-car-to-a-junkyard-tips-for-getting-the-most-money-possible

- ↑ https://www.edmunds.com/sell-car/does-charity-car-donation-still-make-sense-under-tougher-irs-rules.html

- ↑ https://www.yourmechanic.com/article/how-to-make-money-from-your-junk-car

- ↑ https://www.charitywatch.org/charitywatch-articles/tips-for-donating-a-car-to-charity/42

- ↑ https://www.edmunds.com/sell-car/does-charity-car-donation-still-make-sense-under-tougher-irs-rules.html

- ↑ https://www.goodwillcardonation.org

- ↑ https://www.edmunds.com/sell-car/does-charity-car-donation-still-make-sense-under-tougher-irs-rules.html

- ↑ https://www.charitywatch.org/charitywatch-articles/tips-for-donating-a-car-to-charity/42

- ↑ https://www.charitywatch.org/charitywatch-articles/tips-for-donating-a-car-to-charity/42

- ↑ http://www.kars4kids.org/faq.asp