This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 381,971 times.

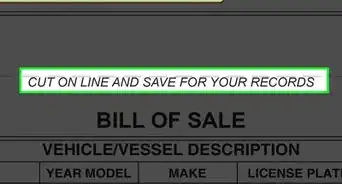

If your car has been damaged in a wreck, this "evidence of repairs" can negatively affect the value of your car should you ever decide to sell or refinance it in the future. This reduction in worth is known as diminished value. Diminished value is an insurance concept that was developed initially to estimate the loss of value of an auto following an accident. Even if your car displays no obvious damages it may still experience inherent diminished value since you may have a legal obligation to disclose to any potential purchaser of the vehicle that it has previously been involved in an accident. Calculating diminished value can be done several ways, depending on who is doing the calculating.

Steps

Understanding Diminished Value

-

1Know why diminished value is important. Imagine that you have a new, $25,000 car and you get into an accident. It isn't your fault, so the other driver's insurance company pays to have your car repaired. You would think that your car is still worth $25,000 because it looks good as new. However, this isn't the case. If you tried to sell the car, you might get considerably less for it, maybe $20,000, once the buyer or dealership determined that the car had been in accident. This is diminished value, and it can drastically hurt the resale value of any vehicle.[1]

- Diminished value isn't the only determinate of sale price. The actual sale price depends upon such things as depreciation, damage, the extent of repairs, and the popularity of the car's make and model.

-

2Understand that different entities calculate diminished value differently. Diminished value must be calculated by car dealerships and private buyers when determining what they are willing to pay for a used car. This helps the buyer get a fair discount for the vehicle if it has an accident history. However, because of the money lost in diminished value, claims are often made against insurance companies for diminished value. This means that insurance companies must also calculated diminished value to respond to these claims.

- Buyers of used vehicles calculate diminished value objectively. This means that they offer an estimated value for the vehicle that they believe to be fair, given the vehicle's history. This will always be lower than the value for a similar car without an accident history. This value may vary widely between buyers and can depend on the extent of damage to your car.[2]

- Insurance companies, in contract, use a very exact formula for calculating diminished value. This calculation is known as "17c" and has been adopted by many insurance companies in the United States.[3] The 17c estimate methodology, by limiting the loss to an arbitrary percentage, generally favors the insurance company.

Advertisement -

3Research your state's diminished value laws. State laws vary widely on the recognition of diminished value insurance claims. Some allow for claims to be made against a driver's own insurer, others against another driver's insurer, and others don't recognize these claims at all. They also differ in exactly how the diminished value may be calculated. Search online for your state's specific diminished value laws to get a better picture of your rights.[4]

-

4Know how to file a diminished value claim. If you've been in an accident that was the fault of another driver, you may be able to file a diminished value claim against their insurer. Again, this will depend on your state's specific laws and the particulars of your case. Contact the other driver's insurance company and inquire about a diminished value claim. If they resist or the amount is not as much as you think you deserve, there are many lawyers that specialize in diminished value claims. Search for one in your area and discuss your case with them.[5]

- In any case, be sure to file your claim as soon as possible. Most states only allow a diminished value claim to be filed within three years of an accident.[6]

Calculating Diminished Value Using 17c

-

1Find your car's value. The easiest way to do this is to go to http://www.nadaguides.com/ and input your car's information. Fill out the various steps, including your make, model, mileage, and options. The website will give you estimate trade-in and sale values of your car. Insurance companies also use this information to determine a fair starting value for your car.

- This service is free to use.

- To begin our example, imagine that NADA determines that your car is worth roughly $15,000.

-

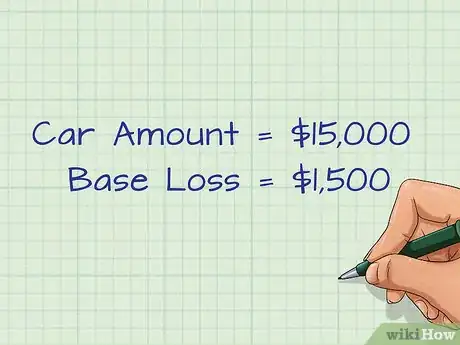

2Calculate the "base loss of value." Insurance companies commonly divide the NADA value by 10 to arrive at a "base loss of value." This is, in theory, the largest amount of value that can be lost as diminished value. So for a $15,000 car, the base loss of value would be $1,500. This means that, at maximum, the diminished value after an accident and repair could be $1,500.

- Keep in mind that not all insurers use this calculation. Your insurer's calculation may take this calculation into consideration or completely ignore it.

-

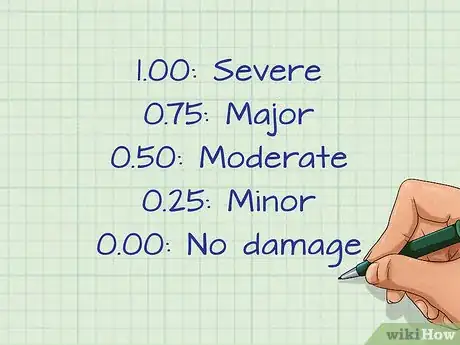

3Multiply by the damage multiplier. After the base value has been set, the company then adjusts it for values specific to your vehicles. The first, the damage multiplier, assesses how damaged your vehicle was by the accident from 0, which represents no structural damage or replaced panels, to 1, which represents major structural damage. Multiply the number by your base loss of value to get your damage-adjusted diminished value.

- Specifically, the numbers are as follows:

- 1.00: Severe structural damage

- 0.75: Major damage to structure and panels

- 0.50: Moderate damage to structure and panels

- 0.25: Minor damage to structure and panels

- 0.00: No structural damage or replaced panels

- For example, if your car experienced moderate damage, you would multiply your base loss value of $1,500 by 0.5 to get $750, your damage-adjusted diminished value.

- Specifically, the numbers are as follows:

-

4Multiply by the mileage multiplier. After adjusting for damage, your claim will now have to be adjusted for your car's mileage. Again, this relies on a set of values that are multiply by the result of your damage adjustment.

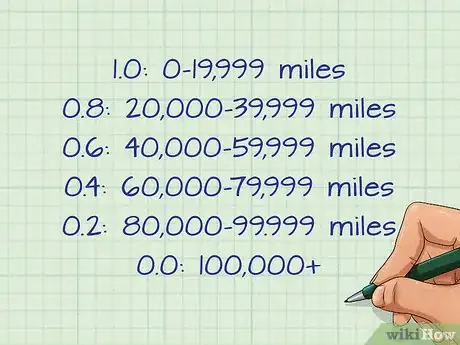

- The values are as follows:

- 1.0: 0-19,999 miles

- 0.8: 20,000-39,999 miles

- 0.6: 40,000-59,999 miles

- 0.4: 60,000-79,999 miles

- 0.2: 80,000-99.999 miles

- 0.0: 100,000+

- So, if your car, with a damage adjusted diminished value of $750, has 65,000 miles on it, you would use the multiplier of 0.4 This would give you 0.4*$750, or $300.

- The values are as follows:

-

5Examine your result. The remaining value after both adjustments is the total diminished value that the insurance company will allow you to claim because of your accident. Keep in mind that their specific calculation how produce a different number. However, this is a generalized form of the calculation that many insurers use.

Estimating Actual Diminished Value

-

1Start with the actual value of your car. Try to determine the value of your car had it not been in an accident. Again, it's best to use the NADA website at http://www.nadaguides.com/ to get the value of your car. You can also use Kelly Blue Book or any used car site to estimate the value of your car or find similar vehicles for sale. Be sure to look for cars as similar to yours as possible, mainly in year and mileage, but other with certain options and in the same color.

- Ignore vehicles that have been in accidents for now, but bookmark these vehicles for later if you come across them.

- Be sure to also search in your area. The same car may be worth more or less, depending on where you live.

-

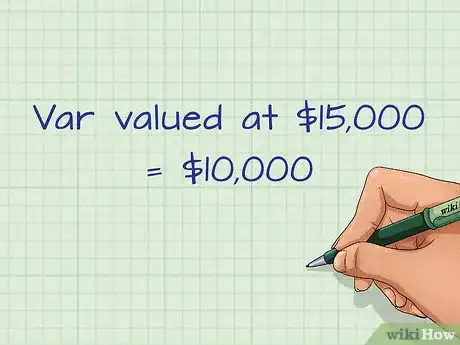

2Use expert estimates. You can begin to estimate your diminished value by using some expert standbys. For example, some law firms specializing in diminished value estimate that the value lost when a vehicle is in an accident is around 33 percent.[7] This means that your car valued at $15,000 would be worth about $10,000 in reality when you tried to sell it. Use this type of estimation as a starting place for determining your diminished value.

-

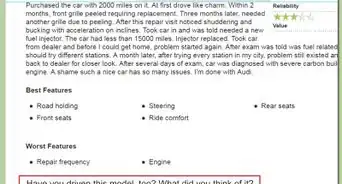

3Search for comparable cars for sale. If you found any cars similar to yours in earlier searches that had an accident in their vehicle history, look at the relative prices of those cars. How much less are they being sold for than a similar car with no accident history? In addition, look at the price differences between "pre-owned" and "certified pre-owned" cars at dealerships. Oftentimes, cars with structural damage from accidents won't be sold as "certified pre-owned." Looking at the price of cars similar to yours sold as just "pre-owned" can give you an idea of what yours is worth.

- For example, imagine that a few cars similar to yours are selling for $9,500 and $11,000 on the used market. These cars have accident histories, but are in good visual condition. You can use this range to estimate the actual value of your own car.

-

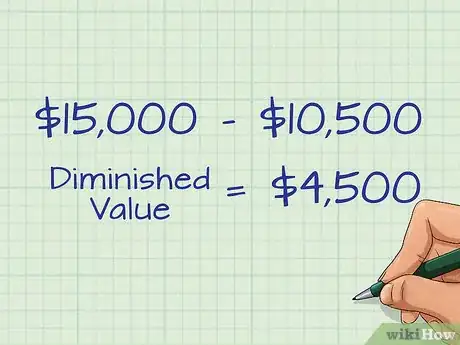

4Bring it all together. Start with what you found as the NADA or KBB value of your car if it had not been in accident. Then, consider your expert estimation and the prices of similar cars with accident histories to arrive at an actual value for your car. The difference between these two values is your estimated diminished value.

- For example, using the $10,000 expert estimate from above and the two similar, used cars at $9,500 and $11,000, you estimate that your car is worth about $10,500. Your diminished value would be the difference between the value of your car if accident-free, $15,000, and your estimated lower value due to accident, $10,500. This gives you $4,500 in diminished value.

Warnings

- This article should not be considered legal or financial advice. It is intended only as a helpful guide. It is strongly advised that you consult with a local accident attorney who will be able to give you specific advice based on your personal situation.⧼thumbs_response⧽

References

- ↑ http://abcnews.go.com/Business/car-wreck-reimbursed-lost/story?id=10713550

- ↑ https://www.latimes.com/archives/la-xpm-1998-dec-10-hw-52389-story.html

- ↑ http://kielichlawfirm.com/insurance-companies-calculate-diminished-value-claims/

- ↑ http://www.mwl-law.com/wp-content/uploads/2013/03/diminution-of-value-in-all-50-states.pdf

- ↑ http://abcnews.go.com/Business/car-wreck-reimbursed-lost/story?id=10713550

- ↑ http://abcnews.go.com/Business/car-wreck-reimbursed-lost/story?id=10713550

- ↑ http://abcnews.go.com/Business/car-wreck-reimbursed-lost/story?id=10713550

About This Article

If you want to calculate your car's diminished value, you should know that different entities, like insurance companies or courts, may come up with different figures. For a general idea, use the 17c formula that many insurance companies use. To do this, first find the value of your car on NADA's website. Make sure to enter your vehicle's mileage, color, and features for the most accurate price. Then, subtract 10% for severe damage or 5% for moderate damage to find the diminished value. To learn from our Financial reviewer how to account for mileage in diminished value, read on!