This article was co-authored by Chad Seegers, CRPC®. Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

This article has been viewed 11,788 times.

Once you hit retirement, it’s a mistake to think that you’re completely done having to worry about investing or spending your money. In reality, investing, withdrawing, and spending your money wisely are crucial to making sure your retirement is a happy one. Fortunately, there is a variety of ways that you can invest your retirement savings and manage your expenses to make sure your retirement goes smoothly.

Steps

Determining How to Invest Your Savings

-

1Invest in immediate annuities for a guaranteed fixed income. Immediate annuities are a form of “insurance” that provide immediate guaranteed income over a fixed period. Place your money in these annuities for a guaranteed source of income outside of Social Security.[1]

- Immediate annuities will pay out an income over the length of the annuity’s term. For example, if you purchase a 10-year term-certain annuity for $100,00, you’ll receive a fixed monthly income of around $700-$800 out of that annuity over a 10-year period.

- When you buy an immediate annuity, the amount you receive each month is not just a return on your investment; you’re also receiving back part of the money you used to purchase the annuity in the first place. Thus, you should purchase an immediate annuity sooner rather than later and only if you expect to live longer than the average life expectancy for someone in your demographic.

- These annuities may be most helpful for people who have trouble staying within their spending limit.

-

2Use retirement income funds to avoid having to keep tabs on your money. Retirement income funds are a form of mutual funds that are actively managed by someone else who invests your money in stocks and bonds for you. These funds are set up to pay a regular income for retirees and are ideal for those who want to minimize their personal responsibility for making investment decisions.[2]

- When researching mutual funds to find the best retirement income funds, look for those have average annualized returns of 3.00% to 4.00%. Funds with these levels of returns are the most likely to adequately balance the positive growth of your investment with your exposure to market risk.

- Although someone else manages your investments with this type of mutual fund, you’ll still be able to access your money at any time.

- Note that some retirement income funds have a minimum investment amount. For example, many funds require that you invest at least $25,000 to receive payout from a retirement income fund.

Advertisement -

3Consider investing in real estate as a source of income. Owning rental properties can be a great way to earn additional income during retirement. However, becoming a landlord may involve more work than you might expect. Make sure you know what managing and maintaining rental properties entails before investing your money in real estate.[3]

- For example, you may have to take care of the property’s maintenance, collect rent from renters, and pay for repairs following natural disasters.

- To get started as a real estate investor, start with one small property in a rental market that has experienced an increase in prices over the past year. As you make money from this property and develop your skills as an investor, you can expand your portfolio to include more diverse properties in a variety of markets.

- If you want to make real estate earnings part of your portfolio but want to delegate the responsibilities involved to a third party, invest your money in a real estate investment trust.

-

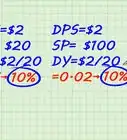

4Have a fund manager oversee your money in a dividend income fund. In a dividend income fund, a fund manager oversees your investments and your income is derived from the dividends paid out by the stocks you own. This is a good way to earn money from the stock market and to have professional guidance for your investments.[4]

- When hiring a fund manager, look into their past successes and failures to gauge how much of their career experiences were due to their own skill (or lack thereof) and how much was due to luck. You’ll want to hire a manager who is successful, but only if that success was their own doing and not the result of mere happenstance.

- Note that with dividend income funds, your income amounts may rise and fall with the market. This makes this form of investment a little more risky than other investment funds.

- Be wary of stocks that promise high dividends, as they may be more risky in the long run.

-

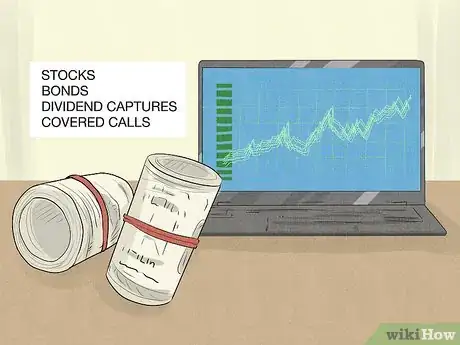

5Put your money in closed-end funds if you’re experienced at investing. Closed-end funds invest money in a variety of different ways and thus generate a similarly heterogeneous income stream. These funds can be particularly lucrative sources of income for retired investors, but they’re also fairly complicated and should only be considered by people with more investing experience.[5]

- The sources of income in a closed-end fund may include stocks and bonds, dividend captures, and covered calls.

-

6Include stocks in your portfolio to ensure your nest egg keeps growing. You’ll want to make sure that your investments continue to grow throughout your retirement, even as you begin to make withdrawals. To do this, make sure a significant portion of your savings are in stocks so that you earn bigger returns and keep ahead of inflation.[6]

- The proportion of your investments that are in stocks will depend on your age and investment strategy. Younger retirees should put 50% or more of their investments in stocks, as they have more time to weather the volatility of the market. For retirees 72 and older, stocks should make up around 30% of their portfolio.

- You should divide your investments between domestic and foreign stocks to minimize risk.

- If you're new to the stock market, try reading investment blogs to help point you in the right direction. These blogs often pull from white papers and research published in journals, and they can be a great way to learn about different parts of the economy and innovations in the market.[7]

Managing Your Expenses and Withdrawals

-

1Aim to withdraw 4% of your retirement assets every year. This has been the standard withdrawal percentage that financial advisors recommend to retirees for years. Although this percentage may be adjusted as you get older or as circumstances change, 4% should be the starting point for your annual withdrawal rate.[8]

- In the first years of your retirement, this rate may need to be reduced if the market is particularly poor. If your withdrawal rate is too high during a bear market (a market where prices are falling), the odds of your savings lasting your whole retirement go significantly down.

- Note that when you stick to a percentage withdrawal rate, you don’t have to worry about manually adjusting your withdrawal amounts to keep up with inflation.

-

2Pay off your mortgage before or immediately after you retire. Paying off your mortgage before you enter retirement is one of the best ways to reduce your monthly expenses during your retirement. If you’re unable to completely pay off your mortgage before retiring, you should do so as soon as possible after you retire.[9]

- A home that has no mortgage balance can also be sold off to pay for a cheaper home for your retirement or to pay to live in an assisted living facility.

-

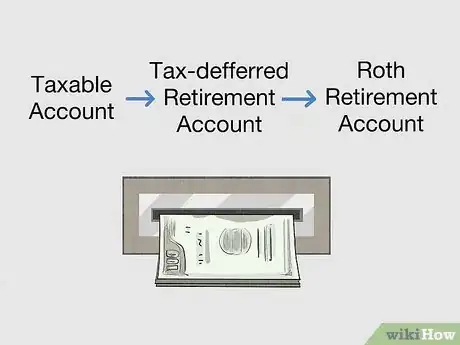

3Withdraw your money in the right sequence. Most retirees will have investments in a variety of different accounts. The most tax-efficient way to withdraw your money from multiple accounts is to do so first from taxable accounts, then from tax-deferred retirement accounts, and then finally from Roth retirement accounts.[10]

- Create a strategy for how to draw income from your investment. For instance, for the first 3 years of your retirement, you might pay your expenses from within your portfolio, like using bonds. Then, during years 3-5, you might use dividends from some portion of your portfolio. After that, you might use long-term growth from your investments.[11]

- Since you will still have to pay taxes on your savings and investments during retirement, withdrawing your money in this sequence is the best way to maximize your savings at tax time.

- This sequence is most strategic because the dividends earned in your taxable accounts will be subject to taxation even if you don’t withdraw them. Thus, it makes the most sense to withdraw and spend that money first.

-

4Avoid using your retirement money to pay for college. If you’re about to retire or just recently retired and you have children or grandchildren who are attending college, you may be tempted to use some of your retirement money to help them pay for school. However, this would not be the best use of your money in the long run, since your children and grandchildren have a much longer time to pay off student loans than you do to rebuild your nest egg.[12]

- If you absolutely have to withdraw money from your retirement account to pay for college, considering offering it as a loan instead of a gift, so that the money is repaid directly to your account sooner rather than later.

Expert Q&A

-

QuestionWhat is the best investment for a retired person?

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Chad Seegers, CRPC®Chad Seegers is a Certified Retirement Planning Counselor (CRPC®) for Insight Wealth Strategies, LLC in Houston, Texas. Prior to this, Chad worked as a Private Wealth Advisor for Sagemark Consulting for over ten years, where he became a select member of their Private Wealth Services. With over 15 years of experience, Chad specializes in retirement planning for oil and gas employees and executives as well as estate and investment strategies. Chad is a supporting member of the World Affairs Council and an emerging leader with the Global Independence Center (GIC).

Certified Retirement Planning Counselor Always have a strategy for your next 5 years' worth of income.For instance, identify where the next 3 years' of expenses are going to come from within your portfolio, which will probably be the bond market. Years 3-5 will probably be dividends from some portion of your portfolio. Then, look at the long-term growth, which will help you outpace inflation.

Always have a strategy for your next 5 years' worth of income.For instance, identify where the next 3 years' of expenses are going to come from within your portfolio, which will probably be the bond market. Years 3-5 will probably be dividends from some portion of your portfolio. Then, look at the long-term growth, which will help you outpace inflation.

References

- ↑ https://www.sensiblemoney.com/learn/best-retirement-investments-for-a-steady-stream-of-income/

- ↑ https://www.sensiblemoney.com/learn/best-retirement-investments-for-a-steady-stream-of-income/

- ↑ https://www.sensiblemoney.com/learn/best-retirement-investments-for-a-steady-stream-of-income/

- ↑ https://www.sensiblemoney.com/learn/best-retirement-investments-for-a-steady-stream-of-income/

- ↑ https://www.sensiblemoney.com/learn/best-retirement-investments-for-a-steady-stream-of-income/

- ↑ https://money.usnews.com/investing/articles/2016-08-08/how-to-invest-in-retirement

- ↑ Chad Seegers, CRPC®. Certified Retirement Planning Counselor. Expert Interview. 16 July 2020.

- ↑ https://www.forbes.com/sites/robertberger/2016/06/05/investing-after-you-retire-3-challenges-and-how-to-overcome-them/#789468ec5de8

- ↑ https://money.usnews.com/investing/articles/2016-08-08/how-to-invest-in-retirement

- ↑ https://www.forbes.com/sites/robertberger/2016/06/05/investing-after-you-retire-3-challenges-and-how-to-overcome-them/#789468ec5de8

- ↑ Chad Seegers, CRPC®. Certified Retirement Planning Counselor. Expert Interview. 16 July 2020.

- ↑ https://money.usnews.com/investing/articles/2016-08-08/how-to-invest-in-retirement