This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 80,613 times.

Tax accounting is a set of accounting methods that deal with the preparation of tax accounts and returns. Learning tax accounting means becoming familiar with tax code and filing requirements for your specific location.[1] Because this type of accounting can be significantly different than regular (GAAP) accounting, it's important for aspiring tax accountants to study these regulations closely and educate themselves extensively on the tax accounting process. While most tax accountants study their craft in higher education, it's also possible to gain basic knowledge of tax accounting on your own.

Steps

Getting an Education in Tax Accounting

-

1Find an accredited bachelor's degree program. The simple truth of the matter is that most professional tax accountants have at least a bachelor's degree in accounting. This degree, whether earned online or through a traditional university or college, must come from an accredited school.[2] Luckily, most universities offer a form of an accounting degree. Just search for a university in your area, one that you want to attend elsewhere, or an online university and find the accounting or business section of their academic catalogue.

- See how to find the perfect college for more information on choosing the right school for you.

-

2Earn a degree in the accounting field. For most tax accountants, there is a variety of possible degrees (majors) that you can choose. These include almost anything in the business or finance field, such as economics, finance, business, or auditing.Advertisement

-

3Prepare for your career while in school. Throughout school, there will be numerous opportunities for you to practice your skills and gain on-the-job experience through internships or temporary work programs. Learning tax accounting is largely about learning the system and repeating the process until it becomes easy to you, so take advantage any and every opportunity to practice your skills.

- In addition, be sure to look for networking opportunities, especially with the big four accounting firms (KPMG, PricewaterhouseCoopers, Deloitte Touche Tohmatsu, and Ernst & Young).[3]

- Internships or temporary jobs also can provide you with a good opportunity to find a specialty that can make you more valuable to employers. International tax law, for example, is a complicated field with a demand for talented accountants.

-

4Pass any required exams and gain certifications. If you choose to become a Certified Public Accountant (CPA), you will have to go through rigorous testing. Even if you don't become a CPA, you are still required to be registered with the Internal Revenue Service (IRS) f you prepare tax returns for businesses or individuals. This requires gaining a preparer tax identification number (PTIN) from the IRS and may require also passing the Registered Tax Return Preparer Test.[4]

- Studying for and passing the CPA exam is a massive and difficult undertaking. For more information, see how to become a certified public accountant (CPA) and how to pass the CPA exam.

- You need a PTIN to assist in the preparation of any tax returns filed with the IRS (that are not your own or your business's tax returns). Go to the IRS's website as https://www.irs.gov/ and search for "PTIN" for more information on applying.[5]

- The Registered Tax Return Preparer Test is currently being phased in by the IRS in an effort to regulate tax accountants. Check with the IRS to see if you are required to take the test.

-

5Continue your education. Even after finding a job as a tax accountant or CPA, you can benefit from continued education. Look for opportunities – these can create value that you can use to land a higher-paying job. You might think about graduate school or becoming a CPA if you have not done so already, for example. In other cases, you may be required to go back to school. CPAs needs to take a minimum amount of continued education each year to retain their license.[6]

-

6Keep an eye on industry changes. Tax law is constantly changing, so also look for continuing education opportunities that can keep you up to date on important changes you should know. These opportunities may be available through your accounting firm, online through accredited schools, or in trade publications.

Learning Tax Accounting Yourself

-

1Understand basic (GAAP) accounting. Before you can learn tax accounting, you'll need to have a basis in the standard Generally Accepted Accounting Principles (GAAP). You can either sign up for a class in basic accounting, perhaps at a local community college or online, or you can teach everything to yourself by taking advantage of free online resources. Create a base in accounting by doing sample financial statements and studying various accounting procedures until you understand them clearly.

- To locate a good online source, try simply searching for "learn basic accounting online" on a search engine. There are many reputable resources online that offer this for free.

- You'll want to learn enough to have a basic grasp of the major financial statements, the dual-entry accounting processes, and proper transaction recognition.

- For more information on basic accounting practices, see how to learn accounting on your own.

-

2Read up on tax accounting. The best place to start learning tax accounting by yourself is the same way that university students will be learning it: by reading accounting textbooks. Either search for common tax accounting textbooks online or check out your local used bookstore to get deals on used ones. Just be sure if you buy them used that they are up-to-date; tax law changes so often that older books are often quickly out of date.

- As a starting point, look for widely-used tax accounting guides, like the US Master Tax Guide by CCH. Guides like this are expensive, but provide the most comprehensive guide to tax accounting available.[7]

-

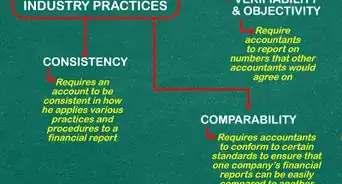

3Learn the differences between GAAP accounting and tax accounting. One of the most important parts of learning tax accounting is understanding the slightly different practices used by tax accountants as compared to regular accountants. These differences may impact the tax rate or value of a taxable asset that is recognized by a company or an individual. These are generally small changes that need to be accounted for to comply with federal, state, or local tax code.[8]

-

4Learn the basic formula for calculating taxable income and taxes payable. The key method for calculating the final tax expense owed by your client is a formula. This formula adjusts their accounting income with tax adjustments and other adjustments to arrive at a taxable income that is then multiplied by the appropriate income tax rate and further adjusted with applicable tax credits.[9] These adjustments vary by the type of tax accounting you want to focus on (personal or corporate) and also by your location and the type of business your client is in.

-

5Learn how to determine the client's credit eligibilities and filing requirements. As a tax accountant, it is crucial that you file your client's taxes properly and get them the largest possible refund. Doing this requires that you read the tax code to find places where your client can benefit from different tax credits and accounting strategies. In addition, you'll want to be sure that you are not missing any filing requirements. Both of these require an ability to know where to look in your applicable state and federal tax codes and a keen understanding of the language involved that can only be developed through trial-and-error practice.

-

6Understand the risk of making mistakes. As a tax professional, you may be held legally responsible for any mistakes you make when filing or calculating a client's taxes. With that in mind, it is important for you to know that risk and what you can do to minimize the impact on your career. For example, if you advise the client to file an amended return immediately after realizing your mistake, this may lower the risk to you. Mistakes will happen, and knowing the proper procedure to follow in these cases can save you a lot of money and trouble.[10]

Improving Your Knowledge

-

1Study the IRS's tax code releases. As part of a guide for the Registered Tax Return Preparer Test, the IRS has provided a list of resources that any aspiring tax accountant should study. The study guide, found here, includes a large variety of IRS forms, form instructions, and publications that will give you a basic knowledge of tax accounting procedure and IRS requirements.

- Consider looking at this study guide regularly during your learning process to ensure that you aren't overlooking any important aspects of tax accounting.

-

2Get sample tax forms and practice filing. You'll want to download sample form 1040 income tax return from the IRS to practice with. These forms, available here are the most basic individual tax return forms and will be used frequently by tax return preparers. Make sure that you understand each section in detail and are comfortable with filling them out.[11]

-

3Go online for help. If there any questions you have or things about the tax filing process that you don't understand, consider going to online forums for help. The largest of these websites have an active professional community of tax preparers and CPA's that are available to answer your questions and clarifying the nuances of tax accounting. To locate on, try searching online for "tax accounting forum."

-

4Learn on the job. If you want to learn more about tax accounting, try getting a job as a tax accounting assistant or a tax preparer. Both of these can be opportunities to increase your tax knowledge and experience while also making money. These jobs will also allow you to study the intricacies of local or state tax regulations in the area where you hope to practice tax accounting.

References

- ↑ http://www.investopedia.com/terms/t/tax-accounting.asp?header_alt=false

- ↑ http://www.learnhowtobecome.org/accountant/

- ↑ http://www.accountingcoach.com/blog/big-4-accounting

- ↑ http://www.accountingtoday.com/news/IRS-Issues-Free-Study-Guide-Tax-Prep-Exam-61156-1.html

- ↑ https://www.irs.gov/Tax-Professionals/PTIN-Requirements-for-Tax-Return-Preparers

- ↑ http://www.learnhowtobecome.org/accountant/

- ↑ http://www.advicefortaxpreparers.com/accounting-majors-the-three-tax-books-used-by-cpa-firms-every-day-that-colleges-do-not-give-you/

- ↑ http://www.pwc.com/ca/en/emerging-company/publications/pwc-tax-accounting-101-2012-02-en.pdf

- ↑ http://www.pwc.com/ca/en/emerging-company/publications/pwc-tax-accounting-101-2012-02-en.pdf

-Step-9.webp)

-Step-9.webp)