This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 492,472 times.

When you're providing funds for an online transaction or filling out form for direct deposit, you'll often be asked for your bank's routing number. That's a nine-digit number provided by the American Banker's Association (ABA) that uniquely identifies the location of you bank account. Fortunately, it's easy to find.

Steps

Finding the Routing Number on a Check

-

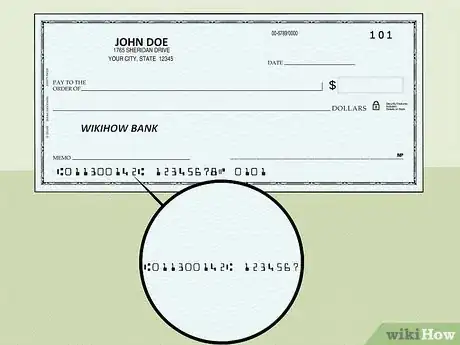

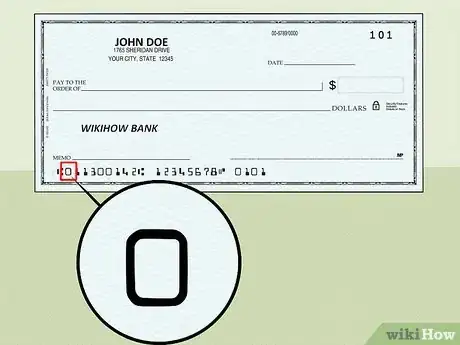

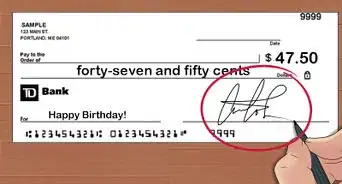

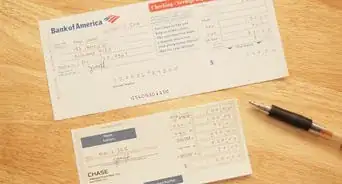

1Look in the lower left hand corner of the check. That's where routing numbers are located.

-

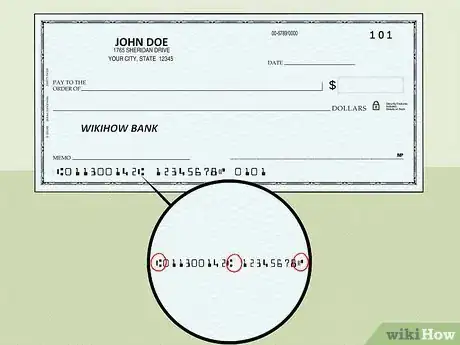

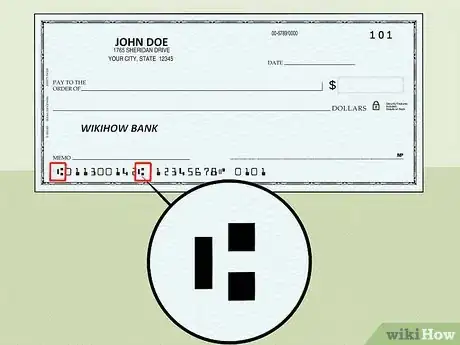

2Look for an icon on the check. The icon is a character is from the BankerScriber MICR font.[1] It's unintelligible and is not part of the routing number.Advertisement

-

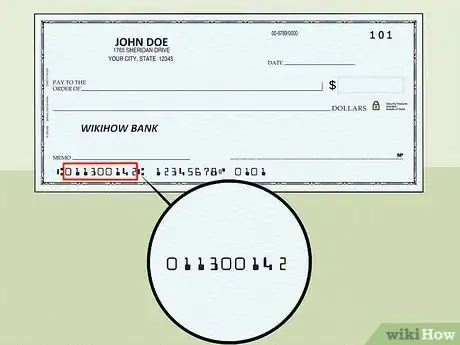

3Identify the first nine numbers. All routing numbers are nine numbers. The first nine numbers in the lower, left-hand part of your check after the MICR character is your routing number.

- Be sure to exclude any preceding MICR characters when determining your routing number.

- Following your routing number, the next set of numbers, up until the next MICR character, is your account number.

- The number following the MICR character at the end of the account number should match your check number.

-

4Confirm your routing number by using symbols. The MICR symbols designating your routing number looks like a vertical line on the left, with two squares, one on top of the other, on the right. The numbers between those characters is your routing number.

-

5Examine the first digit of your routing number. All routing numbers begin with the number 0, 1, 2 or 3.

Contacting Your Bank

-

1Check online for your bank's routing number. Remember, the routing number isn't secure, so it's publicly available. You can often find it online.

- Visit your bank's website and look for a link that will provide information about routing numbers. Often, banks have routing number information published online.

- Google your bank's name plus the words "routing number." If you can't find it by looking directly at your bank's website, try Google. You might be surprised at how often you can find something with Google that you can't find easily at a company site.

-

2Call your bank and ask for the routing number. One of the most reliable ways to get an accurate routing number is to talk to someone who's actually experienced in providing that information.

-

3Visit your bank and ask a customer service representative for the routing number. If you'd like to work with someone locally, instead of at a call center, you should visit your bank and talk to someone who can provide you with your routing number.

Warnings

- Don’t rely on a deposit slip to find your routing number. Depending on the bank, the numbers listed on a deposit slip may be different from the numbers listed on a check.⧼thumbs_response⧽

References

About This Article

To locate a routing number on a check, look at the bottom, left hand corner of your check. The routing number will start with a 0, 1, 2 or 3. If you’re still unsure that you have the right numbers, Google your bank's name plus the words "routing number" or call your bank’s customer service. For more detailed descriptions of how to find the routing number and to know what those other numbers are on the bottom of your check, keep reading.