This article was co-authored by Derick Vogel. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

This article has been viewed 452,077 times.

The rules for cashing a check made out to 2 individuals varies depending on the bank as well as how the check was written. Checks made out to either individual using the word “or” can be cashed by either person. If the check was made out to both people using the word “and,” then it has to be cashed by both parties. It’s important to clarify the rules with the bank first to find out what you need to do to ensure the check clears. Then, tackle any roadblocks, such as by getting the other person’s signature. Most checks are pretty easy to take care of as long as you’re aware of the bank’s rules.

Things You Should Know

- Check the pay-to line; if it says “or” or “and/or,” you can cash the check easily. Sign the back of the check and deposit it at the bank or via mobile app.

- Cash the check with the other person if the names are separated by “and.” Both of you should endorse it and visit the bank together to get the money.

- Ask the payer to rewrite the check if you can’t cash it, or get a notarized power of attorney if the other person on the check cannot sign it.

Steps

Clearing Checks Written out to Either Person

-

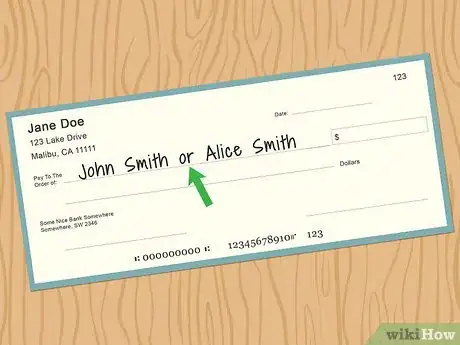

1Check the pay to line for the word “or.” If the payer wrote “or” or “and/or” between the names, then cashing the check won’t be a problem. Banks treat these kinds of checks as payable to either name listed. In most cases, you don’t even have to do anything special to get the check cashed. Treat it like a check made out to a single person.[1]

- If the payer listed the names without any word between them, then it gets a little more complicated. Generally, banks let either person cash the check, but the rules can vary from place to place.

-

2Sign the back of the check. Write your name in the endorsement section on the back of the check. Only one of the people listed on the pay to line needs to sign it to make it valid. Once that person signs it, they can cash it whichever way they prefer.[2]

- Before trying to cash the check, you may want to clear the air with the other person listed on it. They may feel entitled to a portion of the money.

- Wait until you're at the bank in front of the teller to sign your check unless you plan on depositing it over your phone.

Advertisement -

3Take the check to the bank to exchange it for cash. You can cash the check at your own bank or the bank the check was drafted from. The teller will be able to clarify the bank’s rules before approving the check by hand and giving you the money.[3]

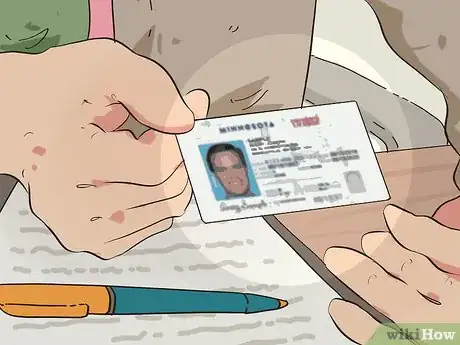

- Bring a government-issued ID along, such as a driver’s license or passport. Make sure it includes your portrait and signature. Expect the teller to ask for it to verify that you are the person listed on the check.

- When you get a confusing check, such as one where the names are separated by a comma, cash it in person. Let a teller verify it so you don’t end up with unexpected fees from an ATM.

-

4Use an ATM or mobile app to deposit the check. If you don't need the money right away, you can deposit the check instead of cashing it. Head to your bank to deposit the check through an ATM or use your smartphone to deposit the check online.[4]

- To use a mobile app, you need to have an account with the bank. Make sure the account name matches the one on the check. The app deposits the check into the account.

- Keep the physical check in a safe place until the funds clear in your bank account.

Handling Checks Written out to Both People

-

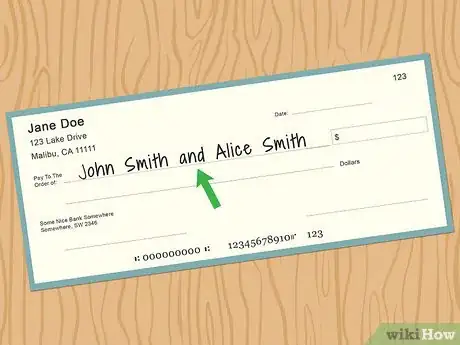

1Look at the pay to line to see if the names are separated by “and.” If the word “and” is present, then the check belongs to both people listed. You cannot cash this kind of check on your own. That means you have to get in touch with the other person listed to arrange a visit to the bank. There are no alternative ways to cash this kind of check.[5]

- Be careful about trying to cash checks the wrong way. If it is specifically made out to both people, expect banks to be vigilant about fraud. They won’t approve the check.

-

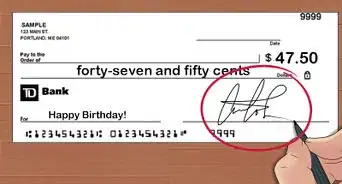

2Have both people endorse the check. Both people need to sign their names on the back of the check. Make sure both names are legible and positioned in the endorsement section at the top. The names have to match the ones written on the front or else the bank may reject the check, forcing you to ask the payee to write out a new one.[6]

- If your name is misspelled, sign your name with the misspelling first, then sign it a second time the correct way.

-

3Schedule a joint visit to the bank to cash the check. If you don’t have a joint account to work with, you will need to go to the bank. Both people have to go together or else the bank won’t cash it. Speak with a teller directly to avoid any potential issues and fees.[7]

- If both people aren’t able to be in the bank at the same time, then you can’t cash the check. Usually, the best solution is to ask the payer to rewrite the check.

-

4Show your ID to the teller if necessary. Each person on the check needs to have a government-issued ID. Pick one with your name, portrait, and signature on it to help the teller verify your identity. Try using a driver’s license, for instance, or a passport. After the teller verifies the information, they then deposit the check into the account you chose.[8]

- You can’t bring in the other person’s ID. They have to be there with you to present their ID to the teller.

- Some banks may even ask you to endorse the check in person. This is uncommon, but it happens sometimes with confusing or valuable checks.

-

5Deposit the check into a joint account as an alternative. Choose an account both you and the other person share, if possible. It’s the simplest way to handle the check. Since both names are on the account, the bank accepts the check automatically. Many banks and credit unions also let you deposit joint checks through mobile apps or ATMs this way.[9]

- Keep in mind that you have to have a joint account. It doesn’t matter what bank you choose, but pick an accessible one and take the check there.

- Remember any special rules your bank has. For example, large banks have regulations stating that you have to have a joint account in order to cash a tax refund.

- Keep in mind that anyone with access to the account can withdraw the money. You won't be able to cash it at the bank. It has to be deposited.

Overcoming Roadblocks

-

1Call the bank if you have any questions. If the check was written in a confusing manner or you're not sure where to cash it, reach out to the bank. Read the teller the information on the "pay to" line to find out if the other person needs to be there when you cash the check. Ask what kind of proof of identity you need to bring, as well.

- You can reach out to the bank that drafted the check or the bank you have an account at.

-

2Ask the payer to rewrite the check if you can’t cash it. The main way to fix the issue is with a fresh check. Have the payer write the word “or” between the names this time. If that isn’t possible, convince the payer to split the amount and write separate checks addressed to each person.[10]

- Getting the check redone can be a hassle, especially if you’re dealing with something like a tax refund from the government. However, it’s the only way to ensure the bank accepts the check.

- For example, if the other person listed is in jail, incapacitated, or you no longer have contact with them, then you’re better off asking for a new check.

-

3Get a notarized power of attorney if the other person is unable to sign. This is a possibility if the other person is unable to cash the check for physical or medical reasons, among other issues. To obtain power of attorney, download a power of attorney form and have the other person sign it. Submit it to your state’s finance and taxation department to legalize it. The power of attorney gives you permission to handle financial matters on the other person’s behalf, which includes cashing checks.[11]

- For example, if the other person is elderly or in jail, then having a power of attorney can give you the right to cash a check with their name on it.

- The power of attorney form needs to be signed and notarized by another adult. Contact a lawyer to help take care of this part.

Community Q&A

-

QuestionI deposited an escrow check made out to me and my ex-wife. My bank accepted it with only my signature on it. Am I obligated to contact her and give her part of the money?

DonaganTop AnswererIf the check was made out to you and your ex (as opposed to or), the bank should have required both signatures before depositing the check. Whether "and" or "or," your ex does have a legal claim to some or all of the proceeds.

DonaganTop AnswererIf the check was made out to you and your ex (as opposed to or), the bank should have required both signatures before depositing the check. Whether "and" or "or," your ex does have a legal claim to some or all of the proceeds. -

QuestionI received a security deposit check refund with both my name and my roommate's name on it. She has left the country and will not be around to endorse it. Will I be able to deposit it without her?

EricTop AnswererIf the check is payable to you and your roommate, you will not be able to cash or deposit the check without her endorsement. It may be easiest for you to request that a replacement refund check be issued to each of you individually so that you can cash your portion of the refund.

EricTop AnswererIf the check is payable to you and your roommate, you will not be able to cash or deposit the check without her endorsement. It may be easiest for you to request that a replacement refund check be issued to each of you individually so that you can cash your portion of the refund. -

QuestionIf the two names are separated by a /, do both parties need to sign the check to deposit it?

DonaganTop AnswererBecause a slash (or stroke) mark does not mean "and," you probably do not need both parties to sign, but it would be up to the banker in charge to decide.

DonaganTop AnswererBecause a slash (or stroke) mark does not mean "and," you probably do not need both parties to sign, but it would be up to the banker in charge to decide.

Warnings

- Attempting to cash a check fraudulently can get you into legal trouble. Don’t try to trick the bank into accepting a check when you need someone else’s signature on it.⧼thumbs_response⧽

References

- ↑ https://www.consumerfinance.gov/ask-cfpb/i-received-a-check-payable-to-both-my-spouse-and-myself-do-both-of-us-have-to-sign-the-back-of-the-check-en-941/

- ↑ https://www.mybanktracker.com/news/deposit-check-written-payees#/What_is_the_difference_between_ldquoandrdquo_and_ldquoorrdquo_on_Two-Party_Checks

- ↑ https://www.mybanktracker.com/news/deposit-check-written-payees#/What_is_the_difference_between_ldquoandrdquo_and_ldquoorrdquo_on_Two-Party_Checks

- ↑ https://firstquarterfinance.com/where-can-i-cash-a-two-party-check/

- ↑ https://www.consumerfinance.gov/ask-cfpb/i-received-a-check-payable-to-both-my-spouse-and-myself-do-both-of-us-have-to-sign-the-back-of-the-check-en-941/

- ↑ https://www.consumerfinance.gov/ask-cfpb/i-received-a-check-payable-to-both-my-spouse-and-myself-do-both-of-us-have-to-sign-the-back-of-the-check-en-941/

- ↑ https://firstquarterfinance.com/where-can-i-cash-a-two-party-check/

- ↑ https://firstquarterfinance.com/where-can-i-cash-a-two-party-check/

- ↑ https://www.pocketpence.co.uk/can-cash-check-two-people-8524818.html

About This Article

To cash a check made out to 2 people, first look at the “Payable To” line to see how the check is written. If the names are separated by a comma, “or,” “and/or,” or nothing at all, you can endorse and cash the check yourself. To cash a check with 2 names separated by “and,” contact your bank or financial institution, since every bank has its own rules about this. You probably will have to endorse the check and get the other party to endorse it, too. Also, you and the other person may have to go to the bank together to cash the check. To learn how to cash a check made out to 2 people if the other person is unavailable, in jail, or dead, read on!