This article was co-authored by Hovanes Margarian. Hovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects (aka Lemon Law), and consumer class action cases. He holds a BS in Biology from the University of Southern California (USC). Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.

This article has been viewed 222,271 times.

There are many benefits to paying off a car loan quickly. You save money on your loan interest and improve your credit rating, to name just two. Although most financial institutions may expect you to make a car loan payment each month, there are methods you can practice in your financial planning that will allow you to pay your car loan off faster and save money. To get started, figure out the details of your loan, what steps you can take, and how to save more money to get the loan paid off more quickly.

Steps

Determining Your Current Balance and Payoff Penalties

-

1Determine the exact payoff amount of your car loan. Obtaining the exact amount of money owed on your car loan will allow you to make financial plans regarding paying off the loan.[1] If you do online banking, this information can be found under your account summary. Alternately, you can review your mailed monthly statement.

-

2Obtain a copy of your bank or loan agreement. You can request this from your financial institution in person or by logging in to your personal account on your lender's website. Speak directly with a loan adviser or review the terms and conditions of your loan to determine if penalties apply for paying the car loan off quickly.

- Some banks or financial institutions may charge you fees or penalties for paying off the car loan sooner than the original life of the loan, especially if you cause them to lose money in interest. These are typically called "prepayment penalties."

Advertisement -

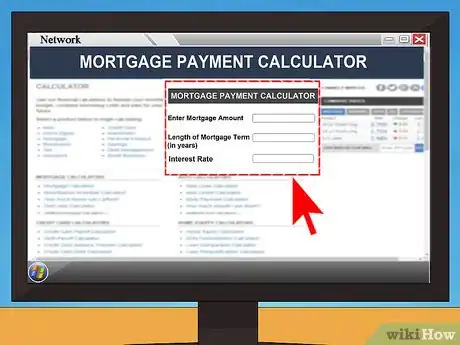

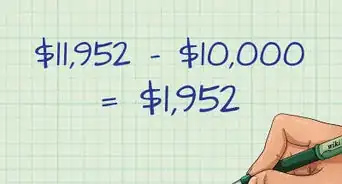

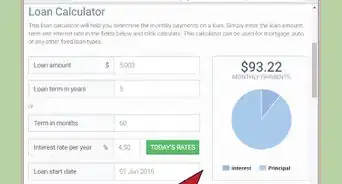

3Calculate savings as a result of making extra payments. You can find online loan payoff calculators at Bankrate.com or MortgageLoan.com where you can plug in your loan's interest rate, monthly payment and payoff amount. Then you will be able to compare how much you can save by paying the car off in one lump sum, making payments twice a month, or increasing the amount of your monthly payments.[2]

- If there are penalties for paying off your car loan early, compare the savings you calculated with the amount of the penalties. Then you will know if you will save money by paying off your loan early.

-

4Consult with your financial institution for loan payoff recommendations. Your loan advisor may be able to educate you on the most beneficial way for you to pay off your car loan faster, especially if penalties apply. For example, ask your lender if they can decrease the balance of your car loan if you can pay the remaining balance in one lump sum.[3]

- In some cases, lenders may lower the remaining balance of your car loan substantially if you can pay off the remaining balance with just one payment.

Paying down the Principal

-

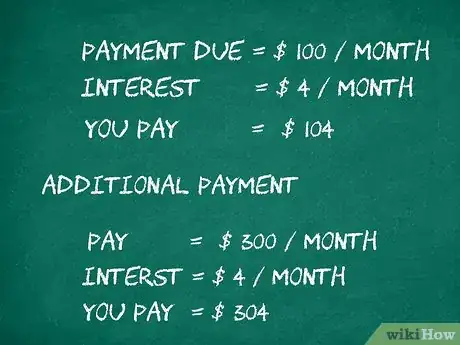

1Determine if you can make additional payments to the principal balance only. Some lenders may only charge you a fixed monthly interest, which can allow you to apply additional payments toward the principal amount. However, other lenders may charge you interest on every payment you make. Ask your lender if you can make additional payments toward the principal amount of the loan without having to pay interest. If so, you can plan to make small, additional payments toward the loan each month and pay less in interest over the life of the loan.

- An example of the difference between the kinds of interest you pay is: if you have a $100 payment due every month with $4 interest that means you pay $104 per month. What you need to find out is if that $4 is a fixed amount per month, which would mean no matter how much you might pay on the principal ($100, $200, $300) you still pay just $4 monthly interest. If, however, they charge interest on every payment, you would end up paying 4% interest on whatever you are putting down on the principal -- $8 if you chose to pay $200 instead of $100, for example.

- Even if you have to pay interest on each payment, it is usually worth your while to make extra principal payments to pay your loan off faster.

-

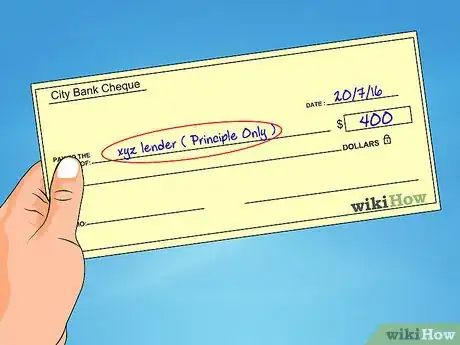

2Make a separate payment for principal. Use a check or pay online to make an extra payment per month, that is separate from your regular car loan payment. Write “Principal Only” on the check so that the lender will not count it toward your loan payment for the next month.[4]

- If you are paying online, pay the extra principal amount before you are billed for the next month.

-

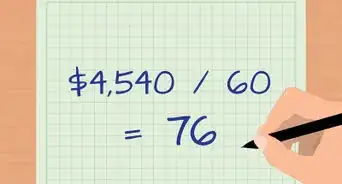

3Make biweekly payments. Instead of making one monthly payment, split it in half and make payments every two weeks. This typically works out to twice per month, but by the end of the year you will have made two more biweekly payments (one full payment) because most months are longer than an exact 4 weeks. In other words, make 26 half-payments per year (every other week for 52 weeks) that will equal 13 full payments, rather than the 12 you would've otherwise paid. This means that the total amount you owe will go down faster, saving you interest on the loan.[5]

Finding Additional Revenue

-

1Apply extra earnings or cash gifts to your car loan. Extra income such as tax refunds, bonuses from your job, or cash gifts from birthdays or holidays could be applied to your car loan, resulting in a faster payoff. You will be paying more in interest on your car loan than you would earn in a savings or money market account.[6]

-

2Earn extra income. If you have the time outside your normal work hours, consider starting a side business in order to generate additional money to pay down your car loan. Examples of side businesses are:

- Rent out a room in your home. This could be for a student or someone staying in your town temporarily for a job. You can advertise this on your local craigslist.com.

- Mow lawns and/or shovel snow.

- Run errands for elderly people or busy professionals.

- Buy china, artwork, tools, jewelry, books, etc. for low prices at estate sales and flea markets and then sell them on eBay.

- Offer at-home party sales. Check out Tupperware, Pampered Chef, Longaberger baskets, Silpada jewelry, Mary Kay cosmetics, Cabi clothing, and The Happy Gardener. If you organize a sales team you’ll be able to reap a percentage of their profits as well.

-

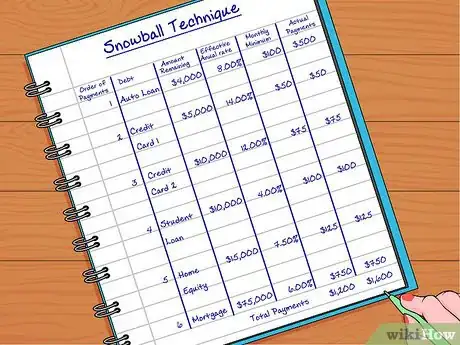

3Use the snowball technique. If you have paid off one of your credit cards, for example, continue to pay that former monthly amount toward your car loan. Then you won't be tempted to spend it on other things.

-

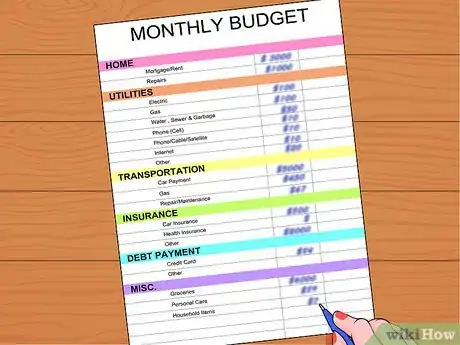

4Establish a budget and minimize extra expenses.[7] Make a list of your monthly income and expenses, including expenses that occur only once or twice a year. Then you will be able to see if you have extra cash at the end of the month to pay down your car loan. If you don't have extra cash, look for areas where you can cut expenses.[8]

- Eliminate expenses you do not need such as cable television channels or a landline telephone. The money you apply to costs such as these can be applied toward your car loan instead.

- Seek lower rates on mandatory expenses and bills such as auto insurance, internet bills, or cell phone bills by consulting with each of your service providers for bundled or promotional rates. You can get auto insurance quotes online to compare to your current policy.[9]

- Lower your food expenses by cooking or preparing meals at home rather than eating out in restaurants. In most cases, a specific meal will cost significantly more if you purchase it from a restaurant than if you buy the meal or ingredients from a grocery store.

Preparing for the Next Car Purchase

-

1Ask about car loans at your bank.[10] Banks will often have much better deals than car dealerships, so look at the loans offered at your bank. Talk to a bank employee about how the loans work, how much interest and what kind they charge, and if there are prepayment penalties. If you choose to take out a car loan with your bank, make sure to take the information about the bank and the loan to the car dealership so that they have the information.

-

2Don't take out a car loan with prepayment penalties. Now that you've learned how to pay off a car loan faster, you know how detrimental it is if there are prepayment penalties. There are many choices of where to take out a car loan, so next time make sure you choose a financial institution that does not require prepayment penalties.

-

3Continue paying yourself the monthly car payment. The fastest way to pay off a loan is to not take one out in the first place. If you were paying $300 a month for your car loan and the loan is now paid off, continue to put this amount in a savings or money market account. Then when you are ready to buy your next car you can pay in cash for a large down payment or the entire amount.

-

4Continue to budget and cut expenses. If you have started to make and follow a budget while cutting expenses, keep up these good habits. Put any money you save into a money market account to earn interest. Or if you don't plan on buying a new car for 3-5 years, you could invest this money in a certificate of deposit (CD). Then you will be able to make a large down payment or not have to take out a loan for your next car.[11]

References

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ http://budgeting.thenest.com/paying-off-new-car-loan-early-3487.html

- ↑ http://www.thesupercars.org/car-tips/how-to-pay-off-your-car-loan-early/

- ↑ http://www.thesupercars.org/car-tips/how-to-pay-off-your-car-loan-early/

- ↑ http://budgeting.thenest.com/paying-off-new-car-loan-early-3487.html

- ↑ http://budgeting.thenest.com/paying-off-new-car-loan-early-3487.html

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ https://couplemoney.com/cars-and-road-trips/how-to-pay-off-car-loan/

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ https://www.depositaccounts.com/cd/?gclid=CjwKEAiAhPCyBRCtwMDS5tzT03gSJADZ8VjRZCKaknRatF6Tj9n7j7lwjGXyRc5i-dqfG6pWCzXvbBoCE-Lw_wcB