This article was co-authored by Hovanes Margarian. Hovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects (aka Lemon Law), and consumer class action cases. He holds a BS in Biology from the University of Southern California (USC). Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.

There are 7 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 186,732 times.

Finance charges applied to a car loan are the actual charges for the cost of borrowing the money needed to purchase your car. The finance charge that is associated with your car loan is directly contingent upon three variables: loan amount, interest rate, and loan term. Modifying any or all of these variables will change the amount of finance charges you will pay for the loan. There are a number of ways to reduce finance charges on a loan, and the method you choose will be contingent upon whether you already have a loan or are taking out a new loan. Knowing your options can help you save money and pay off your vehicle faster.

Steps

Reducing Finance Charges for a New Loan

-

1Learn your credit score. Automobile loans are largely determined by the borrower's credit score; the better the borrower's credit score is, the lower his interest rate will likely be. Knowing your credit score before you apply for an automobile loan can help ensure that you get the best possible loan terms. You can obtain a free copy of your credit report (one free copy is guaranteed every 12 months) by visiting AnnualCreditReport.com or by calling 1-877-322-8228.

- Your credit report won't explicitly contain your credit score, but it will contain information that determines your credit score. Because of this, it's tremendously important to review all of the information contained in your credit report and understand what determines your credit score to ensure that there are no errors.[1]

- If your credit score is low, you may need to improve your credit score. Improving your credit score will likely get you much better terms on your loan.[2] If you can hold off on purchasing your vehicle until you've repaired your credit, it may be worth waiting.[3]

- Consider contacting a credit counseling organization to help you rebuild your credit. A credit counselor can work with you to build and stick to a budget, and can even help you manage your income and your debts. You can find a credit counseling organization near you by searching online - just be clear on the terms and fees of the services offered before signing up with a credit counselor.[4]

-

2Shop around for your loan. Most dealerships offer automobile loans at the dealership, which can make it convenient for buyers. However, the dealership may not be offering the best available loan. Many automobile dealers arrange loans by acting as a "middle man" between you and a bank, which means that the dealership may charge you extra to compensate for its services.[5] Even if the dealership's fees aren't unreasonable, it's likely that the dealer will then sell your contract to a bank, credit union, or finance company, and you may end up making payments to that third party. Even if you end up going with the dealer's financing option, it's worth shopping around for a better loan from a local bank or credit union.[6]Advertisement

-

3Don't take out a small loan. Every loan term is different, depending on factors like your credit score and the amount you're requesting to borrow. Smaller loans typically have very high monthly finance charges, because the bank makes money off of these charges and they know that a smaller loan will be paid off more quickly.[7] If you intend to take out an auto loan for only a few thousand dollars, it may be worth saving up until you have the whole amount that you'll need to purchase an automobile, or purchasing an automobile that fits in your available price range.[8]

-

4Get a pre-approved loan before you buy a car. Pre-approved loans are arranged in advance with a bank or financial institution. This may be helpful, as many people feel pressured to go with the loan options that a dealer offers at the car lot, and end up getting a loan with high finance charges. If you get a pre-approved loan beforehand, you'll know exactly how much you can afford to spend on an automobile, which will also help you stay within your budget.[9]

-

5Consider leasing instead of buying. Leasing a vehicle allows you to use your vehicle for an arranged duration of time and a predetermined number of miles.[10] You won't own your car, but lease payments are typically lower than what the monthly payments on a loan would be for the exact same vehicle. Some lease terms also give you the option of purchasing your vehicle at the end of the leasing period. Before you decide to lease, it may be helpful to consider:

- the lease costs at the beginning, middle, and end of the leasing period

- what leasing offers and terms are available to you

- how long you want to keep the automobile

Refinancing an Existing Loan

-

1Contact your lender. You can apply to refinance your automobile loan with the lender from the original loan, or you can switch to a new lender. Lenders who allow refinancing will replace your existing loan with a new loan, typically offering lower monthly finance charges.[11] Not every lender will allow borrowers to refinance a loan, so it may be worth comparing your options to determine which lender to go with, or whether you're eligible to refinance at all.[12]

-

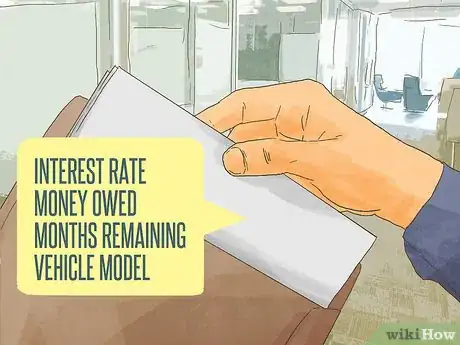

2Gather the necessary information. As part of the refinancing application process, you'll need some basic information to provide the lender. Before you apply to refinance your loan, you'll need to have ready:

- your current interest rate[13]

- how much money is still owed on the existing loan[14]

- how many months remain in the existing loan's terms[15]

- the make, model, and current odometer reading of your vehicle[16]

- the current value of your vehicle[17]

- your current income and employment history[18]

- your current credit score[19]

-

3Compare refinance loan options.[20] If you are eligible for an automobile loan refinance with your existing lender, you may be eligible for a better loan through a different lending institution. It's worth comparing your refinance loan options to get the best available loan terms.[21] When you search around and compare refinance options, it's worth considering:

Pre-paying an Existing Loan

-

1Learn whether you're able to pre-pay your loan. If refinancing isn't an option, you may be eligible for pre-paying your loan. Pre-payment, also called early loan payoff, simply means that you pay off your debt before the agreed-upon end date of an existing loan. The benefit of pre-paying your loan is that you're not subjected to the monthly finance charges you would otherwise be paying on your loan, but for that reason many lenders charge a pre-payment penalty or fee. The terms of your existing loan should specify whether there is any pre-payment or early loan payoff penalty, but if you're unsure you can always consult with your lender.

-

2Learn the pre-payment process for your lender. If your lender permits you to make pre-payments on your loan, there may be a special process for making those payments. These payments are sometimes referred to as principal-only payments, and it's important to specify to your lender that you intend for that payment to be applied to the principal loan, not the finance charges for upcoming months. Each lender's process may be different, so it's best to call or email the lender's customer service department and ask what you need to do to make a principal-only payment towards your loan.

-

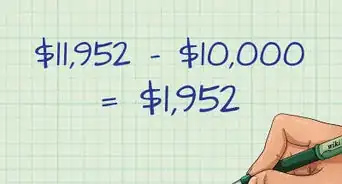

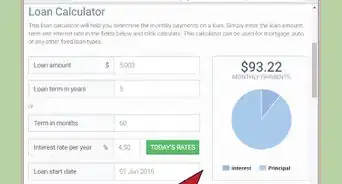

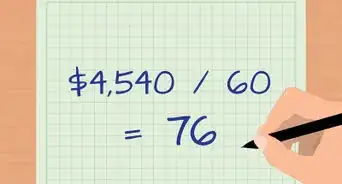

3Calculate your early loan payoff amount. There are many early loan payoff "calculators" available online, but all of them factor in the same basic information to determine how much you will need to pay in order to payoff your loan early:

- the total number of months in your existing loan term

- the number of months remaining on your existing loan

- the amount your existing loan was for

- the monthly payments remaining on your loan

- the current annual interest rate (APR) on your existing loan

Expert Q&A

-

QuestionHow do you get pre-approval for a car loan?

Hovanes MargarianHovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects (aka Lemon Law), and consumer class action cases. He holds a BS in Biology from the University of Southern California (USC). Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.

Hovanes MargarianHovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects (aka Lemon Law), and consumer class action cases. He holds a BS in Biology from the University of Southern California (USC). Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.

Attorney Most car dealers, manufacturers, and credit unions allow you to get pre-approval. With credit unions, you apply, they approve you for a specific amount of money, and then you know you have up to that much to shop for a car. With a dealer, it can be a little more risky to seek pre-approval. If you go to a dealer and say, "Can you approve me for $30,000?" All of the sudden, you've told them how much you can afford and they may give you as cheap of a car as they can find for that amount of money. In order to get the best deal, make sure not to rush the process. Be willing to negotiate and go to a few different places.

Most car dealers, manufacturers, and credit unions allow you to get pre-approval. With credit unions, you apply, they approve you for a specific amount of money, and then you know you have up to that much to shop for a car. With a dealer, it can be a little more risky to seek pre-approval. If you go to a dealer and say, "Can you approve me for $30,000?" All of the sudden, you've told them how much you can afford and they may give you as cheap of a car as they can find for that amount of money. In order to get the best deal, make sure not to rush the process. Be willing to negotiate and go to a few different places.

References

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ http://www.investopedia.com/financial-edge/0611/-6-ways-to-cut-the-cost-of-your-car-loan.aspx

- ↑ http://www.consumer.ftc.gov/articles/0058-credit-repair-how-help-yourself

- ↑ http://www.investopedia.com/financial-edge/0611/-6-ways-to-cut-the-cost-of-your-car-loan.aspx

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ http://www.investopedia.com/financial-edge/0611/-6-ways-to-cut-the-cost-of-your-car-loan.aspx

- ↑ http://www.investopedia.com/financial-edge/0611/-6-ways-to-cut-the-cost-of-your-car-loan.aspx

- ↑ http://www.dmv.org/how-to-guides/auto-financing.php

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ http://www.investopedia.com/terms/r/refinance.asp

- ↑ http://www.dmv.org/buy-sell/auto-loans/auto-loan-refinancing.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/auto-loan-refinancing.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/auto-loan-refinancing.php

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

- ↑ http://www.dmv.org/buy-sell/auto-loans/how-to-refinance-a-car-loan.php

About This Article

Finance charges are interest-based fees that are applied to your car loan. To soften the blow of heavy finance charges when taking out a new loan, shop around with local banks and credit unions, which might be able to offer you better rates than your dealership. If you’ve already got a loan with your dealership, you can also look for a new lender who can take on your loan for a better price. Make sure you compare the overall cost of the loan, including fees and interest, and not just the basic monthly payment. If you have extra funds, you might be able to pre-pay your loan to save on future finance charges. Talk to your lender to explore this option. For more tips from our Financial co-author, including how to calculate an early loan payoff cost, read on!