This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 14 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 25,689 times.

After you divorce, you might think that you own your car outright because the divorce decree states that you are the sole owner. However, your ex is still responsible for the debt if their name remains on the car loan. You can remove your ex from the loan using several different methods—refinance the loan, pay off the loan, ask for a substitute loan agreement, or sell the car. You should choose whichever method works best for you.

Steps

Refinancing Your Car Loan

-

1Ask the lender if you can refinance. When you refinance, you get a new loan. As part of the refinancing process, you can have the loan put only in your name. Call up your lender and ask if you can refinance.[1]

- If your lender won’t refinance, then you could find a new lender who will. Check with credit unions, since they tend to charge the lowest interest rates. You will still have to pledge your car as collateral for the loan.

- You should only ask to remove your ex from the car loan if you know you can make payments. If you can’t make payments, then you’ll probably lose the car.

-

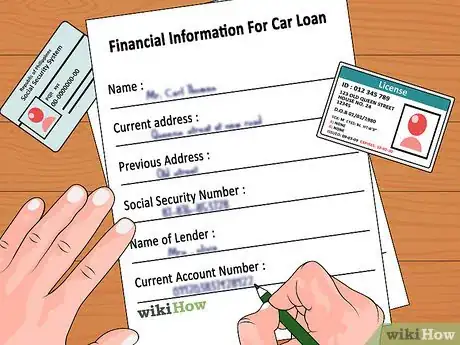

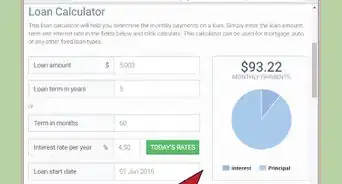

2Gather financial information. The lender will analyze your credit score and financial information to decide whether you can refinance the loan on your own.[2] You will need to provide the following information as part of the application process:[3]

- your Social Security Number

- current and previous addresses

- name of current employer

- name of your current lender

- your current account number for the car loan

- paystubs or other evidence of income, such as W-2 forms

- balance on your current loan

Advertisement -

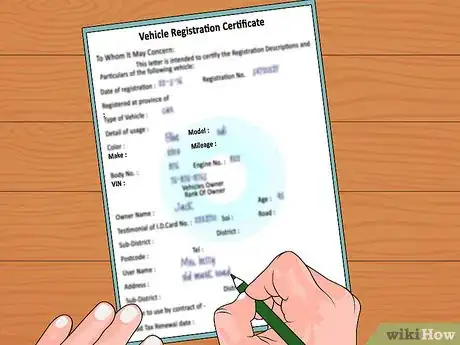

3Get information about the vehicle. You will also need to provide the refinancing company with information about the vehicle. You should gather the following information:[4]

- vehicle make, model, and year

- mileage

- VIN (Vehicle Identification Number)

- vehicle features or special options

-

4Continue to make payments on your current loan. The refinancing process could take a month or so. In the meantime, you need to continue to make payments on your current car loan.[5] If you stop, then you could go into default.

- If you go into default, your new refinance company might cancel the new loan and you won’t be able to refinance.

-

5Get a co-signer, if necessary. Your financial history might not be strong enough to allow the lender to refinance the loan in your own name. In this situation, you might need someone to cosign on your loan.[6] You could ask a family member if they would be willing to cosign.

- Try to avoid asking a new romantic partner. You don’t know how long the relationship will last. If it ends, then you’ll need to try and take their name off the loan.

-

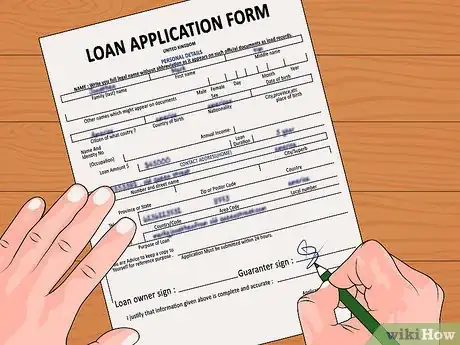

6Sign the new loan. Once you have everything in order, go to the lender and read through the loan document. Sign the new loan and make sure to get a copy for your records.[7]

- You might also want to notify your ex that they are no longer responsible for the loan because you have refinanced.

Paying Off the Car Loan

-

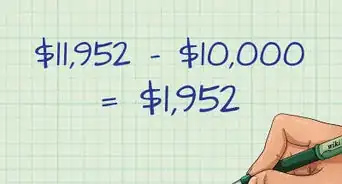

1Check how much you owe on the car loan. Another option is to actually pay off your car loan. If you don’t have the cash, then you can take out another loan. This loan will be a personal loan and not backed by the car.[8] First you need to know how much you owe on the car loan. Take out your paperwork and check.

- If you can’t find your paperwork, then call the lender and ask for your current balance.

- Also tell the lender you are thinking of paying off the loan in a lump sum. Give the lender a date and ask how much you will have to pay on that date.

-

2Find a personal loan. You have several options for getting a personal loan. Try to find favorable interest rates so that you don’t go deeper into debt. You can look for a personal loan in the following places:

- Credit unions. Generally, credit unions offer the lowest interest rates. They also might be willing to extend a loan if your credit isn’t perfect.[9] However, they tend to make smaller loans than banks.

- Banks. Banks may be choosier about who they lend to than credit unions. You may also have to pay a higher interest rate. However, if you have a relationship with a bank, then you should check about getting a personal loan. Banks tend to make the largest personal loans.

- Marketplace lenders. Lenders, like finance companies, are more likely to make loans to those with poor credit. The loans tend to be the smallest (around $2,000 on average).[10]

- Family members. People who know you might be willing to loan you money free of interest.

-

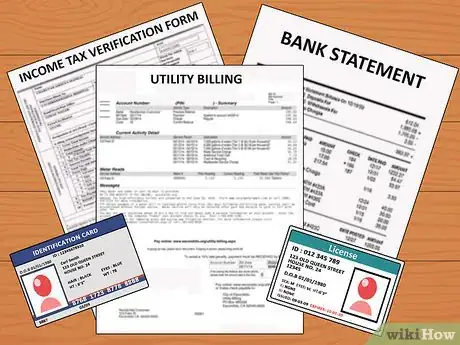

3Apply for a personal loan. You will need to contact a potential lender and ask if you can get a loan in the amount of your car loan balance. Lenders like banks and credit unions will want to see your financial history, so you should gather the following information for them:[11]

- documents that verify your current address, such as a utility bill, lease, or recent piece of mail

- list of previous addresses

- identification, such as a driver’s license, state-issued ID, or a passport

- proof of income, such as pay stubs, W-2 forms, tax returns, and bank statements

- summary of your current monthly debts (such as rent, student loans, credit cards, etc.)

- your employer’s contact information, such as name, address, and phone number

-

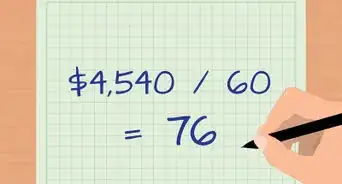

4Pay off the car loan. Once you have the money, you should pay off the entirety of your car loan. Now you own the car free and clear, and the debt no longer exists.[12] However, you still have to make payments on your personal loan.

Substituting a New Loan

-

1Ask your car lender for a “novation.” With a novation, you substitute your old loan with a new loan. You should call up your lender and ask that the loan be transferred into your name alone.[13]

- The original parties to the contract must agree to the novation.[14] This means that your ex, who is a party to the original loan, must agree as well.

-

2Negotiate the terms of the loan. At the same time that you substitute a new loan, you should try to get a better deal. Try to negotiate a lower interest rate, for example. Alternately, you could agree to a longer repayment period if you need to reduce the amount of your monthly payment.[15]

-

3Sign a new loan agreement. If the lender agrees to a novation, then they should send you paperwork to fill out and sign. Keep a copy for your own records. Also notify your ex that they are no longer responsible for the loan.

Selling Your Car

-

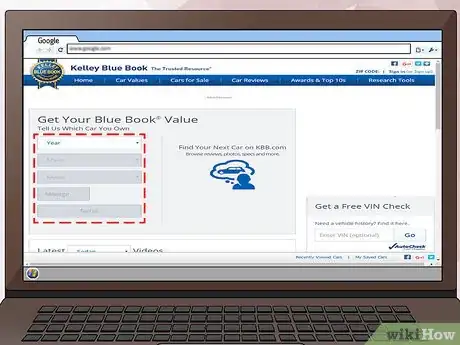

1Estimate the value of your car. You can look up the car’s value on websites such as Kelley Blue Book, Edmunds, or NADA Guides.[16] [17] [18] The car’s estimated value will depend on many factors. You should gather the following information:[19]

- make

- model

- mileage

- trim

- general condition (e.g., new, very good, good, poor, very poor)

- your location

-

2Find a new car. Before selling your car, you should have your eye on a new one—especially if you need a car to get to school or work. Look around and find something that is affordable. Remember that you may have to give your ex a portion of the proceeds from the sale. Accordingly, look for a car that fits within your budget. You can find cars in the following places:

- Craigslist

- eBay Motors

- Autotrader

- Cars.com

-

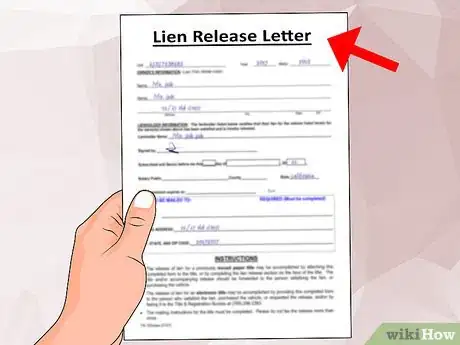

3Get the lender’s permission. Since the car still serves as collateral on the loan, you will need the lender’s permission before you sell it. Call up the lender and ask if you can get a lien release.[20]

- You might not have the money to pay off the loan until you sell the car. In this situation, you can use an escrow service to handle the sale. The escrow will pay off the loan and transfer ownership at the same time. Ask the lender if there is an escrow service they recommend.

- Alternately, you could close the sale with the buyer at the bank. You turn over the proceeds to your lender. Talk to the bank about what option is best.

-

4Trade in your old car. If you want to buy your new car from a dealer, then you should think about trading in your old car. When you trade in, you and the dealer come to an agreement on the value of the car. That amount is then deducted from the amount you have to pay for your new car.

- You might get less money when you trade in with a dealer than if you sold the car on your own.[21] However, the process is usually much simpler.

-

5Advertise your car. Instead of trading in the car, you might want to sell it directly to a buyer. You can certainly do that. You should try to price your car competitively. Get the Blue Book number and then compare it to what people are charging for their cars in your area.

- You can typically advertise cars in the same places where you found used cars being sold—eBay Motors, Craigslist, etc.

-

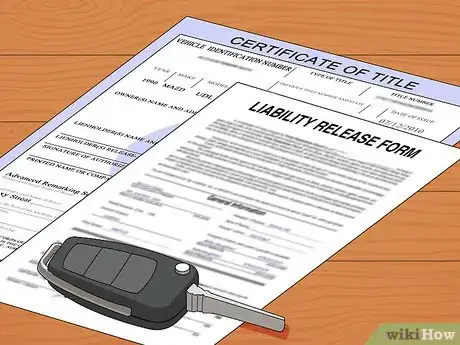

6Sell your car. If you sell to a buyer directly, then make sure to complete all of the required paperwork. You should fill out a bill of sale and sign over the title to the buyer. If your ex was on the title, then they should also sign these documents. You may also need to provide the following:[22]

- Fill out the Release of Liability, which you may need to submit to your Department of Motor Vehicles.

- Provide the buyer with warranty documents, if any.

- Give the buyer maintenance records.

- Provide other paperwork as required by your state’s DMV.

-

7Give your ex part of the proceeds. If your ex was on the title to the vehicle, then you will need to give them half of the proceeds since they are part owner of the vehicle. Talk with your ex. You might be able to come to an agreement to pay them less than half, especially if you made all of the payments on the vehicle.

- You can use your portion of the proceeds as a down payment on your new car.

References

- ↑ https://www.avvo.com/legal-guides/ugc/getting-your-ex-off-a-car-loan

- ↑ https://www.avvo.com/legal-guides/ugc/getting-your-ex-off-a-car-loan

- ↑ https://www.chase.com/personal/auto-loans/checklist/refinance-checklist

- ↑ https://www.chase.com/personal/auto-loans/checklist/refinance-checklist

- ↑ https://roadloans.com/auto-refinance/how-do-i-refinance-my-car-loan

- ↑ https://www.avvo.com/legal-guides/ugc/getting-your-ex-off-a-car-loan

- ↑ https://www.chase.com/personal/auto-loans/checklist/refinance-checklist

- ↑ https://www.avvo.com/legal-guides/ugc/getting-your-ex-off-a-car-loan

- ↑ https://www.nerdwallet.com/blog/loans/cheap-personal-loans/

- ↑ http://www.bankrate.com/finance/loans/where-can-i-get-personal-loan.aspx

- ↑ https://www.nerdwallet.com/blog/loans/cheap-personal-loans/

- ↑ https://www.avvo.com/legal-guides/ugc/getting-your-ex-off-a-car-loan

- ↑ https://www.avvo.com/legal-guides/ugc/getting-your-ex-off-a-car-loan

- ↑ https://www.law.cornell.edu/wex/novation

- ↑ https://www.avvo.com/legal-guides/ugc/getting-your-ex-off-a-car-loan

- ↑ http://www.kbb.com/

- ↑ http://www.edmunds.com/

- ↑ http://www.nadaguides.com/

- ↑ http://www.autotrader.com/car-values/

- ↑ http://www.cars.com/go/advice/Story.jsp?section=sell&story=sellLoan&subject=how_sell

- ↑ http://www.cars.com/go/advice/Story.jsp?section=sell&subject=how_trade&story=trdStory

- ↑ http://www.dmv.org/buy-sell/selling-your-car/guide-to-selling-your-car.php