This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 149,060 times.

While some people save until they can buy a car in full, most people take out a car loan. This makes newer and better cars more accessible to everyone. However, it also makes car ownership even more expensive in the long run. Before taking out a loan, you should consider the additional money you will pay in interest for the duration of your loan. These payments, also known as finance charges, will be included in your payments and can be calculated either as monthly payments or as a sum total over the life of your loan.

Steps

Clarifying the Terms of Your Loan

-

1Determine how much you will borrow. Typically, buyers will make a cash down payment on their new car and borrow from a lender to cover the remaining cost. This borrowed amount, known as the principal, will serve as the basis for your car loan.[1] Keep in mind that you should put as much money down on your car as possible to minimize the amount borrowed and reduce your finance charges.

- This step will require you to know roughly how much your new car will cost. See How to Buy a New Car for more information about finding a good price and working within your budget.

-

2Figure out the annual percentage rate (APR) and duration of your loan. The APR reflects how much additional money you will have to pay beyond your principal for each year of your loan. A low APR will reduce the yearly and monthly amounts of finance charges on your loan. However, many low-APR loans are longer in duration, so the overall cost may remain relatively high. Alternately, a short-term loan with a higher APR may end up being cheaper overall. This is why it is important to calculate your finance charges beforehand.

- Getting a low APR on your car loan may mean seeking other lenders beyond your car dealership. Be sure to do your research and select the cheapest available combination of APR and duration. See How to Get a Low APR on a Car Loan for more information.

Advertisement -

3Find out how many payments you will make each year. The majority of car loan payments are made on a monthly basis. When calculating your monthly payments, you will need to know both how many payments you will make each year and how many payments you will make in total. This information can be easily found in the terms of your car loan.[2]

Calculating Your Monthly Finance Charges

-

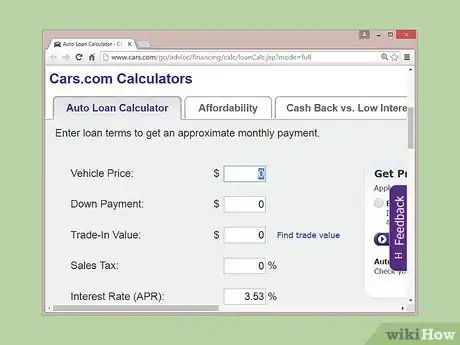

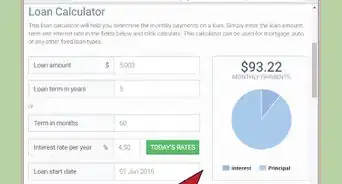

1Save time by using an online calculator. There are many car loan payment calculators available for free online. Take advantage of these free services if you don't want to spend the time calculating your payments yourself. Search "Car loan payment calculator" and you will be provided with many options.[3] If you still want to work it out by hand, continue to the next step.

-

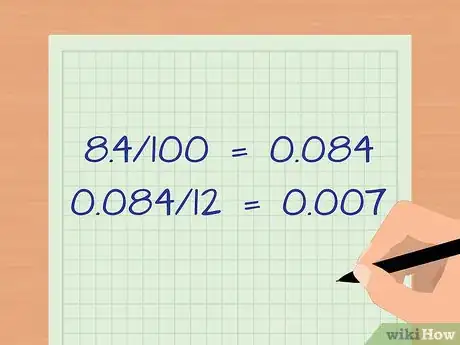

2Find your interest rate due on each payment. Start by converting your APR to a decimal by dividing it by 100. For example, if your APR is stated at 8.4%, 8.4/100 = 0.084. Next, find your monthly percentage rate by dividing your APR decimal by 12. So, 0.084/12 = 0.007. This is your monthly percentage rate expressed as a decimal.

-

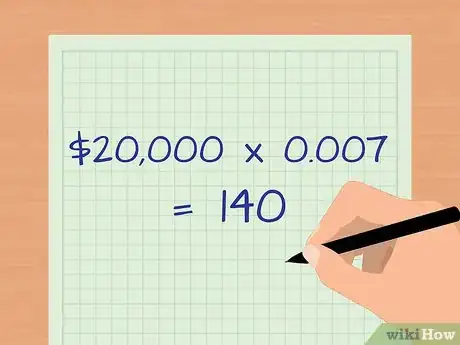

3Multiply your monthly percentage rate times your principal. If, for example, your principal were $20,000 (if you borrowed $20,000 to buy your car), you would multiply this by 0.007 (from the previous step) and get 140.

-

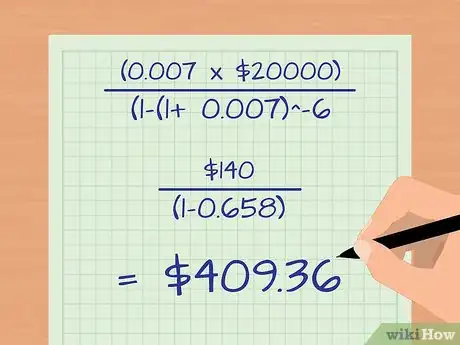

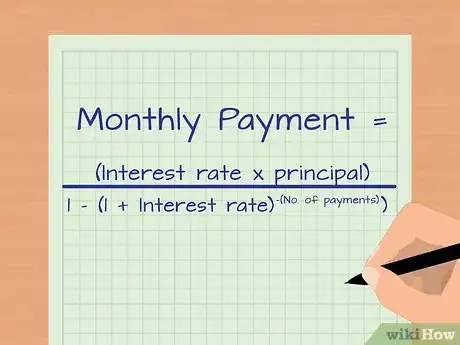

4Input this number into the monthly payment formula. The formula is as follows: Monthly Payment = (Interest rate due on each payment x principal)/ (1 – (1 + Interest rate due on each payment)^ -(Number of payments))[4] The top part of the equation (interest rate due on each payment x principal) is your number from the previous step. The rest can be calculated using a simple calculator.

- The "^" indicates that the figure (-(Number of Payments)) is an exponent to the figure (1 + Interest rate due on each payment). On a calculator, this is entered by calculating 1 + interest rate due on each payment, hitting the button x^y, and then entering the number of payments. Keep in mind that the number of payments is made negative here (multiplied by negative one).

- In our example, the calculation would go as follows (assuming a loan duration of 5 years or 60 months):

- Monthly Payment = (0.007 x $20000)/(1-(1+ 0.007)^-60

- Monthly payment = $140/(1-(1.007)^-60)

- Monthly payment = $140/(1-0.658)

- Monthly payment = $140/0.342

- Monthly payment = $409.36 (this number may be off by a few cents due to rounding)

-

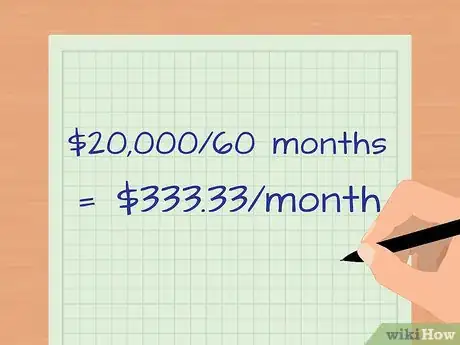

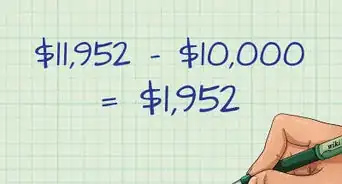

5Calculate the amount of principal paid each month. This is done by simply dividing your principal amount by the duration of your loan in months. For our example, this would be $20,000/60 months = $333.33/month

-

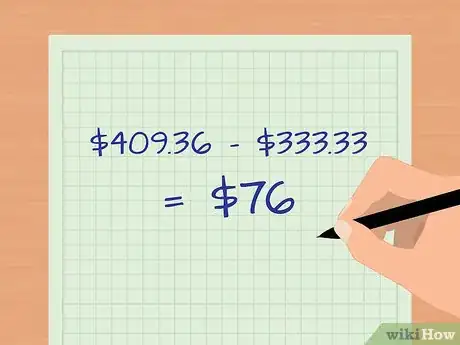

6Subtract your principal paid each month from your monthly payment. In our example, this would be $409.36 - $333.33. This equals roughly $76. So, with this loan agreement, you would be spending $76 per month in interest payments alone.

Calculating Your Loan's Total Finance Charges

-

1Find your monthly payment. To find your total finance charges over the life of your loan, start by calculating your monthly payment. How to do this is explained in the previous section.

-

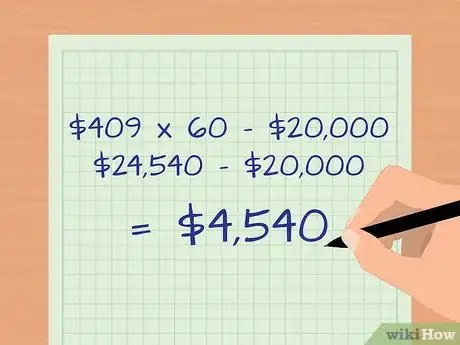

2Plug that number into the total finance charges formula. The formula is as follows: Monthly Payment Amount x Number of Payments – Amount Borrowed = Total Amount of Finance Charges[5]

- So, in our example, this would be:

- $409 x 60 - $20,000 = Total amount of finance charges

- $24,540 - $20,000 = Total amount of finance charges

- Total amount of finance charges = $4,540

- So, in our example, this would be:

-

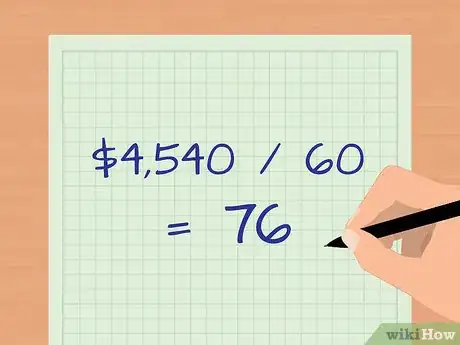

3Check your work. To be sure that you calculated your total correctly, divide that number by the total number of payments (60, in this case). $4,540/60 = 76. If the result matches your monthly finance charges you calculated earlier, then you have the correct number for total finance charges.

Warnings

- While uncommon, some lenders can use a more complicated form of interest called compound interest that will throw off these calculations. Be sure to ask if your car loan charges simple interest (the kind described in this article) before counting on these equations.⧼thumbs_response⧽

References

- ↑ http://biztaxlaw.about.com/od/glossaryp/g/loanprincipal.htm

- ↑ http://www.calculator.net/auto-loan-calculator.html

- ↑ http://www.bankrate.com/calculators/auto/auto-loan-calculator.aspx?loanAmount=15000&years=5.000&terms=60&interestRate=7.200&loanStartDate=09+Oct+2015&show=false&showRt=true&monthlyAdditionalAmount=0&yearlyAdditionalAmount=0&yearlyPaymentMonth=+Oct+&oneTimeAdditionalPayment=0&oneTimeAdditionalPaymentInMY=+Nov+2015&ic_id=auto_loan_calc_calculate_btn

- ↑ https://www.dcu.org/loans/finance-calculations.html

- ↑ https://www.dcu.org/loans/finance-calculations.html

- ↑ http://www.bankrate.com/finance/auto/hidden-numbers-in-zero-percent-financing.aspx