This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 17,963 times.

If you need help preparing your tax return or have a question about tax law, you might want to talk to an IRS agent directly. The easiest way to do this is to call the IRS's customer service number at 1-800-829-1040. However, you may find it difficult to navigate the automated menu just to talk to a live agent directly. Fortunately, there are some tricks you can use to make sure your question is answered as quickly as possible. If you have more significant tax issues, you may also be able to get direct help from the Taxpayer Advocate Service.[1]

Steps

Reaching a Live Agent at the IRS

-

1Gather information and documents related to your question. An IRS agent will need specific information about you and anyone else listed on your tax return. They will also need information from your last tax return so they can pull up your file. Specifically, you'll need to have on hand the following information:[2]

- Your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN) as well as the SSNs or ITINs for anyone listed on your tax return

- Your filing status (single, head of household, married filing joint, or married filing separate)

- Your tax return for the prior year

- Any other tax returns that you have questions about

- Any letters or notices you've received from the IRS

-

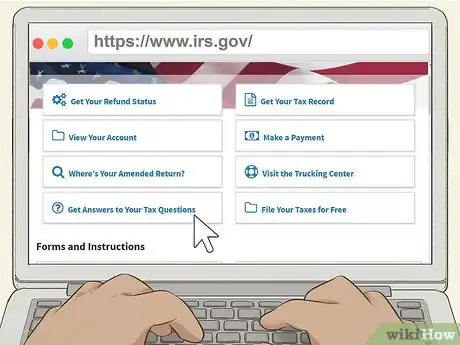

2Search for an answer to your question online first. The IRS has a tremendous database of information about tax returns, including answers to most common questions taxpayers have. You can save yourself a lot of time if you look for an answer there first.[3]

- Go to the main IRS website at https://www.irs.gov/ and click the tab to "Get Answers to Your Tax Questions." Type your question in the search bar and see what comes up. You also have the option of browsing topics by category.

Tip: If you feel like your question is relatively basic, you might want to start by browsing the "Frequently Asked Questions." You may be able to find an answer there more quickly.

Advertisement -

3Call the toll-free IRS number early in the morning. The IRS toll-free number, 1-800-829-1040, is available from 7 a.m. through 7 p.m. (your local time) Monday through Friday. Wait times tend to be shorter first thing in the morning than they are in the evening or midday.[4]

- If you live in Puerto Rico, the number is operational from 8 a.m. to 8 p.m. local time. If you live in Alaska or Hawaii, follow Pacific time rather than local time.[5]

- Wait times are also longer towards the beginning of the week and closer to a filing deadline. On average, you can expect to wait from 15 to 27 minutes.[6]

-

4Navigate through the automated menu. When you call the number, the automated system will ask you to choose your language. After you've set your language, don't choose Option 1, which deals with refunds, even if your question is refund-related. Instead, choose Option 2, "Personal Income Tax." Then continue as follows:[7]

- Press 1: "form, tax history, or payment"

- Press 3: "for all other questions"

- Press 2: "for all other questions"

-

5Do nothing when the system asks for your SSN or ITIN. After you've navigated the menu, the system will ask you to enter your SSN or ITIN. Do not press any numbers. After a minute, it will ask you again. Simply wait. Then you will be given another menu.[8]

- On the new menu, press 2 for "personal or individual tax questions." The system will connect you with a live agent. However, you may have to wait.

Working with the Taxpayer Advocate Service

-

1Organize the documents and information you have about your issue. The documents and information you need will depend on the issue you want the Taxpayer Advocate Service to help you with. Generally, the Service takes cases in 4 categories:

- Expediting refunds if you are experiencing an emergency or financial hardship: Your tax return showing a refund, as well as evidence of your hardship

- Many different IRS units are involved in your case, and you need someone to coordinate: Documents and information related to your case, including any letters or notices from the IRS

- You are unable to resolve your problem through normal IRS channels: Documents and information related to your problem, as well as evidence of your attempts to work with the IRS

- You have unique issues that the usual IRS approach can't address: Evidence of your issues

-

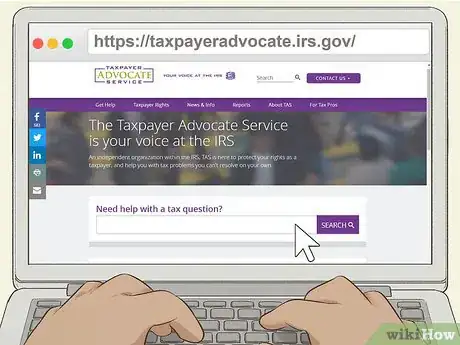

2Visit the Taxpayer Advocate Service website. Go to https://taxpayeradvocate.irs.gov/ to get started with the Taxpayer Advocate Service. There's a box on the home page where you can type questions if you want help or information online. You can also read more about what the Service is and the types of issues advocates help with.[9]

- You may be able to find information directly on the website that addresses your issue. You can still contact them if you feel like you need more information.

-

3Contact your local Taxpayer Advocate Service office. If you want direct help from an advocate, go to https://taxpayeradvocate.irs.gov/contact-us and scroll down to the map. You can click on your state on the map or select its name from the drop-down menu. The box under the menu provides the location and phone number of all offices in your state.[10]

- If you live in a larger state, you may have to scroll down to find the office nearest you. Copy the information and call the number to talk to a local advocate.

Tip: You can also contact the Taxpayer Advocate Service's national office using the toll-free number 1-877-777-4778.

-

4Explain your situation to your local advocate. A local advocate may talk to you over the phone or have you come into the office. They will ask you questions about your case and explain what they can do for you.

- Provide your local advocate with any documents or other information you have that's related to your case. If they need specific documents that you don't have, they'll tell you how to get those documents from the IRS.

- The advocate will work with the IRS to resolve your situation. Once the local advocate is assisting you, it's likely that you won't need to contact the IRS directly again.

Warnings

- This article discusses how to talk to an IRS agent if you have personal return questions. If you have business return questions, call 1-800-829-4933. This number is also available from 7 a.m. to 7 p.m. local time.[11]⧼thumbs_response⧽

References

- ↑ https://www.usa.gov/help-with-taxes

- ↑ https://amynorthardcpa.com/how-do-i-reach-a-real-person-at-the-irs/

- ↑ https://www.usa.gov/help-with-taxes

- ↑ https://amynorthardcpa.com/how-do-i-reach-a-real-person-at-the-irs/

- ↑ https://www.irs.gov/help/telephone-assistance

- ↑ https://www.irs.gov/help/telephone-assistance

- ↑ https://amynorthardcpa.com/how-do-i-reach-a-real-person-at-the-irs/

- ↑ https://amynorthardcpa.com/how-do-i-reach-a-real-person-at-the-irs/

- ↑ https://taxpayeradvocate.irs.gov/