This article was co-authored by Marcus Raiyat. Marcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 59,650 times.

Commodities are standardized products, such as oil, gold, and copper, that are generally used in manufacturing processes around the world. Commodities, and their related financial products, are traded on exchanges between investors and financial institutions. Commodities traders seek to profit from quick changes in the price of these commodities or financial products. Thanks to the internet, these commodities can also be traded online. However, before trading commodities on your own, you'll need a strong understanding of the market and a high risk tolerance.

Steps

Learning About Commodities and Trading

-

1Learn about commodities trading. Commodities trading has been around for many years. Originally, commodities exchanges sold futures contracts so that manufacturers and farmers could buy contracts to guarantee the price of an input of production or crop at a future date. These players still use commodities futures for that purpose, but now speculators have entered the market to bet on the changing prices of commodities and related securities.

- Commodities and related securities are traded on a number of large exchanges throughout the world.[1]

- Commodities can include any of the following types of products:

- Energy, like crude oil and natural gas.

- Metals, including precious metals, like gold and silver, and non-precious metal like copper.

- Livestock and meat, like cattle and pork bellies.

- Agricultural products, like corn, wheat, rice, and sugar.[2]

-

2Understand the different types of commodity contracts and securities. A trader can make bets on commodities prices in a number of ways. Commodities, however, are rarely physically traded. The logistics involved in trading actual commodities make doing so too complicated. Most market participants purchase securities or contracts related to commodities instead.[3] These financial products include:

- Commodities futures. These are the type used most frequently by experienced traders and financial institutions. Futures are contracts that give the holder the right to purchase a set amount of a commodities for a set amount at or before a time in the future. Trading futures is risky and should only be done by experienced investors.

- Commodity stocks. Traders can also focus on stocks related to commodities, rather than the commodities themselves. For example, a trader might purchase stock in a silver mining company if they expected a rise in the price of silver.

- Mutual funds. There are a number of mutual funds that track certain commodities or segments of the commodities markets.

- Exchange Traded Funds (ETFs). ETFs are like mutual funds but are traded like individual stocks. Some ETFs track individual commodities, like gold or crude oil.[4]

Advertisement -

3Read up on commodities trading. Anyone interested in commodities trading should read books on its practice before getting started. Get started by reading Opportunity and Risk: An Educational Guide to Trading Futures and Options on Future. This guide, published by the National Futures Association, can be downloaded for free by visiting http://www.nfa.futures.org/. Other great resources include:

- A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options by Jack D. Schwager.

- Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market by Jim Rogers.

- Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market by Jeff Christian.[5]

-

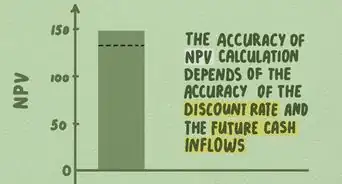

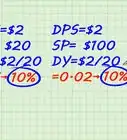

4Know the risks of trading commodities. Commodities trading is traditionally regarded as somewhat riskier than stock trading. This is largely due to the fact that most commodities futures are bought on margin. This means that the trader essentially invests with borrowed money, paying a small amount to control a large amount of commodities. For example, a trader might pay $10,000 to control $100,000 worth of crude oil.

- Trading on margin magnifies potential returns and potential losses. This is because returns are from the controlled commodity amount, not the amount of the investment.

- This means that you can earn $1,000 from the $10,000 investment if the price goes up 1 percent.

- However, this also means that you can lose a substantial amount of money and, in some cases, be responsible for making up a loss that constitutes more than you originally invested.[6]

Building a Trading Strategy

-

1Read news about commodities to come up with trading ideas. Make it a daily habit to read the financial news on commodities. You will get a picture of how the market is doing. Find out if crude oil fell today and by how much. Learn, for example, that the price of gold has been trending up for the past month because investors are uncertain about the economy. Financial news websites, including Bloomberg, Investor’s Business Daily, and the Wall Street Journal, will let you know when futures contracts are about to expire. Reading these sources can help you decide what commodities to trade.

- This type of analysis is known as fundamental analysis and is designed to predict prices based on supply and demand for the commodity.[7]

-

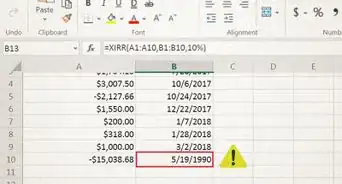

2Use technical analysis to study commodities. Now that you have an idea about which commodities you want to take a closer look at, you should use technical analysis. This consists of predicting the direction of a commodity’s price by investigating its past price behavior, meaning changes in volume and price. Technical analysis requires the use of current price information, which will likely be available through your trading platform.

-

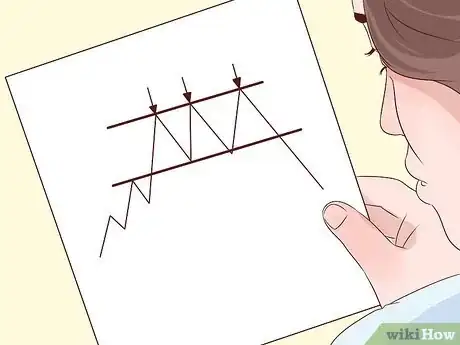

3Study charts for identifying patterns. Study charts to visually identify patterns and trends. These patterns can let you see if a commodity might be topping or bottoming out. Identifying these patterns can help you decide if you should buy or sell a particular commodity. Some of the most common patterns are:

- Head and shoulders top.

- Triple top.

- Double bottom.

- Double top.[8]

-

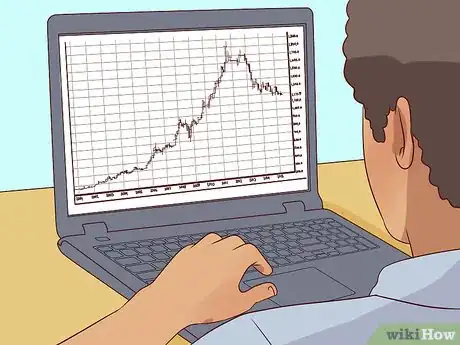

4Use technical indicators for charts. To get a better understanding of where a commodity is trending, apply technical indicators. These are mathematical formulas involving price and volume. Two of the most widely-used indicators are moving averages and the relative strength index. Technical indicators may be constructed by a trader or purchased as part of analysis software.[9]

- One example of a technical indicator is Moving Average Convergence and Divergence (MACD). This tool attempts to assess current trends to predict future trends in the market.

- For more on using MACD, see how to read MACD. This article also contains a method for constructing moving averages in Excel.

-

5Develop a trading methodology. Devising a trading system does not just involve using technical analysis. There are a few things you must consider before executing any trades, such as setting up entry and exit strategies. For example, you should employ stop orders to protect your money. These are orders that automatically sell a security if the price drops below a certain point. When trading commodities, good money-management skills are crucial to preserve your capital.

- Avoid overtrading, which is making too many quick, unprofitable trades in the hope that one of them will end up being profitable.[10]

-

6Test your trading system with simulated trading. Don’t be too quick to put your money at risk. Instead, test your trading system. You can see how your system would have fared if you had actually used it in the marketplace. Most online brokerage firms offer this service free for thirty days. Simulated trading comes equipped with features such as real-time quotes and real-time indicators and charts.

- Real-time trading does not simulate the pressures involved with actual trading, so don't expect your success to translate directly to real trading.[11]

Trading Commodities

-

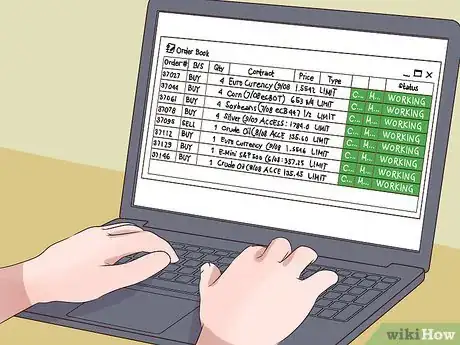

1Compare trading platforms. Trading commodities futures online will require an account with a specialized futures trading platform. A number of platforms are available, though many are disreputable, so make sure to do your research before choosing one. The platforms will also have different cost structures and trading tools for traders, so compare options based on your needs. Some reputable platforms include:

- TD Ameritrade.

- TradeStation.

- Generic Trade.

- MB.

- Lightspeed.[12]

-

2Open an online trading account. Fill out the brokerage firm’s application and wait for approval. For faster service, complete the application online. Keep in mind there’s a minimum-balance requirement you must meet. Ask your broker what the minimum balance is for their company.

- In the application process, you will likely be asked questions about your net worth and trading experience. Based on these questions, the platform will allow you to take on a certain level of risk.

- When you've signed up, take a tour of the features available from the platform and locate a tutorial on how to use them.[13]

- Most platforms require at least $2,500 or $5,000 as an initial deposit.[14]

-

3Make your first order. Place an order for a futures contract by specifying the commodity, date, and other terms of the order. The terms of the order might include how the order is to be settled, either for cash or for delivery. The order is submitted to the broker, who then has the order filled at market. At this point, money is taken from your account to pay for the order.

- You can issue an additional "stop" order to sell your position if the price of the commodity drops below a certain point.

-

4Go light on leverage. You can reduce your risk by taking on less leverage than you need. While your $5,000 may entitle you to $50,000 worth of futures contracts, you should take it easy at first, especially if you are inexperienced. Try trading one or two contracts at a time to limit your leverage and, therefore, your risk. By doing so, you can avoid the pitfalls that affect so many commodities traders.[15]

-

5Work on your approach over time. Commodities traders do not find success over night. Figuring out when to buy and to sell, and which commodities to trade, is a difficult and labor-intensive process that takes years to master. Learn by trial and error, by emulating successful traders, and by reading about trading strategies to begin gaining experience. Figure out which strategies work for you and repeat them.

References

- ↑ http://www.moneycrashers.com/invest-trade-commodities/

- ↑ http://www.investopedia.com/articles/optioninvestor/09/commodity-trading.asp

- ↑ Marcus Raiyat. Foreign Exchange Trader. Expert Interview. 4 March 2021.

- ↑ http://www.moneycrashers.com/invest-trade-commodities/

- ↑ https://www.thestreet.com/story/10390453/1/how-to-trade-commodity-futures.html

- ↑ https://www.thestreet.com/story/10390453/1/how-to-trade-commodity-futures.html

- ↑ https://www.thebalance.com/how-to-start-trading-commodities-online-809250

- ↑ http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns

- ↑ http://www.investopedia.com/articles/trading/11/indicators-and-strategies-explained.asp

- ↑ https://www.thebalance.com/how-to-start-trading-commodities-online-809250

- ↑ https://www.nerdwallet.com/blog/investing/started-futures-trading/

- ↑ https://www.nerdwallet.com/blog/investing/best-online-brokers-futures-trading-commodities/

- ↑ https://www.nerdwallet.com/blog/investing/started-futures-trading/

- ↑ https://www.thebalance.com/myths-of-investing-in-commodities-809160

- ↑ https://www.thebalance.com/myths-of-investing-in-commodities-809160

About This Article

To trade commodities, sign up with a reputable online trading platform, like TD Ameritrade or TradeStation. Additionally, read financial news sources, such as Bloomberg or the Wall Street Journal, to find out commodity price trends. Once you’re ready to place an order, select the commodity you want to buy and enter the date for your futures contract, which is when you’ll sell the commodity. Make sure to trade just 1 or 2 contracts initially so you’re dealing with less risk. For tips on how to analyze commodity prices from technical data, read on!