X

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 145,231 times.

Before you marry, all of your personal and real property belongs solely to you unless you own it jointly. Generally speaking, that property remains yours when you marry unless something you do converts it to marital property.[1] Income and property you earn and acquire, during the marriage is considered marital property, with a few exceptions.[2]

Steps

Part 1

Part 1 of 2:

Knowing What Constitutes Separate Property and Marital Property

-

1Make note of which property is marital property. Generally speaking, everything you earn or acquire during your marriage is marital property, unless you agree otherwise. For instance, your income and money used to pay household bills are marital property. The vehicle you purchased from your joint account, is marital property.[3]

-

2Determine which property is separate (non-marital) property. Separate property is the non-marital property that belongs only to one spouse.[4] While the definition of separate property varies by states, some common forms of separate property include:

- Property owned by one spouse prior to the marriage

- Gifts one partner received before or during the marriage

- Property obtained in one spouse’s name and never used for the benefit of the other spouse or the marriage

- Inheritances received by one partner before or during the marriage

- Property the spouse agrees in writing is separate, as long as the agreement complies with state law

- Property acquired by one spouse, with separate assets, with the intent of keeping it separate

- Personal injury awards for pain and suffering, although awards for lost earnings can be marital property[5]

Advertisement -

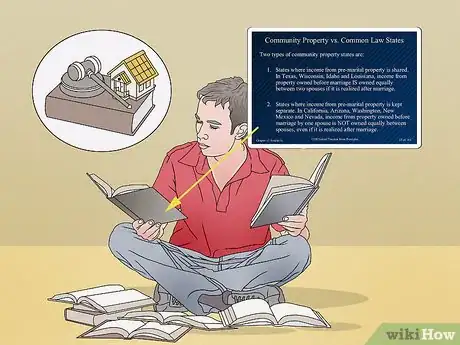

3Find out if your state is a “common law state.” Most states are “common law states.” In these states, if your name is on the title paper (i.e. deed or registration) then it is your separate property. If an item does not have a title document, you own it if you bought it or received it as a gift.[6]

-

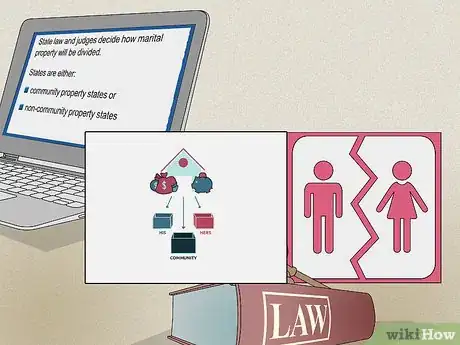

4Determine if your state is a “community law state.” If you state is not a common law state it likely is a community law state. As of June 2015, community law states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin and Alaska (by agreement).[7]

- Generally speaking, spouses own equally almost all property acquired during the marriage, regardless of whose name is on it, in community law states. Also, half of each partner’s income earned during the marriage is owned by the other partner. As well, debts incurred during the marriage are debts of the couple together.[8]

- Separate property, in community law states, includes inheritances to one spouse, gifts given to one partner and property owned before the marriage, that is kept separate during the marriage.[9]

Advertisement

Part 2

Part 2 of 2:

Understanding Actions That Convert Separate Property to Marital Property

-

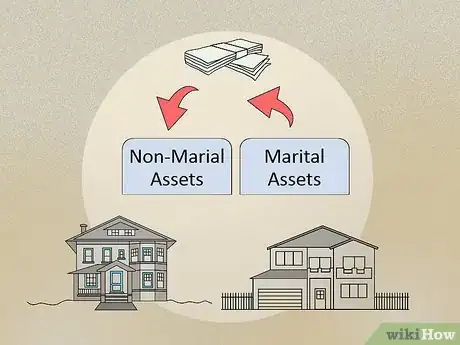

1Watch out for co-mingling non-marital property. Non-marital property can become marital property by co-mingling it.[10] For instance, putting non-marital money into a joint account with marital proceeds will likely make it marital.[11] Additionally, if non-marital proceeds are used to pay marital expenses, they can become marital.[12]

-

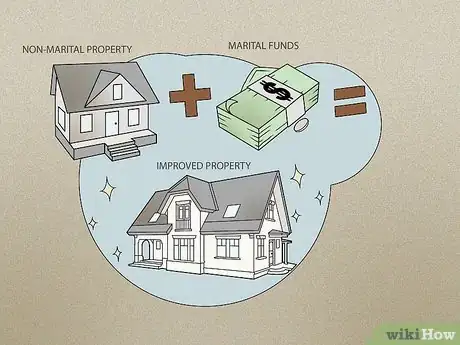

2Be cautious about spending marital money, to improve non-marital asset. Doing so can create a partial marital interest in that asset.[13] The value of the improvement is likely to be considered marital.[14]

- Courts often distinguish between active and passive appreciation of an asset.[15] Passive appreciation of a non-marital asset remains non-marital. Passive appreciation occurs when the non-marital asset increases in value without any action. For instance, passive appreciation occurs when an asset goes up in value without making improvements. [16]

- Active appreciation of a non-marital asset can create a marital interest in the asset. Active appreciation is when the value of a non-marital asset increases because of an act by either party to the marriage.[17]

-

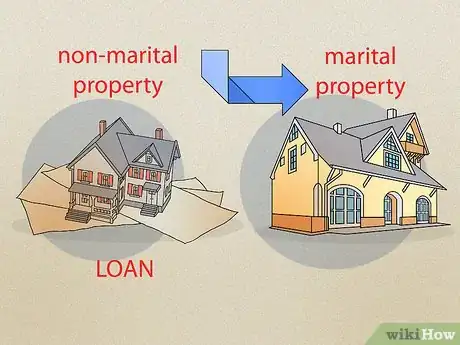

3Be aware that new property loans or modifications to loans can convert non-marital property to marital. It is common for parties to refinance or make other modifications to a home loan, during marriage. It is important to understand that even if the home came into the marriage as non-marital, a refinance, second mortgage or home equity loan could totally or partially erase its non-marital status.[18]

Advertisement

Warnings

- Determining what is separate property and what is marital property can be difficult and differs from state to state. You should consult with an attorney in your state to help make the determination.⧼thumbs_response⧽

- The information provided above constitutes general information related to the law. It does not constitute legal advice.⧼thumbs_response⧽

- If you are seeking legal advice, you should consult a lawyer.⧼thumbs_response⧽

Advertisement

References

- ↑ http://www.divorcehq.com/articles/property.shtml

- ↑ http://www.nolo.com/legal-encyclopedia/separate-community-property-during-marriage-29921.html

- ↑ http://www.nolo.com/legal-encyclopedia/separate-community-property-during-marriage-29921.html

- ↑ http://www.nolo.com/legal-encyclopedia/separate-community-property-during-marriage-29921.html

- ↑ http://www.nolo.com/legal-encyclopedia/separate-community-property-during-marriage-29921.html

- ↑ http://www.nolo.com/legal-encyclopedia/separate-community-property-during-marriage-29921.html

- ↑ http://www.nolo.com/legal-encyclopedia/separate-community-property-during-marriage-29921.html

- ↑ http://www.nolo.com/legal-encyclopedia/separate-community-property-during-marriage-29921.html

- ↑ http://www.nolo.com/legal-encyclopedia/separate-community-property-during-marriage-29921.html

- ↑ http://www.divorcehq.com/articles/property.shtml

- ↑ http://www.divorcehq.com/articles/property.shtml

- ↑ http://www.divorcehq.com/articles/property.shtml

- ↑ http://www.divorcehq.com/articles/property.shtml

- ↑ http://www.divorcehq.com/articles/property.shtml

- ↑ http://www.divorcehq.com/articles/property.shtml

- ↑ http://www.divorcehq.com/articles/property.shtml

- ↑ http://www.divorcehq.com/articles/property.shtml

- ↑ http://www.divorcehq.com/articles/property.shtml

About This Article

Advertisement