This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 68,446 times.

Though most companies won't let you use regular credit cards like a debit card, you can use a prepaid credit card like a debit card. Prepaid credit cards work like debit cards, but they are accepted like credit cards. Though these types of cards won't help you build credit, they can help you keep control of your money so you don't overspend.

Steps

Getting a Secured Credit Card

-

1Find the best deal. Just like regular credit cards, prepaid credit cards come with fees. However, because you are prepaying the fees are setup differently. Shop around to find the best one.[1]

-

2Look for one with a low setup fee. Some prepaid credit cards charge a setup fee. However, the fee isn't the same for every card. Try to find one that is low or nothing.[2]Advertisement

-

3Check the reload fees. Another place that prepaid credit cards hit you is with reload fees. Essentially, when you add more money to the card, some companies charge you again. However, some do not charge you a reload fee, which can make it more economical. Pick one with a low reload fee or no reload fee, if possible.[3]

-

4Look for other fees. Other companies tack the fees on in other places, such as if you try to take cash off the card at an ATM. Still others may charge you to check your balance or if you try to make a purchase without enough money on the card. Try to find all the hidden fees before agreeing to a card.

-

5Check the monthly maintenance fee. These types of cards also usually attach a monthly fee to the card. Of course, you want to find the lowest one you can to avoid paying too much just to keep a credit card on hand.[4]

-

6Look at the fee structure. Some companies may not charge you fees if you put enough money on the card at the beginning. Others require a certain balance to waive fees over time.[5]

- Also, check how often you're required to use your card, as some companies will charge you if you don't use yours enough. In addition, they may charge you if you decide to close your account.

-

7Buy a card. Once you've picked out a card, you essentially purchase it by loading it with money and paying any purchase fee. Because you always preload the card, you will not need credit approval.[6] However, you will need to have a way to add money. You can use cash to load these cards, as long as you do it in a store that sells them. Many of the big box stores sell prepaid credit cards. Be aware that most of them have a minimum load amount along with the purchase price.

- You can also add money from PayPal accounts or have your paycheck deposited on to a card. You can also put money on it from a bank account.[7]

-

8Register your card. Generally, you go online to register your card, and input information such as your address, your card number, and your phone number. It's important to register your card because if you lose it, your company may be able to recover or refund your money.[8]

-

9Check the limit. Different cards have different limits. If you need to make big purchases, you may need one with a bigger limit. Cards can range from as little as $500 to unlimited.[9]

Using Your Card

-

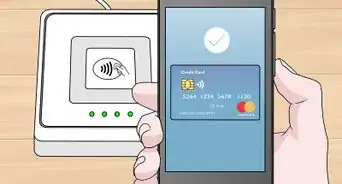

1Use your card as you would any credit card. Essentially, you pay with your card anywhere that accepts credit cards. You do not need to do anything special with this credit card.[10]

-

2Pay bills online. You can also use this card to pay your bills. Simply log on to your account for the bill, and input your credit card information. You'll likely need the expiration date, your name as it appears on the card, and the security code on the back of the card.[11]

-

3Reload your card as needed. As your card gets low, you'll need to add more money to be able to use it. You reload your card the same way you added funds the first time, through a bank account or PayPal, with cash, or by depositing your paycheck on to it.

Withdrawing Cash with a Regular Credit Card

-

1Check your cash credit limit. Some credit cards have a limit on the amount of money you can take out for a cash advance. You should be able to find this information on your account online or by calling customer service for your credit card. In other cases, you may need to turn on the option for cash advances by calling customer service.

-

2Find your pin. If you don't know your pin already, you'll need to get your ATM pin for your credit card. You may be able to find it online, but most likely, you will need to call customer service to get your pin or reset your pin.

-

3Go to an ATM. Just like with a debit card, you insert your card into the machine. Enter your pin when the machine tells you to, and then select an amount to withdraw. Make sure the amount is under your cash credit limit.

-

4Be aware of fees. With cash advances, you'll often be charged higher fees than for regular transactions. If you have a credit card with no interest rate for a year or two, you'll still be charged interest on your cash advance.[12]

Warnings

- This type of card is an option if you need a credit card but can't qualify for a regular credit card. However, a free checking account may be better, as you'll get a debit card and you won't be charged for using your own money.⧼thumbs_response⧽

References

- ↑ http://www.creditcards.com/credit-card-news/help/9-things-you-need-to-know-about-prepaid-cards-6000.php

- ↑ http://www.creditcards.com/credit-card-news/help/9-things-you-need-to-know-about-prepaid-cards-6000.php

- ↑ http://www.creditcards.com/credit-card-news/help/9-things-you-need-to-know-about-prepaid-cards-6000.php

- ↑ http://www.creditcards.com/credit-card-news/help/9-things-you-need-to-know-about-prepaid-cards-6000.php

- ↑ http://www.creditcards.com/credit-card-news/help/9-things-you-need-to-know-about-prepaid-cards-6000.php

- ↑ https://www.mastercard.us/en-us/consumers/find-card-products/prepaid-cards.html

- ↑ http://www.creditcards.com/credit-card-news/help/9-things-you-need-to-know-about-prepaid-cards-6000.php

- ↑ https://www.mastercard.us/en-us/consumers/find-card-products/prepaid-cards.html

- ↑ https://www.mastercard.us/en-us/consumers/find-card-products/prepaid-cards/card.html

-Safe-Step-8.webp)

-Safe-Step-8.webp)