This article was co-authored by Alan Mehdiani, CPA. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

This article has been viewed 153,810 times.

If you have been asked to write a “proof of funds” letter, then most likely you work for a bank or other savings institution. In some instances, a private individual could be asked to provide a proof of funds letter, if you are holding money or other valuable assets on behalf of someone. The proof of funds letter is designed to notify some outside party, usually someone offering a property for sale, that your client has money available in a specified amount, that will allow him or her to complete the transaction. The proof of funds letter that you provide should meet certain formal expectations.

Steps

Verifying the Availability of the Funds

-

1Check the client’s accounts. In most cases, if you are being asked to provide a proof of funds letter, then you are working as a lending officer or other senior personnel at a bank, credit union, or other financial institution. The first step, before you begin to write the letter, is to verify that the client does indeed have the requested funds. You will need to check your bank’s records to ascertain this information.[1]

-

2Clarify which account(s) should be considered. Depending on the client’s needs, you may need to verify more than one account. You should check with the client to determine which accounts may be considered. For example, the client may have savings, checking, money market or other accounts with your institution, but may only want to consider the funds in one particular account. You should fully understand which account or accounts the client wants you to verify.[2]Advertisement

-

3Determine the amount of money to be verified. A proof of funds letter generally should be something more than just a statement of the current account balance. You should check with the client to determine the level of funding that is to be represented in the proof of funds letter. Then limit the language of the letter only to that amount. For the client’s privacy, you should not provide more information than is requested.[3]

- For example, the client may have $2,136,942.27 in a particular account. But at this time, the client only needs to verify proof of funds up to $100,000. Your letter should simply say that the client has “at least $100,000” available. That will serve the purpose but not disclose more of the client’s information than necessary.

Drafting the Letter

-

1Use formal stationery. A proof of funds letter needs to appear official. You should use the official stationery of your institution. This should be on letterhead, providing the name of the institution and its address. If the institution has several branch locations, you should make clear which location is providing the letter.[4]

-

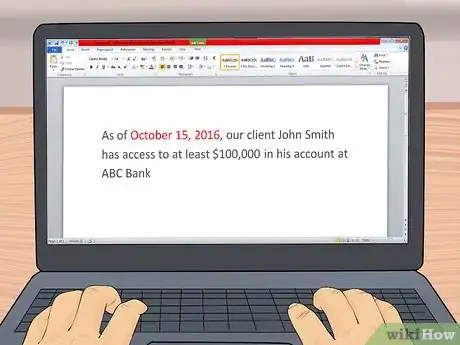

2Provide the date. This seems like a mere obvious formality, but it is extremely important. You should not only provide a date as part of the heading of the letter but also provide a statement in the body of the letter as to the timing of the proof of funds verification.[5]

- For example, your letter should say, “As of October 15, 2016, our client John Smith has access to at least $____ in his account at ABC Bank.”

- Providing the date allows the seller to consider the validity of the proof of funds letter. For example, if you write the letter on October 15, 2016, but the client does not present it until the following April, the seller may have concerns as to whether the funds are still available. In that instance, the seller may require a new proof of funds letter.

-

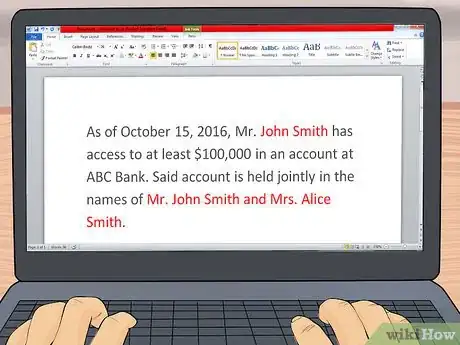

3Specify the name of the account holder. You must be explicit in the proof of funds letter as to the name of the account holder. If there is any discrepancy between the name of the individual requesting the letter and the name or names on the account, you should speak to the client about this. You should provide a clear statement in the proof of funds letter regarding the name or names on the account and the client who is requesting the letter.[6]

- For example, if Mr. John Smith requests a proof of funds letter, and the account is a joint account between Mr. and Mrs. Smith, your letter may say, “As of October 15, 2016, Mr. John Smith has access to at least $____ in an account at ABC Bank. Said account is held jointly in the names of Mr. John Smith and Mrs. Alice Smith.” The seller can then review your letter and make its own determination about whether to proceed with the transaction.

-

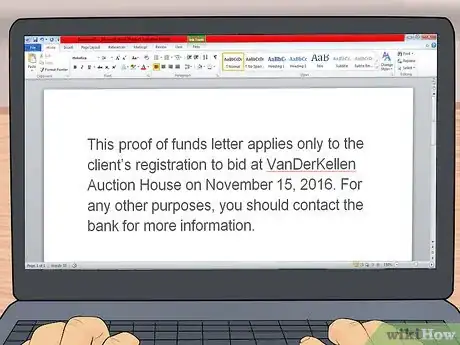

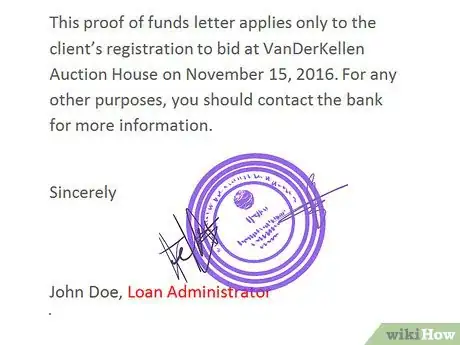

4Mention any limitations. In some cases, a proof of funds letter may be written for a single specific purpose. If this is the case, you should specify any such limitations within the text of your letter. For example, if your client requests a proof of funds letter to attend an auction, your letter might say, “This proof of funds letter applies only to the client’s registration to bid at Van Der Kellen Auction House on November 15, 2016. For any other purposes, you should contact the bank for more information.”[7]

Signing and Formalizing the Letter

-

1Sign the letter. For the proof of funds letter to be accepted, it must be signed by an authorized representative of the institution. If you are not authorized to provide such information but are just drafting the letter, then you will need to obtain the signature of someone with sufficient authorization.[8]

-

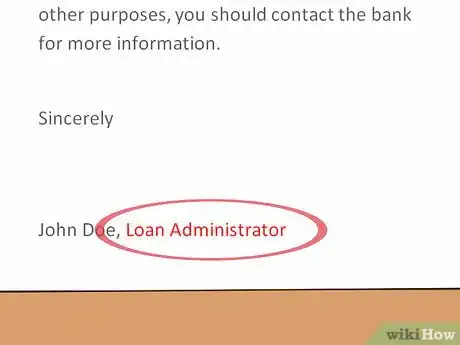

2Provide the signer’s official title. The signature should be accompanied by the official title of the person signing the letter. This may be something like “Assistant Vice President” or “Loan Administrator.” It should be evident that you have the authority to provide the information contained in the proof of funds letter.[9]

-

3Find out if the client needs the letter to be notarized. In most cases, a notarized letter will not be required, as long as the letter meets all the other formalities. However, in some cases, a notarized signature might be required by the seller. You should ask the client if this is a requirement for this particular transaction.[10]

-

4Provide the letter to the client. In many cases, a proof of funds letter needs to be completed and delivered quickly, because the client may be working on a time-sensitive transaction. You should find out from the customer if the letter should be held at your office to be picked up, or delivered to a particular address. The client may ask you to deliver the letter by special messenger or overnight delivery, if time is of the essence. In any case, it is up to you to know what is required.

Expert Q&A

-

QuestionWhat taxes need to be included in a proof of funds letter?

Alan Mehdiani, CPAAlan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

Alan Mehdiani, CPAAlan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

Certified Public Accountant Taxes aren't generally used in a proof of funds letter. Your bank may request a copy of your tax returns when you're trying to get a mortgage or a loan, but that's separate from a proof of funds letter.

Taxes aren't generally used in a proof of funds letter. Your bank may request a copy of your tax returns when you're trying to get a mortgage or a loan, but that's separate from a proof of funds letter.

Warnings

- This article is written primarily for the bank employee who is writing the proof of funds letter. If you are an individual looking to obtain a proof of funds letter, you may find numerous agencies or websites that offer to provide such a letter, without regard to your actual financial accounts. In many cases, for payment of a small fee, you can obtain a proof of funds letter that says you have access to $300,000, $500,000 or even more, without an actual check on your finances. Using a letter from such sources could be considered an attempt to defraud the seller.[11]⧼thumbs_response⧽

Expert Interview

Thanks for reading our article! If you'd like to learn more about proof of funds, check out our in-depth interview with Alan Mehdiani, CPA.

References

- ↑ https://www.thebalance.com/why-sellers-demand-proof-of-funds-from-a-buyer-1798438

- ↑ https://www.thebalance.com/why-sellers-demand-proof-of-funds-from-a-buyer-1798438

- ↑ https://www.thebalance.com/why-sellers-demand-proof-of-funds-from-a-buyer-1798438

- ↑ https://www.thebalance.com/why-sellers-demand-proof-of-funds-from-a-buyer-1798438

- ↑ https://www.thebalance.com/why-sellers-demand-proof-of-funds-from-a-buyer-1798438

- ↑ https://www.thebalance.com/why-sellers-demand-proof-of-funds-from-a-buyer-1798438

- ↑ http://www.vanderbrinkauctions.com/document/Sample-Proof-Available-Funds-Letter.pdf

- ↑ http://internationaloffice.berkeley.edu/funding_documentation

- ↑ http://internationaloffice.berkeley.edu/funding_documentation