This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

There are 7 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 285,502 times.

Deferred revenue (also called unearned revenue) refers to money received by a company before it provides the related goods or services to the customer. It is shown as a liability on the balance sheet.[1] Companies of all sizes and industries commonly enter into transactions involving deferred revenue. You can easily learn how to record deferred revenue properly with some understanding of the underlying accrual accounting concepts behind it.

Steps

Determining What Revenue to Defer

-

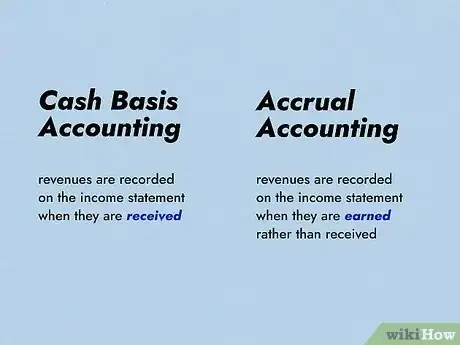

1Familiarize yourself with the accrual basis of accounting. Deferred revenue is an aspect of what is called the accrual basis of accounting. Under the accrual basis of accounting, revenues are recorded on the income statement when they are earned rather than received.[2] This contrasts with the cash basis of accounting wherein the opposite is true.[3]

-

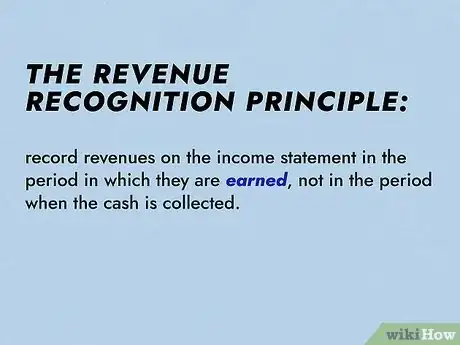

2Understand why you need to defer revenue. Accrual-based accounting requires you to defer unearned revenue because of a principle called the revenue recognition principle. The revenue recognition principle requires accountants to show revenues on the income statement in the period in which they are earned, not in the period when the cash is collected.[4]

- This requires a differentiation between realized and earned revenue. Realized revenue is revenue received regardless of whether the company has fulfilled its obligations to the purchaser. Realized yet unearned revenue is the subset of revenue which must be deferred.[5]

- For instance, say a magazine company receives a twelve-month subscription for a monthly publication. The subscription costs $120, and the subscriber pays the entire cost of the subscription up front. Thus, before the company delivers any magazines to the customer, the $120 is classified as deferred revenue and represents a liability to the company. In other words, the revenue has been realized but not yet earned.

Advertisement -

3Identify transactions involving deferred revenue. Deferred revenue deals with revenue realized in one reporting period but earned in the next. The reporting period can be monthly, quarterly, or annually depending on the company. Identify all customer orders as of the reporting period end date that have not been fulfilled, yet for which the company has already received payment. Report any transaction meeting this criteria as deferred revenue.[6]

- This includes items that have been paid in full but await shipment, as well as subscription-based revenues where the subscription period is still ongoing. Once these transactions have been identified, the accounting staff must calculate and record the amount of the deferral.

Recording Deferred Revenue

-

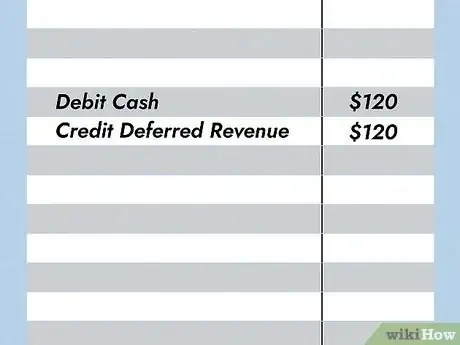

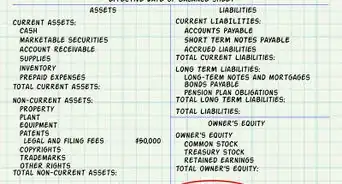

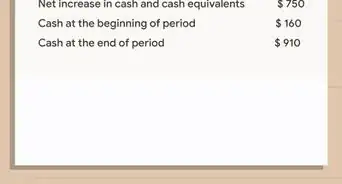

1Record the deferred revenue. Recording deferred revenue applies to the company’s balance sheet. The company receives cash (an asset account on the balance sheet) and records deferred revenue (a liability account on the balance sheet).[7]

- In the example from Part 1, the company receives a $120 advance payment relating to a twelve-month magazine subscription. When the company receives payment (but before delivering the subscription), the company must record the entire amount of the payment as deferred revenue. To do this, the accounting staff will post the following journal entry:

- Debit Cash $120

- Credit Deferred Revenue ($120)

- In the example from Part 1, the company receives a $120 advance payment relating to a twelve-month magazine subscription. When the company receives payment (but before delivering the subscription), the company must record the entire amount of the payment as deferred revenue. To do this, the accounting staff will post the following journal entry:

-

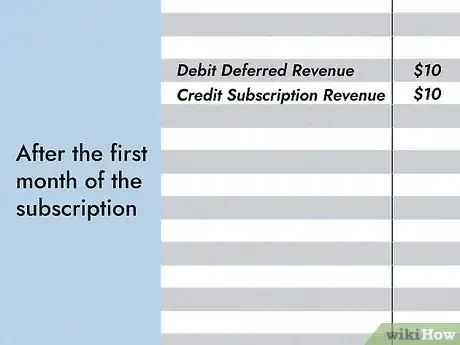

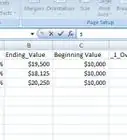

2Record the earned revenue. This journal entry affects the balance sheet and the income statement. This entry essentially updates the entry in the previous step by reducing the balance sheet liability and transferring the amount to the income statement.[8]

- Consider the magazine subscription example. After the first month of the subscription, $10 ($120 / 12) of revenue has been earned and the deferred revenue amount is now $110. The accounting staff will transfer $10 from the deferred revenue account to the earned revenue account using the journal entry below:

- Debit Deferred Revenue $10

- Credit Subscription Revenue ($10)

- Consider the magazine subscription example. After the first month of the subscription, $10 ($120 / 12) of revenue has been earned and the deferred revenue amount is now $110. The accounting staff will transfer $10 from the deferred revenue account to the earned revenue account using the journal entry below:

-

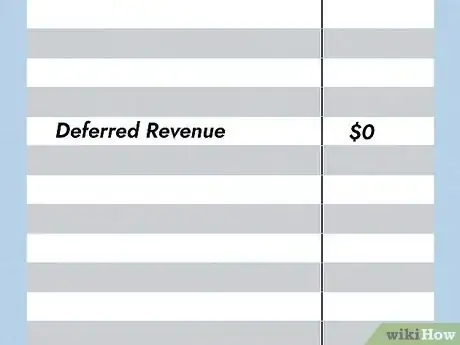

3Continue adjusting the ledger until all the revenue is earned. The company’s accountants must keep adjusting the balance sheet and income sheet over the course of the service.[9] The adjusting entries will continue until the company has fulfilled its obligation of goods or services and the liability to the customer reaches zero.

- Using the previous example, at that time, the deferred revenue account will have a balance of $0, and $120 of revenue will have been recognized.

Expert Q&A

-

QuestionHow is deferred revenue reported in the balance sheet?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor Deferred revenue is an account in the liability section of the balance sheet. It will be a current or long-term liability depending upon when the earnings cycle will be completed.

Deferred revenue is an account in the liability section of the balance sheet. It will be a current or long-term liability depending upon when the earnings cycle will be completed. -

QuestionWhat is an example of a deferred revenue?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor An example of deferred revenue is advance payment of a fee at the beginning of a contract prior to any actual work taking place.

An example of deferred revenue is advance payment of a fee at the beginning of a contract prior to any actual work taking place. -

QuestionWhat is the accounting treatment of deferred income in the following year?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor The deferred revenue initially recorded remains on the balance sheet until it is fully earned. Therefore, the deferred income will continue to be recognized in the following year as it is actually earned, and the balance in the deferred revenue account will be reduced as revenue recognition takes place. Maintaining the deferred revenue account on the balance sheet as a liability allows the company to carry the unearned portion over to the following year so it can be recorded where it belongs.

The deferred revenue initially recorded remains on the balance sheet until it is fully earned. Therefore, the deferred income will continue to be recognized in the following year as it is actually earned, and the balance in the deferred revenue account will be reduced as revenue recognition takes place. Maintaining the deferred revenue account on the balance sheet as a liability allows the company to carry the unearned portion over to the following year so it can be recorded where it belongs.

Things You'll Need

- Accounting software

References

- ↑ http://www.accountingcoach.com/terms/D/deferred-revenues

- ↑ http://www.accountingcoach.com/blog/acrrual-basis-accounting

- ↑ http://www.accountingcoach.com/blog/acrrual-basis-accounting

- ↑ http://www.accountingcoach.com/terms/R/revenue-recognition-principle

- ↑ http://www.accountingcoach.com/terms/R/revenue-recognition-principle

- ↑ http://www.accountingcoach.com/blog/deferred-revenue

- ↑ http://www.accountingcoach.com/blog/reporting-revenue-received-in-advance

- ↑ http://www.accountingcoach.com/blog/appreciating-adjusting-entries

- ↑ http://www.accountingcoach.com/blog/appreciating-adjusting-entries