This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 32,901 times.

Money might not buy happiness, but that doesn't it's impossible to be both rich and happy. We'll help you learn practical ways to increase your earnings while still being fulfilled and content in life!

Steps

Gaining Wealth in Meaningful Ways

-

1Determine what your goals are. Each person has their own concept of what it means to be “rich.” For some it is attaining a certain level of personal worth, or having the financial freedom to acquire and enjoy the finer things in life. For others, being rich means attaining financial security--owning a home, having no debt, and having disposable income, for instance. Keeping in mind that money only increases happiness to a certain point, ask yourself what your definition of “rich” is:

- What income level do you think it would take to achieve your goals or dreams?

- Do you want to build wealth through working, investments, or some other means?

- What kinds of things and experiences would you hope to gain from being rich? A huge home? A yacht? The ability to travel the world?

- What less tangible things would make you feel rich? Supporting a family? Becoming a leader in your career? Being able to make significant donations to charities?

-

2Find work that matters to you. If you are working to build wealth, then the job you choose to pursue will be an important decision to make. Top-earning positions in business, technology, and other high-demand areas can be your ticket to success, but also very hard to come by. If you have slightly more modest goals, you can start building wealth as long as you have at least some money left over after your bills are paid. But to be both rich and happy, you will need to find your job meaningful. [1]

- People are often told that “doing what you love” is the key to success. You can’t always turn your passions into a way to make money, however. Concentrate on finding a job that allows you to earn the level of income you want, and that you value--even if it’s not your dream.

- For example, painting landscapes might be what you really love to do, but hard to turn into a career that will lead to wealth. However, you might be able to pursue a well-paying job managing a museum or arts foundation, and paint in your spare time. While you might not become super-rich this way, you can attain financial security and still find work in an area you value.

- On the other hand, don’t make the mistake of seeking a job you hate, just because it leads to lots of money. That’s a sure way to become burned out and unhappy.

Advertisement -

3Make smart decisions with your money. In most cases, to become rich, you’ll have to do more than just earn money: you’ll have to put your money to work, too. Look for ways to invest, seek out business ventures, and keep your eye on other opportunities to grow your nest egg. In the meantime, live below your means--avoid spending extravagantly, even if you feel like you have plenty to spare. Try doing things like:

- Buying an economical car instead of a Rolls Royce

- Downsizing your home to reduce your mortgage or rent payment

- Regularly setting aside a specific portion of your income for saving and investments

- Putting some money toward investments that are higher-risk but have the potential for higher returns, such as stocks, rather than just toward relatively safe but low-earning investments, like savings accounts.

- Talking to a Certified Financial Planner (CFP) or other trusted advisor to plan your investments and wealth growth.

- Living frugally, which can increase your happiness.[2] Studies show that less clutter, fewer things, and fewer expenses can reduce stress, so keep it simple even if you are rich.

Finding Fulfillment When Wealthy

-

1Avoid envying others. Having money, even lots of it, won’t necessarily stop you from wishing you had something that someone else has. Feeling envious and trying to keep up with the Joneses won’t make you happy--quite the opposite. It’s much more important to find satisfaction with what you have, where you are in life.

- Keep your eye on the intangible, non-material things you identified when defining “rich” for yourself. Things like valuing your work, the people around you, your health, etc. matter much more for happiness, in the end, than the stuff that you have or don’t have.

-

2Spend time with people you love. Whether they are rich or not, everyone wants to be valued accepted by others to some extent. Close relationships with other people build your sense of security, intimacy, and fulfillment in life--all things that contribute to your sense of happiness. When you are rich, don’t neglect the people around you.[3]

- Make sure to spend quality time with your family and friends. Do whatever you enjoy--go on a vacation with them, meet them for dinner, play games together, or just talk.

- Spending quality time with people you love also shows them that you value them above all things, even money. This will increase their happiness as well.

-

3Spend money on experiences instead of things. Accumulating material things might seem like one of the benefits to being rich. To some extent, it’s satisfying to get the things you want, but this satisfaction is usually fleeting. Studies show that spending money on experiences (like vacations, a surprise party for your partner, skydiving, etc.) contribute far more to long-term happiness than material things (like a Ferrari or diamond earrings) do.[4]

- Spending money to free up more of your time can also increase your happiness. So, if you can afford it, pay someone to clean your house, mow your lawn, or other low-priority tasks, rather than doing it yourself, giving you more time to concentrate on what you love.

-

4Donate to worthwhile causes. Though rich people have more money than others, research shows that they tend to be relatively less generous than people with less money. The ultra-rich donate a smaller percentage of their wealth than those with more average incomes. At the same time, research shows that contributing to causes you value increases your sense of happiness. So when you are rich, give generously and reap the rewards of happiness![5]

- Find a charity or organization involved in something you value, whether it’s housing the homeless or giving seed money to startups, and donate.

-

5Volunteer your time and expertise. Giving doesn’t have to be monetary. If you can find ways to devote time to helping others, or to share your knowledge and experience, this can also increase your happiness. And if you are rich, it will can be easier to have the freedom to make this happen. Think about doing things like:[6]

- Tutoring at-risk children

- Giving motivational talks to young entrepreneurs about how you became successful

- Getting involved in your community, through local politics, charities, etc.

Finding Contentment At Any Income Level

-

1Determine your values. Knowing what is important to you, aside from money, is key to feeling fulfilled and happy. Reflect on where you come from, where you are, and where you want to go in life. Brainstorm a list of the things that are most important to you, and then consider ranking or grouping them. Values might include things like:

- A strong sense of family

- Charity (giving to others)

- Independence (the feeling that you are able to do what you want to)

- Pride in your work or other accomplishments

-

2Recognize that money only makes a limited contribution to happiness. Research shows that having enough money to cover your expenses and leave some leftover to enjoy life does boost feelings of happiness. Not having enough money to cover your needs can increase stress. After a certain point, however, more money doesn’t mean more happiness. Keep this in mind when determining what it will take for you to feel rich.[7] [8]

- Remember that rich people encounter their own problems that aren’t a factor in the lives of others. For instance, they may worry that their children will be labeled “trust fund babies,” or that their friends will only like them because they have money.

-

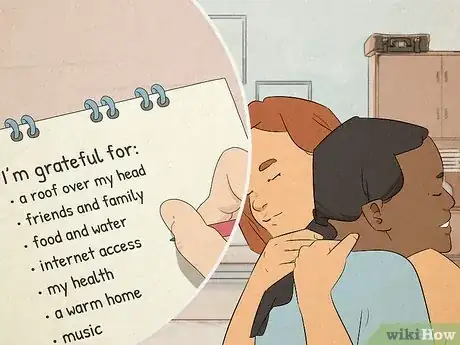

3Express gratitude. Practicing thankfulness means taking the time to reflect on the good things you have, no matter how wealthy you are. It’s especially important to recognize the things you have or that are good in your life, independent of money. You can try keeping a “gratitude journal” where you write down things you are thankful for every day or week. You can also tell others that you are thankful for them. For example:[9]

- You might include an entry in your gratitude journal that describes how you are thankful that someone held the door for you when your hands were full, or how you are thankful for your good health.

- You could tell your sister “Jane, I just wanted to let you know how thankful I am that you always have a positive attitude. You always lift my spirits!”

-

4Reduce or eliminate debt. Even if you aren’t rich, you can take some steps to feel more financially secure. The more you can lower your debt, the better you will feel about your financial situation, no matter your income or wealth. Having fewer financial obligations means that you can free up more income to save, invest, or spend on meaningful experiences.[10]

- Pay down your credit cards, if you have any

- Work to pay off any loans you may have, such as a mortgage or student loans

- Avoid taking on more debt for things you don’t really need. For example, if your current car works fine, don’t take out a loan to buy a new one.

-

5Live in a place with a high standard of living. You are more likely to feel happy living in a location that has well-functioning infrastructures, a stable government, an open society, and amenities that you value. While moving isn't always the easiest thing to do, you might consider relocating to increase your happiness, if you don’t like where you are now.[11]

- The right location for you depends on your values--some people want the excitement and amenities of a metropolitan area, while others long for the openness, quiet, and solitude of rural areas.

Expert Q&A

-

QuestionWhat is the secret to be rich?

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Finance Executive I think the key ways to build wealth are: to find ways to make more money, to find ways to reduce expenses and to invest the difference long term. A good rule of thumb is to invest long term in an S&P 500 Index Fund. Historically, the S&P 500 has returned about 11% a year on average over the last 96 years since it was established.

I think the key ways to build wealth are: to find ways to make more money, to find ways to reduce expenses and to invest the difference long term. A good rule of thumb is to invest long term in an S&P 500 Index Fund. Historically, the S&P 500 has returned about 11% a year on average over the last 96 years since it was established.

Expert Interview

Thanks for reading our article! If you'd like to learn more about getting wealthier, check out our in-depth interview with Andrew Lokenauth.

References

- ↑ https://hbr.org/2012/03/choosing-between-making-money

- ↑ http://www.aarp.org/money/budgeting-saving/info-05-2010/leap-to-cheap.html

- ↑ https://www.helpguide.org/articles/emotional-health/cultivating-happiness.htm

- ↑ https://hbr.org/2016/06/why-rich-people-arent-as-happy-as-they-could-be

- ↑ https://hbr.org/2016/06/why-rich-people-arent-as-happy-as-they-could-be

- ↑ https://hbr.org/2016/06/why-rich-people-arent-as-happy-as-they-could-be

- ↑ http://www.apa.org/monitor/2012/07-08/money.aspx

- ↑ https://www.pnas.org/doi/full/10.1073/pnas.1011492107

- ↑ https://www.helpguide.org/articles/emotional-health/cultivating-happiness.htm