This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 51,125 times.

Running a business can be challenge, no matter what services or products you are offering. To ensure flexibility in closing every possible deal you will want to accept credit cards by becoming a credit card merchant. You want to avoid circumstances in which a customer or client wants to buy your product and the only barrier to your getting paid is that you do not accept credit cards. As a credit card merchant this would not be an issue. You would only see the many benefits to your bottom line that you gain by accepting plastic.

Steps

Meeting the Requirements

-

1Get a business license if you don't have one. Visit the website for your state's Secretary of State and apply for a business license if you don't already have one. You'll need the license to apply for a merchant account and for several other steps down the line. You'll have to wait until you actually have the license before moving forward with your credit card merchant application.[1]

- Getting a business license may require a small fee, depending on your business type and state. See your Secretary of State's website for more information.

-

2Open a business bank account. Even if you own a sole proprietorship, you will need a dedicated business bank account to apply to be a credit card merchant. This account will be used for all of your credit card transactions. When you open the account, be sure to put in a small initial balance, as processing fees or other fees may be charged to the account before you receive any customer money. The amount of the required balance will depend on which payment processor you use.[2]Advertisement

-

3Meet the data security requirements. All business accepting credit card payments, from large corporations to sole proprietorships, are required to adhere to the same data security standards. Collectively referred to as the Payment Card Industry (PCI) standards, they require specific levels of card verification and data encryption. Generally, this is handled by the payment processor, but it is up to you to make sure that they adhere to these rules.[3]

- Online transactions are usually safeguarded by the security of your chosen selling platform and your payment processor.[4]

-

4Make sure your revenue levels are high enough. Many credit card processors require that your business earn a certain amount of revenue each month to qualify for credit card merchant status. This requirement varies from very low, near zero, revenue requirements to upwards of $10,000 per month, depending on the processor. If you don't meet the threshold for a given processor, you might be rejected. However, with a multitude of processor options out there, you will probably not have trouble finding one to service your business.[5]

Finding the Right Partners

-

1Obtain a merchant account. Merchant banks, also called acquirers, are commercial banks that facilitate merchants' acceptance of credit card payments. A merchant account (an account with a merchant bank) is required to receive credit card payments.[6] . These merchant banks process payments using one of the major credit card networks (Visa, MasterCard, American Express, or Discover), which makes sure that payments go to the right issuer (the bank that provided the card to the customer). Go to the websites of the major credit card brands (Visa, MasterCard, Discover, or American Express) and look through their list of merchant banks. Contact them and ask about their rates so that you can compare how much their services will cost.

- Merchant banks' fees are based on a "merchant discount" rate that is charged to you as a percentage of each purchase. Use this figure to compare the costs of different merchant banks.[7]

- When applying for a merchant account, having the following information ready:

- Basic information like your business's name, founding date, type of business, address, and phone number.

- Tax ID (EIN) number and your social security number.

- Processing information (your monthly revenue and whether you do business in person, online, or both).

- Your bank information, including your account number and routing number.[8]

-

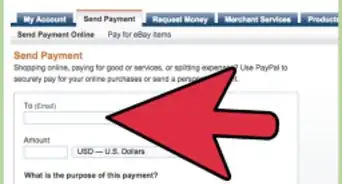

2Consider using an aggregator. Aggregators are similar to merchant banks, but are not financial institutions. They still can run merchant accounts and facilitate credit card transactions, though.[9] For example, PayPal operates as an aggregator. It allows you to accept all major credit cards and charges a discount rate that varies based on your sales volume.

- Aggregators sometimes offer business solutions for much smaller businesses that may not meet the revenue requirements of some of the larger merchant banks.

-

3Find a payment processor. If you don't meet the requirements for a merchant bank, another option is to enlist the help of a credit card processor. These companies help smaller or newer businesses accept credit cards by acting as the merchant account holder for a number of smaller businesses. Essentially, they act as a middle man between your business and the merchant bank and give you access to credit card sales.[10]

- Take care when looking into this type of arrangement, as using a processor may end up being more expensive than using an aggregator.

- Payment processors should be used when your business is not large enough to meet the requirements for partnering directly with a merchant bank.

-

4Set up mobile payments. If you are a mobile business or a growing business that attends trade shows or similar events, it may be beneficial for you to find a processor that can help you accept credit cards on the go.[11] These processors operate similarly to regular processors, but also usually provide a card reader that plugs into you phone or tablet. Look into several of these processors, and their related fee structures, to find one that fits your business.

- Mobile payment processors are particularly useful for small or mobile businesses, like food trucks or pop-up shops.

- They are also generally simple to use and can be set up very quickly.

- Like other payment processors though, they will likely be more expensive than using an aggregator.

- Be sure to look at the fee structures for these processors. There may be additional fees connected with the card scanner or flat per-transaction fees that can eat into your profit margins.

- Some of the processors active in this market include Square, PayPal Here, Amazon Local Register, Intuit QuickBooks GoPayment, SecureNet Payments, and Payanywhere.[12]

Working Out the Details

-

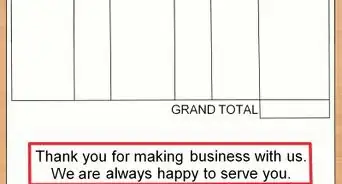

1Calculate processing fees. Fees from merchant banks are fairly straightforward and charge a percentage of each sale based on a "merchant discount" rate. However, processor fees can be more complicated, including fixed transaction fees, monthly fees, startup fees, variable discount rates, or address verification fees, depending on the processor.[13] Look into these fees and what they mean for your business before choosing a processor.

- You also want to make sure that your processor only charges a discount rate for sales. Otherwise, you will be charged twice if a customer returns an item: once when the item is sold and once when returned. In this case, you'd be charged twice and still not have made an actual sale.

-

2Decide what cards to accept. It's generally best to accept all major type of credit card (Visa, MasterCard, Discover, and American Express). However, sometimes certain card types can charge higher discount rate fees, making them impractical for small businesses. In these cases, you can always choose to accept only two or three of the card types now and choose to accept the others later if you feel that you are losing customers because of it.

-

3Open another merchant account, if necessary. In some situations, you may be required to open two separate merchant accounts. For example, if you plan to accept ACH payments (similar to an online check), you will need to open a separate merchant account to deal with these payments.[14] Other situations may arise in which you need to open separate merchant accounts to accept different types of payments. Make a judgment call on whether or not the application process and additional fees are worth it before committing.

-

4Transfer your storefront account online. If you have a physical location and also do some business online, you can use the same merchant account for both operations. This can simplify your accounting and payment processes by consolidating your accounts. Talk to your merchant bank to arrange online payments and get help setting them up.[15]

References

- ↑ https://paysimple.com/blog/10-things-you-should-know-about-opening-a-merchant-account/

- ↑ https://paysimple.com/blog/10-things-you-should-know-about-opening-a-merchant-account/

- ↑ http://www.businessnewsdaily.com/6511-credit-card-processing-very-small-businesses.html

- ↑ https://usa.visa.com/content_library/modal/find-an-acquirer.html

- ↑ http://www.businessnewsdaily.com/6511-credit-card-processing-very-small-businesses.html

- ↑ http://www.businessnewsdaily.com/6511-credit-card-processing-very-small-businesses.html

- ↑ https://usa.visa.com/content_library/modal/find-an-acquirer.html

- ↑ https://usa.visa.com/content_library/modal/find-an-acquirer.html

- ↑ http://www.businessnewsdaily.com/6511-credit-card-processing-very-small-businesses.html

- ↑ https://www.mastercard.us/en-us/merchants/start-accepting.html

- ↑ http://www.businessnewsdaily.com/6511-credit-card-processing-very-small-businesses.html

- ↑ http://www.digitaltrends.com/mobile/square-vs-intuit-gopayment-vs-paypal-here-mobile-credit-card-processors/2/

- ↑ http://www.businessnewsdaily.com/6511-credit-card-processing-very-small-businesses.html

- ↑ https://paysimple.com/blog/10-things-you-should-know-about-opening-a-merchant-account/

- ↑ https://paysimple.com/blog/10-things-you-should-know-about-opening-a-merchant-account/