This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 59,973 times.

Accumulated savings includes the amount you are able to put back or invest each period and the interest that is accrued on your savings. Even a very low interest rate will begin to add up as your balance increases, making it possible for you to save more than you might realize. Knowing how to calculate accumulated savings can help motivate you toward creating a larger nest egg.

Steps

Using a Spreadsheet

-

1Launch your preferred spreadsheet. This could be Microsoft Excel, Zoho Sheets, Google Docs Sheet or another spreadsheet application. Create labels for the variables relating to your account in cells A1 down through A5 as follows: Balance, Interest Rate, Periods, Additional Deposits and Future Value.

-

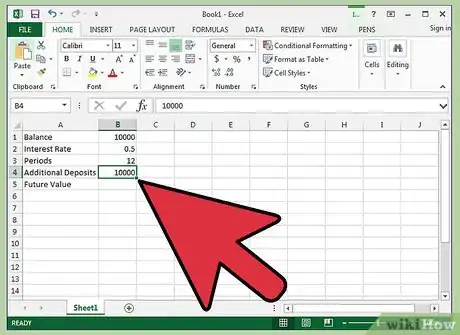

2Enter the details for your current savings plan. Enter these numbers in cells from B1 down through B4. This includes your current balance, interest rate earned, number of months, and any additional deposits you plan to make over time.

- Make sure you know the compound period of your interest rate — not all interest is compounded on a monthly basis and this number will make a difference on the outcome. The compounding period could be yearly, monthly, quarterly — check with your financial institution to find out the period.

- If the compound period is once a month, then you will divide your annual interest rate by 12 to arrive at a monthly interest rate. You will want to enter the number of periods as months, not years.

- In addition, be sure input the interest rate as a decimal instead of as a percentage. Convert this number by dividing by 100. For example, 6% would be entered as 6%/100, or 0.06. This would then by converted to a monthly rate by dividing by 12, to get 0.06/12, or 0.005.

Advertisement -

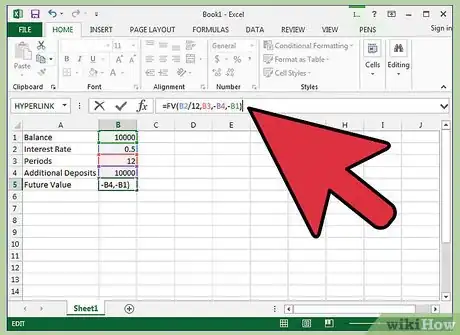

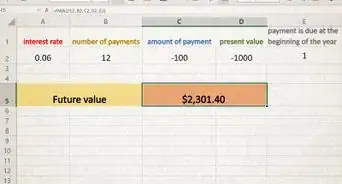

3Create a formula in cell B5. This will calculate the future value of your savings. Type "=FV(B2,B3,-B4,-B1)" in the address bar. Or you can click the function button (labeled "fx") and choose the Future Value formula to create the formula.[1]

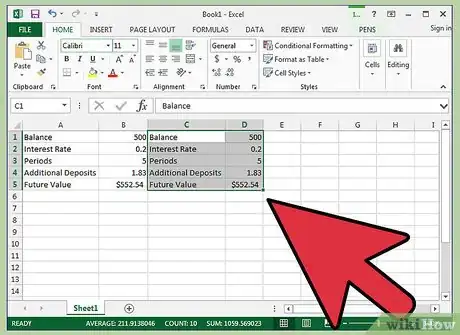

- For this example, assume that you have $500 as a beginning balance, that your savings account earns 2 percent interest each month, that you will not be depositing additional money each month and that you want to see the result after five years.

-

4Review the formula result. Using the example variables, this account should total $552.54 after five years. In other words, at 2 percent interest, you will earn $52.54 after five years on savings of $500.

Changing Variables for Future Results

-

1Predict results by changing the variables. Copy cells A1 through B5 and paste in cells C1 through D5. This will copy the formulas you previously entered.

-

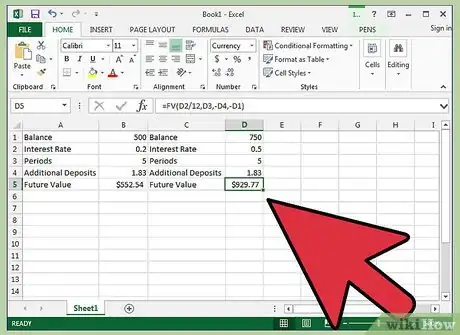

2Change the variables in rows D1 down through D4. You can examine other scenarios such as a lower interest rate, a longer period, or an additional monthly payment. Simply enter a new value for each variable, or change them all at once.

-

3Compare the results. By simply increasing the interest rate, number of years, or payment, you can see drastically higher future values for your investments. Play around with the numbers and see how an extra $20 per month can affect your account value over 10 or 20 years.

-

4Use an amortization table. You can calculate the future value of an account with a varying interest rate and additional monthly payments using an amortization table. These can be found online by searching for "compound interest amortization tables."

Solving for Accumulated Saving Manually

-

1Gather the details of your savings plan. You will need the beginning balance, fixed interest rate and the period for which you would like to calculate. Assume you will not be making any additional deposits.

-

2Enter data into the formula. Replace the variables in the formula with your actual details. Here is what the variables represent:[2]

- FV represents the future value of your account

- Replace "P" with the amount of your beginning balance.

- Replace "r" with the annual interest rate, expressed as a decimal

- Replace "c"with the number of times your interest is compounded each year.

- Replace "n" with the the number of years you are measuring growth over.

-

3Use the "PEMDAS" rule. This is used to calculate first the part of the equation in parentheses, then the exponents and finally the multiplication."PEMDAS" is an acronym for "parentheses, exponents, multiplication, division, addition and subtraction" and provides the order that mathematical operations should take place.[3]

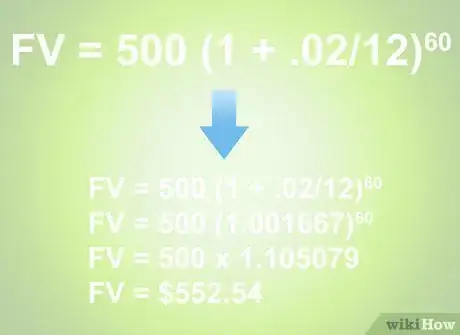

- Assume your account details include a $500 starting balance in an account bearing 2 percent interest, compounded monthly. Assume, also, that you are looking for the future value of your account after five years.

- Your completed equation would look as follows:

- Solving for the multiplication and division within the parentheses first, we get:

- Next, solve the addition within the parentheses to get:

- Raise the number within parentheses to the exponent:

- This can be done on a calculator by entering the number in parentheses, pressing the button, then entering the exponent and pressing enter.

- Multiply the two remaining numbers to get your accumulated savings amount:

Warnings

- If you are estimating the future value of account many years from now, realize that your result will be affected by for inflation. $500 today will likely have more buying power than $500 twenty years from now.⧼thumbs_response⧽