This article was co-authored by Bryan Hamby and by wikiHow staff writer, Jennifer Mueller, JD. Bryan Hamby is the owner of Auto Broker Club, a trusted auto brokerage in Los Angeles, California. He founded Auto Broker Club in 2014 out of a passion for cars and a unique talent for customizing the car dealership process to be on the buyer’s side. With 1,400+ deals closed, and a 90% customer retention rate, Bryan’s focus is to simplify the car buying experience through transparency, fair pricing, and world class customer service.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 7,929 times.

You've found a car you want, but now you have to face the finance manager. Unlike a banker, most finance managers work on commission and their ultimate job is to make the dealership money.[1] X Research source These skilled salesmen are very good at what they do—but you can be better. Read on to find out everything you need to know to beat the finance manager at their own game and potentially save thousands on your new ride.

Steps

Be ready to walk away at any time.

-

You always have ultimate control over the buying process. Remember that you're there to complete a business transaction at the best possible terms for you. You're not there to make friends. Avoid making a lot of small talk or answering personal questions. If you set these boundaries early, the finance manager will be less likely to pressure you.[2] X Research source

- For example, if the finance manager asks if you have any kids, you might say, "I'm not here to talk about my family. I'm here to buy a car."

- When you walk into the finance manager's office, greet them as an equal. If you're normally a shy or timid person, psych yourself up first. Go in there and be bold about what you want.

- Always look at the car during the day! It's much more difficult to see any potential issues in the dark.[3] X Trustworthy Source Consumer Reports Nonprofit organization dedicated to consumer advocacy and product testing Go to source

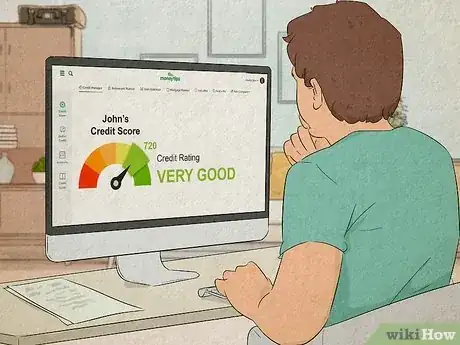

Check your credit before you start looking at cars.

-

Know what's on your credit report to avoid any unpleasant surprises. It's always a good idea to pull your credit report before you apply to finance a car. If there are any errors, get them corrected before you apply for car loans—the boost to your score could save you thousands.[4] X Research source

- If you order a free credit report, it won't include your score. Check with all 3 major credit bureaus online for your score.

- The types of credit you've had also helps lenders determine how risky it is for them to lend to you. For example, if it's your first car, you're unlikely to get the best rate even if you have a great credit score.

Assess the value of your trade-in.

-

The finance manager is likely to low-ball you on your trade. Check online to see what dealers and private sellers in your general area are selling similar cars for—it'll give you some idea of what your car is worth. You won't get that much (the dealer has to make money too), but you'll at least have an idea what the dealer will likely sell it for.[5] X Research source

- If you're planning on trading in your car at the same time you buy, clean it out and get it washed and detailed before you go to the dealership. You'll get more money if your car looks its best.

Get competing finance offers.

-

Apply for pre-approved financing before you go to the dealership. Start with your own bank. You're likely to get a great deal from them, especially if you've had an account with them for several years. At the dealership, let the finance manager make an offer. Then, bring up the pre-approved financing offers you already have as a bargaining chip.[6] X Research source

- Because finance managers at dealerships typically have several lenders bidding for the same contract, they can often get you an even better rate than you could get on your own—but they won't do this without some nudging from you.

- If you're a first-time buyer, check out local credit unions. They're often willing to take on more risk than other lenders, so you're more likely to get a good rate despite your lack of credit history.

- Getting pre-approved for a loan can also help you figure out what your budget will be.[7] X Research source

- Here's a public resource you can check out for auto loan shopping: https://www.consumerfinance.gov/consumer-tools/getting-an-auto-loan/plan-to-shop-for-your-auto-loan/

Look up manufacturer rebates if you're buying a new car.

-

Disreputable dealerships will keep the rebate if you don't know about it. Manufacturers offer multiple rebates and incentives on new cars throughout the year. All it takes is a quick online search to find out about them—you can even do it from your phone while you're at the dealership. Then a quick question for the finance manager: "Does this price include the manufacturer's rebate?"[8] X Research source

- It's actually smart to have the info you found handy on your phone. If the finance manager hems and haws or claims they don't know of any rebate, you can show them the proof.

Focus on the total price over the monthly payment.

-

Finance managers try to distract you with a monthly payment you like. You probably have in mind the monthly payment you'd like to have—but don't tell the finance manager what it is. Tell them that you'd prefer to focus on the total purchase price of the car instead.[9] X Research source

- Finance managers count on the fact that a lot of people don't care about anything else as long as they can afford the monthly payment.

- Focusing on the total "out the door" price puts you in control of how much money you're financing—and that is ultimately how you'll keep your monthly payment down.

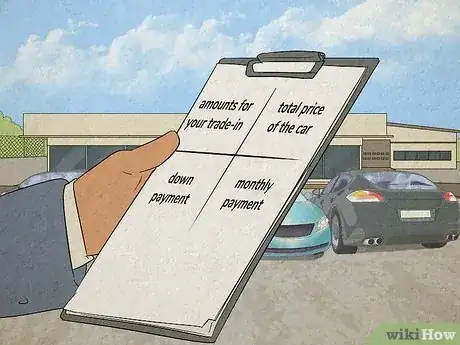

Nail down one aspect of the deal at a time.

-

Finance managers try to confuse you with different numbers. One of the most notorious ways they do this is by using the "four-square" worksheet. This sheet has 4 squares with amounts for your trade-in, total price of the car, down payment, and monthly payment. Refuse to use this worksheet and insist that you only want to focus on one thing at a time.[10] X Trustworthy Source Consumer Reports Nonprofit organization dedicated to consumer advocacy and product testing Go to source

- Your monthly payment is based on the finance term and the interest rate, both of which are negotiable—work on those and the payment will follow.

- Settle on the total price of the car first. Then, deal with your trade-in if you have one. After that, you can work on financing.[11] X Research source

Ask the finance manager to explain each fee.

-

All fees are negotiable and none of them are absolutely required. Don't be afraid to haggle on fees if they sound ridiculous. For example, every dealer is going to charge a document fee—that's for handling all the paperwork, registration, and title transfer. They should get something for that, sure—but not hundreds of dollars. Tell them you'll pay $75.[12] X Research source

- Sometimes, dealers hide fees that simply equate to more money for the dealer behind obscure initials and hope you won't ask. For those, just ask what it is and it will disappear like magic—that's usually all it takes.

Negotiate the rate on your loan.

-

Loan rates are just as negotiable as the price of the car. The dealer's rate will often be a couple of points higher than whatever the lender would quote you directly. Why? Because the dealer wants to make money on the loan as well. But if you checked your credit and already have finance offers, you know the rate you're entitled to.[13] X Research source

- You might say, "Is 10% the lowest rate you can get? I can finance this through my bank for 8%, but with all the resources you have at your disposal, I figured you could get me something more like 4%."

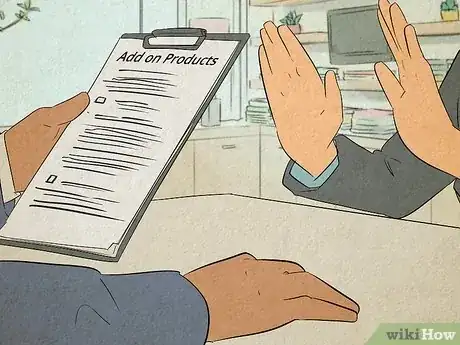

Refuse unnecessary add-on products.

-

All of the products offered in the finance office are marked up. You're already there and you're already making a purchase of tens of thousands of dollars. What's a few hundred more? The finance manager is an excellent salesman and will take advantage of your nervousness to sell you extras they promise will enhance your car's value and safety. Don't fall for it![14] X Research source

- For example, they might offer to etch your car's VIN on the window for added safety and anti-theft protection. The dealer will charge hundreds of dollars—but you can buy a VIN etch kit and do it yourself for less than $25.

- They might also offer you Scotchgard protection for your interior. This is also something you can do yourself for around $25 or $30 that will cost you hundreds of dollars if you add it on through the finance office.

- You can also buy an extended warranty or service agreement later. In fact, you can buy it any time before your warranty expires. It's a good idea to wait if you're not sure how long you're going to own your car.

Take time to read through the contract.

-

Tell the finance manager you want 30 minutes alone. Step outside if you need to, but get out of the finance manager's office. You don't want them hovering over you or pressuring you in any way. Mark the items that you don't understand so you can ask the finance manager to explain them to you.[15] X Research source

- Remember that you control the pace of the interaction. Don't let an "impatient" finance manager rush you into agreeing to something you don't completely understand.

- When you ask about something, the finance manager might say, "that's not important" or "don't worry about that." Respond with, "If it's not important, then it shouldn't matter if we just take it out, right?"

Calculate contract amounts yourself.

-

While you're going through the contract, check the numbers as well. Don't take it for granted that the finance manager's math is correct. It might be that they've made a simple mistake—but they could also be trying to hide a little extra money for the dealership.[16] X Research source

- If you can't get the numbers to add up, ask the finance manager to explain the discrepancy.

- If the numbers are different than what you thought you agreed to, ask the finance manager why they changed.

Resist pressure to buy immediately.

-

If you need time to think about it, take all the time you need. Finance managers want to close the deal today. To make that happen, they might tell you that their offer is only good until the close of business—don't bite. If you want to look over the contract more, talk to your partner, or even shop around at other dealerships, feel free to do so.[17] X Research source

- Even if the car you're looking at gets sold, they'll likely have a similar one.

- Remember that you're making a significant financial decision. It's perfectly normal if you don't want to act impulsively.

Wait to sign until the deal is final.

-

Always ask if the deal has been approved before you sign the contract. If the finance manager hasn't gotten final approval on the deal, it could change. Don't agree to anything until you're looking at the final numbers.[18] X Research source

- Make sure you read carefully and understand any changes that are made and how they affect the bottom line. Finance managers can try to sneak things in to get a little more money for the dealership—don't let them do that.

- After you've signed, get copies of all of your paperwork before you leave the dealership.

You Might Also Like

References

- ↑ https://www.payscale.com/research/US/Job=Automotive_Finance_Manager/Salary

- ↑ https://cars.usnews.com/cars-trucks/tips-for-negotiating-at-a-car-dealership

- ↑ https://www.consumerreports.org/used-cars/how-to-inspect-a-used-car-a1377126659/

- ↑ https://www.nada.org/media/3211/

- ↑ https://cars.usnews.com/cars-trucks/how-to-negotiate-the-best-price-on-a-new-car

- ↑ https://www.npr.org/2019/10/31/774757867/5-tips-for-buying-a-car-the-smart-way

- ↑ https://www.nerdwallet.com/article/loans/auto-loans/advantages-of-getting-pre-approved-for-a-car-loan

- ↑ https://www.nada.org/media/3211/

- ↑ https://www.caranddriver.com/features/a22652499/car-dealerships-donts/

- ↑ https://www.consumerreports.org/consumerist/dealerships-rip-you-off-with-the-four-square-heres-how-to-beat-it/

- ↑ https://www.npr.org/2019/10/31/774757867/5-tips-for-buying-a-car-the-smart-way

- ↑ https://www.nada.org/media/3211/

- ↑ https://www.npr.org/2019/10/31/774757867/5-tips-for-buying-a-car-the-smart-way

- ↑ https://www.nada.org/media/3211/

- ↑ https://www.nada.org/media/3211/

- ↑ https://cars.usnews.com/cars-trucks/how-to-negotiate-the-best-price-on-a-new-car

- ↑ https://www.caranddriver.com/features/a22652499/car-dealerships-donts/

- ↑ https://www.nada.org/media/3211/

About This Article