This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 138,099 times.

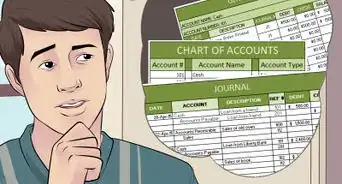

Every business, no matter how large or small, needs to keep track of all its transactions. There are many simple financial software systems you can purchase, but it is best if you first have a clear understanding of how accounting transactions work. You will need to enter every business transaction such as receiving payment or paying a bill into an accounting journal that is like a big log book. Here you will have a collection of categories called accounts, and you will debit (increase or decrease) one account and credit (increase or decrease) another account (examples will follow.) The makers of accounting software programs still follow that formula, but they have made the process much easier for the average user.

Steps

Entering Transactions

-

1Gather any paperwork relating to business transactions. These can include invoices from suppliers, utility bills, credit memos issued to customers, tax statements, checks issued, and payroll information. Check every bill or payment received for accuracy before recording it in an accounting journal. Ensure all have been approved by a supervisor or business owner before you enter any transactions.

-

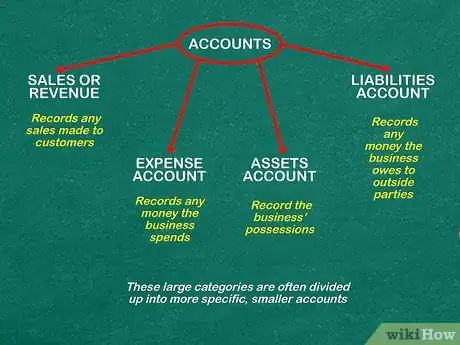

2Set up different accounts or categories for each type of transaction. Accounts can consist of cash, inventory, expenses, etc. Think of them as different pages in a notebook or line items you might list in your own personal budget. You'll need to set up the following types of accounts:

- The sales, or revenue, account records any sales made to customers.

- Likewise, the expense account records any money the business spends, like on operating its facilities, producing the product, and selling the product.

- In addition, the business will have to record its possessions, like cash, accounts receivable (sales to customers that have not been paid for yet), and physical possessions like buildings and equipment. These will be recorded in the assets account.

- The liabilities account, on the other hand, records any money the business owes to outside parties, like bank loans, accounts payable (to suppliers, for example), and wages payable (wages employees have earned but have not yet been paid for).

- These large categories are often divided up into more specific, smaller accounts.

Advertisement -

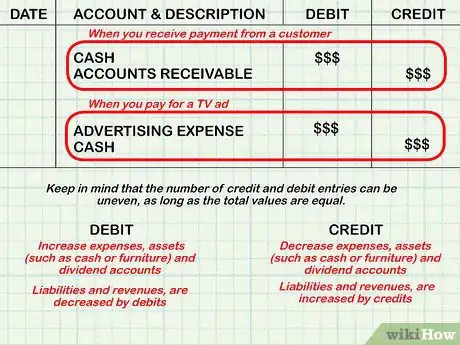

3Decide which accounts to debit or credit. It is most important to remember that every transaction can be described as a debit/credit and that credit(s) must always be accompanied by equal debit(s). For example, when you receive payment from a customer, you would debit Cash and credit Accounts Receivable in your accounting journal. When you pay for a TV ad you would debit "Advertising Expense" and credit Cash.

- Debits increase expenses, assets (such as cash or furniture) and dividend accounts and credits decrease these accounts. An easy way to remember this increase is D-E-A-D (debit assets, expenses, dividends). Other accounts, like liabilities and revenues, are increased by credits and decreased by debits. This accounting system has its own set of logic and you are better off memorizing it as opposed to applying your own logic with what is "increased" and what is "decreased."

- Keep in mind that the number of credit and debit entries can be uneven, as long as the total values are equal. For example, if a customer paid for half of a product in cash and half in credit, there would be two debit entries, to cash and accounts receivable, and only one credit entry, to sales.

- All of the computer software systems available will make recording accounting transactions easy for you by placing every entry into its correct place in the journal.

- You may need to create new account names in the journal if you have an out of the ordinary transaction such as the sale of stock or the purchase of land.

-

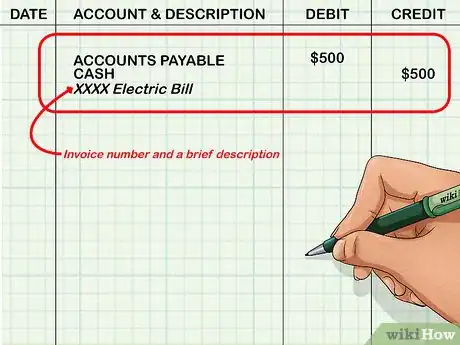

4Double check all accounting transactions entered in the journal. Each transaction should appear in its appropriate category: for example, debit on one side of the journal, and an amount equal to that transaction should appear in the opposite credit side of the journal.

- For example, you would enter a transaction for a $500 electric bill in the Debit column under Accounts Payable and in the Credit column under Cash for $500 after it's paid. Be sure to include the invoice number and a brief description in the notes.

-

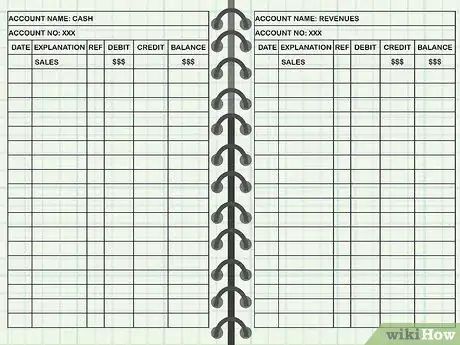

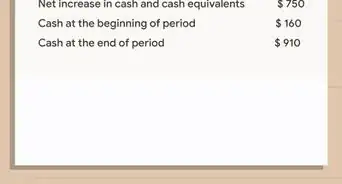

5Transfer journal entries into a general ledger periodically. The general ledger is a collection of all your accounts. For example, there will be a page in the general ledger for each of your categories of cash, accounts receivable, accounts payable, utilities expenses, etc. Then you will be able to see the totals for each type of account in a specific time period.

- The general ledger records information by account, as opposed to the journal, which records transactions. In other words, a single transaction transferred to the general ledger will be entered in at least two places, or accounts.

- For example, a sale to a customer that is paid with cash would be recorded in the journal as a single transaction, recognizing a debit to the cash account and a credit to revenues. When transferred to the general ledger, this entry would be recorded in two separate locations, the cash account and the revenues account. This allows you to see how the transaction, and the others around it, affected each account individually.

- Entries in the general ledger should be accompanied by the date of the transaction to help identify the source of the transaction. Some accountants also include a reference number, like an order number for example, to make it easier to trace transactions back to their journal entries.[1]

Balancing Accounting Transactions

-

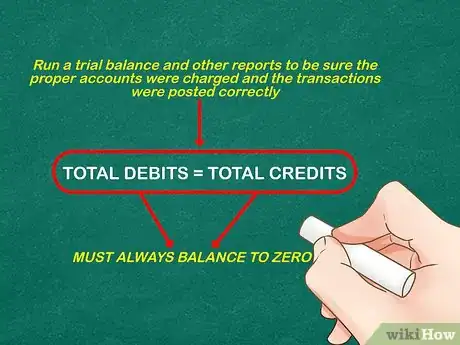

1Balance the general ledger before closing it out every time you enter an accounting transaction. Run a trial balance and other reports to be sure the proper accounts were charged and the transactions were posted correctly. Whether you entered 1 transaction or 100 transactions, total debits must equal total credits.

- If you are adding manually or using accounting software, you will add up all your debits and all of your credits, no matter what category they are in. They should always balance to zero.

-

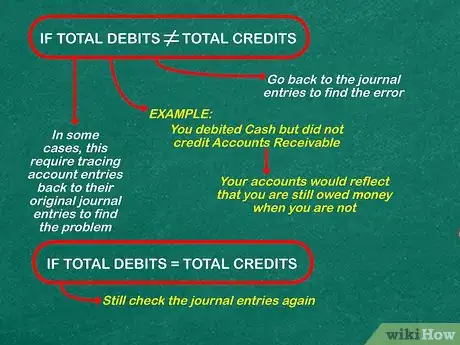

2Check for errors in the trial balance. If debits do not equal credits, you will have to go back to the journal entries to find the error. Even if debits do equal credits there still may be an error if a transaction was not entered or was entered twice, or if a transaction was posted to the wrong account.

- For example, when you received payment from a customer, you may have debited Cash but forgot to credit Accounts Receivable, meaning that your accounts would reflect that you are still owed money when you are not. In this case, your credits would not equal all your debits.

- In some cases, this may require tracing account entries back to their original journal entries to find the problem. This is why it is helpful to always pair these entries with the date of the transaction and/or a reference number.

-

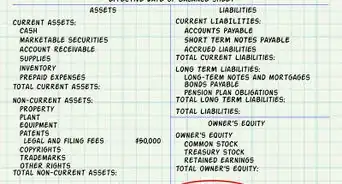

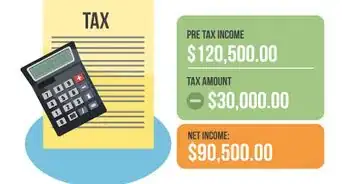

3Run reports for income statements, balance sheet and statements of retained earnings. This can be done manually or using an accounting software system. Then you will have a complete picture of the status of your business.

- The income statement, for example, will subtract your expenses from the revenue you earned in a particular time period, and you will know whether you made a profit or had a loss. For more, see how to write an income statement.

- A balance sheet shows all of a business's assets and liabilities. Assets include cash, equipment, land and accounts receivable. Liabilities include accounts payable and notes payable. For more, see how to make a balance sheet for accounting.

- If you have paid any dividends (payments to shareholders) out in the last period, you will also need a retained earnings statement. A retained earnings statement shows the amount of profit you made (net income) minus any dividends paid. Retained earnings themselves represent profits reinvested in the company.

Keeping Detailed Records of Accounting Transactions

-

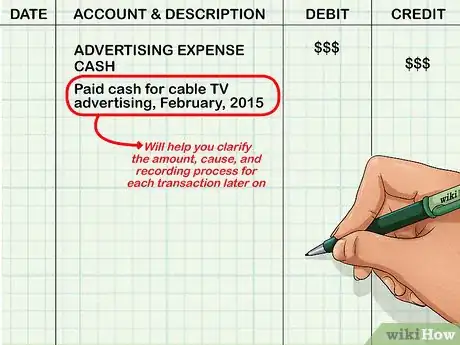

1Include a brief description for each transaction you enter into the journal. For example, "paid cash for cable TV advertising, February, 2015." This will help you clarify the amount, cause, and recording process for each transaction later on.

-

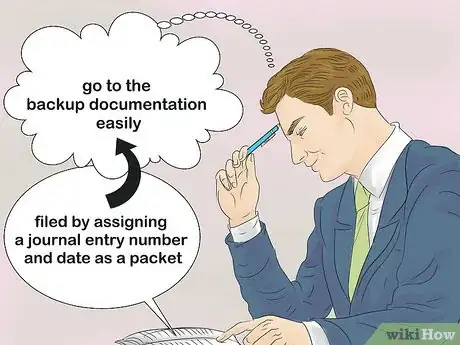

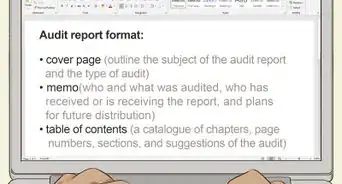

2Keep backup documentation on your journal entries. This is very important in case there are errors or for any questions later. Documentation on all entries can be filed by assigning a journal entry number and date as a packet. Anyone should be able to look up a journal entry in the general ledger and then go to the backup documentation easily.

-

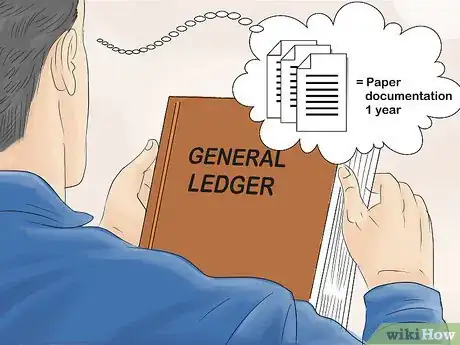

3Keep paper copies of all documentation for at least one year. This includes both your journal and ledger entries, along with any receipts and other transaction documents. You will need these until your accounts have been audited and your taxes filed.

-

4Save documentation electronically for at least seven years. Scan them, front and back, and keep those copies on two disks, one to be stored in the office and one off site to be used in case of emergency. There is always the chance that your taxes will be audited for several years back, so it's important to keep these records.

Warnings

- Keep backup copies of all accounting transactions stored on a computer disk. Make it a habit to download the entire accounting journal at the end of each business day. Make a second backup copy, and store the 2 disks in separate locations, 1 of them outside the building that houses the physical journal. This will be invaluable in the event of a catastrophic event such as fire or destructive weather.⧼thumbs_response⧽